Early 2017, we have written an article regarding the Malaysia’s

banking sector as we see a bright future for the local banking players.

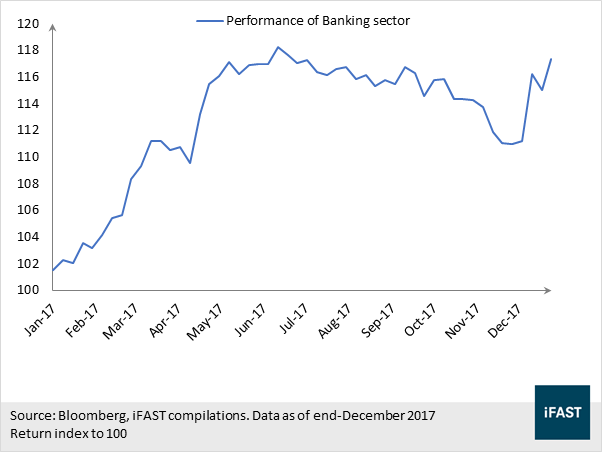

After a year since our call on the banking sector, on average, the share

price of the local banking players surged about 17%, with the two

banking giants – Malayan Banking Berhad and CIMB Group Holdings Berhad

rising close to 24% and 51% respectively. As the banking industry

accounts for about 32% of weightage in FBMKLCI Index, the sector’s

prospect would provide harbinger of the performance for FBMKLCI Index.

As such, in this article, we would like to review the financial

performance of the local Banks in 2017 and to discuss the industry’s

outlook in 2018.

DECENT 9M’17 FINANCIAL PERFORMANCE

Before looking into the prospect of the banking industry, let’s

review the financial results for the various banking players in 2017. On

average, Malaysia’s Banks reported rather decent results, with the

third quarter’s profit surging more than 11% on year-on-year basis. On

9-month cumulative basis, banks’ net profit soared about 15%. The strong

financial performance was a result of healthy loan growth, improving

net interest margin (on average, banks’ NIM expanded by 3.7% for 3

quarters ended September 2017) and a better control on operating

expenses.

HEALTHY LOAN GROWTH

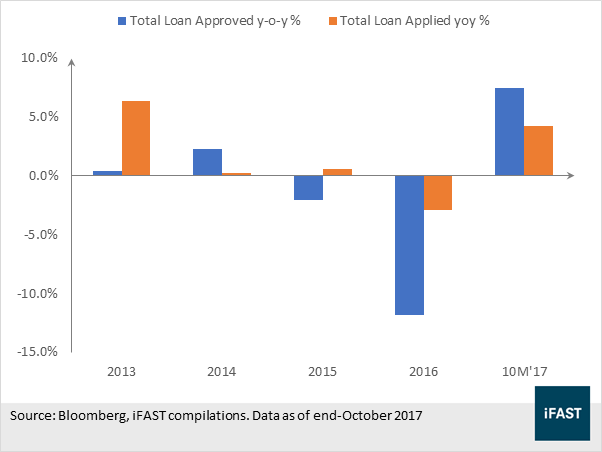

Overall, banking sector saw encouraging growth for total loan

applied (+4.2%) and loan approved (+7.5%) for 10-month ended October

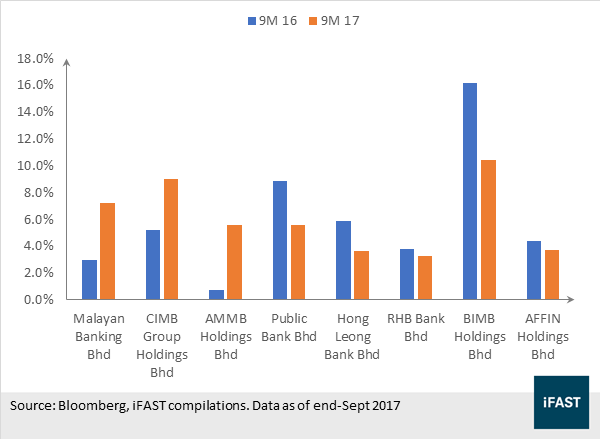

2017 (see figure 2). On the individual bank level, CIMB Group Holdings

Bhd, Malayan Banking Bhd and AMMB Holdings Bhd registered the strongest

loan growth of 9.0%, 7.2% and 5.6% y-o-y respectively (see figure 3).

The positive loan growth for Malaysia’s banking industry was a result of

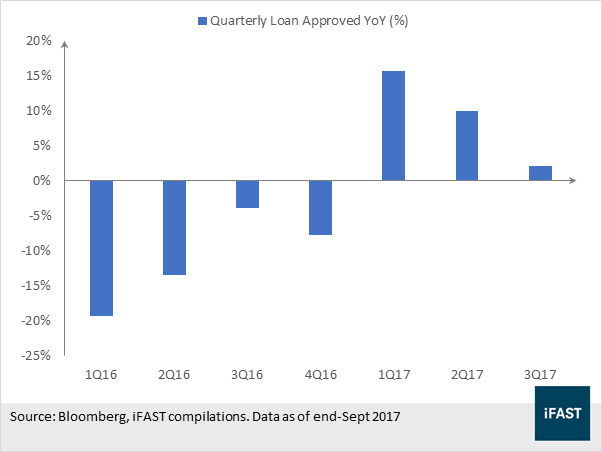

the Banks’ leniency in approving loan applications. From figure 4, one

can notice that the quarterly loan approved posted three consecutive

quarters of positive growth rate after experiencing 4 continuous

quarters of contraction in 2016 as banks seem to have loosened up in

their lending due to the strengthening economic condition in Malaysia.

Given the rather pronounced loan growth, banks’ loan portfolios are

likely to expand at a respectable pace which would allow them to garner

more interest income in years ahead.

BANKING SECTOR LIKELY TO RIDE ON THE STILL STRONG ECONOMIC GROWTH IN 2018

On economic front, 2017 was a very good year for Malaysia, where

we saw the economic activity grew by 5.6%, 5.8% and 6.2% respectively

for the first 3 quarters of 2017. The private sector was the main driver

for Malaysia’s economy, with both the private consumption and private

investment growing at high single digit growth rate of more than 7%. On

top of that, the local manufacturing sector, which accounts more than

20% of Malaysia total GDP, grew at an average growth rate of about 6%

underpinned by strong demand for local E&E products given the rise

in global Technology sector. Hence, the better than expected economic

activity has contributed to the upgrade in Malaysia 2017’s GRP growth by

several organization such as, RAM Ratings Agency World Bank and

International Monetary Fund.

After stepping into 2018, we believe the consumer spending is

likely to further improve underpinned by the cut in personal income tax

and several measurements proposed during the budget 2018 as these

measures are likely to increase the average household disposable income.

On top of that, as the General Election 14 is around the corner, we are

likely to see a pick-up in government spending which might subsequently

lead to higher local consumption and accelerating construction and

infrastructure projects. As such, we expect the banking sector to be one

of the biggest winners in 2018 as the abovementioned factors poise to

create positive impetus for recovering loan demand this year.

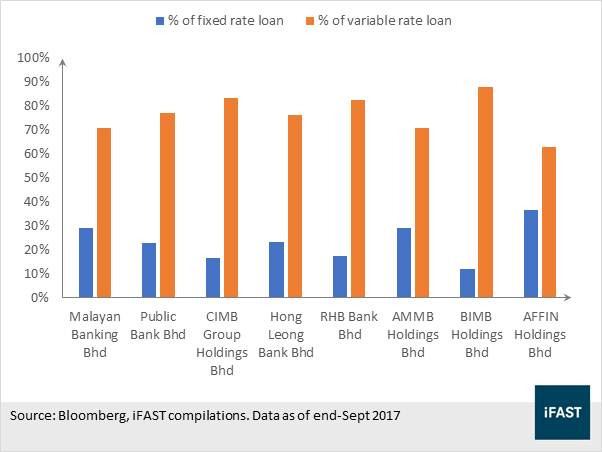

NET INTEREST MARGIN IS LIKELY TO FURTHER EXPAND FOLLOWING BNM’S HAWKISH STANCE

The stronger than expected GDP for Malaysia over the first 3

quarters of 2017 puts OPR hike in play for 2018. During the last

Monetary Policy Committee (MPC) meeting, although our central bank

maintained the OPR rate at 3.0%, they gave the strongest signal for

interest rate hike this year given their bullish stance on Malaysia

economic outlook. As such, OPR hike by the local central bank appears to

be in the pipeline, but we believe it does not indicate the start of a

series of rate hike. However, regardless of how many rate hikes this

year, the banking sector is likely to be the biggest beneficiary from

the hawkish monetary policy as we might see improvement in banks’ profit

margin. The degree of improvement on each of the individual banks would

vary depending on the composition of fixed rate and variable rate loans

of the banks’ loan portfolio (see figure 5). In fact, bank with a

higher level of variable rate loans is likely to benefit the most from

the OPR hike.

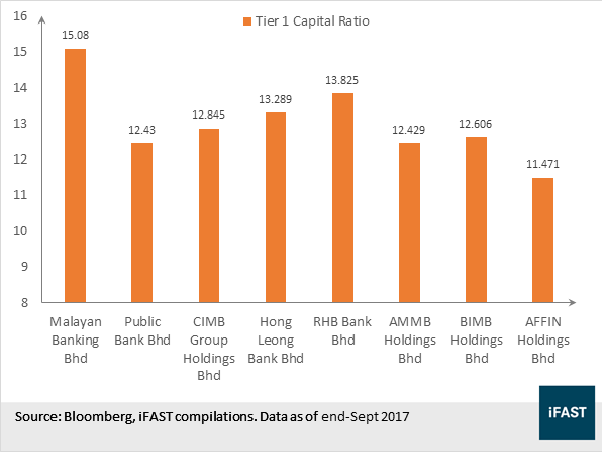

HEADWIND: NEW REPORTING STANDARD – MFRS 9

Starting from 1st January 2018, the new accounting standard – MFRS

9 which required amendments to the following areas such as impairment,

hedge accounting, classification and measurement for financial

instruments has kicked into effect. To a certain extent, the adoption of

the new standard is likely to post a greater impact on the banking

sector by increasing the impairment losses provision.

However, at this early stage, no one could determine exactly what

are the impacts on banks’ income statement and balance sheet but the

increase in impairment losses provision will be charged to retained

earnings, hence it might have a lesser impact on banks’ earnings as

compared to their balance sheet. As such, one should not overly concern

about this as most of the local banks have strong buffers, with the Tier

1 capital ratios well above the minimum capital ratio (6%) required by

the central bank.

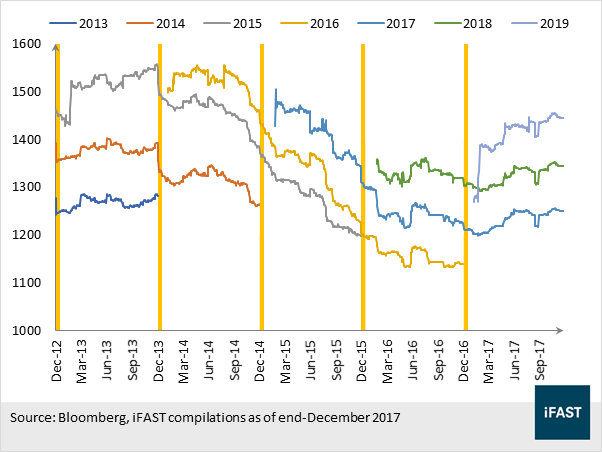

CONCLUSION

After 3 years of earnings downward revision since 2014 to 2016, we

have finally saw an earnings upward revision for the banking sector in

2017 (see figure 7). Stepping into 2018, given the strong economic

backdrop, healthy loan growth, and the expectation of rate hike that

might improve the banks profit margin, analysts have revised the

earnings forecast for banking sector from -2.9% to 3.2% for 2018 and

13.8% for 2019.

For investors who are interested in the banking sector and look for more weightage on this sector, they can consider Affin Hwang Equity Fund;

the fund has more than 30% of allocation into banking and finance

sector as of end-November 2017. On top of that, as mentioned earlier,

given the high weightage of the banking sector in FBMKLCI Index and its

improving prospect in 2018, it poises to be one of the drivers for the

local equity market this year. As such, for investors who want to seek

for exposure within the local equity market, they can considerKenanga Growth Fund. Meanwhile, for investors with greater risk appetite, they might consider KAF Vision, KAF Tactical, Interpac Dynamic Equity and Interpac Dana Safi,

which are investing into the small cap space. However, when come to

fund allocation for small cap funds, investors should limit their

exposures for not more than 20% of their total equity risk budget.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Research Team is part of iFAST Capital Sdn Bhd | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

https://www.fundsupermart.com.my/main/research/-View-Banking-Sector-2018-–-A-Bullish-Year-For-Malaysia’s-Banks-9256