Hibiscus (KLSE: 5199):

Calculating Smart Money Tide's Average Holding Price and Projection of Tide's Target,

22 February 2018, 12.55am Singapore Time

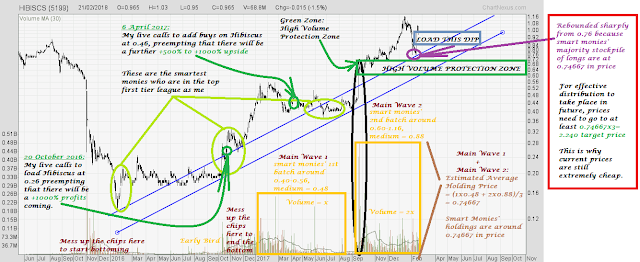

(Click on Technical Chart above to Expand)

Attached is the cards-counting approach applied on Hibiscus Petroleum in

the calculation of Smart Money Tide's Average Holding Price and

Projection of Tide's Target. Before we begin this approach, we would

need certain assumption to be true: that the retailers often make up a

fixed z% volume flow with a fixed y-std-deviation such that the volume

flow can be stably in fixed proportion for smart monies in the market.

With this in mind and the Pareto Principle in effect, the market volume

can now be reasonably fixed as majority belonging to smart money tide

without distortion of data from retailers' volumes (everything in fixed

proportion).

The 1st dark brown wording region is where the initial mess-up of chips

occurred as international crude oil market raced towards the bottom. The

2nd dark brown wording region is where the messing up of chips ended to

mark the end of a bottom.

This was then followed with Main Wave 1 with its volume flow as

highlighted in 1st orange zone. In this 1st orange zone, the aggregated

volume is around x. The smart money tide's first batch of grabs from all

sell queues on offer as well as absorption at the buy queues occurred

in the range of 0.40-0.56 with median = 0.48 for this batch.

After slight doldrum in volumes, this was then followed with Main Wave 2

with its volume flow as highlighted in 2nd orange zone. In this 2nd

orange zone, the aggregated volume is around 2x, approximately twice the

flow of Main Wave 1. The smart money tide's second batch of grabs from

all sell queues on offer as well as absorption at the buy queues

occurred in the range of 0.60-1.16 with median = 0.88 for this batch.

For the entire Main Wave 1 + Main Wave 2, the Smart Money Tide's

Estimated Average Holding Price = (1x0.48+2x0.88)/3 = 0.74667 for

Hibiscus Petroleum.

Compare now to the purple circled region on chart: this is why Hibiscus

Petroleum rebounded very sharply from 0.76000 right after

early-February's worldwide market correction ended. Because smart money

tide's majority stockpile of longs are at around 0.74667. They need to

protect the stockpiles of longs. The high volume protection zone had

been set up in DARK GREEN RECTANGLE. This is an invisibly and invincibly

strong SUPPORT.

Now, for effective distribution to be able to take place in future,

prices need to go to at least 3x 0.74667 = 2.240 target price. This

makes current prices close to majority of stockpiles held by smart money

tide. This is why current prices are still extremely cheap, because

there is a lot of room for more than +100% profits (more multi-fold run

to come).

The Donovan Norfolk Technical Rating:

Bullish

with

MULTI-FOLD PROFIT UPSIDE

Past Hibiscus Analyses and Track Records:

https://donovan-ang.blogspot.sg/search/label/Hibiscus%20Petroleum

with

MULTI-FOLD PROFIT UPSIDE

Past Hibiscus Analyses and Track Records:

https://donovan-ang.blogspot.sg/search/label/Hibiscus%20Petroleum

https://donovan-ang.blogspot.sg/2018/01/crude-oil-target-us175-to-us180-per.html

https://donovan-ang.blogspot.sg/search/label/Reuters-Jefferies%20Commodities%20CRB%20Index

https://donovan-ang.blogspot.sg/2018/01/the-us-dollar-super-big-downwave-28.html

http://donovan-ang.blogspot.sg/2017/10/baltic-dry-index-shipping-industry-and.html

https://donovan-ang.blogspot.sg/search/label/Reuters-Jefferies%20Commodities%20CRB%20Index

https://donovan-ang.blogspot.sg/2018/01/the-us-dollar-super-big-downwave-28.html

http://donovan-ang.blogspot.sg/2017/10/baltic-dry-index-shipping-industry-and.html

Additional Related (Optional to read):

https://donovan-ang.blogspot.sg/search/label/Light%20Crude%20Oil

http://donovan-ang.blogspot.sg/2018/02/hengyuan-refining-company-klse-4324-8.html

https://donovan-ang.blogspot.sg/search/label/SembCorp%20Marine

https://donovan-ang.blogspot.sg/search/label/Light%20Crude%20Oil

http://donovan-ang.blogspot.sg/2018/02/hengyuan-refining-company-klse-4324-8.html

https://donovan-ang.blogspot.sg/search/label/SembCorp%20Marine

Top 8 Commodity Stocks of Malaysia:

(These trenders will continue to go trending up powerfully and widen the gap from the pack)

http://donovan-ang.blogspot.sg/2018/01/commodities-cyclical-upturn-to-come.html

(These trenders will continue to go trending up powerfully and widen the gap from the pack)

http://donovan-ang.blogspot.sg/2018/01/commodities-cyclical-upturn-to-come.html

http://donovan-ang.blogspot.my/2018/02/hibiscus-klse-5199-calculating-smart.html