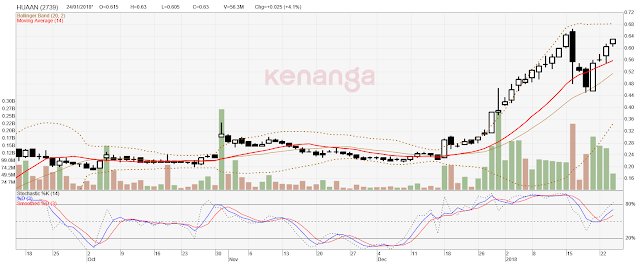

Apparently Upside Limited !!!

Business Involved …

HuaAn is a producer of metallurgical coke.

It has been listed on the Main Board of Bursa Malaysia for more than 10 years.

Its business is production and sale of metallurgical coke ("Coke"). Coke contributes 79% to the revenue (21% from other by products).

HUAAN business is supported by its 1.8 million tones per annum production plant in Linyi City, Shandong Province, China.

What is Coke? The producer buys coal and process it into COKE. The demand for COKE is from the steel industry as it is an important input in the steelmaking process. The process is called blast furnace.

HUAAN

Financial Highlight

For 3QFY17 ended Sept 2017, it posted a net profit of RM34.147 mil vs. RM10.2m loss last year. EPS is at 3.04sen (vs. negative 0.91 sen in 3QFY16). Reason for the earnings surge is mainly due to better average coke price of RMB2,043 per tonne in 3QFY17 and higher sales volume of 210,000 tonnes.

As at Sept 2017 its cash and short term investment stood at RM22.13 million, total debt stood at RM25.36 million.

In 9M17, HUAAN already make 4.91 sen of EPS. Lets assume a full year FY17 EPS of 6.00 sen (A small 1.09 sen for 4Q17 which should be achievable).

What about FY18? Most conservative scenario = 6.11 sen (assuming only 2% earnings growth in FY18). Bullish scenario = 6.90 sen (assuming 15% earnings growth).

The Company is worth at least 6.75x PE. The 6.75x PE is at 25% discount against ANNJOO and MASTEEL (both trading at historical PE of 9x till 23 Jan 2018/).

Most conservative scenario = 6.25x PE * 6.11 sen = 38 sen

Bullish scenario = 6.25x PE * 6.90 sen = 43 sen.

http://bursa-chat.blogspot.my/2018/01/huaan-2739.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+BursaChat+%28Bursa+Chat%29