Visit https://www.facebook.com/donkeystock/ or http://www.donkeystock.biz/ for more infographic.

Subscribe us to get a free copy of e-book on Investment Guides all in infographics.

You may be interested in:

Red Flag Spotting: Signals to beware when analysing financial statement.

Value Trap: Are you falling into these traps?

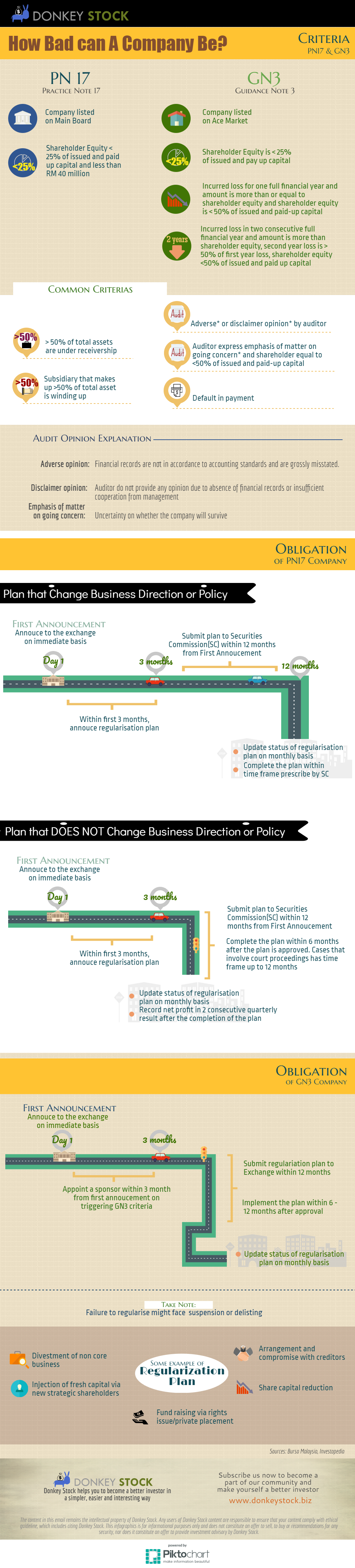

· Shareholder equity falls below 25% of issued and paid up capital and shareholder equity is less than RM40 million

Guidance Note 3, also known as GN 3, is triggered as long as a company listed in Ace market meets the following criteria:

· Shareholder equity is less than 25% of issued and paid up capital

· The firm has incurred loss for one full financial year the loss amount is equal to or more than shareholder equity and shareholder equity is less than 50% of issued and paid up capital

· It has incurred loss in two consecutive full financial year and the amount is more than shareholder equity, the second year loss is more than 50% of first year loss and the shareholder equity is below 50% of issued and paid up capital

Beside the situation that related to shareholder equity, a company will trigger PN 17 or GN 3 as long as the experience the situation as stated below:

· 50% of total assets are under receivership

· Subsidiary that makes up more than 50% of total asset is winding up

· Adverse or disclaimer opinion by auditor

· Auditor express an emphasis of matter on going concern and shareholder equity is less than 50% of issued and paid-up capital

· The company default in its payment

Adverse Opinion: Financial records are not in accordance to accounting standards or grossly misstated

Disclaimer Opinion: Auditor do not provide any opinion due to absence of financial records or insufficient cooperation from management

Emphasis of matter on going concern: Uncertainty on whether the company will survive

When a company hits the criteria of being a PN17/ GN3 company, they have to announce to the exchange immediately. The below is a timeline of what a company should do when it became a PN17/GN3 company.

If the PN 17 firm plans to change its business direction or policy

- Announce a regularization plan within the first 3 months

- Submit the regularization plan to Securities Commission (SC) for approval within 12 months from the First Announcement

- Update the status of regularization plan on a monthly basis

- Complete the plan within the time frame prescribe by SC

If the PN 17 firm does not plan to change its business direction or policy

- Announce a regularization plan within the first 3 months

- Submit the regularization plan to the exchange for approval within 12 months from the First Announcement

- Complete the regularization plan within 6 months from the time the plan being approved. Cases that involve court proceedings are being given a time frame of up to 12 months.

- Update the status of regularization plan on a monthly basis

- Record a net profit in 2 consecutive quarterly result after the completion of the plan

- Appoint a sponsor within the first 3 months

- Submit the regularization plan to the exchange for approval within 12 months from the First Announcement

- Complete the regularization plan within 6 – 12 months

- Update the status of regularization plan on a monthly basis

A failure to do so will face a suspension or delisting of the counter.

Some example of regularization plan

· Divestment of non-core business

· Injection of fresh capital via new strategic shareholders

· Agreement and compromise with creditors

· Share capital reduction

· Fund raising via rights issue or private placement

http://klse.i3investor.com/blogs/donkeystocks/122792.jsp