WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

Date : 14 DEC 2017

----------------------------------------------------------

THE STOCK & TARGET

----------------------------------------------------------

Current Price : RM3.58

Stock : George Kent (Malaysia) Berhad - GKENT

Target : GKENT (1st) RM3.80 & (2nd) RM4.20

Call warrant : GKENT-CA (0.17 cts) : TP more than 0.30cts +++ '100%'

This stock has been alerted and called by Kim personally on 29 September 2017 at RM3.12. You may refer screenshot below :

----------------------------------------------------------

WHAT KIM SAY?

----------------------------------------------------------

1. " I

forsee this company will continue to grow and its already have strong

order book and deliver the projects in hand towards meeting their

customers’ expectations and continue to improve shareholders’ value. The

TS Chairman and the board is optimistic of next year 2018 as their

strong order book provides sustainable earnings visibility going

forward. This stock already surpass my important line at RM3.30 so then anytime blast to my target..”Good luck! " - Kim Spartan

2."

As the boss said they will continue to execute on their strong order

book of RM5.83 billion to deliver value to their shareholders. Noted

also continue to look out for new opportunities in both the Engineering

and Metering sectors"

3. "George Kent is a key rail play with exposure to the LRT extension, LRT3 and MRT2..." - Kim Spartan

3. "George Kent is a key rail play with exposure to the LRT extension, LRT3 and MRT2..." - Kim Spartan

4." Give it chance and be patient in 7 days from today, you will see my near TP or RM3.70 test.. " - Kim Spartan

----------------------------------------------------------

THE PROFILE

----------------------------------------------------------

George Kent (Malaysia) Berhad an

investment holding company, engages in the manufacture and marketing of

water meters, waterworks fittings, fiber glass reinforced polyester

panel tanks, and various hot-stamped brass products and components in

Malaysia and internationally. The company also markets industrial

measurement and automatic control products, compressed air pumping and

heating equipment, valves, and pipes and pipeline fittings. In addition,

it is engaged in the design, supply, installation, commissioning, and

maintenance of instrumentation, process control systems, and Scada

systems for industries, as well as building automation and building

security systems. Further, the company is involved in mechanical and

electrical turnkey water infrastructure project management, and also

operates and maintains a water treatment plant. It exports its products

to Singapore, Thailand, Vietnam, Myanmar, Cambodia, Indonesia, the

Philippines, Papua New Guinea, Australia, Hong Kong, Sri Lanka, Kenya,

South Africa, and the United Kingdom. George Kent (Malaysia) Berhad was

founded in 1936 and is based in Puchong, Malaysia.

----------------------------------------------------------

THE KEYNOTE

----------------------------------------------------------

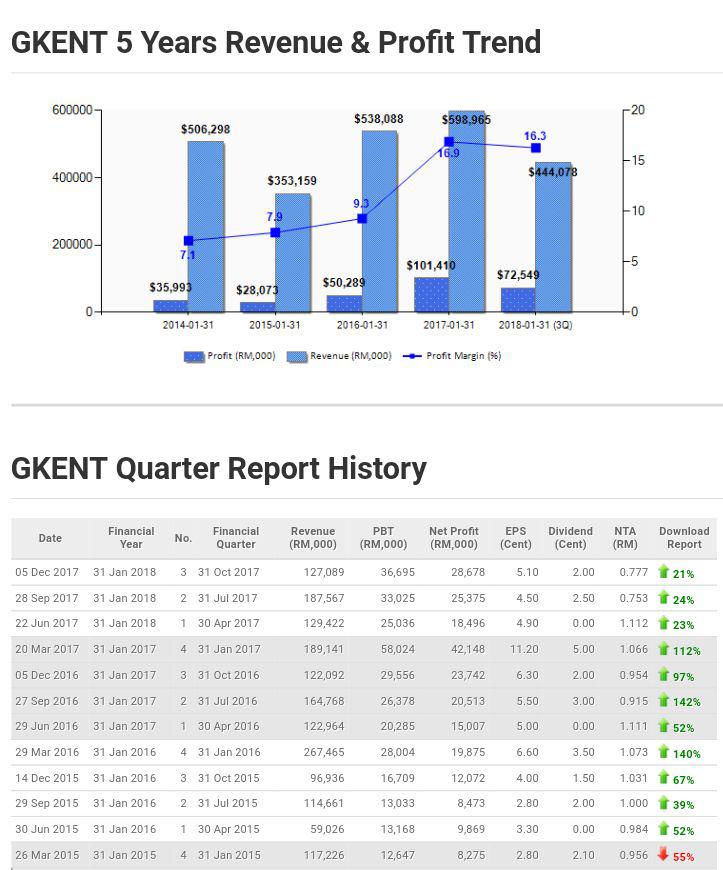

DEC 2017GKENT - Net profit for the third quarter ended Oct 31, 2017 (3QFY17) rose 21% year-on-year to RM28.68 million, from RM23.74 million, driven mainly by sales of water metres locally. The company said revenue for the quarter rose 4% to RM127.09 million, from RM122.09 million a year earlier. Earnings per share for the quarter rose to 5.10 sen, from 4.20 sen previously. George Kent declared a second interim dividend of 2 sen per share, amounting to RM11.27 million, to be paid on Jan 12, 2018.

GKENT - George Kent has yet to book in any significant project delivery partner (PDP) fees for the LRT3 project. While this is the case, share of joint venture profits (from the PDP role) increased 81% y-o-y to RM8.9 million which was mostly due to reimbursables for initial works undertaken. Thus far, six viaducts and one depot package for the LRT3 project has been awarded totalling RM7.1 billion. Recognition of the PDP fees should gain traction in FY19.

----------------------------------------------------------

JAN - NOV 2017

GKENT - Planning

a two-to-three share split, posted a 114% surge in net profit for the

fourth quarter ended Jan 31, 2017 (4QFY17) to RM42.15 million, from

RM19.66 million a year earlier, as gross profit improves, while cost of

sales shrank. It also recorded higher unrealised gain on foreign

exchange of RM1.85 million on foreign currencies held. Its quarterly

revenue, however, was down 29% to RM189.14 million from RM265.58 million

a year ago, mainly as its construction and metering segments'

contributions fell.

GKENT - Reported

a 100% year-on-year increase in net profit to RM101.41mil for FY17, on

the back of record contributions from its engineering and water metering

divisions. The group’s total revenue for the year rose 12% to

RM598.97mil compared with RM536.2mil in FY16.

GKENT - Has

secured contracts amounting to RM1.1bil in FY17, enlarging its order

book to RM6.2bil. This translates to a superior cover ratio of 10.4

times on FY17 construction revenue.

GKENT - Delivered

a strong set of financial results for its first quarter ended Arpil 30,

2017, with earnings up 23.3% to RM18.49mil while its order book has

grown to RM6.1bil. It reported earnings rose from RM15mil a year ago.

Earnings per share were 4.9 sen compared with four sen a year ago. Its

revenue increased by 5.2% to RM129.42mil from RM122.96mil a year ago.

GKENT - They

said capital expenditure this year would run into several million and

it is an ongoing exercise. The company, which presently derives some 80%

of its revenue from the construction division, plans to switch its

listing status to the construction sector from the trading and services

sector on Bursa Malaysia. The sale of water meters contributes to the

remainder of the revenue.

GKENT - Tendering

for about RM4 billion worth of projects ranging from railways to

hospitals, as the group progresses with its RM6.1 billion outstanding

order book. They also highlighted that Singapore’s national water agency

Public Utilities Board has made its third consecutive contract since

2012, with an order for 323,000 units, while the group has also secured

another contract for 600,000 units from Hong Kong.

GKENT - The group has RM95 million in outstanding orders for the water meter business.

GKENT - Has

won for the second time, a US$6.86 million (RM28.72 million) tender bid

to supply water meters to the Water Supplies Department of Hong Kong.

The latest contract entails George Kent’s subsidiary, George Kent

International Pte Ltd, delivering 650,000 DN15 Brass PSM-T water meters

across 24 shipments in two years.

GKENT - The

only company that has simultaneously secured large water meter

contracts from both Hong Kong and Singapore water authorities both

renowned for their stringent standards in water meter evaluations.

GKENT - Second

quarter earnings ended July 31 was 23.7% stronger at RM25.37mil from

the previous corresponding quarter, on the back of 18% stronger revenue

of RM187.57mil. This brought the group's first half net profit to

RM43.87mil, 23.5% higher compared to the first half of 2016. Revenue for

the period stood at RM316.99mil, 10% higher from the year-ago period.

The group has declared a dividend of 2.5 sen per share for Q2, with ex

and entitlement dates set on Oct 11 and 13, 2017, respectively.

GKENT - Partnering

Siemens Aktiengesellschaft, Germany, and Siemens Pte Ltd, Singapore,

for the Kuala Lumpur to Singapore High Speed Rail (HSR) tender. They and

Siemens will form an engineering, procurement and construction (EPC)

pre-consortium to prepare a joint offer on EPC level to the special

purpose company which shall bid for the development, financing,

construction and technical operation and maintenance of the Kuala

Lumpur-Singapore HSR. The agreement may lead to the participation of the

company in the Kuala Lumpur-Singapore HSR project, which could

contribute positively to the company's earnings and net assets in the

future.

----------------------------------------------------------

THE FINANCIAL

----------------------------------------------------------

----------------------------------------------------------

THE PROJECTS

----------------------------------------------------------

Their current projects as below :

No. |

Project Title |

Client Name & Contact |

Contractual Commencement Date |

Contractual Completion Date |

Scope of Works |

|---|---|---|---|---|---|

|

1

|

Ampang Light Rail Transit (LRT) Line Extension Project

|

Prasarana Malaysia Berhad

|

31/07/2012

|

Fully operational and officially launched on 30 June 2016

|

The engineering, procurement, construction, testing and commissioning of System Works

|

|

2

|

Proposed Upgrading Hospital Kuala Lipis Phase II

|

Ministry of Health

|

23/10/2014

|

23/04/2017

|

Design, construction, equipping, commissioning and maintenance of 56-bed Hospital

|

|

3

|

Mount Eriama Water Treatment Plant, Port Moresby, Papua New Guinea

|

Eda Ranu, Port Moresby Papua New Guinea

|

June 1997

|

2019

|

Operation & maintenance of Mount Eriama Water Treatment Plant

|

|

4

|

Construction and Completion of Light Rail Transit Line 3 (LRT3) from Bandar Utama to Johan Setia

|

Prasarana Malaysia Berhad

|

04/09/2015

|

2020

|

Procurement and appointment of consultants and contractors

including preparation of pre-qualification and tender documents,

supervision and management of consultants and contractors appointed to

carry out the development of the entire LRT3 including design, value

engineering, manufacture, deliver, install, test, commission and making

good defects of Systems Works, Track Works and all other Infrastructure

Works with the aim of ensuring delivery of Project

|

|

5

|

Construction and Completion of MRT Sungai Buloh-Serdang-Putrajaya Work Package SSP-SY-2014

|

MASS Rapid Transit Corporation Sdn Bhd

|

August 2016

|

2022

|

Engineering, procurement, construction, testing and

commissioning of Trackworks, maintenance of Vehicles and Work Trains

|

|

6

|

Design and Build 150-Bed District Hospital in Tanjung Karang

|

Public Works Department, Malaysia, Ministry of Works

|

November 2016

|

November 2020

|

Design & build 150-bed Medical and Ward Block, 30 units of

Houseman’s Quarters, 24 units of Class “F” and “G” Quarters, 50-Pax

Child Nursery Centre, Engineering Block, Cafeteria and Visitor Gallery, 2

Fully Equipped Operating Rooms (OR)

|

|

7

|

Design and Build 220-Bed Endocrine Hospital in Precinct 7, Putrajaya

|

Public Works Department, Ministry of Works

|

December 2016

|

January 2020

|

Design and construction of 220-bed Hospital Extension Complex

with Link Bridge to existing Main Block of Hospital Putrajaya and

Multi-Storey Car Park

|

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Or Join Elite Spartan Group Traders (SGT)

http://klse.i3investor.com/blogs/spartan/141395.jsp