We highly believe that the recent rally that started early of this year was in anticipation of a much better QR next month.

Recap

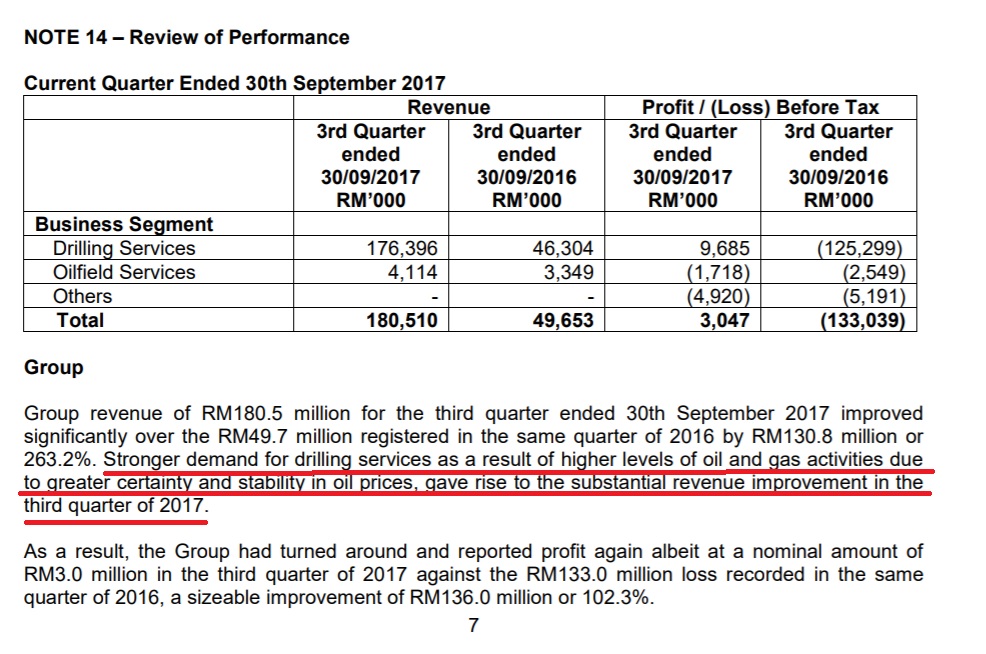

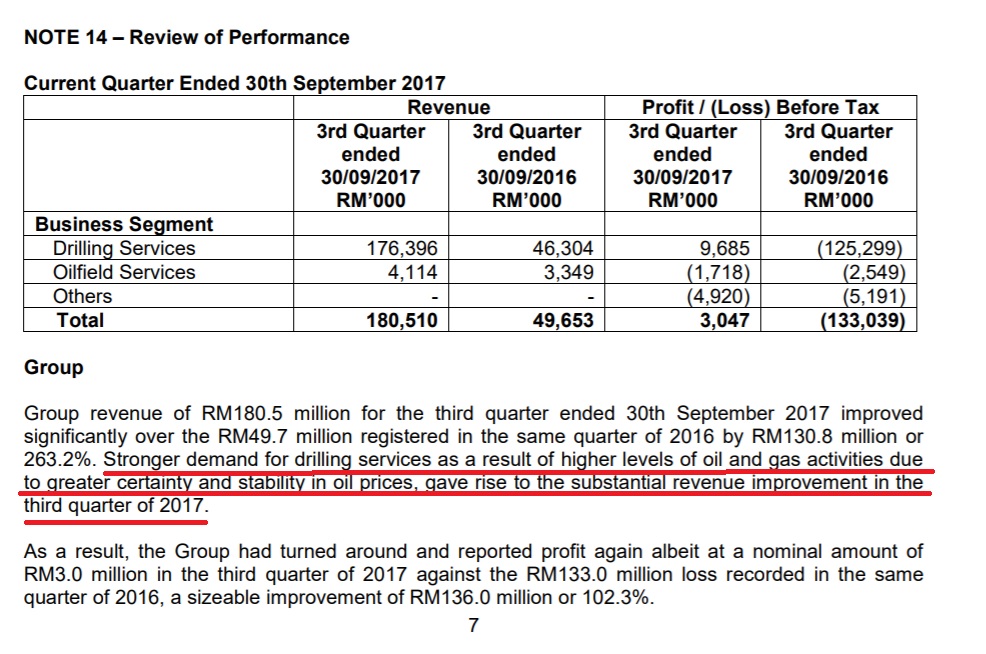

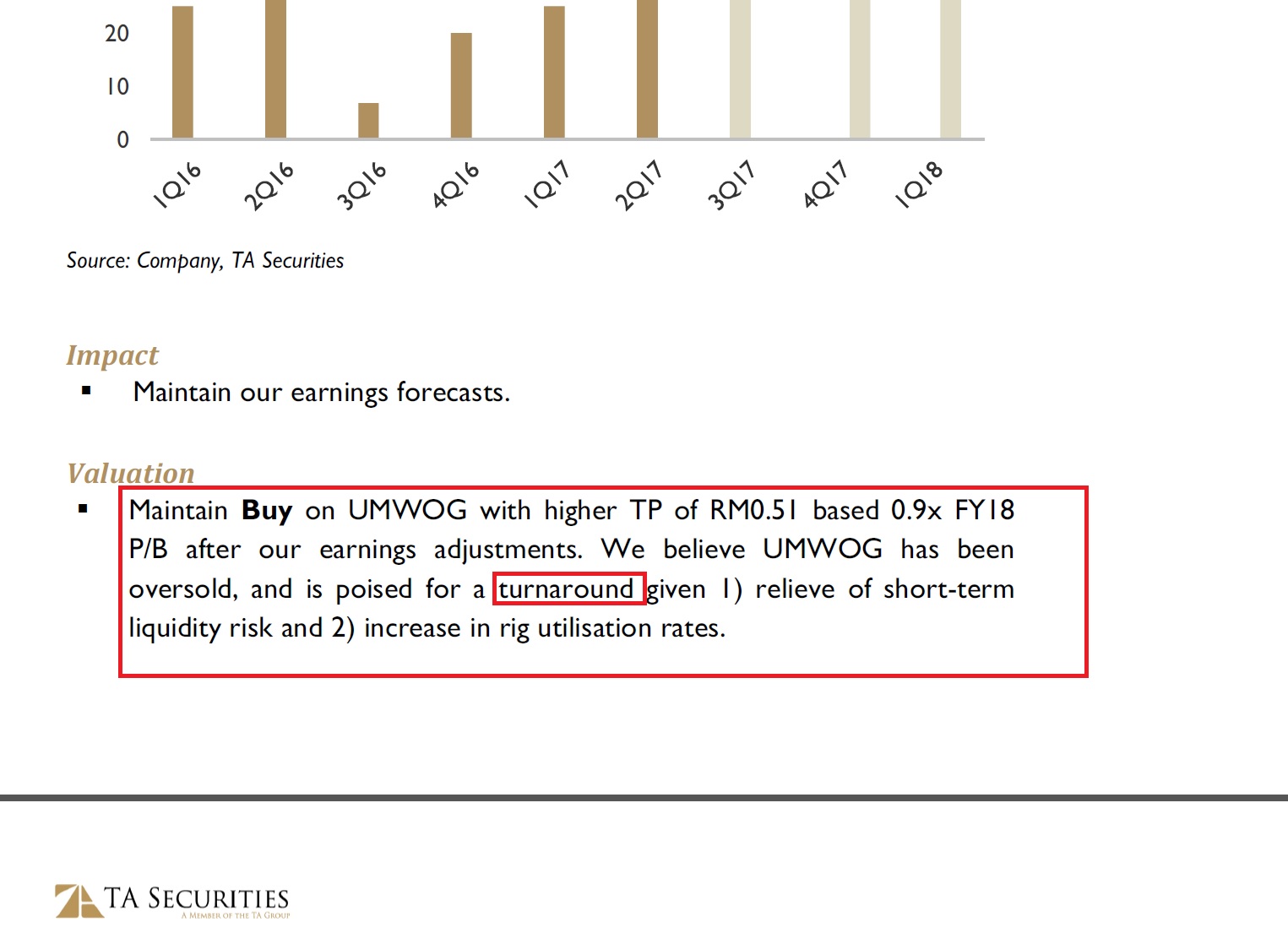

that earnings for the third quarter of financial year ended Sept 30,

2017 (3QFY17) earnings saw a turnaround after significant losses over

the past two years. Headline net profit came in at RM3.4 million, which

is a growth of 107% quarter-on-quarter (q-o-q) or 103% compared with a

year ago, a sharp improvement over the previous quarter’s losses.

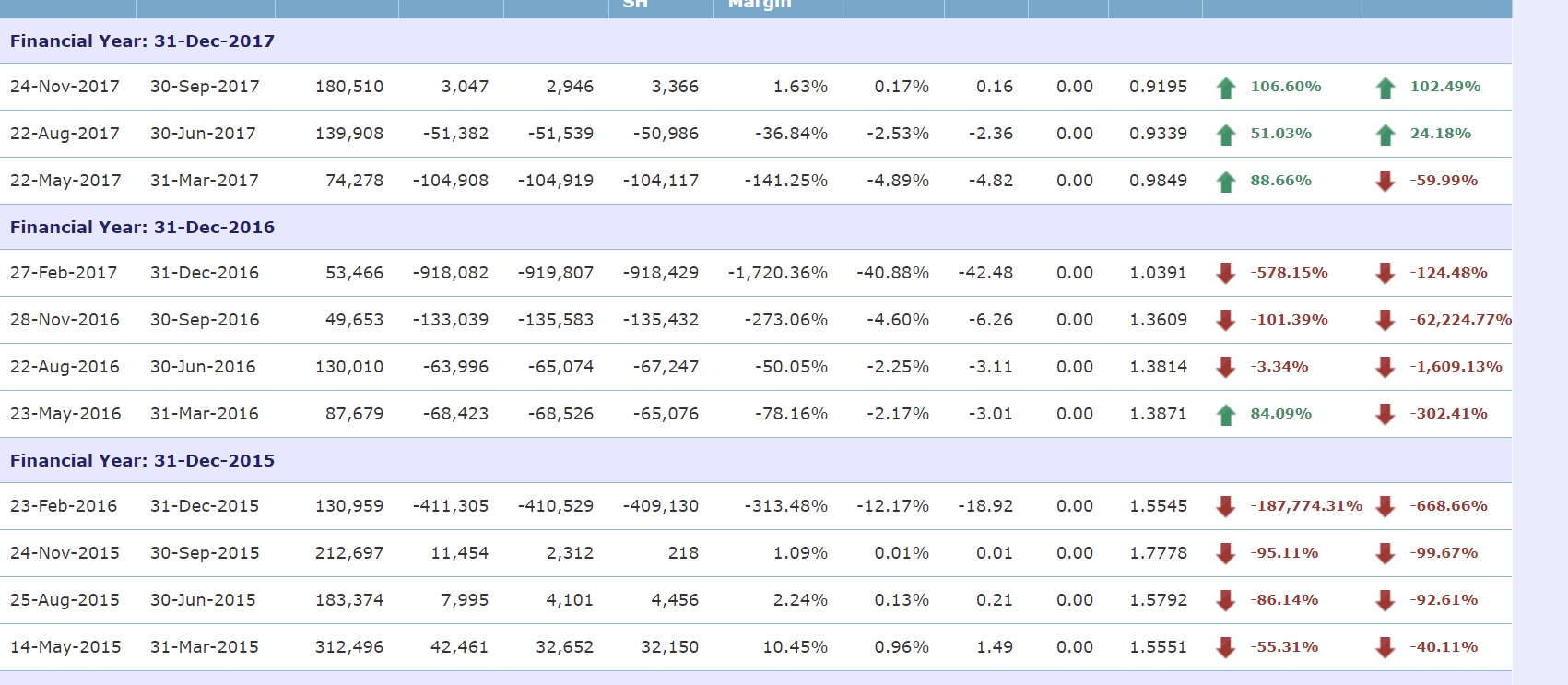

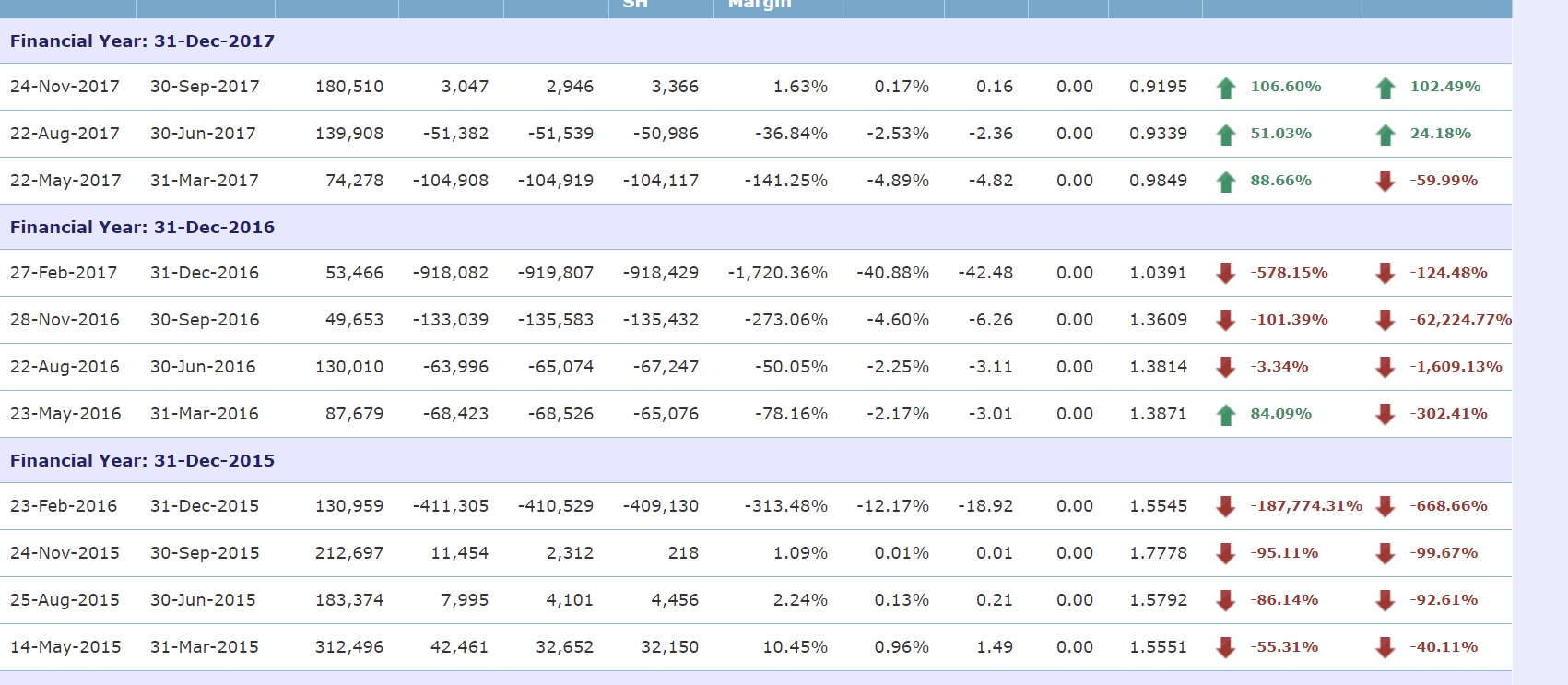

EPS was finally showing a positive figure of 0.16 cents, compared to 7 previous consecutive quarters of negative EPS.

And if you would have noticed, their EPS have been showing growth since 4QFY16. From -42.48 cents to -4.82 cents, then -2.36 cents before finally arriving at a positive 16 cents. We are seeing a continuous improvement in EPS growth quarter after quarter since the last financial year. It is indeed turning around.

This also concurs with a famous Malaysian philantrophist's rule of investing in a counter with 2 or more quarters of consecutive EPS growth. Reference is also made to a blog by Merlin: AN OPEN LETTER TO KYY: I AM SURE YOU WILL LOVE UMWOG

Why? Because UMWOG has, and will continue, to turn around.

EPS was finally showing a positive figure of 0.16 cents, compared to 7 previous consecutive quarters of negative EPS.

And if you would have noticed, their EPS have been showing growth since 4QFY16. From -42.48 cents to -4.82 cents, then -2.36 cents before finally arriving at a positive 16 cents. We are seeing a continuous improvement in EPS growth quarter after quarter since the last financial year. It is indeed turning around.

This also concurs with a famous Malaysian philantrophist's rule of investing in a counter with 2 or more quarters of consecutive EPS growth. Reference is also made to a blog by Merlin: AN OPEN LETTER TO KYY: I AM SURE YOU WILL LOVE UMWOG

If we refer to the chart, on 27th Nov 2017 right after the date of

announcement, the share price surged from an all time low of 27.5 cents

until a max of 34 cents before eventually ended up at the starting point

before the results announcement i.e. 27.5 cents. Then, after a short

consolidation, the rally began on 2nd Jan 2018.

Note that the most recent correction ended at 34.5 cents. The difference this time is, it did not end up back at 27.5 cents.

Why?

Firstly in TA, this suggests a resistance turned support. Secondly,

because now it is only one month left to go before the next QR

announcement. It is poised to continue rally coming weeks.

The insiders knew that the coming QR will be better. Therefore in

technical analysis, price and volume often speak ahead of news. And the

rally that we have seen recently is no b***s*** either.

They have info that others like us do not have. And when they presented

that "info" through actions which is a price rally that we are seeing

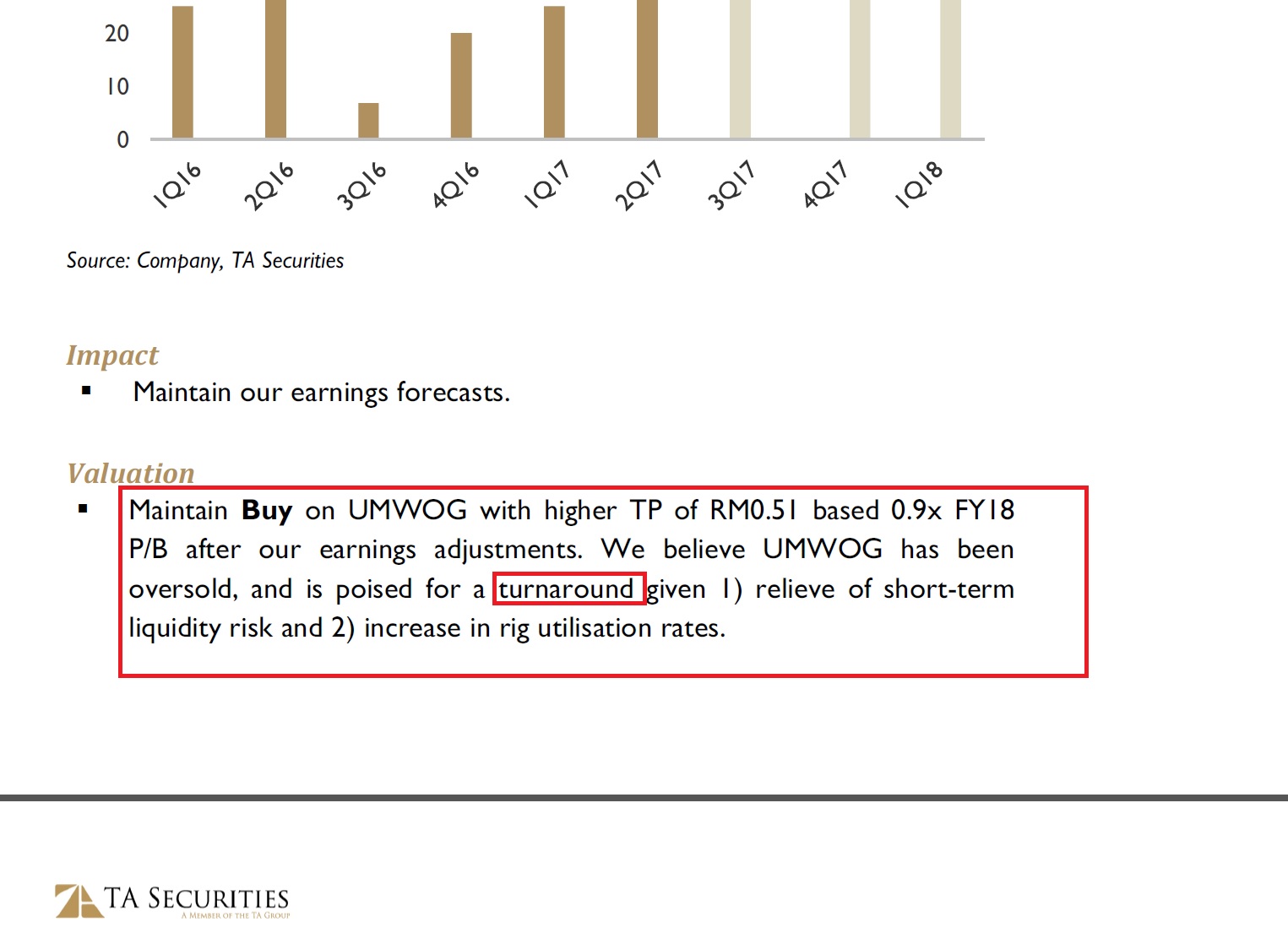

right now, it has to mean something. And that something, we believe, concurs with what TA securities mentioned on the turnaround that UMWOG is poised to go through.

If you were to go through their analyst report on 28th Nov 2017, you

will believe why the recent rally took place, and will continue to take

place, until the next QR comes out.

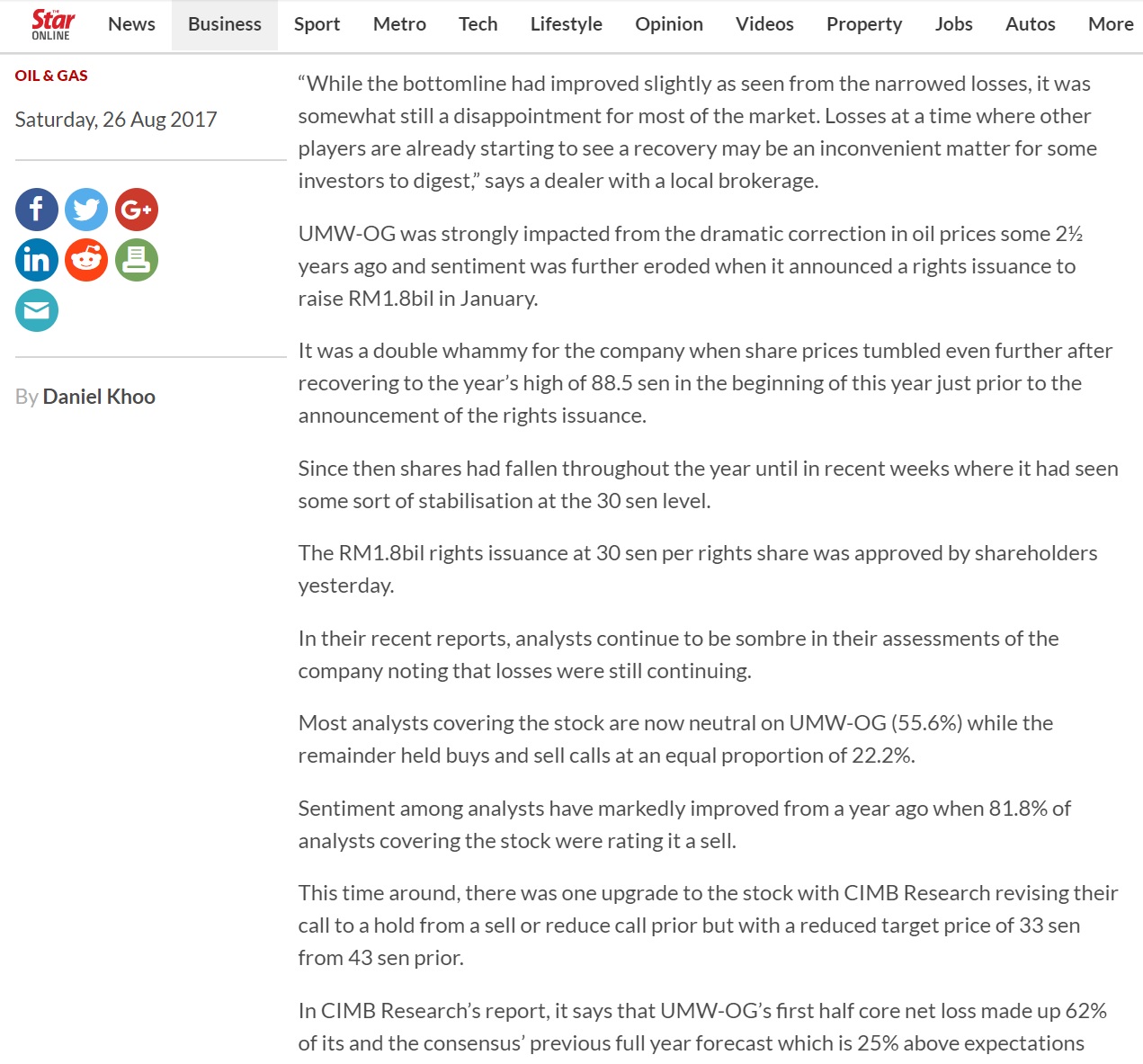

With UMWOG's current share price of 34.5 cents still being so near to

its all time low of 27.5 cents, we consider it as a "baby bull" stock,

with much upside to go.

References are made to our earlier posts below

Also, the above was extracted from its latest 3QFY17 QR. The red

underlined sentense is obviously pointing to a stronger 4Q QR next

month. With a very simple reason of, the crude oil price for 4Q is definitely higher than 3Q.

http://klse.i3investor.com/blogs/changwt/144924.jsp