It had been a year since I last posted on i3investor. As MASTEEL is

currently one of my main holding, I would like to take this opportunity

to share on this company. Cheers! :)

Malaysia Steel Works (KL)

As to date, the Group is mainly involved in the production of steel billets and steel bar including high tensile round and deformed bars. The rounds bars are widely used in light structural construction whilst the deformed bars are primarily used in the construction of buildings and infrastructure projects.

Both of its melt-shop and rolling mills are located strategically at Petaling Jaya and Bukit Raja, with installed capacity of 700,000mt steel billet and 700,000mt steel bars per year.

Bukit Raja & Petaling Jaya Factory

MASTEEL’s established position in the Klang Valley and strong track record for timely delivery of quality steel products placed it in favorable position to meet rising steel bar requirements in the domestic market.

The Group had effectively captured higher market share of steel bars in recent years, as the construction of major infrastructural projects such as MRT and LRT extensions were being progressively implemented.

MASTEEL had seen steady income in the last few years as approximately 33% of its steel sales were for the development of MRT project. Its plant in Petaling Jaya provided a cost advantage for the MRT works that carried out within the area.

Back to year 2013, MASTEEL had undergone expansion of the downstream segment, by constructing a new second rolling mill in Bukit Raja, as the downstream production is able to provide substantially better margins compared with the upstream segment.

The Group had allocated MYR100m for the growth in its downstream activities, which boost its downstream steel bar production capacity from 450,000mt to 700,000mt upon reaching full capacity. With this, MASTEEL’s downstream steel bar capability would efficiently match its upstream steel billet production capacity of 700,000mt.

Previously, its downstream segment was served by its rolling mill plant in Petaling Jaya, which has a capacity of 450,000mt. The expansion represents a 250,000mt increase in its downstream segment, which provides better margins for the Group.

Its new steel rolling mill, which commenced operations in the second half of year 2016, had contributed towards the additional sales volume and profit margin improvement. The new mill, which is also the Group's third facility, manufactures premium-grade steel bars that fetch better margins.

Based on average selling price of MYR2,500 per tonne, the new rolling is expected to contribute an additional RM625m annually to MASTEEL’s topline at full capacity.

Financial Performance

For a country’s economy to grow, major development such as infrastructure projects and factories need to be built and steel is the main component. As such, the demand of steels is always there.

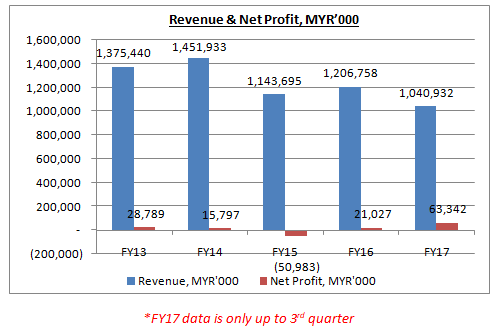

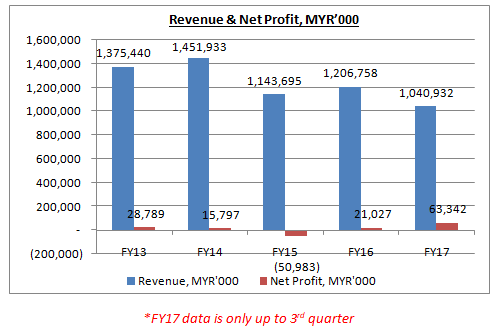

MASTEEL had been going through a challenging period of declining steel prices in FY15, on the back of oversupply in major steel producing countries in Asia. Severe dumping of steel products at unsustainable low prices, especially by Chinese steel mills into Malaysia had reduced demand and margins for local steel products.

Average domestic prices of steel bars weakened more than 30% from MYR1,950–2,100 range in early year 2015 to MYR1,450–1,550 in end of year 2015.

In year 2016, steel industry sentiment improved significantly following the announcements by China’s government to curb overcapacity. With the consolidation of the Chinese steel sector which accounts for over 55% of the world’s steel capacity, steel prices globally had rebounded by one fold from the bottom.

In FY17, MASTEEL had recorded new high result in Q3, at where its net profit surged by more than 30 folds, thanks to higher selling prices of steel bar and increased sales volume. The sharp rise in earnings was also due to improving market conditions and robust demand from the domestic construction industry.

Besides, its earnings in FY17Q3 were further strengthened by the recovery of tax over provision amounting to MYR20.6m. Excluding this exceptional item, MASTEEL’s core profit should be approximately MYR18m.

Foreign Exchange Gain

In FY17, MASTEEL recorded total of MYR54m PBT in first three quarters, partially contributed by higher foreign exchange gain from the strengthening of MYR.

The Group recorded total foreign exchange gain of MYR10.5m in Q1, Q2 and Q3 which made up 19% of its PBT.

MASTEEL’s income was mainly derived from local market, which accounted 89% of FY16 revenue, while the remaining 11% was derived from foreign countries.

According to annual report 2016, for every weakening of USD against MYR by 5%, MASTEEL is expected to gain additional MYR5.4m net profit. In other words, MASTEEL is a beneficiary of weakening of USD/MYR.

Back in last quarter of year 2016, USD/MYR surged from 4.14 to 4.48. As a result, MASTEEL incurred huge foreign exchange loss of MYR11m in FY16Q4.

Moving forward, as USD/MYR further weakened from 4.22 to 4.00 in last quarter of year 2017, MASTEEL is likely to record favorable foreign exchange gain, which will give a boost to its overall earnings in FY17Q4.

Hike in Natural Gas Price

In Nov 2017, the Government had announced the natural gas tariff revision for Peninsular Malaysia from Jan 2018 onwards.

The average natural gas base tariff was revised upwards from MYR26.46 per MMBtu to MYR32.52 MMBtu for the non-power sector, including steel producers, in Peninsular Malaysia from 1/1 to 6/30 this year, which translated into an increment of 23%.

Over the last four years, the natural gas tariff had increased six times, from MYR16.07 per MMBtu to current MYR32.52 per MMBtu, an increase of 102%.

FYI, electricity and natural gas are essential utilities for making steel products and represented the second highest production cost component. The viability and competitiveness of the steel industry was affected by the rise in natural gas price.

According to MASTEEL’s annual report 2014, the upward revision of natural gas tariff had dragged down the Group’s result, as it incurs 15% of its cost from energy.

The impact of the recent gas price hike on steel industry players can vary significantly. With the new gas tariff in place, MASTEEL’ ability to pass on the additional costs to consumers will be tested.

Local Steel Bar Price

Local steel rebar prices had rose 19% from MYR2,300 to MYR2,740 per tonne in FY17Q4, which was higher than the average selling price in FY17Q3. Barring any unforeseen circumstances, local steel makers’ profit margin is likely to be improved in coming quarter.

The steel price had been riding on an uptrend last year as China continues its curb on steel production, in addition to the pick-up in domestic demand.

According to Southeast Asia Iron and Steel Industries, the annual total steel consumption in Malaysia is about 10m tonnes for the past four years from 2013 to 2016, while the total capacity of the four major steel rebar maker in Malaysia is only 8.5m.

Historically, domestic steel demand was mainly supported by local production and cheap imports from China. Nevertheless, the scenario has changed since year 2016 after China committed to performing structural supply-side reforms in its steel sectors due to an overcapacity issue.

As a result, steel prices are trending up due to capacity elimination. There is not likely to see huge decline in global steel prices moving forwards.

Overall, most of the local steel companies are currently enjoying strong cash flows and reasonably good demand visibility in the intermediate term.

As at 1/24, the latest Y16-32 steel bar price per tonne is as below:

Local Demand

Moving forward, against the backdrop of a production cut in China and rising domestic demand, the steel sector’s prospects look likely to be promising.

Besides, in view of the government-led infrastructure projects, local building material sector is expected to benefit from the increasing demand, particularly the steel industry.

Local steel industry will be underpinned by the stronger demand for building materials based on record order books of construction players, thanks to infrastructure projects such as

MASTEEL aims to improve its sales volume to East Malaysia due to the mega infrastructure projects expected to be rolled out in the next five years.

The improvement of its sales volume will be targeting more new end users such as government-linked companies and main contractors in West Malaysia and new dealers in East Malaysia.

To enhance its sales volume by 15%, the Group is actively pursuing new sales opportunities for its products in Sabah and Sarawak in anticipation of the heightened demand for steel with the construction of Pan Borneo Highway that will be implemented from year 2017 till 2022.

Technical Chart

As at 25th Jan 2018, MASTEEL closed at MYR1.70.

MASTEEL had been riding on an uptrend since beginning of year 2017, at where it shares price surged from 0.65 to current 1.70, which equivalent to a gain of approximately 160% in one year.

With the breakout above downtrend line, MASTEEL is likely to test its previous high 1.82 in short term. A successful resistance level breakout above 1.82 will spur prices higher towards 1.85-1.95 zones.

At present, MASTEEL is trading at a trailing 12-month PE of 8x, and has a market capitalisation of RM536.57m based on its last traded price.

Its downside risks should be limited amid undemanding valuations and signs of bottoming up in technical indicators. Its current key supports are situated near 1.58.

Conclusion

As one of the premier steel manufacturer in Malaysia, MASTEEL benefits from the uptrend of steel bar price and implementation of safeguard duties. Its products go through stringent processes so that they meet the construction industry’s requirements, while it also has an advantage due to the strategic location of its Petaling Jaya plant.

Moving forward, local steel industry will be underpinned by the stronger demand for steel based on record order books of construction players. MASTEEL aims to improve its sales volume due to the mega infrastructure projects expected to be rolled out in the next five years.

As for the Group’s profitability, the recent natural gas price hike is a concern for local steel makers. With the new gas tariff in place, MASTEEL’ ability to pass on the additional costs to consumers will be tested.

Considering USD/MYR slipped from 4.22 to 4.00 in last quarter of year 2017, coupled with higher average selling price, MASTEEL is expected to deliver a strong set of result in FY17Q4.

Let’s assume MASTEEL will be able to deliver MYR60m core profit in a full financial year. Based on outstanding shares of 315.21m, it will have an earnings per share of 19 cent. With forwarded PE of 10-12, MASTEEL will have an intrinsic value of MYR1.90-2.28.

Just for sharing!

For those who interested in my stock analysis reports, may contact me at info.rhresearch@gmail.com or https://www.facebook.com/rhresearch/

Happy investing!

Malaysia Steel Works (KL)

- Share price - MYR1.68

- No. of shares - 315.63m (including 0.42m treasury shares)

- Market cap - MYR530.3m

As to date, the Group is mainly involved in the production of steel billets and steel bar including high tensile round and deformed bars. The rounds bars are widely used in light structural construction whilst the deformed bars are primarily used in the construction of buildings and infrastructure projects.

Both of its melt-shop and rolling mills are located strategically at Petaling Jaya and Bukit Raja, with installed capacity of 700,000mt steel billet and 700,000mt steel bars per year.

Bukit Raja & Petaling Jaya Factory

MASTEEL’s established position in the Klang Valley and strong track record for timely delivery of quality steel products placed it in favorable position to meet rising steel bar requirements in the domestic market.

The Group had effectively captured higher market share of steel bars in recent years, as the construction of major infrastructural projects such as MRT and LRT extensions were being progressively implemented.

MASTEEL had seen steady income in the last few years as approximately 33% of its steel sales were for the development of MRT project. Its plant in Petaling Jaya provided a cost advantage for the MRT works that carried out within the area.

Back to year 2013, MASTEEL had undergone expansion of the downstream segment, by constructing a new second rolling mill in Bukit Raja, as the downstream production is able to provide substantially better margins compared with the upstream segment.

The Group had allocated MYR100m for the growth in its downstream activities, which boost its downstream steel bar production capacity from 450,000mt to 700,000mt upon reaching full capacity. With this, MASTEEL’s downstream steel bar capability would efficiently match its upstream steel billet production capacity of 700,000mt.

Previously, its downstream segment was served by its rolling mill plant in Petaling Jaya, which has a capacity of 450,000mt. The expansion represents a 250,000mt increase in its downstream segment, which provides better margins for the Group.

Its new steel rolling mill, which commenced operations in the second half of year 2016, had contributed towards the additional sales volume and profit margin improvement. The new mill, which is also the Group's third facility, manufactures premium-grade steel bars that fetch better margins.

Based on average selling price of MYR2,500 per tonne, the new rolling is expected to contribute an additional RM625m annually to MASTEEL’s topline at full capacity.

Financial Performance

For a country’s economy to grow, major development such as infrastructure projects and factories need to be built and steel is the main component. As such, the demand of steels is always there.

MASTEEL had been going through a challenging period of declining steel prices in FY15, on the back of oversupply in major steel producing countries in Asia. Severe dumping of steel products at unsustainable low prices, especially by Chinese steel mills into Malaysia had reduced demand and margins for local steel products.

Average domestic prices of steel bars weakened more than 30% from MYR1,950–2,100 range in early year 2015 to MYR1,450–1,550 in end of year 2015.

In year 2016, steel industry sentiment improved significantly following the announcements by China’s government to curb overcapacity. With the consolidation of the Chinese steel sector which accounts for over 55% of the world’s steel capacity, steel prices globally had rebounded by one fold from the bottom.

In FY17, MASTEEL had recorded new high result in Q3, at where its net profit surged by more than 30 folds, thanks to higher selling prices of steel bar and increased sales volume. The sharp rise in earnings was also due to improving market conditions and robust demand from the domestic construction industry.

Besides, its earnings in FY17Q3 were further strengthened by the recovery of tax over provision amounting to MYR20.6m. Excluding this exceptional item, MASTEEL’s core profit should be approximately MYR18m.

Foreign Exchange Gain

In FY17, MASTEEL recorded total of MYR54m PBT in first three quarters, partially contributed by higher foreign exchange gain from the strengthening of MYR.

The Group recorded total foreign exchange gain of MYR10.5m in Q1, Q2 and Q3 which made up 19% of its PBT.

MASTEEL’s income was mainly derived from local market, which accounted 89% of FY16 revenue, while the remaining 11% was derived from foreign countries.

According to annual report 2016, for every weakening of USD against MYR by 5%, MASTEEL is expected to gain additional MYR5.4m net profit. In other words, MASTEEL is a beneficiary of weakening of USD/MYR.

Back in last quarter of year 2016, USD/MYR surged from 4.14 to 4.48. As a result, MASTEEL incurred huge foreign exchange loss of MYR11m in FY16Q4.

Moving forward, as USD/MYR further weakened from 4.22 to 4.00 in last quarter of year 2017, MASTEEL is likely to record favorable foreign exchange gain, which will give a boost to its overall earnings in FY17Q4.

Hike in Natural Gas Price

In Nov 2017, the Government had announced the natural gas tariff revision for Peninsular Malaysia from Jan 2018 onwards.

The average natural gas base tariff was revised upwards from MYR26.46 per MMBtu to MYR32.52 MMBtu for the non-power sector, including steel producers, in Peninsular Malaysia from 1/1 to 6/30 this year, which translated into an increment of 23%.

Over the last four years, the natural gas tariff had increased six times, from MYR16.07 per MMBtu to current MYR32.52 per MMBtu, an increase of 102%.

FYI, electricity and natural gas are essential utilities for making steel products and represented the second highest production cost component. The viability and competitiveness of the steel industry was affected by the rise in natural gas price.

According to MASTEEL’s annual report 2014, the upward revision of natural gas tariff had dragged down the Group’s result, as it incurs 15% of its cost from energy.

The impact of the recent gas price hike on steel industry players can vary significantly. With the new gas tariff in place, MASTEEL’ ability to pass on the additional costs to consumers will be tested.

Local Steel Bar Price

Local steel rebar prices had rose 19% from MYR2,300 to MYR2,740 per tonne in FY17Q4, which was higher than the average selling price in FY17Q3. Barring any unforeseen circumstances, local steel makers’ profit margin is likely to be improved in coming quarter.

The steel price had been riding on an uptrend last year as China continues its curb on steel production, in addition to the pick-up in domestic demand.

According to Southeast Asia Iron and Steel Industries, the annual total steel consumption in Malaysia is about 10m tonnes for the past four years from 2013 to 2016, while the total capacity of the four major steel rebar maker in Malaysia is only 8.5m.

Historically, domestic steel demand was mainly supported by local production and cheap imports from China. Nevertheless, the scenario has changed since year 2016 after China committed to performing structural supply-side reforms in its steel sectors due to an overcapacity issue.

As a result, steel prices are trending up due to capacity elimination. There is not likely to see huge decline in global steel prices moving forwards.

Overall, most of the local steel companies are currently enjoying strong cash flows and reasonably good demand visibility in the intermediate term.

As at 1/24, the latest Y16-32 steel bar price per tonne is as below:

- Southern Steel – MYR2,610

- Amsteel (Lion Industries) – MYR2,600

- Ann Joo – MYR2,640

- Masteel – MYR2,590

Local Demand

Moving forward, against the backdrop of a production cut in China and rising domestic demand, the steel sector’s prospects look likely to be promising.

Besides, in view of the government-led infrastructure projects, local building material sector is expected to benefit from the increasing demand, particularly the steel industry.

Local steel industry will be underpinned by the stronger demand for building materials based on record order books of construction players, thanks to infrastructure projects such as

- KL-Singapore high-speed rail (“HSR”) – MYR60b

- East Coast Rail Link (“ECRL”) – MYR55b

- MRT 2 - MYR32b

- Pan Borneo Sarawak Highway – MYR16b

- LRT 3 – MYR12b

- Gemas-Johor Bahru electrified double-tracking railway – MYR9b

- Large-scale property development such as the Tun Razak Exchange and KL118

MASTEEL aims to improve its sales volume to East Malaysia due to the mega infrastructure projects expected to be rolled out in the next five years.

The improvement of its sales volume will be targeting more new end users such as government-linked companies and main contractors in West Malaysia and new dealers in East Malaysia.

To enhance its sales volume by 15%, the Group is actively pursuing new sales opportunities for its products in Sabah and Sarawak in anticipation of the heightened demand for steel with the construction of Pan Borneo Highway that will be implemented from year 2017 till 2022.

Technical Chart

As at 25th Jan 2018, MASTEEL closed at MYR1.70.

MASTEEL had been riding on an uptrend since beginning of year 2017, at where it shares price surged from 0.65 to current 1.70, which equivalent to a gain of approximately 160% in one year.

With the breakout above downtrend line, MASTEEL is likely to test its previous high 1.82 in short term. A successful resistance level breakout above 1.82 will spur prices higher towards 1.85-1.95 zones.

At present, MASTEEL is trading at a trailing 12-month PE of 8x, and has a market capitalisation of RM536.57m based on its last traded price.

Its downside risks should be limited amid undemanding valuations and signs of bottoming up in technical indicators. Its current key supports are situated near 1.58.

Conclusion

As one of the premier steel manufacturer in Malaysia, MASTEEL benefits from the uptrend of steel bar price and implementation of safeguard duties. Its products go through stringent processes so that they meet the construction industry’s requirements, while it also has an advantage due to the strategic location of its Petaling Jaya plant.

Moving forward, local steel industry will be underpinned by the stronger demand for steel based on record order books of construction players. MASTEEL aims to improve its sales volume due to the mega infrastructure projects expected to be rolled out in the next five years.

As for the Group’s profitability, the recent natural gas price hike is a concern for local steel makers. With the new gas tariff in place, MASTEEL’ ability to pass on the additional costs to consumers will be tested.

Considering USD/MYR slipped from 4.22 to 4.00 in last quarter of year 2017, coupled with higher average selling price, MASTEEL is expected to deliver a strong set of result in FY17Q4.

Let’s assume MASTEEL will be able to deliver MYR60m core profit in a full financial year. Based on outstanding shares of 315.21m, it will have an earnings per share of 19 cent. With forwarded PE of 10-12, MASTEEL will have an intrinsic value of MYR1.90-2.28.

Just for sharing!

For those who interested in my stock analysis reports, may contact me at info.rhresearch@gmail.com or https://www.facebook.com/rhresearch/

Happy investing!

http://klse.i3investor.com/blogs/rhinvest/145713.jsp