Mr. Fong Si Ling’s name appeared in latest 30th largest

shareholder list of Jaya Tiasa. When all followers shouted for buy call

given the on track oil palm business, I am worrying about the timber

division of the company. Why? Let’s have a brief analysis.

Important points regarding timber division in Annual Report 2017:

1. In line with the directive from the State government on timber certification, overall timber output from Sarawak has been affected, including the Group’s timber operations. Contribution from our timber segment will continue to be subdued.

(Sarawak’s government had implemented stricter regulation on extraction quota for logging industry in the state.)

2. Our concession log extraction quota for the 2017/2018 Coupe Year was 630,400m3.

(For 2016/2017 was 780,000m3, which is around 19% reduction that could badly affects the operation of this segment.)

3. We have scaled down our downstream wood processing activities recently following a decrease in logs supply due to changes in regulations and our commitment to Sustainable Forest Management Certification.

(An impairment of 66m was recognised during the year since the production and sales in wood processing segment reduce a lot, from sales RM347m in 2016 to RM210 in 2017, around 40% reduction!)

4. Timber

• 32% decrease in revenue was caused by reduction of sales volume. Sales volume in the logging division dropped by 9% while plywood division dropped by 27%. The reductions were due to 41% and 22% decrease in production volume respectively.

• 13% and 7% decrease in the average selling prices for both log and plywood.

(Obviously, both sales volume and selling price dropped recently. With the reduction in log extraction quota of 19% and strengthening of RM to USD recently which will lower down its export income, performance in timber division in worsening and this may cause further impairment loss in PPE in coming future.)

5. Review of operating activities:

6. Higher COGS in timber division

8. Further reduction in log production in latest 3 months:

According to monthly production data released by company in Bursa website, total log production for Q1 FY2018 is 79450m3, which is 38% lower than 127413m3 in Q1 FY2017. Annualised the log production, we get annual log production of around 32000m3. Assuming that the log sales remains constant at 310000m3 level, how much log supply left for wood manufacturing division?

Conclusion

Timber division of Jaya Tiasa remained challenging mainly due to reduction in logging activity which caused lower log sales. This problem worsens the operation of its wood production division due to lack in log supply. We don’t think that it will recover in near future since excess capacity in plywood and vessel factory is forecasted to continue. This may cause further impairment loss in this division. Thus, although the oil palm division has bright future, we are pessimistic in operation of its timber division.

*Just my own 20 cent opinion. Please do your own homework before invest. Happy investing

http://klse.i3investor.com/blogs/13Research/136559.jsp

Important points regarding timber division in Annual Report 2017:

1. In line with the directive from the State government on timber certification, overall timber output from Sarawak has been affected, including the Group’s timber operations. Contribution from our timber segment will continue to be subdued.

(Sarawak’s government had implemented stricter regulation on extraction quota for logging industry in the state.)

2. Our concession log extraction quota for the 2017/2018 Coupe Year was 630,400m3.

(For 2016/2017 was 780,000m3, which is around 19% reduction that could badly affects the operation of this segment.)

3. We have scaled down our downstream wood processing activities recently following a decrease in logs supply due to changes in regulations and our commitment to Sustainable Forest Management Certification.

(An impairment of 66m was recognised during the year since the production and sales in wood processing segment reduce a lot, from sales RM347m in 2016 to RM210 in 2017, around 40% reduction!)

4. Timber

• 32% decrease in revenue was caused by reduction of sales volume. Sales volume in the logging division dropped by 9% while plywood division dropped by 27%. The reductions were due to 41% and 22% decrease in production volume respectively.

• 13% and 7% decrease in the average selling prices for both log and plywood.

(Obviously, both sales volume and selling price dropped recently. With the reduction in log extraction quota of 19% and strengthening of RM to USD recently which will lower down its export income, performance in timber division in worsening and this may cause further impairment loss in PPE in coming future.)

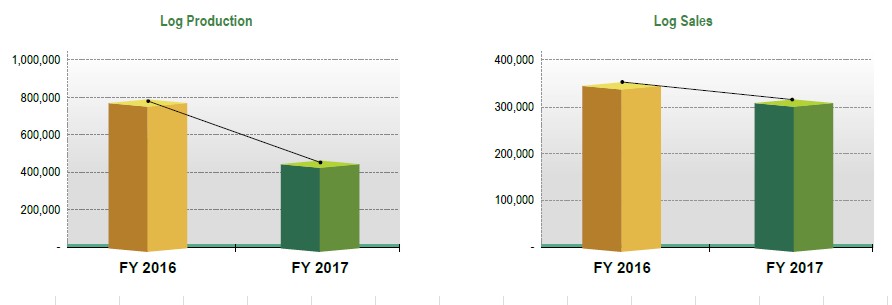

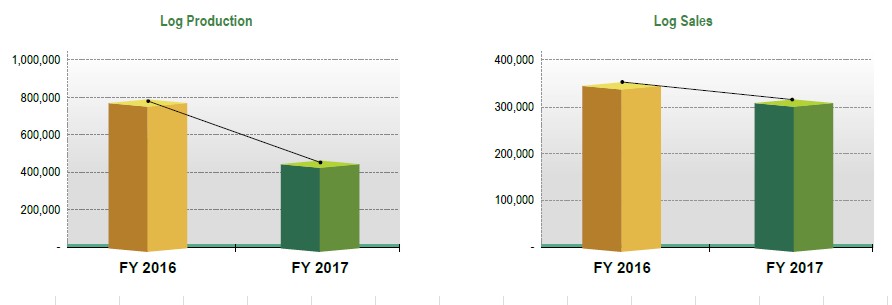

5. Review of operating activities:

- Logging

- Log production reduces from 785602m3 to 463505m3, 41% decrease compared to 2016.

- Log sales volume reduces from 341375m3 to 310651m3, 9% decrease compared to 2016.

- Unfavorable weather conditions as well as the impoundment of

the Bakun and Murum hydroelectric dams have continued to impede the

transportation of logs for downstream processing mills and exports.

- We are also in the midst of applying for timber licenses

extension and undertaking Sustainable Forest Certification. As such we

foresee further lowering in production in the coming financial year.

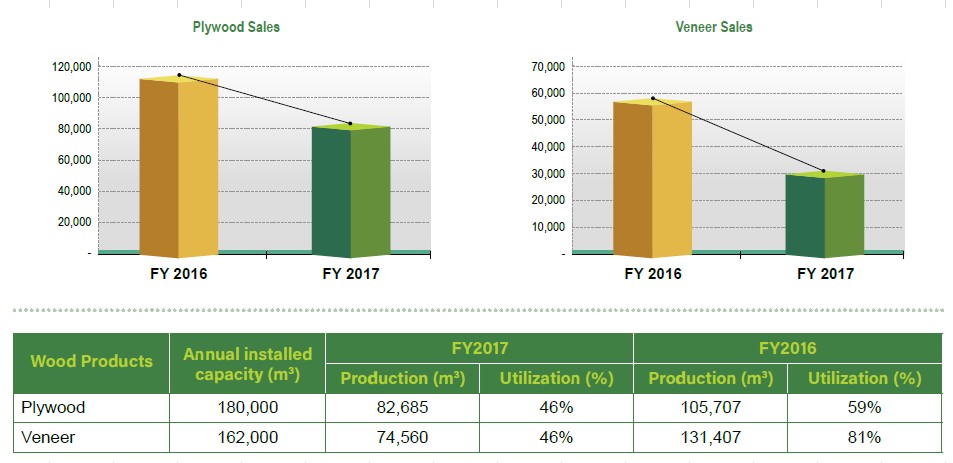

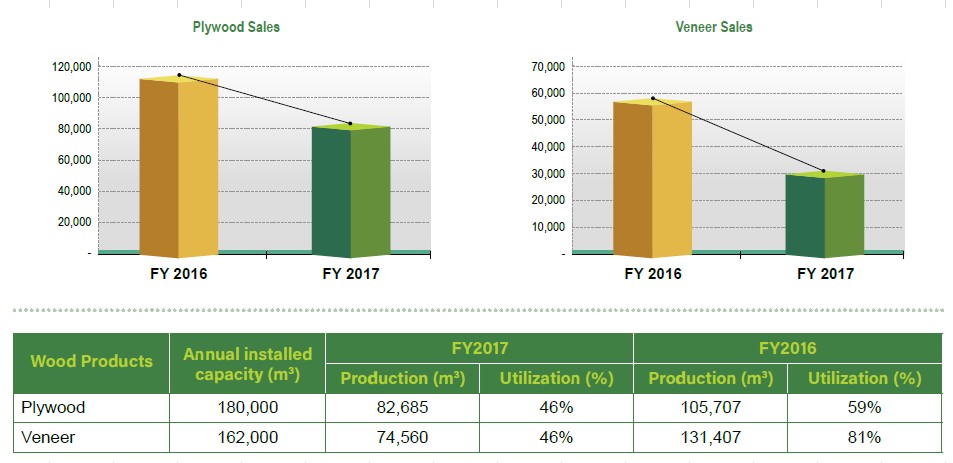

- Wood Manufacturing

- Plywood sales volumes decreased by 27% YoY, while the average selling price decreased by 7%.

- For Veneer, sales volume decreased by 47% and the average selling prices decreased by 3%.

- The utilization rate for the reported financial year for

plywood and veneer facilities was approximately 46% respectively

compared to 59% and 81% in 2016. The main reason for that is the

reduction in log supply since the log production reduced 41% in 2017.

- Log supply has been decreasing and with rising cost of operation, our unit cost is on the rise.

- Rivalry and threat of substitute are getting more and more intense due to technological breakthroughs.

- The downsizing of our plywood manufacturing facility was in

response to market conditions and limited timber

resources.

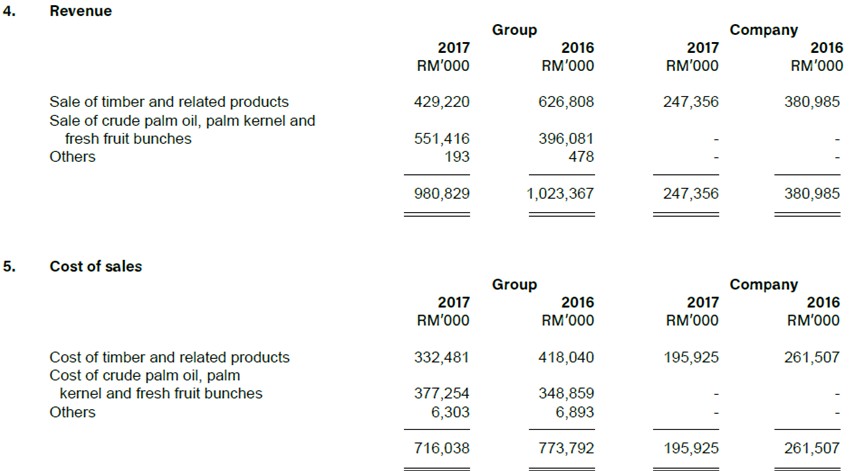

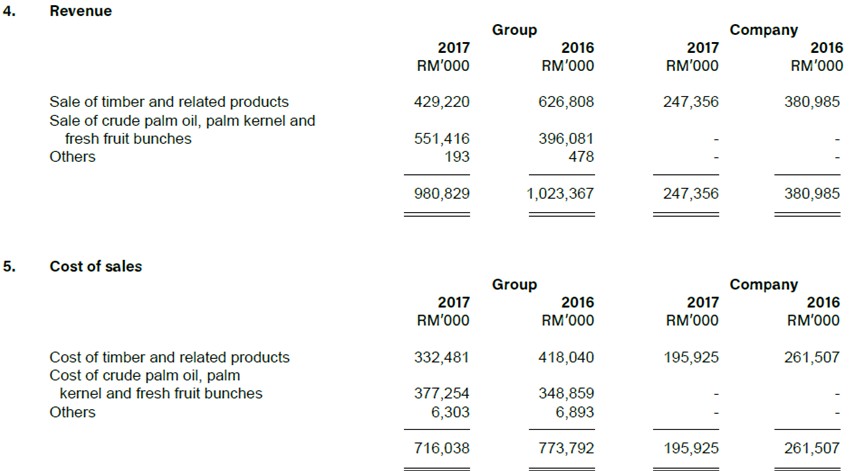

- COGS in timber division in 2016= 418040/626808=67%

- COGS in timber division in 2017= 332481/429220=77%

- Higher COGS is mainly due to average lower production which caused the increase in unit cost of product.

- Our logging business has been affected by the state government’s current initiatives requiring all industry players to revise the methodology on operation.

- Production has dropped due to our undertaking in Sustainable Forest Certification.

- We are fully committed to comply but risk unforeseen delay in its renewal.

- Also, the hike in log premium will adversely impact our profit margin.

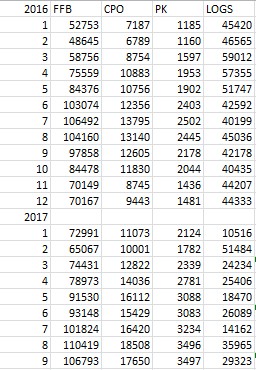

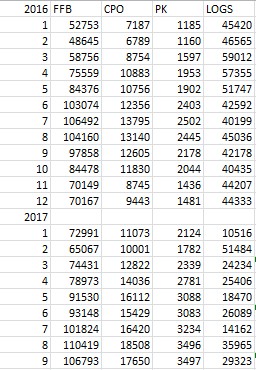

8. Further reduction in log production in latest 3 months:

According to monthly production data released by company in Bursa website, total log production for Q1 FY2018 is 79450m3, which is 38% lower than 127413m3 in Q1 FY2017. Annualised the log production, we get annual log production of around 32000m3. Assuming that the log sales remains constant at 310000m3 level, how much log supply left for wood manufacturing division?

Conclusion

Timber division of Jaya Tiasa remained challenging mainly due to reduction in logging activity which caused lower log sales. This problem worsens the operation of its wood production division due to lack in log supply. We don’t think that it will recover in near future since excess capacity in plywood and vessel factory is forecasted to continue. This may cause further impairment loss in this division. Thus, although the oil palm division has bright future, we are pessimistic in operation of its timber division.

*Just my own 20 cent opinion. Please do your own homework before invest. Happy investing

http://klse.i3investor.com/blogs/13Research/136559.jsp