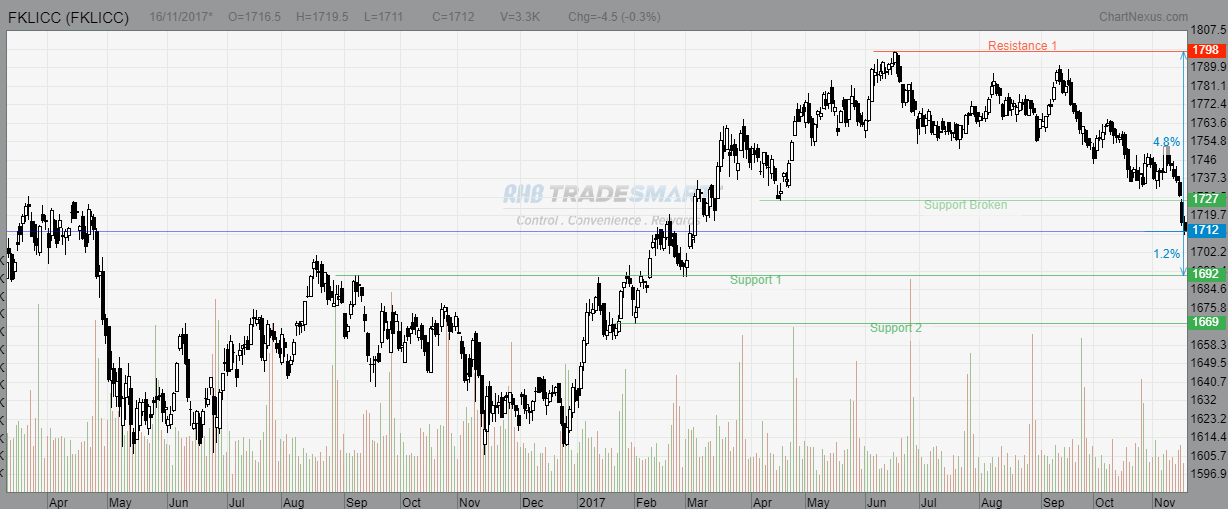

1. FBMKLCI - break 200 days moving average technically in down turn territory. Strong support 1727 break, next support 1692, 1669. Uncertainty and political risk force foreign investor keep on selling Malaysia equities.

Short term view - KLCI almost continuous drop for 7 seven days, chances to test 8 days and the longest is 14 days for recent record.

2. Hang Seng Index - bullish uptrend continue, no signal of reverse. Technically strong support is 26090 which mean a 10% room of adjustment. However we didn't see any sign of adjustment coming in yet. Currently index still stay above 50, 100, and 200 days moving average. 2017 is a good year for Hang Seng since beginning of the year the index has been up around 7000 over points until now.

Short term view - Only two days small adjustment, waiting for big adjustment to come.

3. Strait Times - Singapore also same like Hang Seng maintain at bullish trend. Strong support at 3275 and 3200. STI index since beginning of the year has been up around 500 over points until now. From economic points of view, Singapore's economic recovery is gathering pace due in part to a sustained increase in global electronics demand.

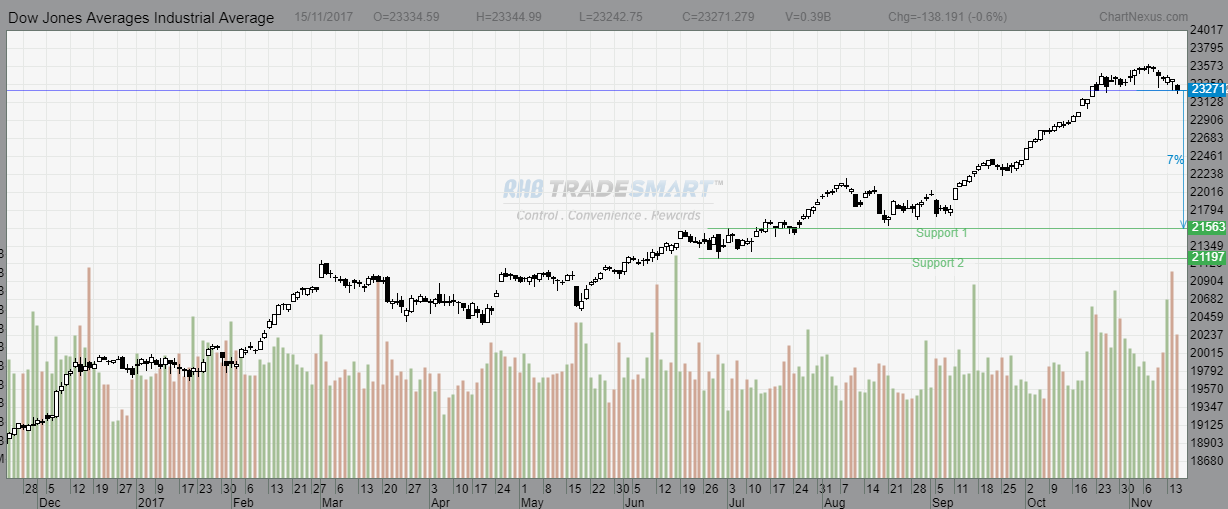

4. DJIA - US Dow Jones super bullish run for 2017, the index has been up 4000 over points until now. Strong support at 21563 and 21197. Strong recovery from US economy has helped to sustain the growth of DJIA until now. DJIA still continue maintain at uptrend territory as the 50 and 100 days moving average not yet broken.

Short term view - Small downward only.

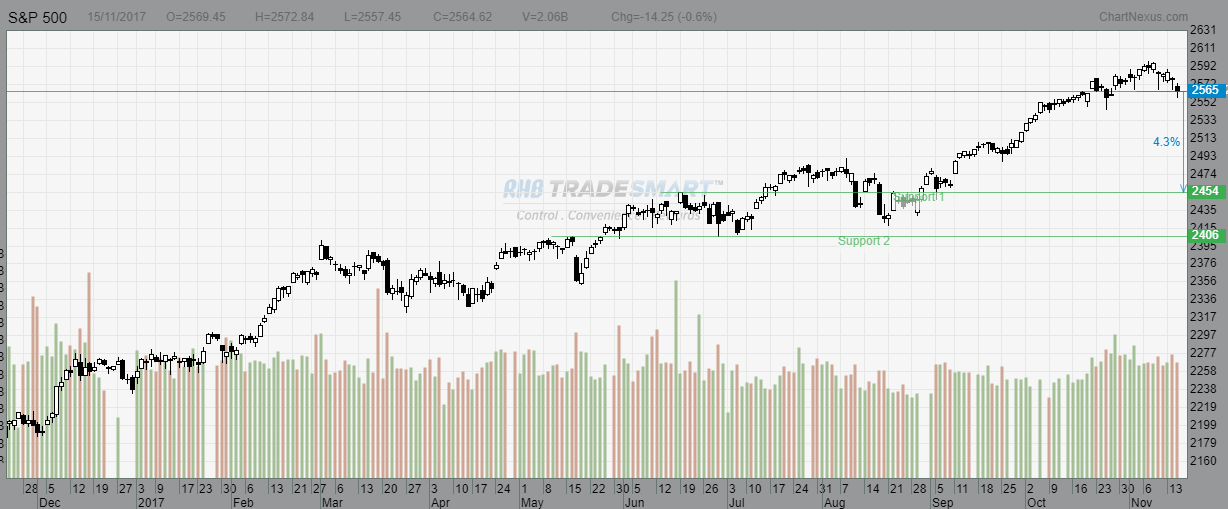

5. S&P 500 - Bullish trend, strong support are 2454 and 2406.

6. Nasdaq - Technology companies enjoy a super bullish year in 2017 as the demand for new technology products and application of new technology have helped to push the business of the world super IT brand companies and their supply chain related companies.

** Index is just a guide for overall

market performance, counters movement might not be affected by index.

However index still a guide for us when we see market, therefore to have

a clearer picture you can zoom in to industry index for a better guide.

以上纯属个人分析与评论,如有任何疑问,欢迎与我交流讨论。任何股票买卖建议输赢绝对不负责。

From:林友志 (Lim Yu Chee)

http://klse.i3investor.com/blogs/emergingasia188/138423.jsp