I began cover cuscapi on 14 March 2017 and have since wrote 3 articles about Cuscapi. Below the link.

https://klse.i3investor.com/blogs/cuscapi/118258.jsp

https://klse.i3investor.com/blogs/cuscapi/124791.jsp

In this article, i would like to dig deaper into the numbers. Let begin.

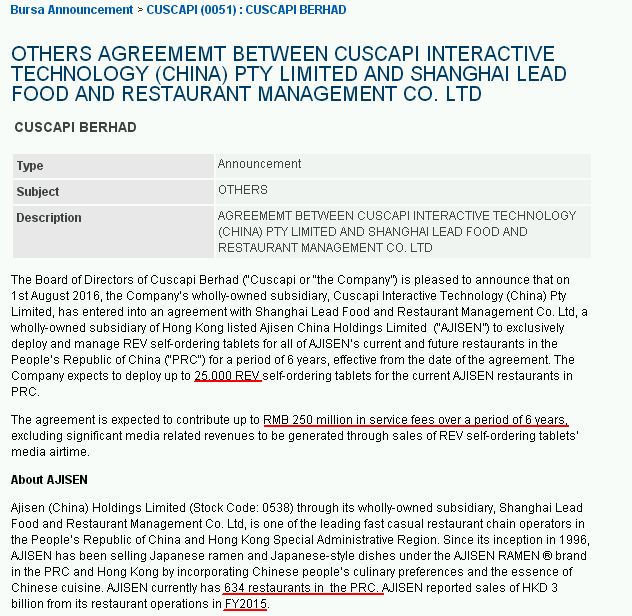

On 1 Aug 2016, Cuscapi informed that they have inked an agreement with Ajisen Ramen. http://www.malaysiastock.biz/Company-Announcement.aspx?id=911398

Based on above annoucement, the key info here is:

1) 25,000 tablet

2) RMB 250 million service fee for 6 years or RMB 41.6 mil per year

3) 634 restaurant

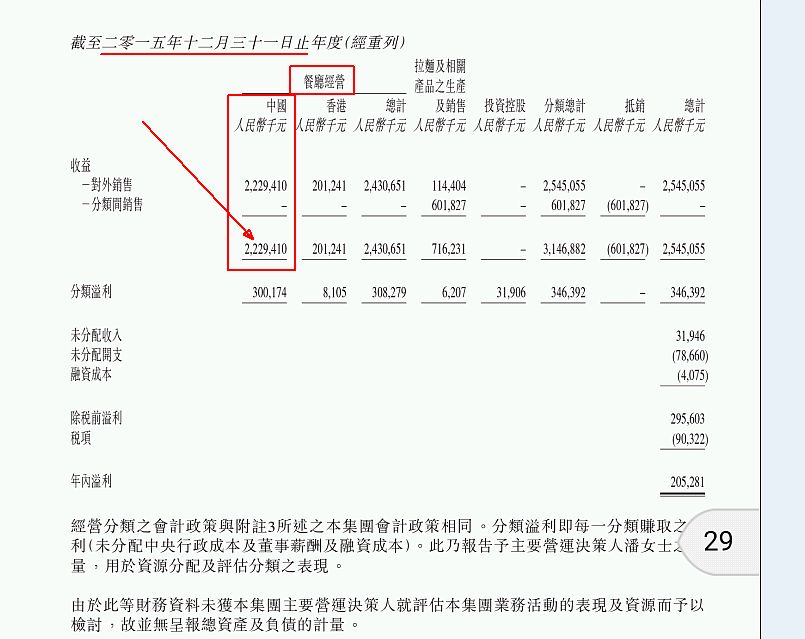

I did a seach to Ajisen China website, below 2015 Financial info i found.

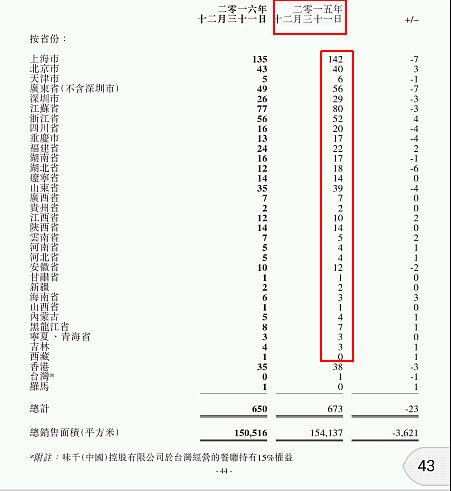

1) Based on above 2 pieces of info from 2015 financial report, the numbers of restaurant situated in PRC is 673 - 39 = 634 restaurant (tally with the bursa annoucement)

2) Based on RMB 2.23B revenue recorded in year 2015 PRC restaurant chain, Cuscapi should received RMB 250 mil service fee. If divide by 6 years, is equivalent to RMB 41.6 mil. or 1.87% from Ajisen total annual revenue generated from restaurant chain.

Assumption: All order are generated via Cuscapi Self-Ordering Tablet.

3) The above numbers is excluding SIGNIFICANT media related revenue according to above cuscapi annoucement.

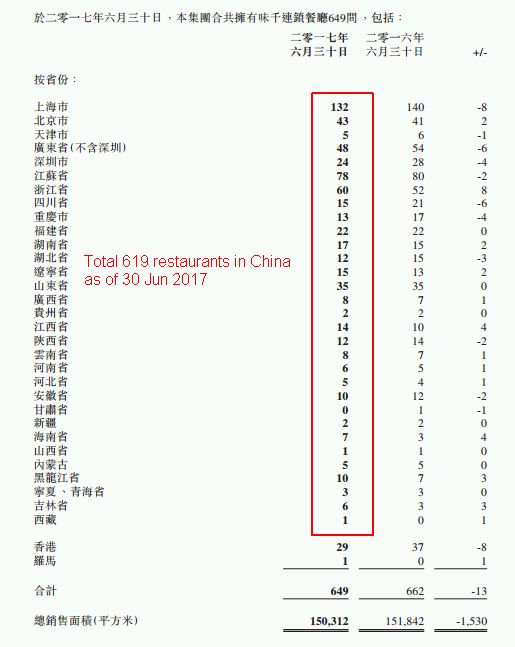

Now, Let fast forward to 30 Jun 2017:

This is important as Cuscapi's Service Fee should be calculated based on Jan 2017 onward following the deployment date, in stages.

Key observation:

1) Ajisen Restaurant in operation stood at 619 as of 30 Jun 2017 vs 634 as of 31 Dec 2015.

2) Total number of Rev tablets to be deployed is expected to be less than 25,000 tablet since the number of restaurats has reduced. But, it is still very substantial.

Key Observation:

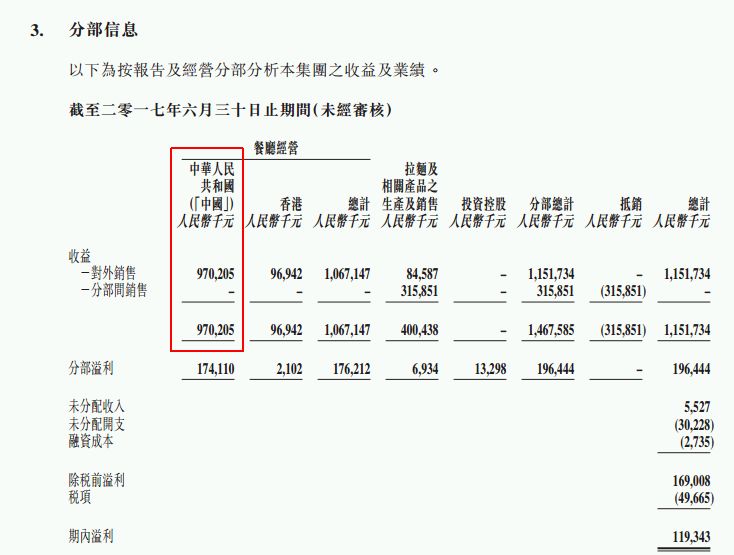

1) Ajisen China recorded RMB 970,205,000 revenue for the 1st half of 2017, annualized it will be roughly RMB 1.94 billion

2) Based on 1.87% model above, it is equivalent to RMB 18.14 mil for half year or RMB 36.3 mil for full year projection.

3) Based on exchange rate of 1.58, is it equivalent to RM 11.48 mil for 6 months or full year RM 22.9 mil service fee to be received by Cuscapi.

4) The RM 22.9 mil is a very substantial sum to Cuscapi, in my opinion.

I strongly believe Cuscapi is turning around. But, exact timing depends on the COMPLETION of full deployment

How much is the profit to be generated? I believe the answer will be in Q3 or Q4 quarterly report.

I put Q4 instead of Q3. I think i must give buffer to possible delay in completion of full deployment.

Below a newspaper interview in 2016,

http://www.thestar.com.my/business/business-news/2016/08/08/cuscapi-pins-hope-on-rev-to-revive-interest/

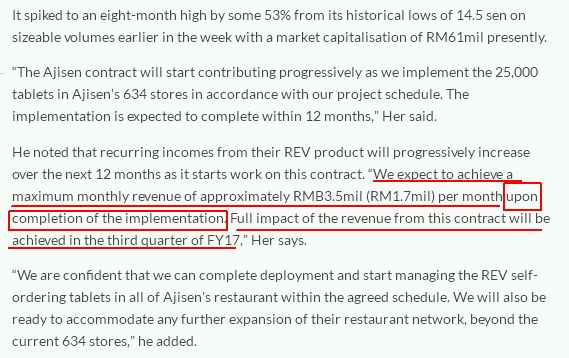

From above news info, RM 1.7 mil per month or RM 5.1 per quarter or RM 20.1 mil revenue per year.

This number is slightly lower than the projection based on 1st half of 2017 i made.

By Q4, (instead of Q3) we should have answer.

Ajisen Corporate Development:

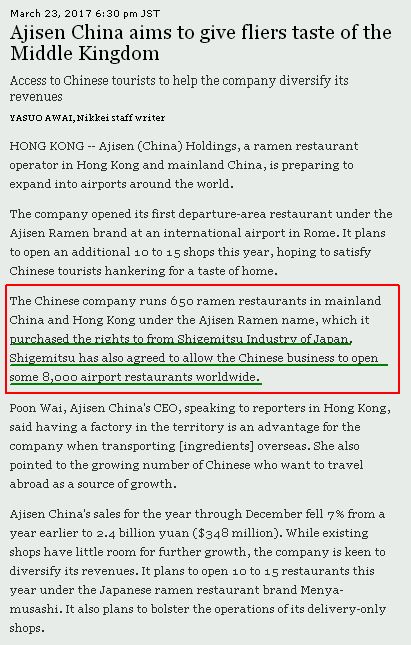

Ajisen Ramen has ventured out of china. It secured the rights to operate 8000 airport restaurants world wide in first quarter 2017.

Source: http://asia.nikkei.com/Business/Companies/Ajisen-China-aims-to-give-fliers-taste-of-the-Middle-Kingdom

Will Cuscapi provide similar service to Ajisen for these 8000 restaurants? Nobody knows. But cuscapi will certainly has advantage over other competitors.

Cuscapi Latest Development:

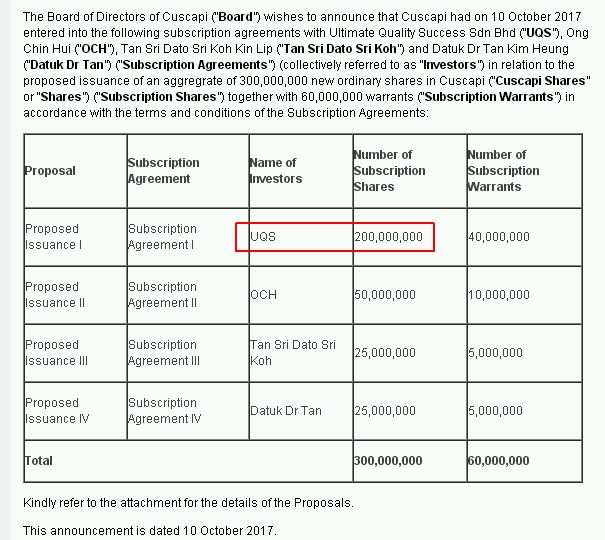

After the above proposal completed, UQS will become largest shareholder of Cuscapi.

We all know that the person behind is Datuk Jaya.

Do you believe the quote: you see Datuk jaya, you will be berjaya! [ I say one]

Also we saw several other savvy investors.

Why they invest and become largest controlling stake holder of Cuscapi?

I think there is a very big room of imagination.

I have wrote something about Myeg GST monitoring system project. below the link:

https://klse.i3investor.com/blogs/YiStock/116387.jsp

And according to below news:

http://www.theedgemarkets.com/article/myeg-benefit-selling-foreign-workers-insurance

(1) I smell money since cuscapi has many many giant F&B chain under their portfolio and cuscapi is also the leader in the POS system.

(2) RM 80 mil to be invested into Cuscapi for business expansion and acquistion. This is crazy sum of investment.

YiStock

note: till now, all articles written by me are based on my guessing work. Please do not treat it as buy/sell call.

http://klse.i3investor.com/blogs/cuscapi/127967.jsp