As the world’s regulation has become more stringent on energy-efficient light sources, it gave LED market a huge penetration into lighting market. The total market is expected to grow annually by 5% until 2020 and 3% thereafter – “Sources: Lighting the way: Perspectives on Global Lighting Market”.

In my opinion, JHM Consolidated Bhd is one of the company that will benefit from the growing LED market. The Group, through its subsidiaries, operates in two segments: electronic products, which is engaged in manufacturing and assembling of components related to rear automotive high brightness light emitting diode (HB LED), direct current (DC) micromotor components and fine pitch connector pins. I’ve summarised few important notes below.

1) A Glimpse into JHM’s Recent Financials

It is important to keep track on a company’s Sales and Net Profit. Based on net profit from 2007 to 2014, JHM’s profit has been flattish. This might be due to strong competition in LED industry. In 2014, JHM made a lost in net profit due to increase in operational cost and lower demand for high profit margin products in LED application. This clearly shows that JHM relies solely on LED application products and if the profit margin of this product declines, it will impact JHM’s profit.

However, from 2015 and 2016, the revenue and net profit results accelerated especially in Electronic Products segment. What happens now? Let’s take a deep dive. End of FY 2014, JHM has secured new customers (manufacturing of electronic printed circuit boards assembly) and broaden its customer base to reduce dependency on a major customer. In FY 2015, JHM reported that the new customers have contributed RM 23.81 mil or 18.13% of Group’s total revenue. In turn, this is reflected in their financial performance coupled with better economy of scale and productivity.

2) JHM’s Core Business

As shown above, JHM is concentrated into Electronic Product segment which incorporates Electrical and Electronic Business, Mechanical Business and Assembly of Automotive. JHM plays an OEM role from fabrication of tooling, design and assembly of LED Lighting application such as Rear Automotive LED for passenger cars, production in LED application supporting 3D effects.

3) Key Growth Drivers

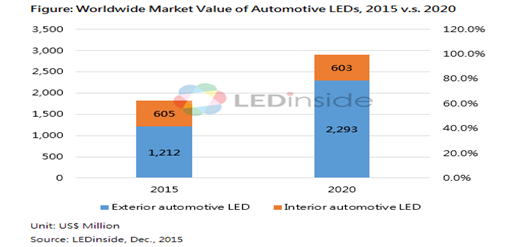

(i) High expected growth in automotive LED lighting market

“In additions to passenger cars, JHM is in preparatory stages to commence manufacturing in LED lighting modules for motorcycles, trucks and buses for European and Japanese multinational corporations.” Sources – theedgemarkets.com

(ii) Upcoming business segment in Aerospace Supply Chain

The main purpose of this certification is to establish, develop, and maintain industry quality requirements to improve product and process integrity. Below are some of the requirements companies need to comply with for AS9100 certification,

· Include regulatory requirement of product and services.

· Include process for continual development

· Conclude definitions for product risks, special requirements, critical items and characteristics.

· Documentation of Quality Manual, Procedures, Forms & Records, Control Document and Forms.

According to The Edge Financial Daily on February 2017, JHM said BSI Group is accredited under the Industry Controlled Other Party Scheme (ICOP) and the assessment was performed in accordance with the requirements of AS9104/1 Rev 2012-01 (AS9100) for the scope under “The Manufacture and Assembly of Electronic Lighting Modules”.

ICOP is a globally harmonised aerospace QMS certification process defined by International Aerospace Quality Group, a Brussels-based non-profit association within the aerospace and defence industry.

In short, AS9100 Quality Management System certification is not easily obtainable and this gives an advantage to JHM as this is perceived as high entry barrier. Lastly, the new aerospace business will be projected to contribute starting early of 2018.

My INSIGHTS

Given the fact that automotive LED lighting industry is expected to growth at a substantial rate and certification of AS9100 in Aerospace and Aircraft supply chain, this puts JHM is a strong position to gain market presence.

No doubt JHM is considered as a company that has high growth potential but investors should always be cautious of the risk lurking in every company. Risk of being dependent on major customers and possibility of delays in R&D activities might disrupt the company’s well-being.

“A company’s expected future must not be viewed as a predicted definite outcome, but as a range of possibilities that might occur.” – Norman. Y

You may find other articles here (http://www.stocksinsights.com/)

http://klse.i3investor.com/blogs/IntelligentContrarians/137871.jsp