KAB (0193) - Kejuruteraan Asastera Berhad Balloting- Retail Offering oversubcribed by 57 times

Kejuruteraan Asastera Berhad (KAB)'s IPO to raise RM20 million funding received an overwhelming response from the public. The company is principally involved in provision of electrical and mechanical engineering services in Malaysia.

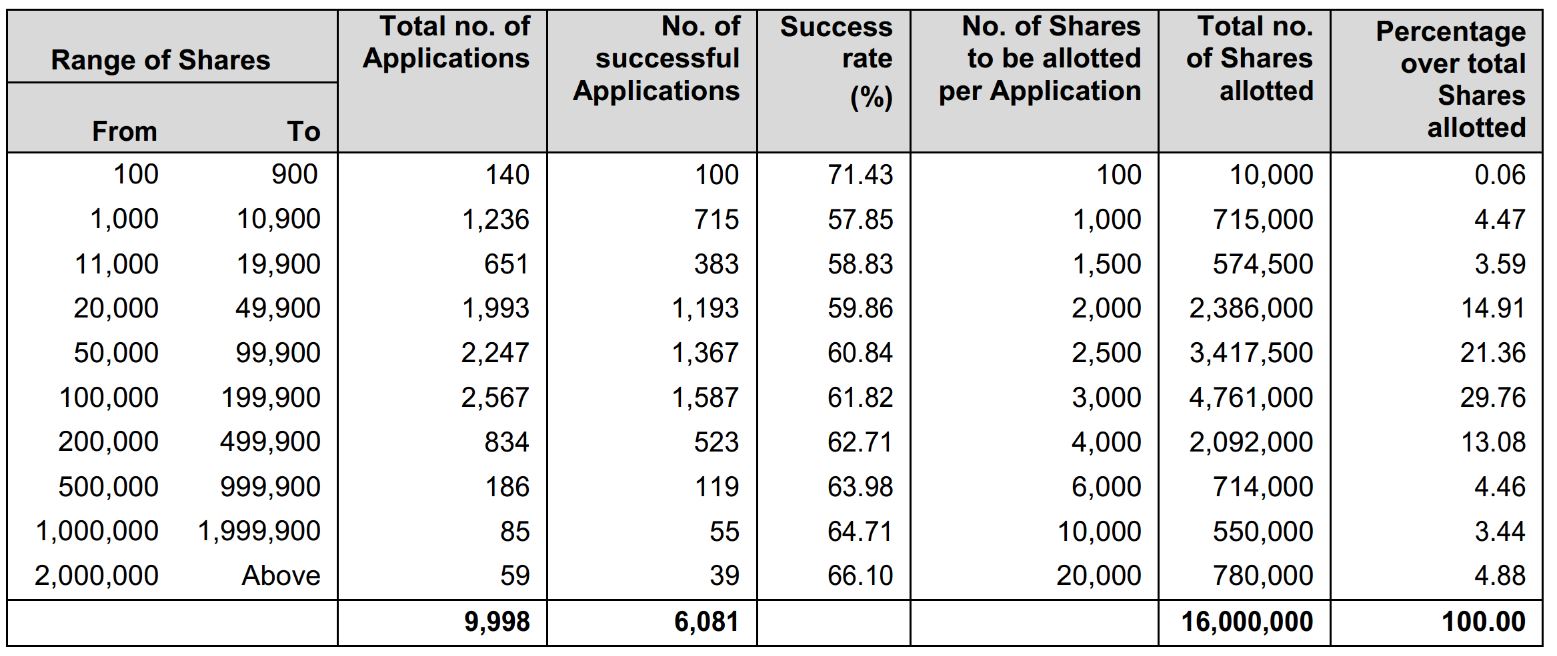

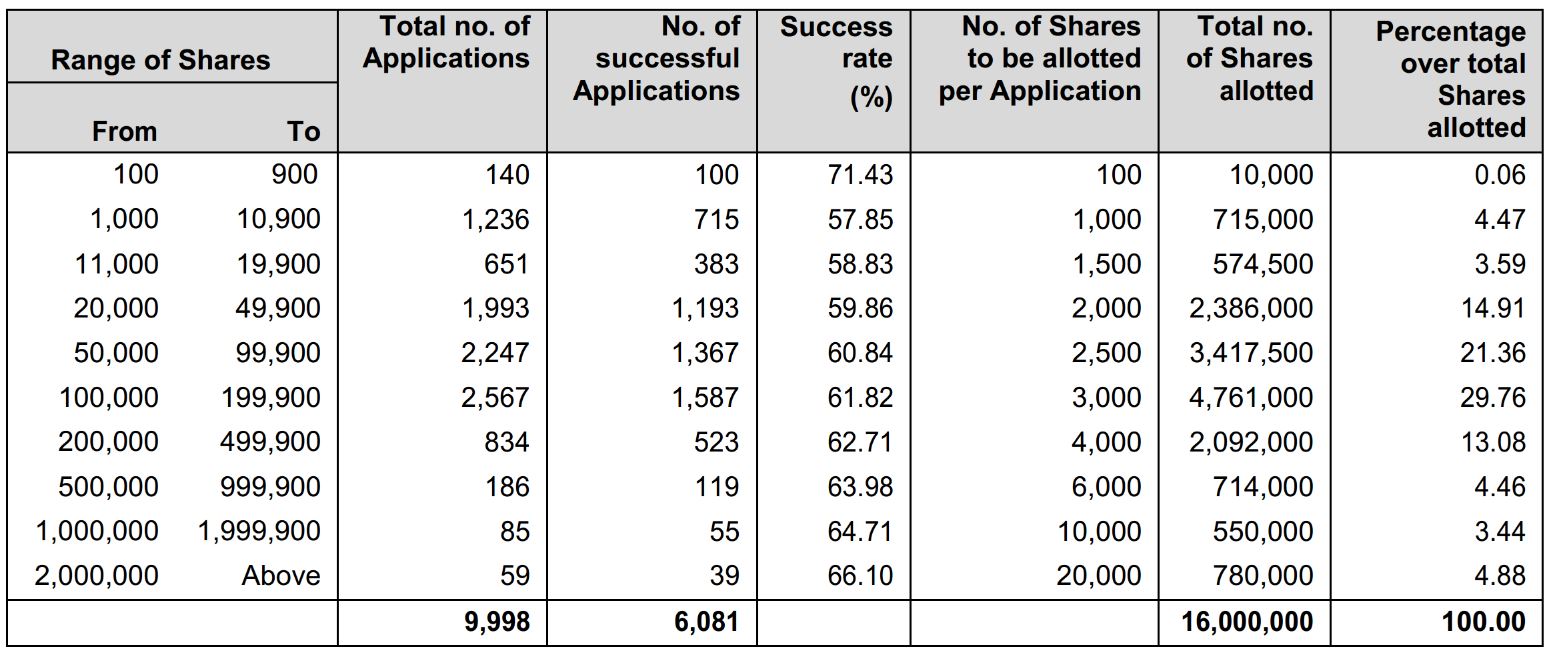

A total of 9,998 applicants seeking for a slice of 16 million issue shares made available for Malaysian public, had applied KAB shares reaching an aggregate sum of 933,280,800. This resulted into an overall oversubscription rate of 57.33 times. However, there is no surprise given how small the offering is available to retail investors, with merely 5 percent of the IPO issuance.The number of successful applicants is 6,081, and the allocation is set out as below:-

For the public portion aside from the retails offering, the balance 8 million shares which are made available to Directors, eligible employees and person contributed to the success of KAB have been fully subscribed.The rest of the IPO issuance totaling 88 million shares for Private Placement has been fully allocated and placed out to 27 selected investors. The distribution of the Placement Shares is set out below:-

The KAB share is priced at 25 sen per share. Successful applicants can expect the KAB shares to be allocated into their CDS account on 15 November 2017 and the listing day will be on Friday, 17 November 2017. The KAB's market capitalisation upon listing is RM 80 million and will be listed in ACE market Bursa.

What to do you think this IPO shares will perform on the first day of listing?

http://klse.i3investor.com/blogs/erenthink/138217.jsp