WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

Date: 17 November 2017

--------------------------------------------------------

STOCK & TARGET

----------------------------------------------------------

Stock : INARI - (RM2.84)

Target Price : RM3.30 & RM3.50 ------------- & RM4.50 (FY1/18)

Warrant : INARI-C3 : TP more than 0.20cts +++ 'Jackpot CW"

----------------------------------------------------------

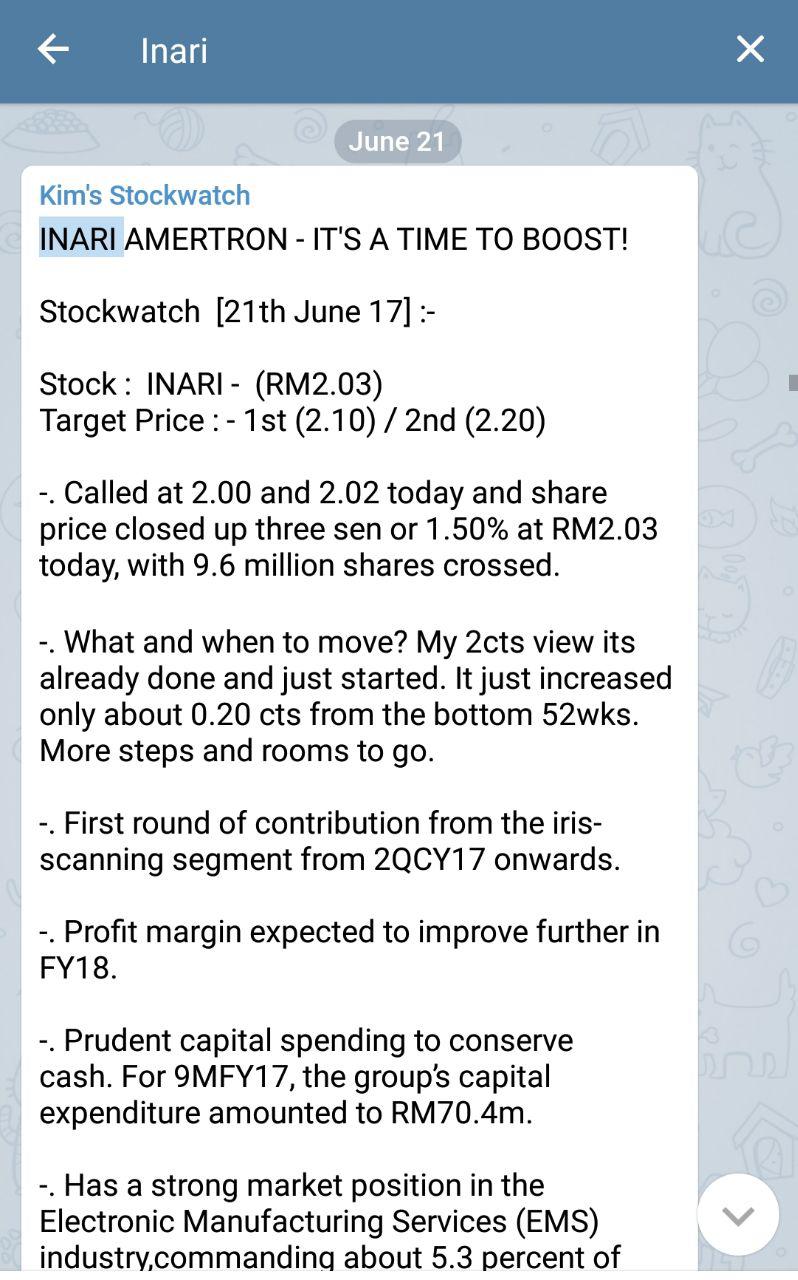

TRACK RECORD

----------------------------------------------------------

then followed Kim TP's as below :

(RM2.10 / 2.20 / 2.30 / 2.45 / RM2.80) - (uptrending)

(PART II) - INARI AMERTRON - IT'S A TIME TO BOOST!!! AS A STOCK OF OCTOBER!!! - https://klse.i3investor.com/blogs/spartan/134234.jsp

"One of the strongest revenue prospects among Malaysia’s local outsourced semiconductor assembly and test companies." - Kim Spartan

- Revenue could double in three year’s time, particularly given the opportunities to grow its business with Broadcom Ltd (on commercialisation of 5G networks in 2019 which will spur demand growth in the radio frequency [RF] segment) and hopefully on its penetration into Germany’s Osram Licht AG’s other business segment as this customer’s new fab plant in Kulim, Malaysia, is slated to open by the end of next month.

- Inari’s latest business segment involving assembly and testing jobs for iris scanners started commercial production in the fourth quarter of FY17 (4QFY17). It contributed negligible sales in FY17 but sales contribution is expected to grow to 10% of total sales in FY18 on a capacity ramp-up.

- While Inari is still in the mode of ramping up its capacity for iris scanners, it is also actively researching facial recognition with its client, preparing to ride on future trends in biometric authentication. Inari’s bread-and-butter radio frequency (RF) segment contributed about 50% of FY17 revenue. Inari has just added another 85 units of RF testers, bringing the total to 850 units.

- Inari could continue to see strong loading volumes in the RF segment in the next two quarters, boosted by its US end-client’s new smartphone models.

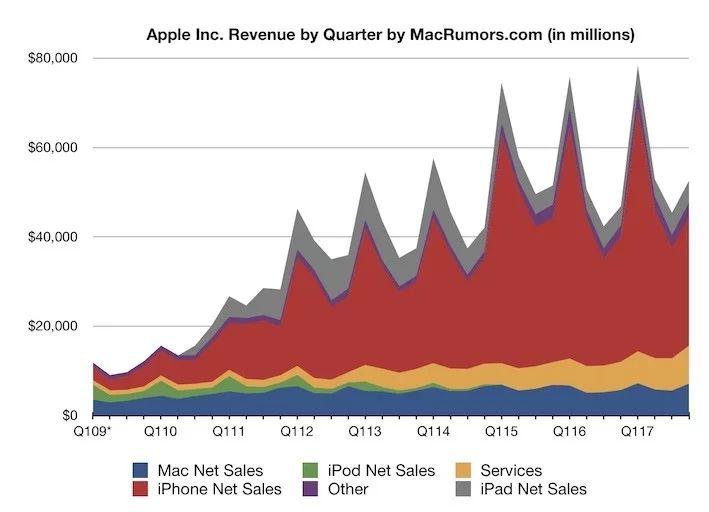

- Also I expecting Q1 for Inari will be release nextweek mirror by Apple

- "Apple announced financial results for the third calendar quarter and fourth fiscal quarter of 2017. For the quarter, Apple posted revenue of $52.6 billion and net quarterly profit of $10.7 billion, or $2.07 per diluted share, compared to revenue of $46.9 billion and net quarterly profit of $9 billion, or $1.67 per diluted share, in the year-ago quarter. The revenue and earnings per share numbers were company records for the fourth fiscal quarter, although the total profit fell short of the 2015 figure. Gross margin for the quarter was 37.9 percent, compared to 38 percent in the year-ago quarter, with international sales accounting for 62 percent of revenue. Apple also declared an upcoming dividend payment of $0.63 per share, payable November 16 to shareholders of record as of November 13. " - source Macrumors

----------------------------------------------------------

THE PROFILE

----------------------------------------------------------

Inari Amertron Berhad (Inari) is a Malaysia-based company. Inari is an Investment holding Company. The Company with its subsidiaries is involved in the electronics manufacturing services (EMS) industry. The Company is an EMS company principally involved in back-end semiconductor packaging, which comprises back- end wafer processing, package assembly and Radio Frequency (RF) final testing for the electronics/semiconductor industry. Inari serves wireless RF and microwave telecommunication semiconductor market. On 20 September 2010, Inari acquired Inari Technology Sdn Bhd. On 21 September 2010, the Company acquired Simfoni Bestari Sdn Bhd. The Company through its subsidiary Inari Technology provides packaging services, such as Back-End Wafer Processing, Package Assembly, Final-Test and Final Packaging, and other activities. The Company through its subsidiary Simfoni provides services, such as Sip/QFN; PCBA and Box-Build, and Universal Remote Controls.

Following the acquisition of Amertron

Inc. (Global) in 2013, Inari Amertron expanded its product range to

include optoelectronics products used in fiber-optic communications,

data centers, automotive and defence sectors, consumer computing devices

and industrial automation. The enlarged Group's operations are now

situated regionally across three countries, i.e. Malaysia (Penang and

Johor Bahru), Philippines (Clark Field and Paranaque), and China

(Kunshan).

----------------------------------------------------------

KEY SUBSIDIARIES

----------------------------------------------------------

INARI TECHNOLOGY SDN BHD

(Inari Technology) is a leading OSAT provider to multinational and local electronics product manufacturers. Inari Technology is one of a handful of OSAT providers in the ASEAN region performing and providing DC and RF wafer testing, wafer back-grinding, wafer sawing, wire bonding, substrate molding, substrate sawing, chip sip assembly and other related services. Inari Technology has strong technical know-how in these manufacturing processes and quick turnaround response times. Inari Technology is certified with the ISO9001 Quality Management Systems (QMS) and the ISO14001 Environmental Management Systems (QMS) certifications. Inari Technology is strongly committed to high product and service quality and also to environmentally friendly practices by utilizing RoHS compliant process and RoHS compliant materials. Inari also complies with the General Specifications for the Environment (GSE) requirement.AMERTRON GLOBAL GROUP

is a leading provider of tailored EMS contract manufacturing services to the semiconductor and optoelectronic industry in Southeast Asia and globally. It currently has two subsidiaries, namely Amertron Philippines establish in 1988 and Amertron Technology establish in 2000. Amertron Global Group has over 25 years of experience in providing semiconductor and optoelectronic products and has built strong relationships with the key players in the industry. An engineering-driven company, it has successfully developed a diverse range of manufacturing capabilities from traditional semiconductor technologies, including custom-tailored ICs and SMT to advanced optical components and modules. Additionally, Amertron Global Group has received numerous awards from its customers in recognition of its exceptional, and reliable service while at the same time maintaining stringent quality control. Amertron Global, through its subsidiaries, currently specializes in the field of optoelectronics, which accounts for the vast majority of its revenue. Optoelectronic devices are electrical-to-optical or optical-to-electrical transducers, or instruments that use such devices in their operation. In other words, optoelectronics include any device that seeks to source, direct, or control light. Optoelectronic technologies are essential in modern society and include fibre optic communications, laser systems, electric eyes, remote sensor systems, medical diagnostic systems, and optical information systems. Within Amertron Global's optoelectronics segment, the majority of its revenue can be attributed to fibre optics, LED based optoelectronics and infrared optoelectronics, contributing approximately 43%, 24%, and 21% of the Company`s total revenue, respectively.Amertron Global Group also produces a range of LED display products that account for approximately 10% of the Company`s total revenue. The remaining 2% is attributed to the Customised IC packaging. Due to numerous emerging applications and the energy-efficient nature of many LED and other optoelectronic products, Amertron Global is well positioned to continue to be a leading contract manufacturer in these fields and expand its product portfolio. Amertron Global Group provides its services to some of the largest players in the semiconductor and optoelectronics industry. The majority of its business comes from Southeast Asia, however; it has a global scope and also delivers products for clients in North America and Europe. Its clients include: Avago Technologies now renamed Broadcom, the former semiconductor division of Hewlett-Packard; Osram, a division of Siemens AG; Lite-On; and Sigmatron International, among others. The management has spent several decades in some cases building durable business relationships with these companies, ensuring high rates of repeat business. For more information, please refer www.amertron-global.com

CEEDTEC SDN BHD

is the primary engineering solutions provider focussing on R&D, Product development and engineering solutions. Ceedtec Technology on the other hand focuses on manufacturing providing product manufacturing, assembly & test. When these capabilities are combined, the company is able to provide complete end-to-end product development and full turnkey manufacturing services and solutions to its customers. Ceedtec was incorporated in November 2005 and commenced operations in February 2006. The company focuses on ODM (Original Design Manufacturer) Product Development & R&D (Research & Development) of precision Test & Measurement products. Ceedtec takes a product from concept stage to a finished product that is ready for mass production. The product design cycle starts from concept and product architecture development, prototyping, complete product design to product qualification and certification. The design process ends with product validation, manufacturing and delivery of finished goods to the customer. Ceedtec Technology Sdn Bhd (CTT) was incorporated in December 2007. The Company is a wholly owned (100%) subsidiary of Ceedtec Sdn Bhd and is the dedicated manufacturing arm for all the products developed by Ceedtec Sdn Bhd. Ceedtec Sdn Bhd is certified with ISO 9001:2008.

----------------------------------------------------------

THE KEYNOTE

----------------------------------------------------------

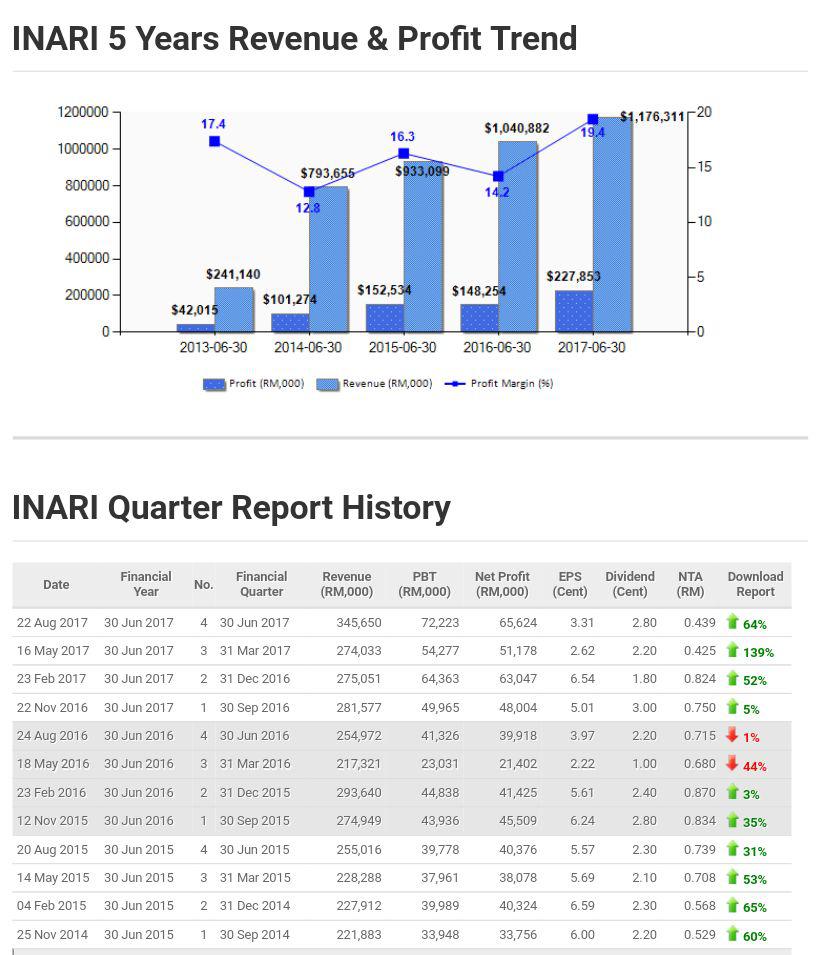

The group’s FY16 saw a decline of 2.81% in its net profit to RM148.3 million from RM152.5 million in FY15 despite a revenue growth of 11.6% to RM1.04 billion during the same period. However, its latest financial results for the first quarter ended Sept 30, 2016 (1QFY17) saw its net profit return to growth, with an increase of 5.5% to RM48 million from RM45.5 million in 1QFY16.

INARI (FEB) - Strong replacement cycle for smartphones could be expected due to an anticipated launch of a new generation smartphone model in the United States on Sept 17 and another model in South Korea in the first half of the year. That several outsourced semiconductor assembly and test (OSAT) providers have been ramping up capacities to ride on this smartphone wave.

- Inari

Amertron Bhd’s net profit swelled by 52.2% for the second quarter ended

Dec 31, 2016 (2QFY17) to RM63.0 million, from RM41.4 million a year

earlier, due to favourable forex differences. Revenue slid 6.3% to

RM275.1 million, from RM 293.6 million in 2QFY16, due mainly to changes

in its product mix. Net profit for the six months ended Dec 31, 2016

(6MFY17) grew 27.7% to RM 111.1 million, from RM86.9 million for 6MFY16.

Revenue slid 2.1% to RM556.6 million in 6MFY17, from RM568.6 million a

year ago.

- Move into iris scanning manufacturing earlier this year is starting to make headway as the venture will help fuel revenue growth of 18% for the financial year ending June 30, 2018 (FY18). Major smartphone makers will include this capability in their upcoming flagship models in the wake of higher mobile payments adoption and fingerprint verification

INARI (AUG) - Achieved a 68% surge in its net profit to RM65.62 million, or 3.31 sen per share, for the fourth quarter ended June 30, 2017 (4QFY17) from RM39.92 million or 2.02 sen per share a year ago on higher demand of its products and gain from disposal of quoted shares. The big jump on the fourth quarter's earnings lifted Inari's annual profit to a high of RM227.85 million for the financial year ended June 30, 2017 (FY17). Quarterly revenue expanded 34.4% to RM345.65 million from RM257.21 million a year ago amid higher demand for its current and new products.

- Has declared a special dividend of half sen per share on top of an interim dividend of 2.3 sen per share after registering solid earnings growth in its latest reported quarter. The technology company saw its fourth-quarter ended June 30 net profit rise by 64.4% year-on-year to RM65.62mil on the back of revenue also rising 34.4% to RM345.7mil from RM257.2mil a year ago.

INARI (SEP) - The earnings of local electronic manufacturing services (EMS) player Inari Amertron Bhd (Inari) is anticipated to be supported by Apple Inc’s (Apple) brand new iPhone X, 8 and 8 plus models.

----------------------------------------------------------

THE FINANCIAL

----------------------------------------------------------

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Or Join Elite Spartan Group Traders (SGT)

http://klse.i3investor.com/blogs/spartan/138426.jsp