ORION IXL had been dumping during 2Q and 3Q of last year due to the announcement of proposed right issues and new warrants.

However, I have noticed that this stock has started been accumulating by operators since 4Q17. You can detect this from money flow indicator (MFI) perspective.

Surprisingly, the accumulation is agressive, where the indicator has been on uptrend while forming positive divergence with sideways trend in the share price.

Judging from this pattern, positive divergence means a bullish pattern. The stock could start its bullish rally anytime soon as the indicator is now reaching the bull zone.

I expect the upside is more than 100%, where the share price will climb back to where it was before the announcement of rights issue and new warrants.

At the time, the share price was 38sen, which translates to 125% upside from current price of 15.5sen.

The fact is the share price of Kanger last time also had the same adverse impact of annoucement and then the share price revert to where it was before the announcement.

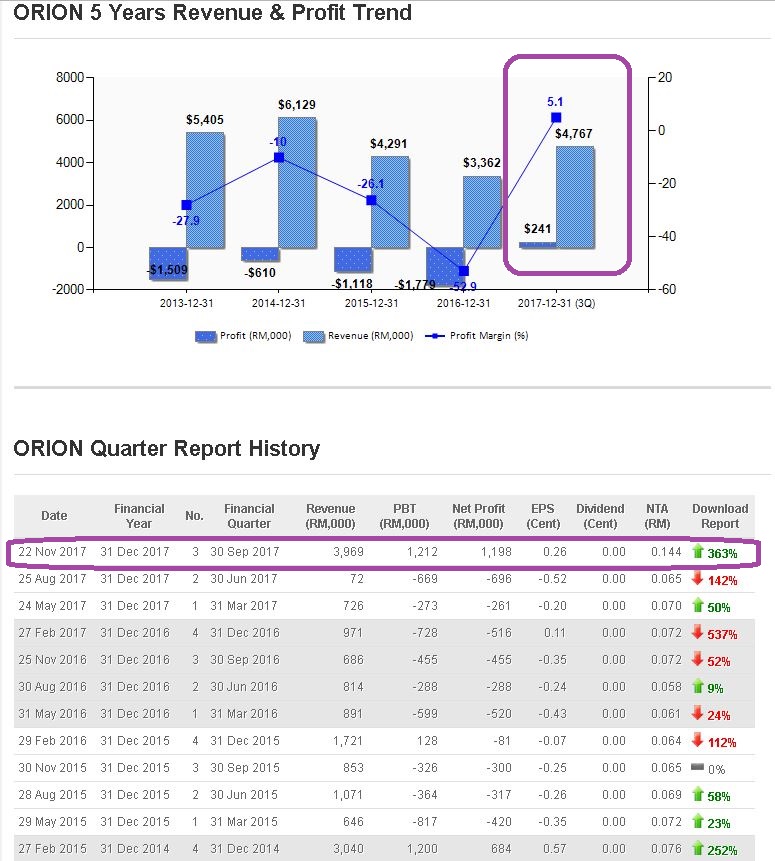

The bullish in ORION IXL also is not a speculative play, but it will be supported from rejuvanated in its earnings and margin expansion.

The Company has profit guarantee of at least RM7.5 million annually from its new acquired company, ASAP Bhd.

A final say, I have gained from abovementioned trend in Kanger and that is why now I am expecting the same trend in ORION IXL, which I will benefit next before CNY.

You do your own judgement.

http://klse.i3investor.com/blogs/superfatprofit/145803.jsp