Superlon Holdings

Berhad is Malaysia's leading manufacturer of high quality

thermal insulation materials used mainly in the Heating, Ventilation,

Air Conditioning and Refrigeration (HVAC&R) system of residential,

commercial and industrial buildings. The company’s thermal insulation

products are used as vapor barrier for the prevention of condensation or

frost formation on cooling systems, chilled water and refrigeration

lines and heat loss reduction for hot water plumbing, heating and dual

temperature piping (Annual Report)

Super

Holdings Berhad just announced its latest Annual Report for Financial

year 30 April 2017 in August with revenue and net profit increased by

about 17.5% and 43.2% to 106.3m and 23.7m respectively. Net profit

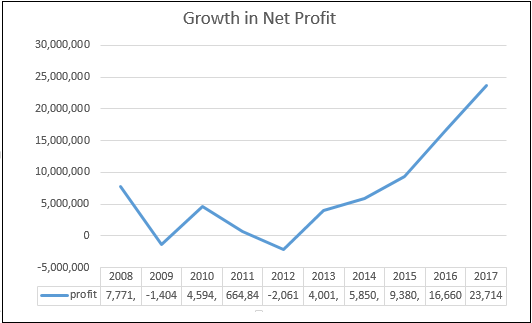

margin remains very high at about 22%. I have plot the growth net profit

for Superlon Holdings Berhad for a better view on its performance.

Figure 1: Growth in Net Profit

Growth in net profit begins to improve exponentially from 2013 after

management move out from its loss making business of Steel Pipes

manufacturing and focus on its core business. Profit growth from 2008 to

2017 recorded a compounded annual growth rate (CAGR) of

13% which is good but if we calculate from 2013 to 2017 its CAGR is at

staggering 42.74% and all of this growth is organic which means it comes

from the business itself not from M&A, one-off gains or any other

extraordinary income.

Figure 2 : Gross Profit Margin

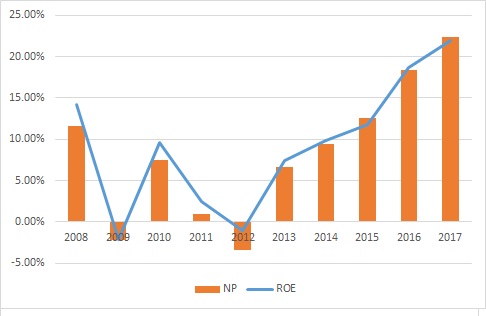

Figure 3 : Net Profit vs ROE

Figure 2 shows the trend in Revenue to Cost of Sales to Gross Profit

which we can see an exponential increase in its Gross Profit Margin

especially if we observe from 2012 to 2017 (16% to 41%) a threefold

increase in Gross Profit Margin which derives its value from high growth

in revenue while keeping the cost under control. For me this is a sign

of a quality growth company with efficient business operation in place.

The same can be observed for its Net Profit margin and Return On Equity

increasing in tandem with the revenue and Gross Profit Margin's growth

from its lowest point of -1.06% Return on Equity in FY2012 to 21.96%

Return on Equity in FY2017, far exceed any return on fixed income or

safer investment vehichles. This spectular growth with achieved with no

debt and even better it keeps generating a healthy amount of cash flow

to fuel the growth.

"Never take your eyes off the cash flow because it's the life blood of business"

Richard Branson

Looking solely at a company's profit growth does'nt tell its quality if

the company fails to generate cash from its business especially free

cash flow which the company can then use for busniess expansion, buying

back shares or distributing dividends

Table 1 : Cash Flow of Superlon

| 2,013 | 2,014 | 2,015 | 2,016 | 2,017 | Average | |

| Net Profit | 4,001,613 | 5,850,480 | 9,380,590 | 16,660,089 | 23,714,774 | 11,921,509 |

| CFFO | 9,393,602 | 10,516,133 | 11,525,241 | 25,131,142 | 16,224,959 | 14,558,215 |

| Capex | 494,714 | 3,140,327 | 2,932,470 | 5,382,982 | 12,346,997 | 4,859,498 |

| FCF | 8,898,888 | 7,375,806 | 8,592,771 | 19,748,160 | 3,877,962 | 9,698,717 |

| FCF/Profit | 222% | 126% | 92% | 119% | 16% | 115% |

Table 1 above shows that Superlon Holdings Berhad is a cash generating company with an impressive 5-year FCF/Profit averaging to 115%,more than its net profit. FY 2017 FCF/Profit is the lowest among the 5-year (16%) due to high Capex spending for the new warehouse and its coming factory in Vietnam. It confirms the quality of the spectacular growth shown in Figure 1-3 above.

Valuation of Superlon Holdings Berhad using Free Cash Flow

At current price of 2.83 as at 21th September 2017,is Superlon still cheap and worth to invest in?

"Price is what yo pay value is what you get"

Warren Buffet

"The value of a stock is worth all of the future cash flows expected to be generated by the firm, discounted by an appropriate risk-adjusted rate"

John Burr Williams

Using the average FCF from 2012 to 2017 of 9.6m, assuming growth rate of 20% for the first 5 years, 15% the next 5 years and a 5% untill forever(terminal value).Discount rate of 10% as it has a reasonable healthy balance sheet, the FCF attributed to common shareholders is RM3.39 per share. This represents margin of safety of 17% investing in Superlon Holdings Berhad at RM2.83 at the close on 21th September 2017. Notice that i make a pretty consevative assumptions on the growth rate of 20% compared to the company's recorded net profit CAGR of 42.74% to minimise the impact if my assumptions turn out to be wrong “Heads, I win; tails, I don’t lose much.”

With an excellent management team that has a proven track record over the years where they was able to turn around a loss making company to an excellent company in 5 years , Superlon Holding Berhad is in my opinion an investment that can give its investor a good night sleep.

Disclaimer : This article is only for sharing purpose . It is not a

buy or a sell call. Please do your own analysis before buying or

selling

http://klse.i3investor.com/blogs/antifragileinvesting/131995.jsp