《Trending Case Analysis 4 - Mitrajaya》

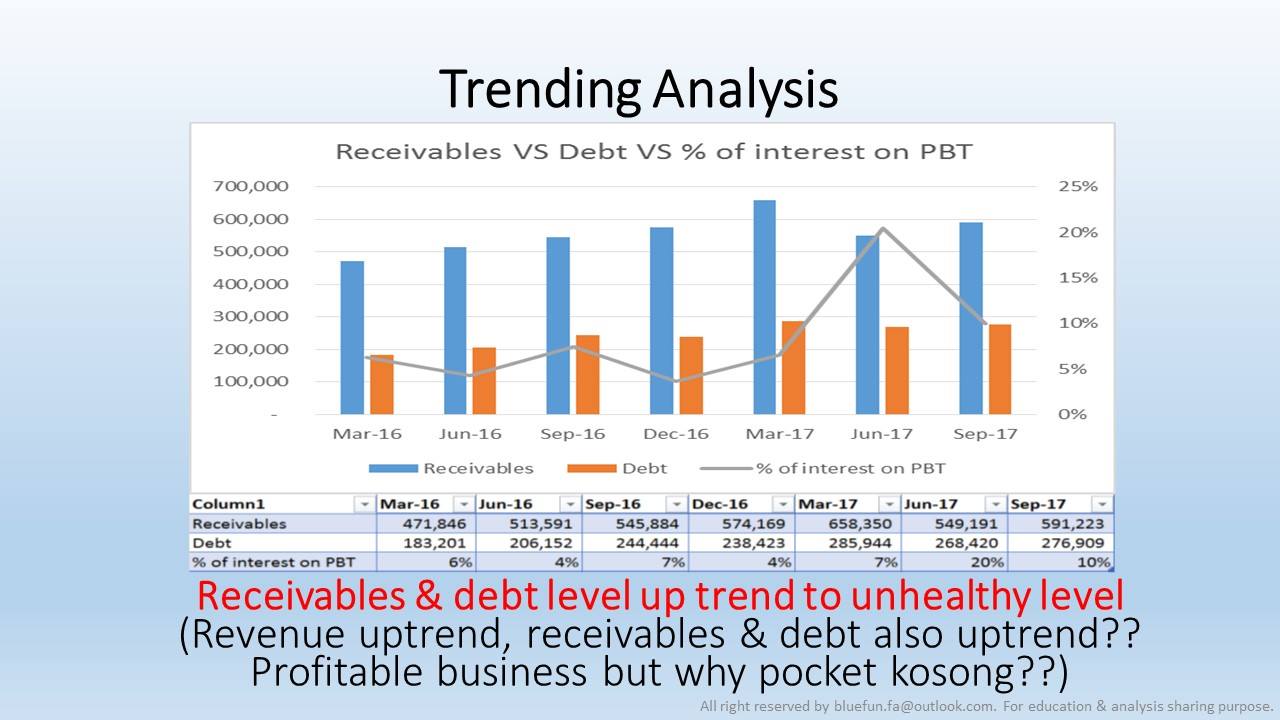

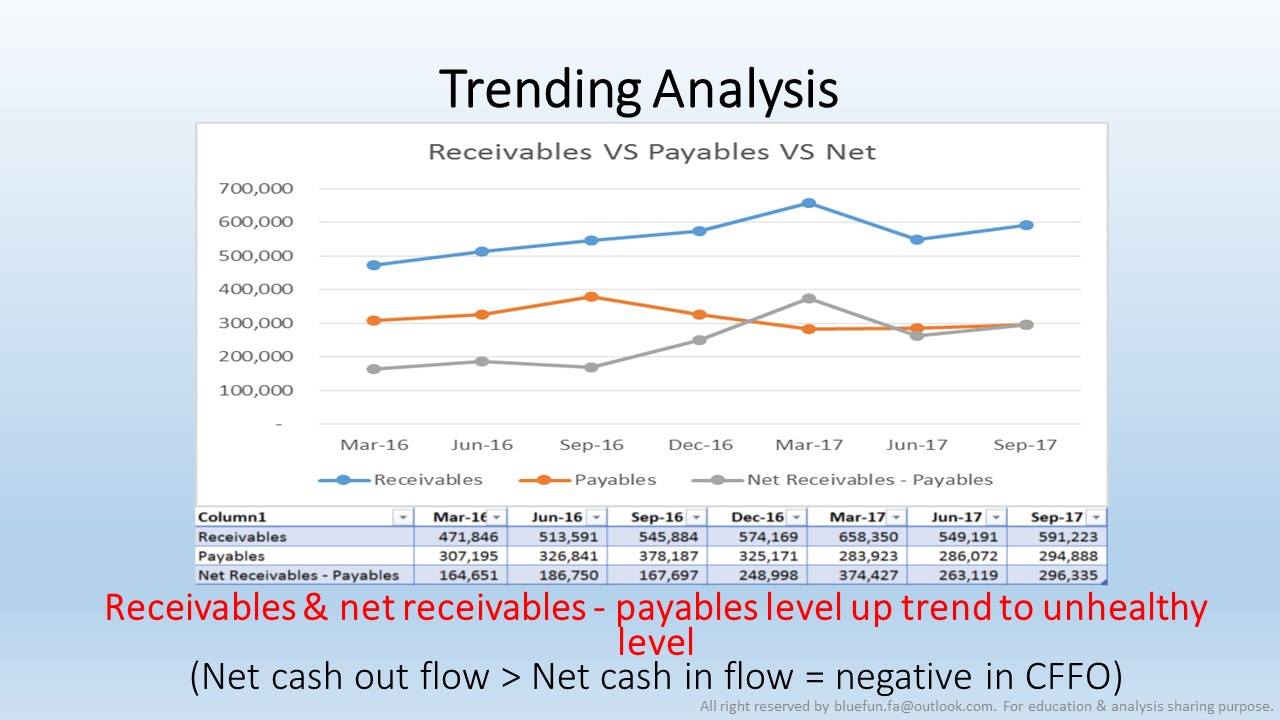

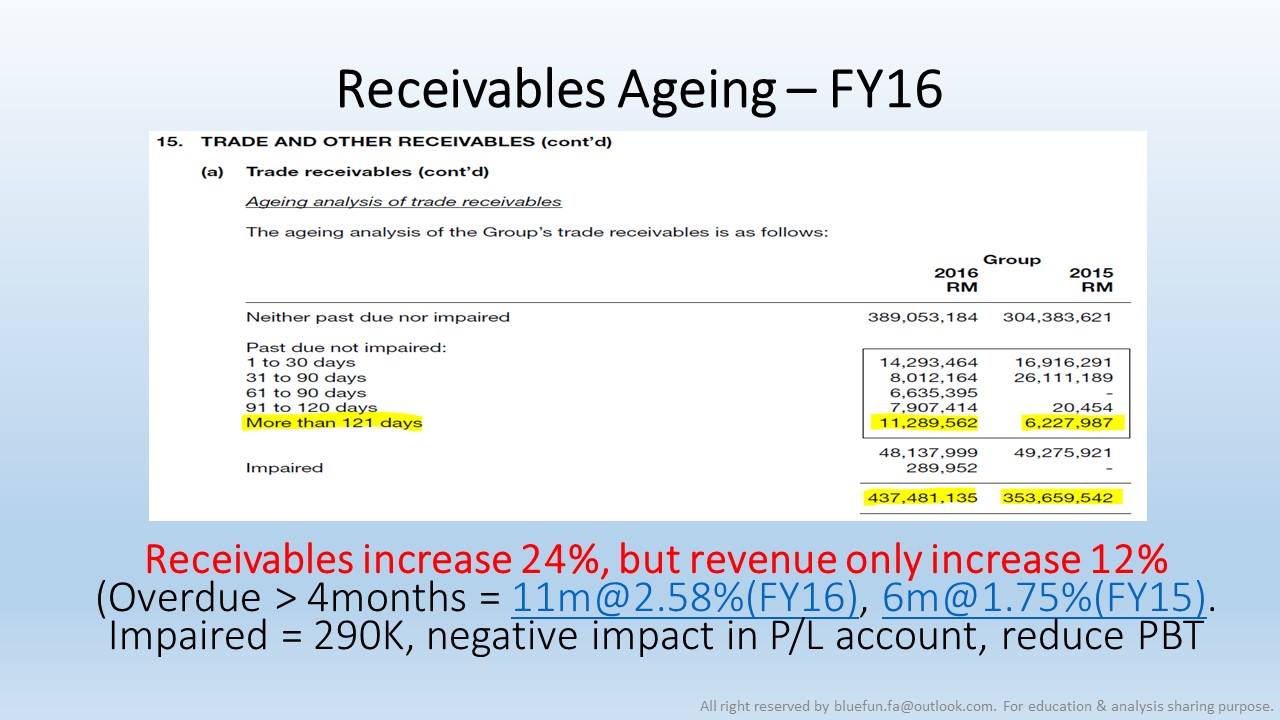

增长的营业额,大成长的客户欠贷??

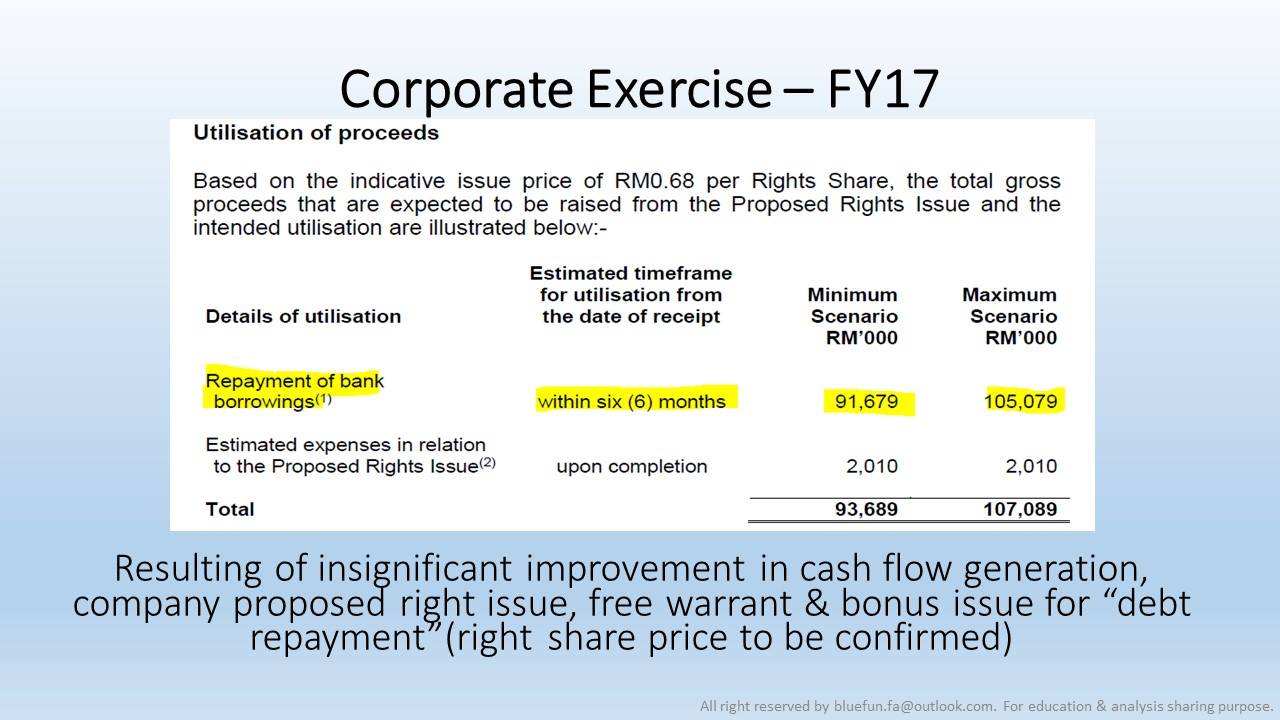

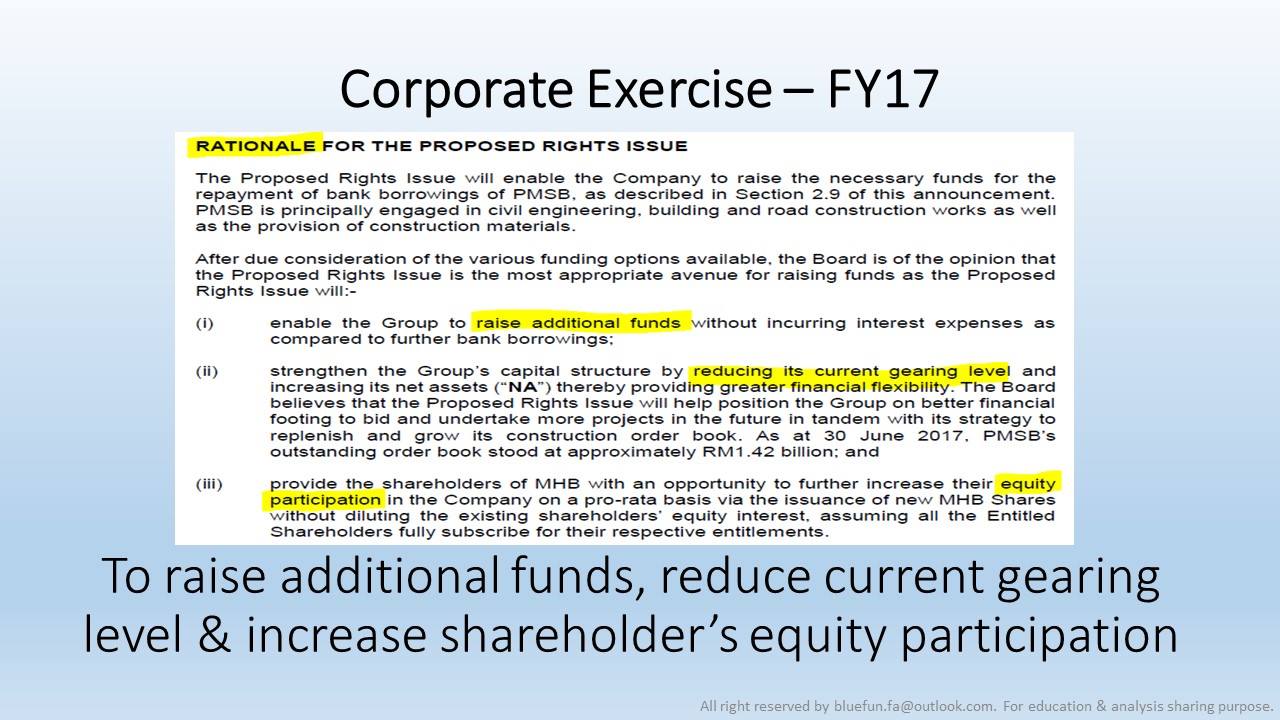

增长的营业额,大大增长的债务??

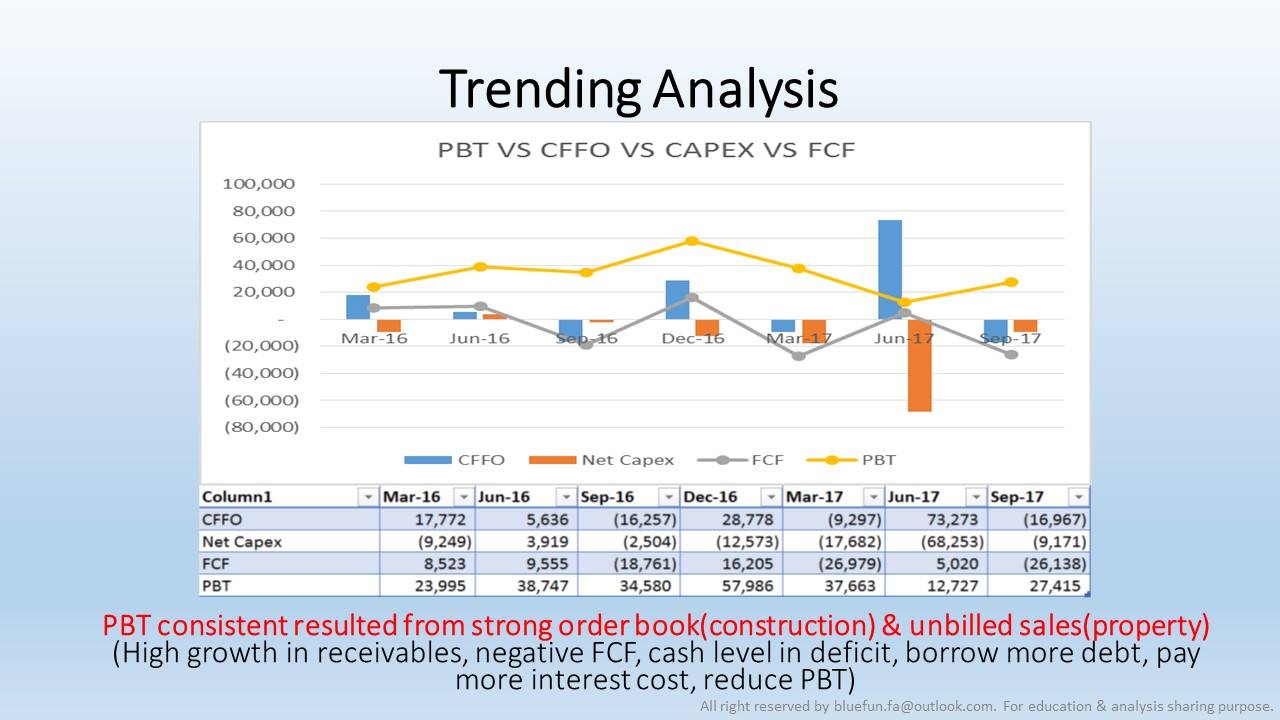

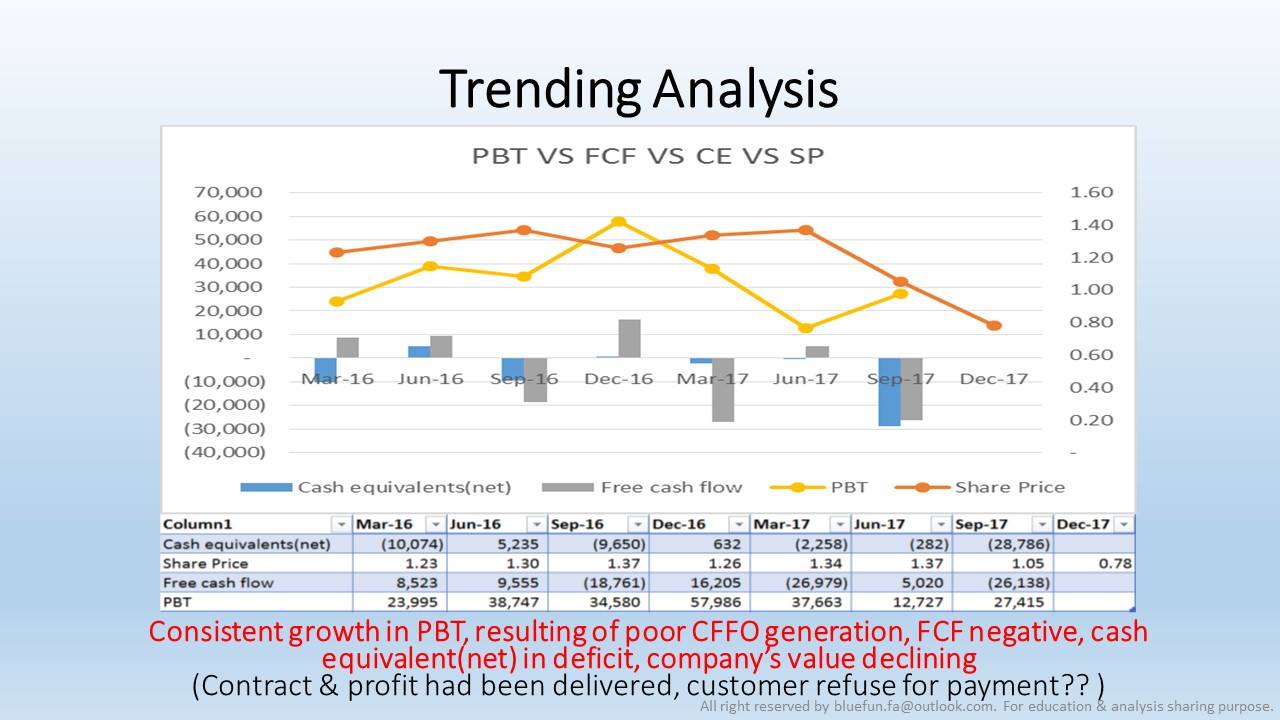

稳定的盈利,为债务不停上扬??

稳定的盈利,为何公司缺钱??

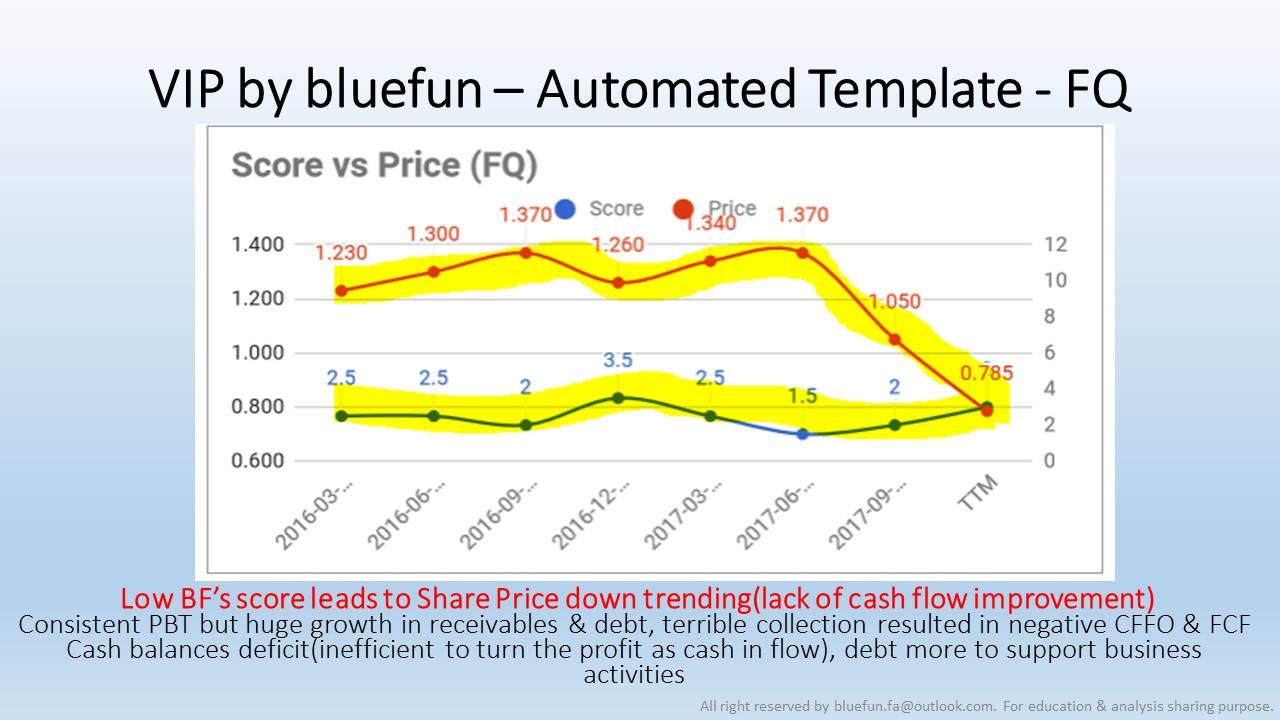

稳定的盈利,为何公司的价值却一直跌跌不休??

一切的答案盡只在 《Fairy tale 之看不见的钱》裡探索。

____________________________________________________________________________________________________________-

用簡單的比喻来说就是,我們這些老百姓多數屬於打工一族,monthly salary & annual bonus (cash in flow) 就是我們的 revenue ,扣除一些大大小小的日常开支如 fuel,dining & beverage,entertainment,expense for family, miscellaneous installment (cash out flow)之後,再扣除 tax & EPF (cash out flow) 就是我們的 net profit 。

試著想一想,若是我們的雇主沒 on time 發薪資(cash in flow),那你說生活中大小事上是不是會面對绑手绑脚的困局??

難道要先個人借貸 (loan & borrowings),來維持生活上的費用??這不僅要承擔借貸利息(interest cost),分分鐘還會陷入破產的風險,既不是得不償失??

Monthly salary & Annual Bonus 與 profit 的的確確只是一個完美的 figure罷了。若是雇主沒發薪資 (cash in flow) ,那你願意繼續奮鬥下去打拼嗎,哈哈哈???

Free cash flow = Net CFFO - Net Capex

Net CFFO = Net cash in flow - Net cash out flow

Net CAPEX = Purchase of PPE + Proceeds of disposal on PPE - Purchase of company core business asset + proceeds of disposal on company core business asset

這套用在一家公司的身上也是一樣的道理呀,哈哈哈。所以說 cash is king,cash flow is queen ,margin is our majesty 。

你我都是打工仔,钱难赚呀钱难赚;

薪水一进到银行,还车贷屋贷还有卡债;

若是薪水不准时,你说老板您是啥意思;

打工仔努力奋斗,为了养家为了未来;

若是付出像水东流;打工仔愿不愿意先个人借贷;

还车贷屋贷还有卡债??

Eye on cash flow & improvement of cash flow

Clear our debt before spend

趨勢中的基本面,只是純粹的炒麵 XD

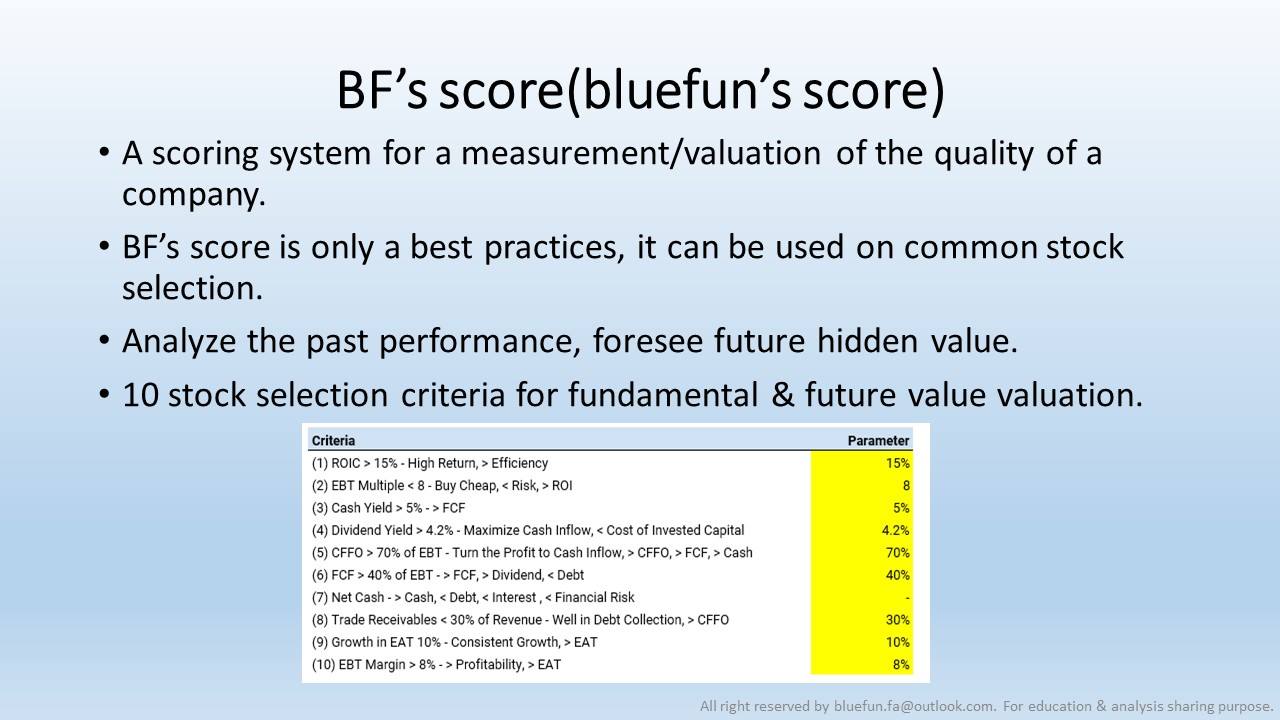

VIP by bluefun = Past financial performance to foresee future value :D

#持之以恒 #水到渠成

#心中要有信才会成

bluefun

17.12.2017

Fb page

P/S: This article is just for education & discussion purpose,this is not a buy call, sell call or hold call. Please trade at your own risk。

http://klse.i3investor.com/blogs/bluefun/141666.jsp