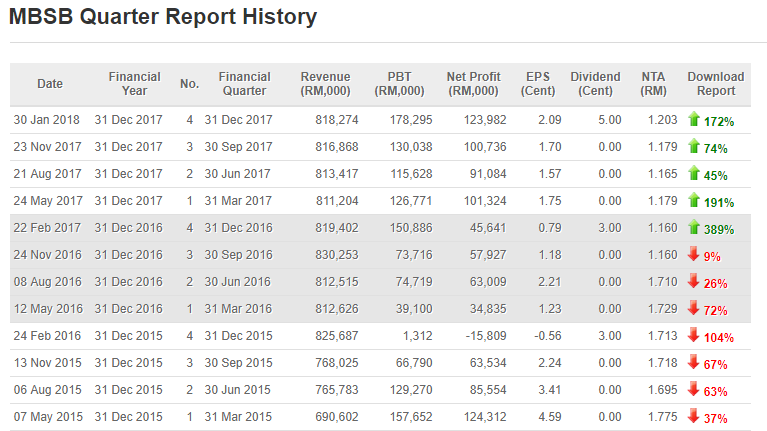

The Group registered revenue of RM3.26 billion for FYE17 and RM818.27 million for 4Q17 which are consistent with RM3.27 billion (FYE16) and RM816.87 million (3Q17). The revenue is generated from the Total Assets of RM44.81 billion as at 31 December 2017, a 3.56% growth or RM1.54 billion from RM43.27 billion as at 31 December 2016. The rise in Total Assets is contributed by the higher investments in liquefiable assets.

The Group reported its Profit After Tax (PAT) of RM417.13 million for the full Financial Year Ended 31 December 2017, a significant increase of 107.1% or RM215.71 million from RM201.41 million posted in the previous Financial Year Ended 31 December 2016 (“FYE 2016”). On a quarterly basis, PAT has also trended upwards by 23.08% or RM23.25 million from RM100.74 million posted in the last quarter (3Q17). Meanwhile, Profit Before Tax (PBT) of RM550.73 million (FYE17) showed major improvement of 62.74% or RM212.31 million PRESS RELEASE KENYATAAN AKHBAR For Immediate Release 30 JANUARY 2018 2 compared to RM338.42 million (FYE16). Compared to a PBT of RM130.04 million (3Q17), the amount of RM178.30 million (4Q17) is an increase of RM48.26 million or 37.11%. The substantial increase in profits is mainly attributed by the lower cost of funds and lower allowances for the impairment losses on financing, loans and advances.

On the results’ announcement, Datuk Seri Ahmad Zaini Othman, MBSB’s President and Chief Executive Officer commented, “With the ending of the impairment program in 4 th quarter of 2017, we have achieved what we had planned when it was first initiated in the 4 th quarter of 2014. Our 4Q17 and FYE 2017 results were partly attributed by strengthened collection efforts which in turn have reduced the impairment allowance for the year.”

The Group’s gross financing and loans contracted slightly by 3.07% y-o-y from RM35.28 billion (FYE16) to RM34.20 billion (FYE17). This is due to the reclassification of selected impaired retail financing and loans to Financial Assets Held-for-Sale and which sale is expected to be completed in the first quarter of this year. Nevertheless, Gross Corporate Financing and Property Financing have recorded notable annualized growths of 10.01% and 16.29% respectively. On the latter, Datuk Seri Ahmad Zaini added, “We remained to be selective in growing our financing assets but certain corporate segments have continued to be viable and we have managed to secure substantial financing stock moving into the new year from these segments”.

The Group also grew its Deposits from Customers by RM2.14 billion from RM30.61 billion as at 31 December 2016 to RM32.76 billion as at 31 December 2017. However, on a quarterly basis, it recorded a small drop of 1.17% or RM387 million from 3Q17 to RM33.14 billion (3Q17).

Asset quality as measured by the Net Impaired Financing/Loans (NIFL) ratio stood at 2.11% (FYE17), which is an improvement of 0.76 percentage points from 2.87% (FYE16) and 1.05 percentage points from 3.16% (3Q17). The Gross Impaired Financing/loans Coverage stood at 139.52% (FYE17), a remarkable progress from 109.24% (FYE16) and 109.82% (3Q17). On these observations Datuk Seri Ahmad Zaini commented, “It has to be highlighted that despite spending significant time and efforts to ensure the corporate exercise with Asian Finance Bank reaches a positive conclusion, we did not compromise on our 2017 deliverables. Collection and recovery efforts persisted throughout the year to ensure the resultant entity post-merger is premised on solid and healthy assets. This is key in bringing ourselves closer to a comparable position with the industry impairment ratios”.

The Net Return on Average Equity has advanced to 6.02% (FYE17) from 3.48% (FYE16) and 5.69% (3Q17). Similarly, Net Return on Average Assets moved up to 0.95% (FYE17) from 0.48% (FYE16) and 0.89% (3Q17), an increase of 0.47 and 0.06 percentage points respectively. The Group’s Cost to Income ratio (CIR) slightly regressed to 22.62% (FYE17) from 20.82% (FYE16) and 21.93% (3Q17) due to the necessary merger expenses and the expansion of business products and segments. Nevertheless, MBSB’s CIR still remained below the industry average of 49.7%.

Commenting on the Group’s outlook, Datuk Seri Ahmad Zaini stated, “We are certainly excited with the prospects of the new platform upon completion of the merger exercise. While we shall remain committed to doing what has always been profitable, for example the affordable housing projects and the penetration in selected SME sectors but rolling out new products in the immediate years shall be a very positive development for the new entity. We intend to add value by establishing new delivery channels as this shall help to bring prospective customers on board.”

http://klse.i3investor.com/blogs/MBSB_finance/145945.jsp