AnnJoo Resources Berhad is an investment holding company engaged in manufacturing and trading of steel and steel related products. It operates in two segments: steel and investment holding, property management and others. The Company, through its steel-making plant and rolling mills, focuses on production of steel product ranging from billets, bars to wire rods serving mainly construction and engineering sectors. The trading division deals with a diversified product portfolio comprising of flat and long steels. Let see the recent quarter results summary as table below:

Source: http://www.malaysiastock.biz

For Q3’17, Annjoo posted a profit after tax of 47.2 mil against a 22.9 mil a year ago (106% improvement YoY). Again, this is accounting profit. A very important earning quality metric for me is cash flow from operation. Let us go through the latest quarter report Cash Flow From Operation (CFFO) as shown in the table below:

Source: Q3’17 report

We can notice that Annjoo has generated free cash flow from operation (CFFO) of 231 mil in the past 9 months. (capex for purchase for property, plant and equipment is just 23 mil). This indicates high quality of Annjoo earning as the CFFO of 231 mil is much higher than accounting profit of 149 mil.

Let see how much cash generated in Q3 (past 3 months) by comparing CFFO of Q1, Q2 and Q3 as below:

|

|

CFFO (mil) |

Total Borrowings (mil) |

|

Q4’2016 (Ended 31 Dec 2016) |

-57 (higher inventory) |

957 |

|

Q1’2017 (Jan-Mar) |

31 |

936 |

|

Q2’2017 (Apr-June) |

66.8 |

892 |

|

Q3’2017 (Jul-Sept, ended 30 Sept) |

133.2 |

822 (benefit is future finance cost will be lower) |

|

Q4’2017 |

?? |

|

|

Total (3Q) |

231 |

822 (reduction of RM135mil debts in 9 months’ time (31 Dec to 30 Sept 17) |

The increment of cash flow from operation in Q3 alone is huge (133.2 mil). Half the the cash flow generated used to pay off debt reducing from 892 mil to 822 mil in Q3. Based on the relatively high current average selling price (ASP) of rebar, it is expected Annjoo may be able to generate another 100-130 mil cash flow from operation in Q4. This could make the total cash flow generation in FY2017 to reach RM330mil to RM360 mil (vs estimated accounting profit of 220 to 250 mil). There is no major capex requirement (only 23 mil so far) for Annjoo in 2017 or 2018 which implies that the majority of the cash generation could be used to pay dividend and pare down borrowings. The net free cash flow after deducted capex is RM208 mil in the past 9 months. Annjoo has paid 76mil for dividend while paid off 135mil debt in the past 9 months.

With this rate of cash flow generation, I would expect Annjoo continues to distribute high dividend in Q4 and further pare down its debt. If this cash flow generation rate can be sustainable for another 2 years, the total borrowings of Annjoo might reduce to below 300 mil. In fact, Annjoo total borrowings have been reduced substantially from RM957mil to RM822mil in 9 months’ time.

This cash flow generation capability makes me to think of a company called Petronm which had reduced its 1 billion borrowings to zero in 3-4 years’ time. Another cash generation machine is Hengyuan which even able to generate more than 500 mil cash in 6 months’ time (https://klse.i3investor.com/blogs/davidtslim/131336.jsp).

Annjoo Key Financial Data

Let us go through some key financial data (included latest result) of Annjoo as table below:

|

|

Annjoo (12-month up to Sept 17 result) |

Remark |

|

PE |

10.6 |

2nd among top 4 rebar rebar players (lower is better) |

|

Quality of Earnings (past 9 months) (Operating cash flow/net profit) |

=231/149 =1.55 |

Highest among top 4 rebar players |

|

ROE |

16.09% |

Highest among top 4 rebar players |

|

Net profit margin (%) |

9.5% |

Highest among top 4 rebar players |

|

ROIC |

6.03% |

Highest among top 4 rebar players |

|

EPS |

36.52 sen |

Highest among top 4 rebar players (per share price is lower than Masteel) |

|

Return On Assets (ROA) |

8.50 |

Highest among top 4 rebar players |

|

Cash & Equivalents |

66 mil |

3rd among top 4 rebar players |

|

Total debt |

822 mil |

Second highest among top 4 rebar players (lower is better) |

|

Dividend yield |

4% |

Highest among top 4 rebar players |

Based on these relatively good financial ratios, highest profit margin among rebar players, bright rebar business outlook in Q4 (Oct-Dec) and 2018, I think Annjoo should deserves higher valuation at PE12 to PE13 which translates to price of RM4.38 and RM4.76 respectively (forward 3-month PE is expected to be even lower when Q4 result is out in Feb 2018).

In view of Annjoo’s high inventory and high profit margin, I would expect Annjoo coming Q4 profit will be higher than Q3’17 and Q3’16 due to higher selling price and lower iron ore cost (mean forward 3 month PE will be lower). Malaysia Rebar outlook will be discussed in the following section (Malaysia Rebar Q4 and 2018 outlook).

Let me have a SWOT analysis on Annjoo as below:

SWOT analysis (S-strengths, W-weaknesses, O-opportunities, and T-threats)

|

Strengths |

Weaknesses |

|

1.Highest profit margin (due to blast furnace)

2.Strong cash flow generation (highest quality of earning)

3.Highest dividend yield

4.Highest inventory level

5.Consistency in profit in past 2 years.

6. Highest ROE and ROIC, ROA

7.Lowest payable amount (among top 4 rebar)

|

1. Dilution from PA shares

|

|

Opportunities |

Threats |

|

1.Malaysia rebar safeguard tax for 3 years to reduce import from China

2.High local Rebar price from July to Nov 2017.

3.China production cut in winter season that lead to higher price in China which can drive local price higher

4.A lot of infrastructure projects running in 2017 and 2018 which provide demands for rebar.

5.ASEAN export market opportunity due to high china rebar price

|

1.High Iron ore price

2.High scrap metal price

3.Higher transportation cost due to higher fuel price in recent two months

4.Property market slow down

|

The outlook or profitability of rebar manufacturer highly depending on rebar average selling price (ASP) and their materials cost. First let me show you the recent Malaysia ASP per ton of rebar products from Q3 and Q4 (up to Nov 2017) as per the table below:

|

2017 |

ASP (RM) |

QoQ comparison |

|

July |

2000-2200 |

|

|

Aug |

2200-2500 |

|

|

Sept |

2500-2650 |

|

|

Oct |

2650-2350 |

Increase by 350 -400 if compared Oct vs July |

|

Nov |

2350-2550 |

Increase by 100 if compared Nov vs Aug |

|

Dec |

? |

? compared Dec vs Sept |

|

ASP for 3 months |

Q3 ~ 2350 Q4 ~ 2450+ till Nov |

|

Based on the MITI data, Malaysia Q3 ASP about RM2340 per ton while Q4 (up to Nov) is about RM2500 (depend on products). The ASP in Q4 is about 7% higher than Q3. Let see the latest scrap metal and Iron ore price (Annjoo raw materials) which has been dropping recently as below.

Source: MITI_Weekly_Bulletin (Oct and Nov)

Let us visit the data of rebar import from China and other countries as below:

Source: Annjoo’s Analysts’ Briefing slides (http://www.annjoo.com.my/investor-relations/latest-news/)

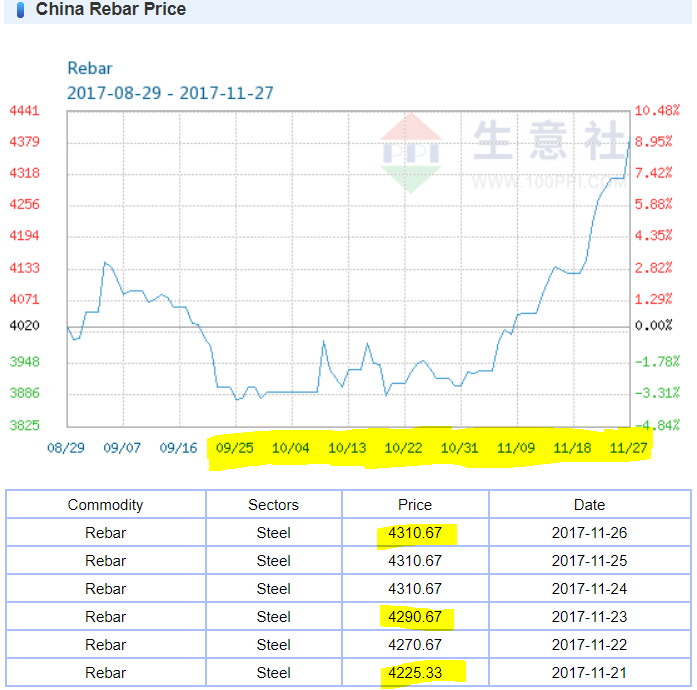

Let us revisit China import rebar price as below:

Source: http://www.sunsirs.com

From the figures above, I can see high profit visibility of Annjoo and other rebar players in Q4 and 2018 due to lower materials cost and higher selling price. China rebar price is on uptrend and recent price has been gone up to RMB4310 and this open up export opportunity for Annjoo to ASEAN countries (export is about 9% of their revenue). Let us see the steel demands data in ASEAN and Asia for possible export opportunities as below:

Source: Annjoo’s Analysts’ Briefing slides

Summary

1. Annjoo has the highest profit margin among top 4 rebar players due to its hybrid blast furnace technology.

2. Annjoo has the highest inventory (RM800mil+) level among top 4 rebar players and this leads to a better opportunity to reap profit in a relatively high rebar price time in Q4.

3. Cash flow generation from operation is strong (more than 50% than accounting profit). The cash has been used to pare down debts and to reward shareholders through dividend in Q4.

4. Total borrowings of Annjoo has been reduced by 135mil in 9 months’ time (paid off 70 mil of debt in Q3 alone), this will lead to a lower finance cost in Q4 and 2018.

5. Annjoo has dividend policy of 60% and the normally they will declare dividend in coming Q4 (based on past years practice).

6. Profit visibility is supported by its raw materials (iron ore, scrap iron) price dropping trend from USD380 to USD310. In addition, RMUSD rate appreciation (4.12 now) in Nov which implies that Annjoo stands to have lower import cost for their raw materials and possible to have some forex gain.

7. High steel (rebar) price in China should be sustainable due to their government’s order to cut their production by half in winter season (4 months). The high china rebar price may help local high rebar price to sustain and provides export opportunities for Annjoo to ASEAN countries.

8. Annjoo is a Syariah Compliant company, is a good choice for medium term investment with its future profit visibility, earning consistency, high dividend yield and strong cash flow generation.

If you interested on my future analysis reports, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/david_masteel/139566.jsp