Updates on Glotec (5220)/ NuEnergy CBM Gas Commercialisation Projects in Indonesia

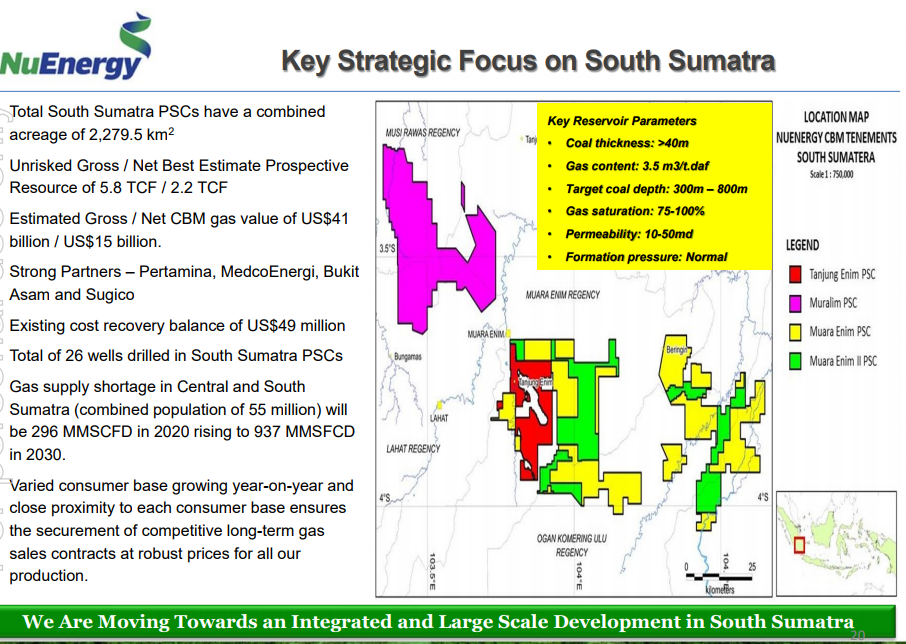

Glotec/NuEnergy has 6 CBM Assets in South Sumatra & Kalimantan covering over 3,600 sq. km: 1. Tanjung Enim PSC (LEMIGAS Confirmation of CBM Gas Reserves/Deposits with Production/Gas Sales - Initial POD sales of 12 MMSCFD for 10 years. Estimated total revenue of ~ US$ 430 Million or RM 1,720 Million? ) 2. Muara Enim 1 PSC 3. Muara Enim II PSC 4. Muralim PSC 5. Rengat PSC 6. Botang Bengalon PSC

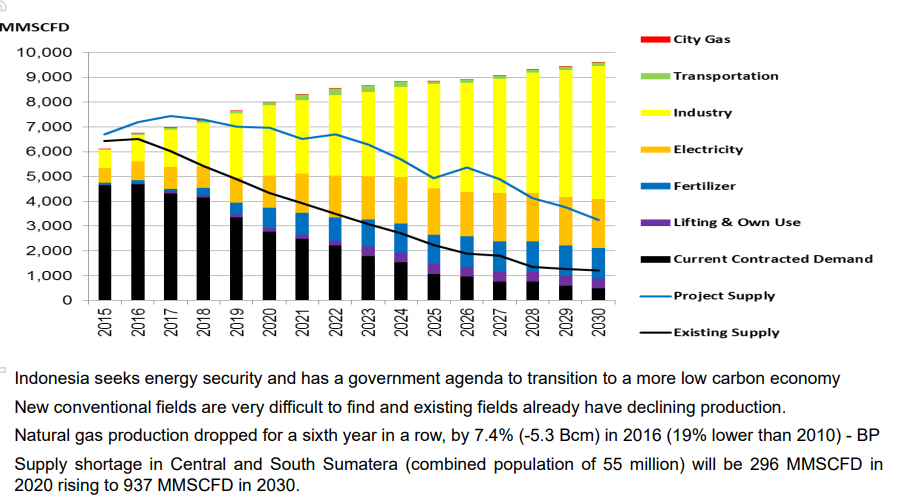

Oil and Gas prices is steadily increasing in 2018. There is a gas supply shortage in Central & South Sumatra with a combined population of 55 million, which will be 296 MMSCFD IN 2020 RISING TO 937 MMSCFD IN 2030.

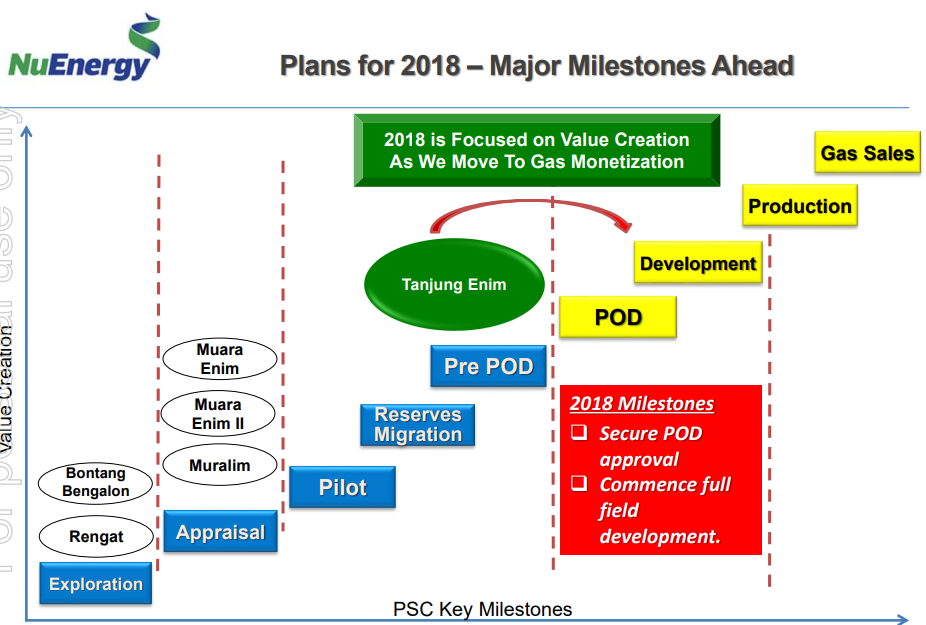

Milestones: 1. Tanjung Enim PSC, South Sumatra - SKK Migas approval for the POD preparation: The Energy segment will work closely with SKK Migas on the POD preparation with the objective to submit the POD proposal to the Indonesia Ministry of Energy and Mineral Resources through the Head of SKK Migas before the end of 2017 with POD approval anticipated by end of the first half of 2018.

The 2 partners, PT Pertamina and PT Bukit Asam, 2 leading state owned energy and resources companies, have both given their full commitment to the POD preparation and the long term development of the PSC. The initial POD plans covers an area 16 km2 and involves the drilling of 100 wells with an estimated gas value of US$430 million/ RM1,720 million.

2. Glotec/ NuEnergy has executed a MOU with PT Pertamina Gas (“Pertamina Gas”) to explore the supply of CBM gas from the Tanjung Enim PSC to Pertamina Gas for distribution to consumers in Sumatra.

"Pertamina Gas is a subsidiary of PT Pertamina, a state owned oil and gas conglomerate and one of our joint venture partner for the Tanjung Enim PSC. Pertamina Gas has a focus in midstream and downstream gas industry of Indonesia with its primary activities in gas trading, gas transportation, gas processing and gas distribution and other businesses related to natural gas and their inheritance products.

This MOU is an important step for the Energy segment to progress on its POD and for the negotiation of the Gas Sales and Supply Heads of Agreement to agree on the main commercial terms including volume, supply period, supply volume and gas price."

3. Announcement on Jan. 15 2018 of LEMIGAS Certification of CBM Gas Reserves at Tanjung Enim PSC

4. Glotec/NuEnergy POD preparation & approval will confirm target gas buyers and negotiate optimal gas sales agreements. Once in production our CBM assets can be quickly monetised with several high-price marketing options with available infrastructure in close proximity, including local compressed natural gas users, electricity companies and independent powers producers. The energy/gas consumption in Indonesia is growing year-on-year and our proximity to each consumer base ensures we can secure competitive long-term gas sales contracts at robust prices for all of our gas production. The POD plans for the development in two target areas, in the north and north-west of the PSC where the Energy segment has focused its exploration, drilling and pilot production activities over the last 8 years. (Now it's payback time)"

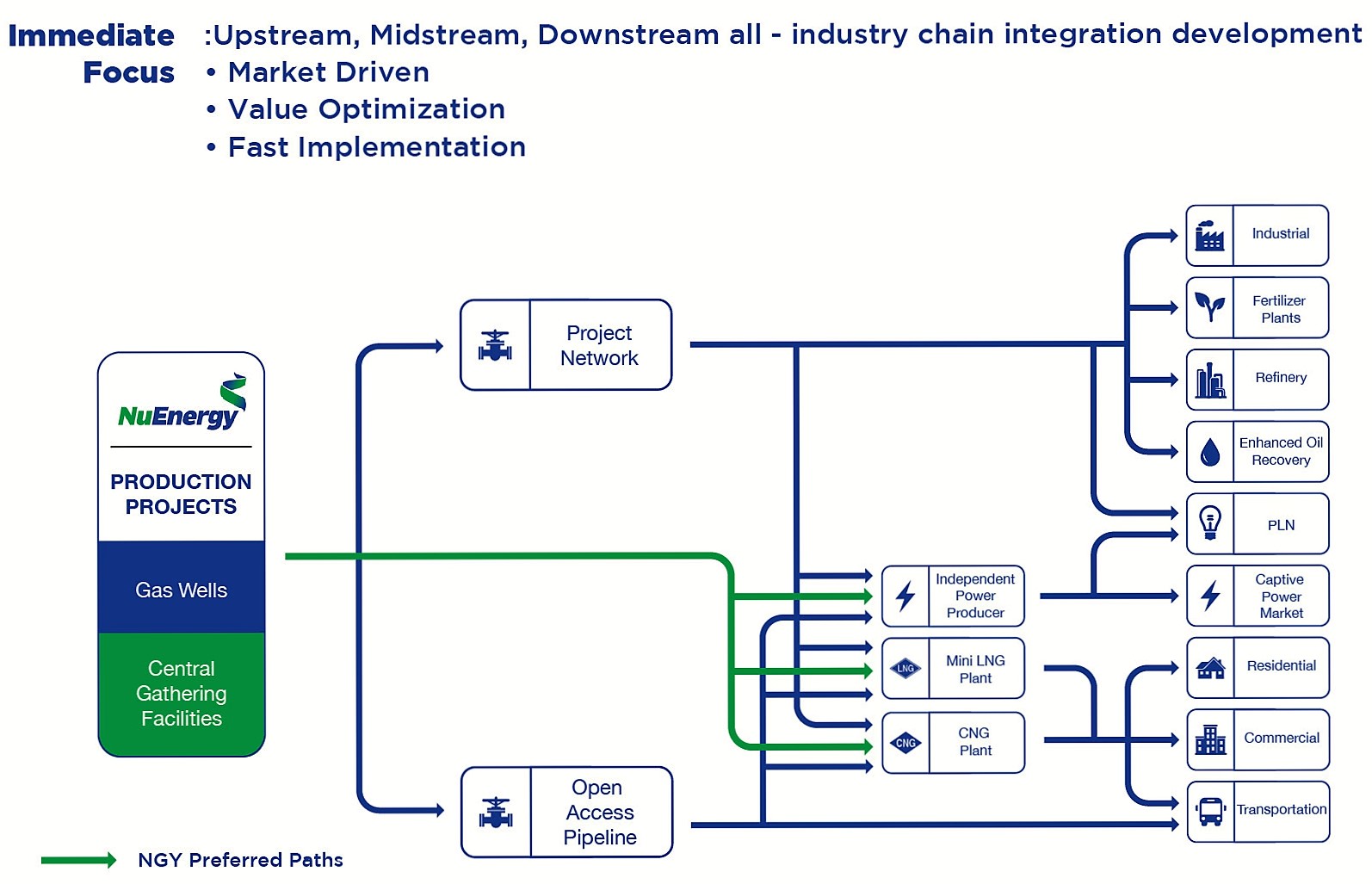

Indonesia’s growing energy demand, in combination with attractive government energy policies, will give NuEnergy Gas the opportunity to grow into a fully integrated energy company, fulfilling our vision to be Asia’s preferred clean energy provider. After successfully developing our Tanjung Enim PSC into production we can invest a proportion of our cash-flow into midstream and downstream infrastructure projects to build out our internal capability for delivering an end-to-end gas solution, from production to consumption.

Gas is clean, versatile, efficient and affordable. The image below illustrates the gas value chain in Indonesia. Every part of this chain can be unlocked to create new value for NuEnergy shareholders.

Glotec/NuEnergy have access to four main end-use consumers: 1. Residential and commercial users (for heating and cooking) 2. Industrial users (for electricity generation, heating and industrial processes) 3. Electric utilities (for electricity generation) 4. Transportation

These four consumer bases in Indonesia are growing year-on-year and our proximity to each consumer base ensures we can secure competitive long-term gas sales contracts at robust prices for all of our production.

Disclaimer: This is not a call to buy, always do your own research before investing in any stocks...

Sincerely Yours,

laulau :)

http://klse.i3investor.com/blogs/laulauramblings/145664.jsp