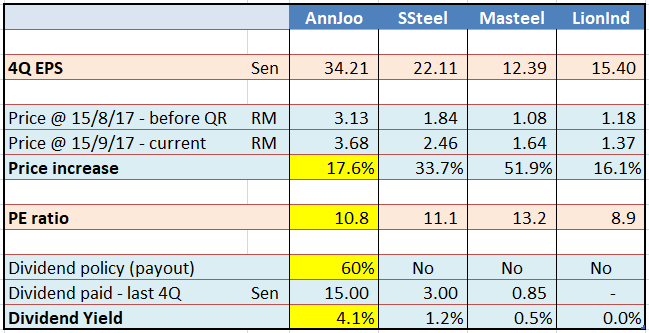

Lower PE accorded by market to LionInd due to its loss-making retail business - Parkson.

Masteel

With recent rally in steel counters, among the top steel makers, Masteel 's share price moved faster than others, up 52% within 1 month, further fuelled by its bonus issue ex-date (26 Sept) announcement. 4Q PE ratio runs up to 13.2x, ahead of average of 4 counters above.

SSteel

In terms of share price, SSteel is the second runner up with 34% increase within 1 month. PE ratio now stands at 11.1x.

AnnJoo

Industry cost leader - AnnJoo's share price moved slower than others, merely increased 17.6% from one month ago. PE ratio at 10.8x, less demanding than Masteel and SSteel.

Given its superior profit margin, decent dividend policy with 60% payout & slower share price rally than others steel counters, I think AnnJoo has more upside going forward.