2Q17 Results to be announced on 25 August 2017 (In 5 days) expected to be Best Results

Oceancash 2Q17 revenue is expected to have increased by 19.0% yoy and net profit increased by 45.0% yoy, on the back of higher sales from both hygienic and insulation divisions. Based on conservative valuation to 2017E EPS, results in higher target price of RM0.91 based on an PE of 15.7x.

Entry of Value Investors - Mr. Tan Teng Boo (Chief Investment Manager of Icap.biz Berhad) and Mr. Fong Siling (Value investor)

Oceancash Annual Report 2017's List of 30 Largest Holders of Shares include icapital.biz Berhad as the 8th largest shareholder with 2,230,000 shares and Mr. Fong Siling as the 14th largest shareholder with 1,400,000 shares.

icapital.biz Berhad is Malaysia one and only closed-end listed fund focused on value investing. At helm, Mr Tan Teng Boo, occasionally rises above the investment community as Malaysia's own Warren Buffet.

New Customer in the Automotive Industry

The Group recorded stronger demand for its insulation products from Malaysia, Philippines and Indonesia in its 1Q17 results. The Group has recently secured a new automotive customer in 1Q17. Demand for insulation products from Indonesia also increased by 30.8% yoy in 1Q17 (Expected to further increase by 42.2% yoy in 2Q17), underpinned by recovery in the automotive sector in Indonesia. A rebound in Indonesia auto sales would benefit Oceancash, as the company is well positioned there with a factory in Jakarta.

Automotive sales in Indonesia continue to surge to record month high in April 2017 of 89,623 (vs. 84,770 in April 2016) and May 2017 of 94,021 (vs. 88,567 in May 2016). Owing to seasonal factor (Eid al-Fitr celebration) in June 2017, auto sales declined 27.5%. Despite, auto sales during Eid al-Fitr celebration in 2016 (July) were lower than 2017, at 61,891. However, preliminary estimates for July 2017 Indonesia automotive sales have hit a record high of 108,384.

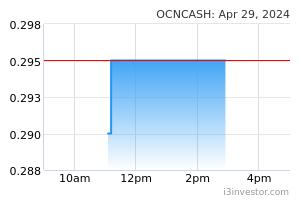

Improved Share Price Technical Indicators on last Friday's trading session (18 August 2017)

The share price formed a bullish engulfing candle with a three white soldier formation over last week's trading session. Despite overall market bourse being in correction mode last week, Oceancash's share price staged more than 5% gain on Friday trading session, implying strong technical reversal in anticipation of 2Q17 results.

Strong buying interest during last Friday session could indicate that share price has bottomed out.

Bonus issue and Dividend surprise

Since the sharp rally in share price from February 2017, Oceancash's share price took a 4 month long breather, trading between 0.68 to 0.85 between this period. The share price may stage a further rally next week in anticipation of its record high revenue and net profit results.

Based on channel check, there could be a surprise bonus issue and dividend sweetener for the upcoming 2Q17 results.

BUY With a Target Price of RM0.91

Based on FY17 EPS of RM0.058 (Net profit of RM12.9mil), Oceancash is worth RM0.91 per share (Based on historical and concensus PER of 15.7x)

http://klse.i3investor.com/blogs/fundementalanalysis/130366.jsp