Dear investors,

I know if I am saying this, it sounds crazy to you, but that is its fundamental value.

I can say most of investors here don't really understand the model of the Group's operation, that is why the share price has yet react to its fundamental value.

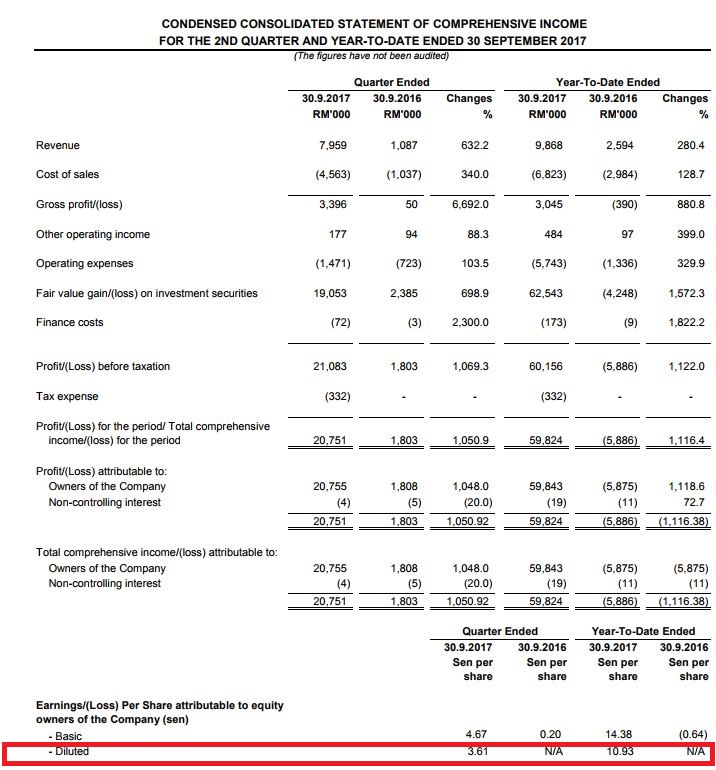

I am quite surprised to see Fintec Global Bhd's latest PE ratio is deep undervalued at only 0.7x after annualising its diluted FY18 EPS and based on current share price of 16sen!

Yes, I noted that its EPS was derived by fair value gain/loss. You would saying that it is not their core or recurring income.

Actually, you are correct as at company level, but at the Group level or as an investment holdings, those fair value are recognisable as part of their net profit because their investments are in position as a business incubator.

Their investment is to help start-up companies they have invested in.

In other words, their operation share similar charateristic with private equity or venture capital but the difference is they also effectively link talent, technology, capital, and know-how in order to leverage entrepreneurial talent and to accelerate the development of companies they have invested in.

This operation is one of kind in local equities market.

The following are local public listed companies they have invested in or we can call them incubatees:

As those companies or incubatees are now making progress towards generating higher profit, their share prices would reflect as well. Thus, the increase in their share prices would contribute higher fair value gain to Fintec's bottomline.

In fact, if they were to dispose their investments, it will translate huge profit to the Fintec's bottomline.

This also would strengthen further its already healthy balance sheet. The Group is in net cash position as of latest quarter results and also remarkable ROE of 27.3%. Meanwhile, its price-to-book value is being trading only at 0.57x.

Contrarian undervalued stock

Soon or later, people will start realise its potential value. Market has discounted the value of this stock too much and it is unfair to the Company.

If I were to play PE ratio just like Mr Koon Yew Yin has been practicing succesfully, this suits well.

So, let's look below for its indicative valuation based on small-cap PE range and its annualised FY18 EPS of 21.86sen.

Remember, if they can do better in the next quarters, its indicative valuation would be even higher than below:

|

Price-to-earnings ratio (PE)

|

Indicative valuation (RM)

|

|

1x

|

0.22

|

|

2x

|

0.44

|

|

3x

|

0.66

|

|

4x

|

0.87

|

|

5x

|

1.09

|

Conclusion

I

have done my own compilation and analysis, and my note here is for your

reference. My opinion is neither recommending BUY, HOLD nor SELL.

http://klse.i3investor.com/blogs/themagicofmerlin/142511.jsp

http://klse.i3investor.com/blogs/themagicofmerlin/142511.jsp