We last wrote about Orion IXL here - https://klse.i3investor.com/blogs/wiz_of_finance/144185.jsp

Game Over?

Last week witnessed a significant pullback for small to mid cap counters which was less evident for bigger cap stocks in the KLCI.

Orion IXL was not spared. It gave up nearly all of its gain from the week before. While it has not been the only small cap counter which declined last week, the question to ask for Orion IXL which tend to have very low volumes after huge spikes of activity, would be: - Is the Game Over for Orion IXL?

What we think...still too early to tell

The dry up in liquidity after a significant fall in price is a concern. However, the fundamentals remain intact - i.e. healthier balance sheet and compelling earnings visibility, Hence, we believe the liquidity and volume for the next weeks until the announcement of the quarterly results in end February warrants observation. We expect the quarterly results in February to be equally positive as the company finally works itself to black after so many years of negative earnings.

Recap of what interest us

- Unique for a penny stock to have reasonably strong fundamentals - i.e. net cash position, strong capitalisation, turn-around in performance

- Sudden spike in volume two weeks ago which was first attracted our attention - One day turnover in volume of approx. 1/3 of the total shares outstanding. However, this has started to come down last week during the small and mid cap retracement. Could this be a simple pump and dump? A 1 day action does not seem too characteristic of a pump and dump and yet there has also been no major announcements in the change of substantial shareholding. This again warrants more observation

-

A strong turnaround story with much potential if it performs

-

2018 is looking to be the first year in 5 years that the company turns black.

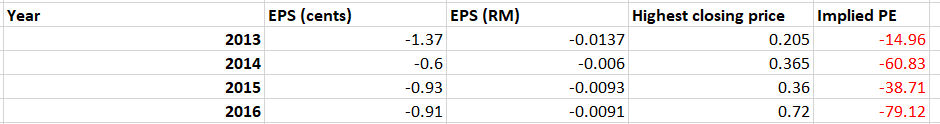

And in the past five years while the EPS has consistently been

negative, the share price has been much higher than it currently is:

-

Favourable relative valuation with the new business kicking in.

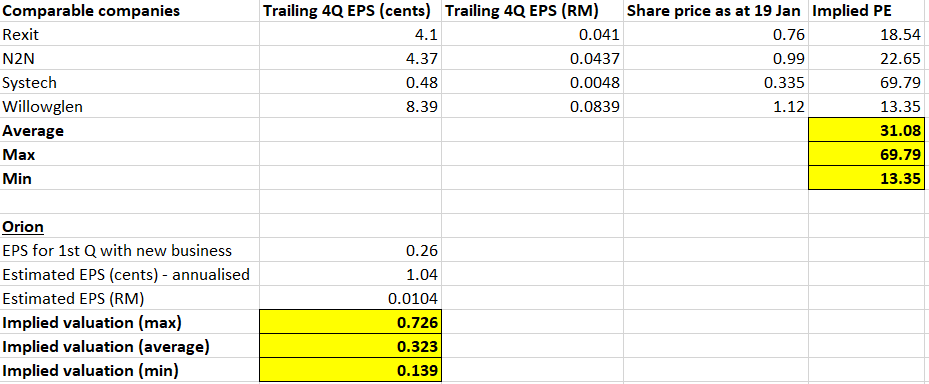

The below comparable companies are used by the independent advisor in

the circular to shareholders. To illustrate the below, we have taken the

last quarter EPS of 0.26 cents and annualised it. This should be a

prudent assumption as we believe once ASAP, the new business, is fully

integrated into the current business, there should be further cost

savings and the losses in the original business should be reduced as

well. Following that, the implied valuation based on relative

comparables range from RM0.139 to RM0.726, which is a huge range. Taking

the average PE, the implied valuation is RM0.323. It is also reassuring

that using the minimal PE of 13x, the implied valuation is

approximately what Orion is priced at now which is RM0.135 to RM0.14.

-

2018 is looking to be the first year in 5 years that the company turns black.

And in the past five years while the EPS has consistently been

negative, the share price has been much higher than it currently is:

-

Orion has historically seen a strong rally every year since 2016 which

unfortunately always retraces back. Will we see a rally in 2018? Only

time can tell.

Conclusion

Good potential but recent retracement and fall in liquidity are negative. If the counter fails to see any jump in activity in the next few weeks leading to the quarterly result, Orion could go back to its slumber. While the fall in price in the last week can be taken positively as a better entry price, the potential dry up in volume and reduction in activity is a significant drawback. Hence, we urge caution to our readers who are interested in this counter. This counter still warrants observation over the next few weeks. Only invest once you have done your homework.

Our post on our "picks" for 2018 - https://klse.i3investor.com/blogs/wiz_of_finance/143455.jsp

Disclaimer: This is not a buy call. Please do your own research before investing.

Cheers,

Wiz_of_Finance

If you are interested in contacting us, please contact us at wiz.of.finance@gmail.com

http://klse.i3investor.com/blogs/wiz_of_finance/144937.jsp