RM vs USD is strengthening & Masteel is directly benefiting from the RM appreciation.

30/09/2016 = RM4.125

31/12/2017 = RM4.486 (-8.75%, QR forex loss = 11.02mil)

31/03/2017 = RM4.427 (+1.3%, QR forex gain = 1.3mil)

30/06/2017 = RM4.295 (+2.98%, QR forex gain = 6.44mil)

07/09/2017 = RM4.192 (+2.4%, QR forex gain = ???)

http://cdn1.i3investor.com/my/files/st88k/5098_MASTEEL/qr/2016-12-31/5098_MASTEEL_QR_2016-12-31_Masteel%204Q%202016_-825292021.pdf

http://cdn1.i3investor.com/my/files/st88k/5098_MASTEEL/qr/2017-03-31/5098_MASTEEL_QR_2017-03-31_Masteel%201Q2017_-131092758.pdf

http://cdn1.i3investor.com/my/files/st88k/5098_MASTEEL/qr/2017-06-30/5098_MASTEEL_QR_2017-06-30_Masteel%202Q2017_-2042900894.pdf

http://cdn1.i3investor.com/my/files/st88k/5098_MASTEEL/qr/2017-03-31/5098_MASTEEL_QR_2017-03-31_Masteel%201Q2017_-131092758.pdf

http://cdn1.i3investor.com/my/files/st88k/5098_MASTEEL/qr/2017-06-30/5098_MASTEEL_QR_2017-06-30_Masteel%202Q2017_-2042900894.pdf

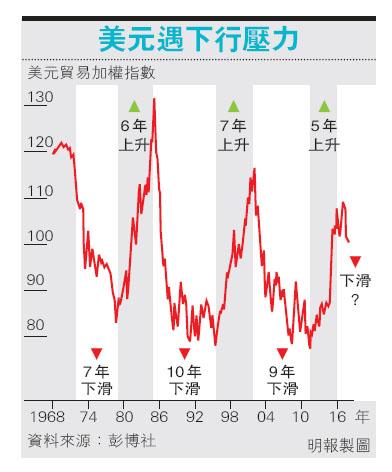

野村證券:美元跌浪剛開始 (香港明报)

【明 報專訊】地緣政治形勢不明朗之際,野村證券發表的報告表示,美元兌歐元及日圓將進一步偏軟。野村預期,美元整體趨勢將是下行,且持續「多年」的跌浪才剛剛 開始(見圖)。野村外匯策略師Bilal Hafeez預測,歐元兌美元可能在未來幾年上漲20美仙,至1.4美元;日圓兌每美元將由目前的109水平,升至90或以下。Source: http://klse.i3investor.com/blogs/stockkingdom/131728.jsp

Ringgit at near 10-month high

KUALA

LUMPUR: Asian currencies rose on Thursday as investors saw the

resignation of US Federal Reserve vice chair Stanley Fischer as a sign

that it will be even more cautious about raising interest rates again,

implying further weakening in the dollar.Source: http://www.thestar.com.my/business/business-news/2017/09/07/ringgit-at-near-10-month-high/

Sept 8: Ringgit continues climb against other major currencies

KUALA LUMPUR: The ringgit opened stronger against the US dollar today, in line with regional currencies.

At 9am, the local unit traded at 4.1865/1895 versus the greenback, from yesterday's 4.2080/2110.

A dealer said Asian currencies are rising

because investors see the resignation of US Federal Reserve vice-chair

Stanley Fischer as a sign that the US central bank will be even more

cautious about raising interest rates again, implying further weakening

of the dollar.

Source: http://klse.i3investor.com/servlets/fdnews/236665.jsp

http://klse.i3investor.com/blogs/happyinvest/131769.jsp