WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

Date : 15 DEC 2017

----------------------------------------------------------

THE STOCK & TARGET

----------------------------------------------------------

Current Price : 0.83 cts

Stock : Hibiscus Petroleum Berhad - HIBISCS

Target : HIBISCS (1st) 0.98 cts & (2nd) RM1.30 (FY18)

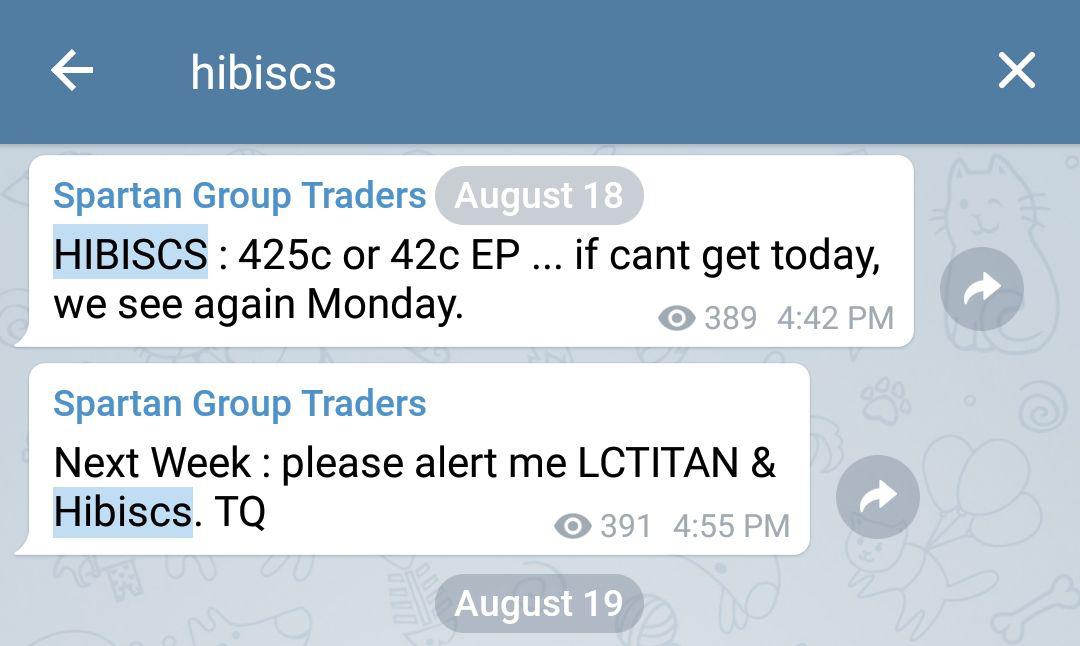

This stock has been alerted and played since at 0.40 cts till now. You may refer screenshot below :

----------------------------------------------------------

WHAT KIM SAY?

----------------------------------------------------------

1. " Next QR will show us the real HIBS..so invest now.." - Kim Spartan

2. " The Anasuria Cluster may help them again stay in the black for the next quarters.." - Kim Spartan

3. "

Very intresting for me what the chairman said is the best thing to do

is to ensure that the company is healthy, and demonstrate growth for the

benefit of the shareholders... I like this sincerity.." - Kim Spartan

----------------------------------------------------------

THE PROFILE

----------------------------------------------------------

Hibiscus Petroleum Bhd

is a Malaysian oil and gas E&P company which developes small oil

and gas fields in the South Asia, South East Asia and Oceania regions by

Upstream oil and gas activities consisting of exploration, development

and production of oil and gas resources. Hibiscus Petroleum Berhad was

incorporated in Malaysia under the Act as a private limited company on 5

December 2007 under the name of Hibiscus Petroleum Sdn Bhd and

converted into a public company under its current name on 20 December

2010.

----------------------------------------------------------

THE KEYNOTE

----------------------------------------------------------

FEB 2017HIBISCS - Hibiscus Petroleum Bhd reported a net profit of RM10.68 million for the second quarter ended Dec 31, 2016 (2QFY17), versus a net loss of RM164.17 million a year earlier, on contribution from the North Sea's Anasuria Cluster. Hibiscus said revenue spiked to RM62.82 million, from RM955,000. Hibiscus' website indicates the firm and Ping Petroleum Ltd are joint operators of Anasuria.

MAY 2017

HIBISCS - Hibiscus

Petroleum Bhd net profit for the third quarter ended March 31, 2017

fell to RM6.49 million from RM80.5 million a year earlier. Hibiscus said

revenue for the quarter rose to RM69.24 million from RM31.78 million a

year earlier. Earnings per share was 0.45 sen compared to 7.32 sen a

year earlier. For the nine months ended March 31, Hibiscus posted net

profit RM97.44 million from net loss RM78.91 million a year earlier.

Revenue for the period jumped to RM186.81 million from RM32.98 million

in 2016.

HIBISCS - Petroliam

Nasional Bhd (Petronas) has given the greenlight to Royal Dutch Shell

PLC for the sale of the latter's 50% stake in the 2011 North Sabah

enhanced oil recovery production sharing contract (PSC) to Hibiscus

Petroleum Bhd's indirect unit SEA Hibiscus Sdn Bhd. Hibiscus announced

last October that it had reached an agreement with Shell for the US$25

million or RM104.63 million stake buy, subject to Petronas' approval.

HIBISCS - Hibiscus

Petroleum Bhd proposed a private placement of up to 144.38 million

shares or 10% of its existing issued share capital to raise up to

RM64.97 million, mainly for working capital purposes.Hibiscus said it

planned to spend RM64.67 million for expenses like business development,

payment to trade and other payables, staff costs, repayment of

borrowings (in future, if any), utilities and other operating expenses,

and potential expansion and capital expenditure (if any).

JUL 2017

HIBISCS - Hibiscus

Petroleum Bhd, which proposed in May a private placement of up to 10%

of its share capital to raise some RM65 million, said it is considering

and pursuing alternative sources of funding from financial institutions

to meet its needs in the near future. These are being planned for

implementation in the near future. The proposed private placement is an

additional effort by the group to maintain a satisfactory buffer, over

and above the group's recurring cash flows, to meet near-term payments

and obligations, while the alternative sources of funding are being

considered and pursued.

AUG 2017

HIBISCS -

Hibiscus Petroleum Bhd’s net profit dropped 54% year-on-year to RM8.65

million in the fourth quarter ended June 30, 2017 (4QFY17) from RM18.95

million, despite a 53% spike in revenue to RM74.47 million from RM48.72

million. Its financial statements show higher taxation of RM19.05

million in 4QFY17, compared with RM4.29 million a year earlier. Pre-tax

profit jumped 65% to RM27.7 million from RM16.79 million, partly because

the previous quarter recognised negative goodwill of RM228.8 million

from its Anasuria Cluster acquisition.

SEP 2017

HIBISCS - Hibiscus

Petroleum Bhd has been granted major project status for the West

Seahorse Project in Australia. Australian Manufacturing, an online

portal specialising in manufacturing-related news, reported on Sept 8

that Australian Minister for Industry, Innovation and Science Arthur

Sinodinos confirmed that the Federal Government had renewed its Major

Project Status to the West Seahorse Project which is located in the

Gippsland Basin, off the coast of Victoria. The project is undertaken by

Hibiscus Petroleum unit Carnarvon Hibiscus Pty Ltd.

HIBISCS - Hibiscus

Petroleum led penny oil and gas stocks higher in active trade on

Wednesday, riding on fresh corporate news and the oil price rally, which

was near its largest third-quarter gain in 13 years.

NOV 2017

HIBISCS -

Hibiscus hopes to increase oil production at Anasuria Cluster, its

primary asset in the North Sea off the United Kingdom, by up to 56% over

the next two years, to 5,000 barrels per day (bbls/day) from 3,204

bbls/day in its financial year ended June 30, 2017 (FY17). This was on

the back of the recently completed project enhancements at three wells

at the Anasuria Cluster of oil and gas fields, designed to improve

short- and medium-term performance to compensate for the expected

production decline of such a mature asset, while seeking to improve

health and safety aspects.

HIBISCS - As

a result of lower tax credit recognised, Hibiscus Petroleum Bhd’s net

profit in the first quarter ended Sept 30, 2017 (1QFY18) was down 86.6%

year-on-year to RM10.78 million, from RM80.28 million year-on-year

(y-o-y). Hibiscus received a tax credit of RM1.06 million, as compared

to RM72.8 million received in the corresponding quarter last year.

HIBISCS - Hibiscus

Petroleum Bhdhas received consent from Petronas Carigali Sdn Bhd to

acquire Royal Dutch Shell's 50% participating interest in the 2011 North

Sabah enhanced oil recovery (EOR) production sharing contract (PSC).

Currently, the PSC is operated by Sabah Shell Petroleum Co Ltd, in

partnership with Shell Sabah Selatan Sdn Bhd and Petronas Carigali. The

Shell units each own 25% stake in the contract. Under the terms of a

conditional agreement signed in October last year, Hibiscus' indirect

unit SEA Hibiscus Sdn Bhd would buy the 50% stake from Shell for

US$25mil and assume the role of operator of the PSC.

----------------------------------------------------------

THE FINANCIAL

----------------------------------------------------------

----------------------------------------------------------

THE PROJECT PORTFOLIO

----------------------------------------------------------

UNITED KINGDOM

Asset Name: Anasuria Cluster, comprising:

-

Cook (38.6%) Producing Field

-

Teal (100%) Producing Field

-

Teal South (100%) Producing Field

-

Guillemot A (100%) Producing Field

-

Anasuria FPSO (100%) FPSO

Effective Interest:50% of Anasuria Cluster (Hibiscus is Joint Operator)

Asset Type: Producing assets with development and exploration potential based around the Anasuria FPSO

Location: ~ 175 km east of Aberdeen, UK North Sea

Water depth: ~ 94 m

Operator: Anasuria Operating Company Limited (JOC) Note 1

Partner: Ping Petroleum Limited

Note 1:

Joint Operating Company with equal ownership between Anasuria Hibiscus

UK Limited (a wholly-owned subsidiary of Hibiscus Petroleum) and Ping

Petroleum Limited.

The Anasuria Cluster comes with stable

positive cash flow from current production with in-field future

development opportunities and exploration upside. It represents an

attractive, geographically focused package of operated interests in

producing fields and associated infrastructure. The assets have a proven

and producing resource base which provides a platform for further

development. A number of incremental development and exploration

opportunities exist within the licence areas which are expected to

generate significant incremental value in the medium term.

AUSTRALIA

Asset Name: VIC/L31 (West Seahorse Field)

Effective Interest: 100% (Hibiscus is Concession operator)

Acquisition Date: January 2013

Licence type: Production License

Reserves: 8.0 MMbbls of 2P + 2C Oil Reserves

Asset Name: VIC/P57

Effective Interest: 78.3% (Hibiscus is Concession Operator)

Acquisition Date: January 2013

Licence Type: Exploration Permit

Water Depth/Size: Up to 150m/460km2

Hibiscus Petroleum holds substantial

equity interest and is the Operator of two licences – VIC/L31 and

VIC/P57 – in Australia via our wholly-owned subsidiary, Carnarvon

Hibiscus Pty Ltd (CHPL). Both licences are located offshore, in shallow

water, in the Gippsland Basin and are core assets to the company. As the

Operator, we have a high level of operational and financial control and

we are responsible for the entire planning and execution of all

activities under these licences.

The VIC/L31 production licence includes

the West Seahorse discovered field, whilst the VIC/P57 exploration

licence comprises several geologically exciting prospects.

The development of the West Seahorse

field has been a key objective of our company due to the near term

visibility on the development and subsequently, production of this

field. In the current low and volatile oil price environment, the

Company has deferred the Final Investment Decision for the West Seahorse

development project. As for the VIC/P57 permit, in accordance with our

obligations under the terms of the permit, CHPL has recently drilled an

exploration well in the Sea Lion prospect in the second quarter of 2015,

demonstrating our ability to execute drilling operations offshore

Australia whilst maintaining a good HSE track record.

OTHER ASSETS

Other assets under the Hibiscus

Petroleum Group are held via its 35% owned joint venture company, Lime

Petroleum Plc. These assets are located in Norway and the Middle East

which are currently in the exploration stage.

Given the extended period of low oil

prices, the Company intends to continue its review of investments in

licences that are primarily exploration weighted against a new set of

investment criteria. In the current volatile price environment, the

Company’s agenda is to take secondary positions in exploration assets

whilst the industry struggles to define its short term outlook. Assets

which have a clearly defined path to near term production will however

be prioritised.

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Or Join Elite Spartan Group Traders (SGT)

http://klse.i3investor.com/blogs/spartan/141501.jsp