(Icon) Gadang - Likely To Report Super Profit In 2018

1. Share Price Retracement

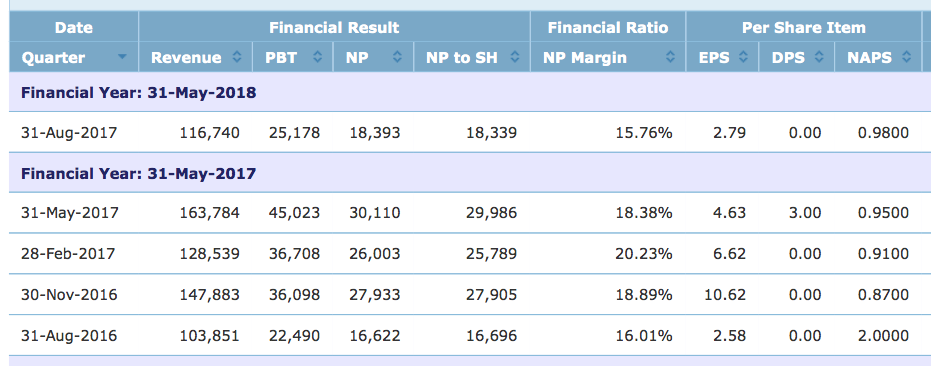

Gadang reported a weak set of result on 25 October 2017. Since then, share price has retraced from RM1.28 to RM1.07.

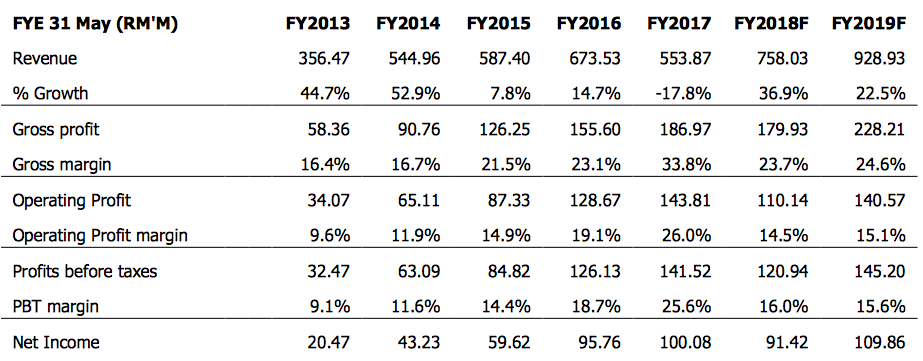

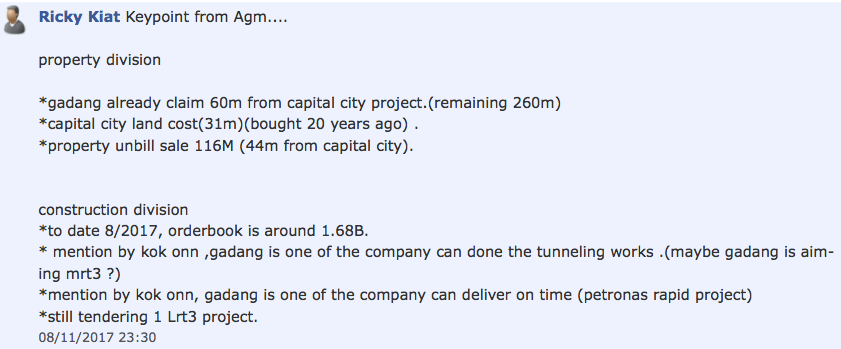

Despite the set back, analysts are still positive about the stock. JF Apex and RHB Investment Bank expect earning to normalise in subsequent quarters, with EPS around 15 sen for FY2018.

(Source : JF Apex Securities)

(Source : RHB Investment Bank)

Based on existing price of RM1.07, Gadang looked undervalued, trading at prospective PER of merely 7.1 times.

Curious about the stock, I decided to take a closer look. What I found was interesting : there might be further upside to the analysts' earning forecast for 2018. The company still has huge earning coming in from its Capital 21 project in Johor.

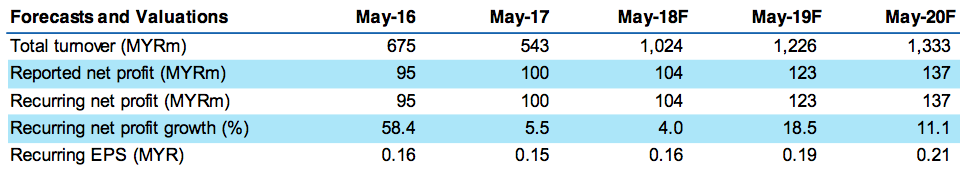

2. Update On Capital 21

According to forum member Ricky Kiat who attended Gadang's AGM on 8 November 2017, there is still RM260 mil revenue to be booked in from Capital 21. The Capital 21 land cost is only RM31 mil. Based on assumption of 25% tax, the project will contribute RM171 mil to net profit going forward.

Unknown to may people, the Capital 21 Project has been listed on Singapore's Catalist (equivalent to malaysia's ACE Market) in May 2017 :

(Source : www.sgx.com)

Please click on the following link for Capital World's latest quarterly report and corporate presentation :-

http://infopub.sgx.com/FileOpen/Capital%20World%201Q2018%20Results%20Ann.ashx?App=Announcement&FileID=478343

http://infopub.sgx.com/FileOpen/Capital%20World%201Q2018%20Corp%20Presentatn.ashx?App=Announcement&FileID=478345

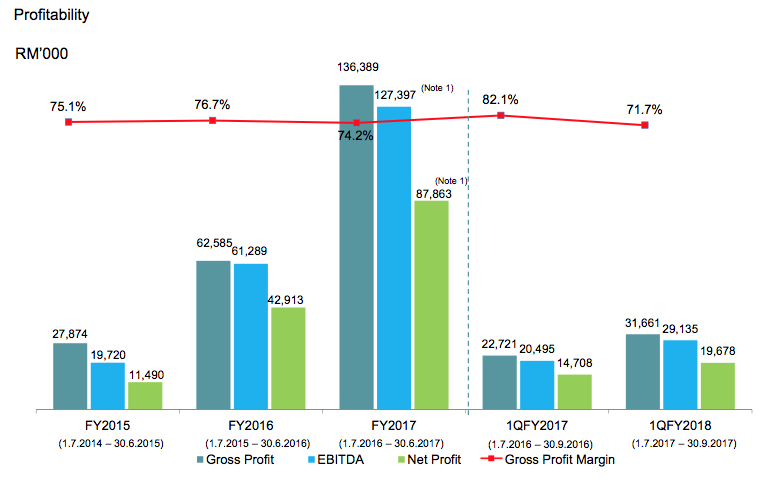

Capital World has been reporting decent profit since FY2015 :-

(Source : Capital World's corporate presentation for September 2017 quarterly report)

Actually, I am not so interested in how well Capital World is doing. What interests me is that the Capital 21 project is progressing well. This is because if the Capital 21 project is doing well, Gadang will get paid.

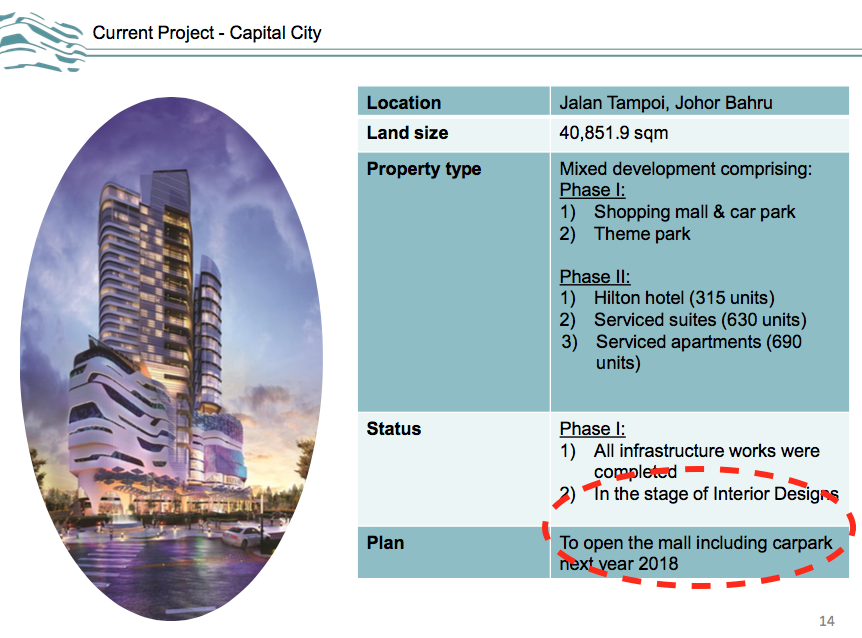

Perhaps the most interesting information from the September 2017 quarterly report is that Capital 21 is currently in Interior Design stage and targets to open in 2018.

(Source : Capital World's corporate presentation for September 2017 quarterly report)

Just to recap, Capital World's project in Johor comprises two components :

(a) the mall with GDV of RM1.3 billion; and

(b) office, service apartments, hotel, etc with GDV of RM500 mil.

(Source : Gadang's 2014 circular to shareholders)

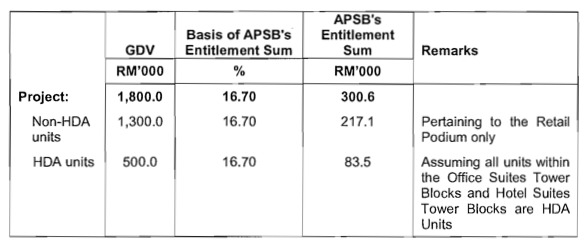

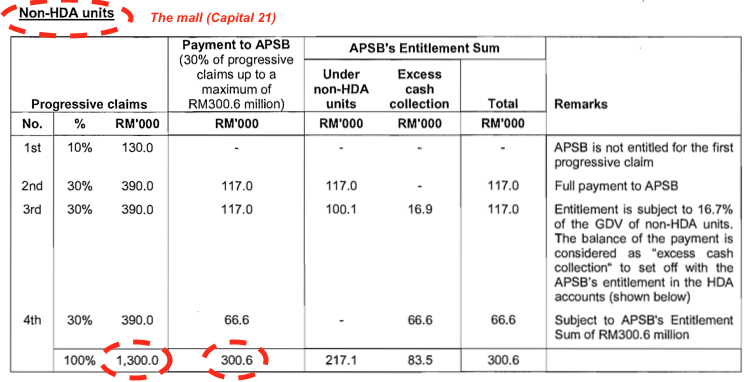

As mentioned above, the mall is targeted to be completed and open in 2018. The remaining components (service aprtments, etc) will likely complete in 2020 (as per Gadang management's guidance during AGM). However, payment to Gadang is substantially based on the mall (RM300 mil out of the RM320 mil). Please refer to below :-

(Source : Gadang's 2014 circular to shareholders)

In this regard, with the opening of the mall, Gadang can expect to receive as much as RM240 mil (being RM300 mil less RM60 mil already received) from Capital World in 2018.

I have to point out that things might not be as simple as I describe above. It seemed that the RM300 mil is further split into RM217 mil and RM83.5 mil (as per table above), depending on Capital World's cash collection. Having said so, I think it is reasonably safe to assume that at least RM217 mil is payable to Gadang upon completion of the mall. Less out the RM60 mil already received, we can expect revenue of lets' say, RM157 mil in 2018 (the rest spills over to 2019 or perhaps 2020). After deducting RM31 mil land cost and 25% tax, 2018 net profit contribution from Capital 21 works out to be RM95 mil. Still a fantastic figure.

3. Concluding Remarks

My guess is that Gadang should do well in 2018. Due to rise in operating cost (steel, labour, etc), the group is likely to experience certain degree of margin compression going forward. However, this will be largely compensated by expansion in construction revenue as the group ramps up execution of its RM1.98 billion construction order book. Cushioned by huge incoming contribution from Capital 21 project, earning visibility for 2018 (and 2019, if Capital 21 spills over) is very good. At current level, risk vs reward seemed favorable.

Gadang will be one of my top picks for 2018.

http://klse.i3investor.com/servlets/cube/icon8888.jsp