Recently, Unimech Group Berhad has been catching attention from the

technical perspective as the company has been providing a key support

for the stock price through buybacks against falling to below RM1.

However, these buying signals are a little contradictory because Lim Kim

Guan (Deputy CEO) on the 29th of June had sold 2 million unit of shares

at an average price of RM1.12. In 2016, both Cheah Chooi Lim and Kim

Guan Lim bought 2 million unit on June 13th but Kim Guan Lim proceeded

to sell off 2 million unit of shares in September. Hence, the nature of

their transaction is a little ambigouos.

Company Overview

To a certain extent, I agree with Icon8888 that the business is beautiful because it incorporates the servicing aspects too that usually command better margin and the business structure requires quite high technical expertise. As a starter, Unimech Group Berhad is an investment holding company with four key subsidiaries involved in manufacturing and seven in engineering services and distributorship (they do import foreign products and distribute).

Product Analysis

Financial Analysis

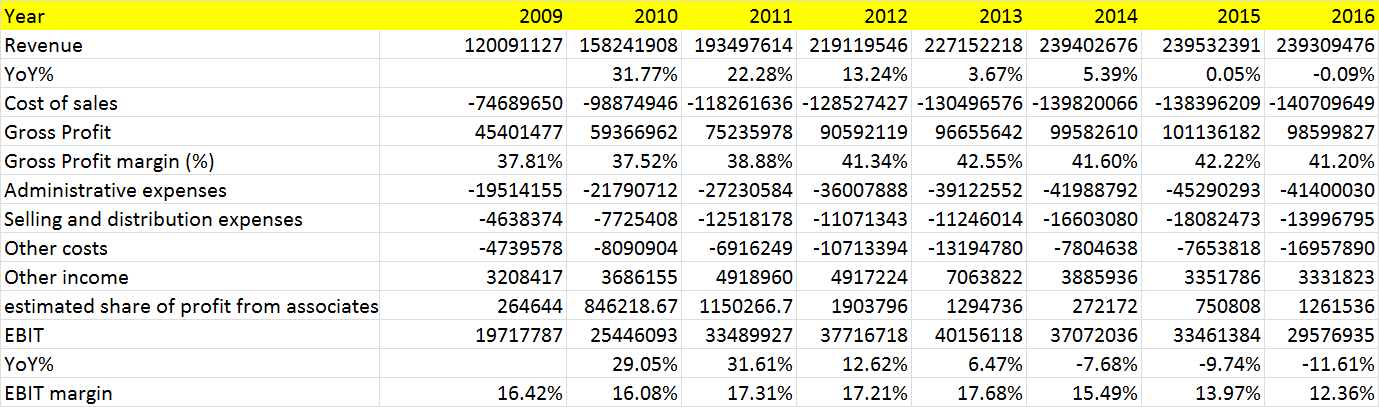

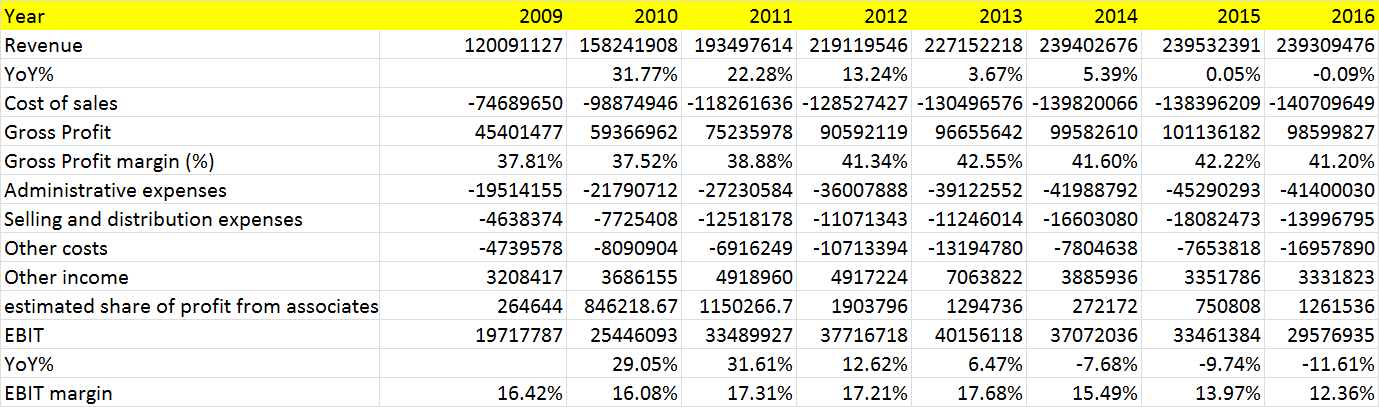

Despite frequent impairment costs being calculated into the company's expenses, there is almost a corresponding equal number of times for a follow-up reversal of impairment taken in the subsequent year so Other costs and Other income are included in the presentation to obtain the nett amount of impairment. Although impairment is not a cash expense, the nature of the company's impairments is difficult to determine accurately and hence should be factored inside.

NWC Requirement from 2009 to 2016

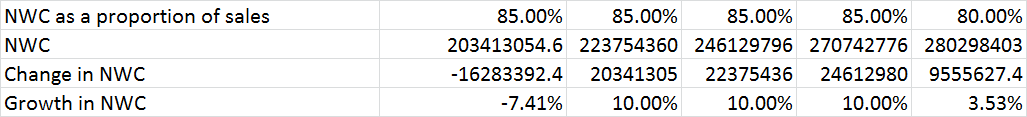

Although the business is beautiful in terms of its products and services, the company's net working capital requirement is too high and this is in my opinion the biggest value-destroyer in the busines operation. Unless the management can reduce their net working capital requirement, it will be difficult to discover value out of this business operation.

Free cash flow projection

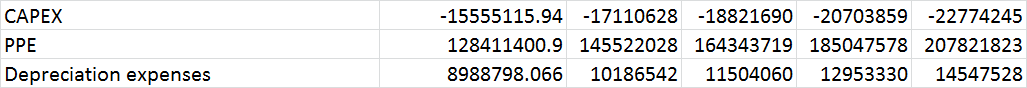

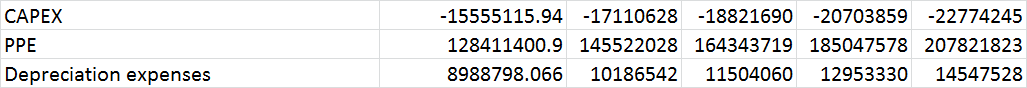

Using the past eight year average of the company's capital expenditure requirement (including those paid to acquire incremental ownership in their subsidiaries and associates), upcoming capital expenditure is projected assuming 6% of sales revenue every year while depreciation expenses constitute an approximate 7% of Property, plant and equipment annually.

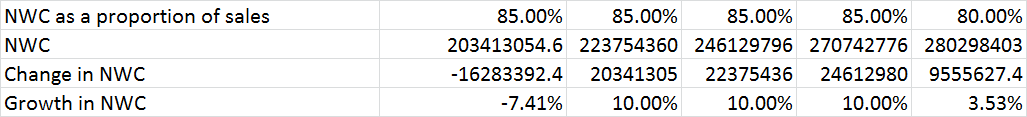

As for net working capital requirement, a benefit of doubt is given to the company that it can reduce its NWC requirement to 85% of sales revenue for the next 4 years from its current 91.8% and on the fifth year to 80% (which is still high) to show confidence towards the management.

Given a discount rate of 9% (cost of equity at 12%), terminal growth of 3%, annual sales growth for the next five years at 10% (the company wants to keep expanding although sales growth in my opinion is not generating significant incremental cash flow due to high net working capital requirement) and EBIT margin of 15%, the net present value after debt and minority interest comes to be around RM1.28. However, the complication lies in the potential dilution from its outstanding warrants and ICULS.

Dilution Potential

ICULS (irredeemable convertible unsecured loan stock) will mature in

about a year from now and the holders of the ICULS are entitled to

convert ICULS into new ordinary shares of the company. Similarly, the

ICULS will be automatically converted into new ordinary shares upon expiry. As for the warrants, it has a strike price of RM1.50 and

will expire on the 18th of September 2018. As the directors all

together hold about 13671092 warrants at the end of 2016(approx. 22.62%,

and Lim Cheah Chooi disposed 4810000 warrants in 2016), I personally do

not think that the management will pursue buybacks to generate upward

momentum to approach the strike price given a continuation of current

business climate. Moreover, the additional cash obtained from the

exercise of those warrant will not add much value to shareholders since

the increase in net cash per share 0.5 per share which comes to be

around RM30 million. Therefore, the valuation from the second scenario

in my opinion will be most appropriate.

PT Arita Prima

On 29th October 2013, Unimech Group Berhad completed its proposed listing of its 85% indirect owned subsidiary, P.T. Arita Prima Indonesia. This business subsidiary targets to get contracts in oil and gas secotrs, customers from power plant, oil palm and oleochemical companies. Infact, it is the first valve company listed in Indonesia. There is no doubt that Indonesia has huge growth potential in the future but with current net working capital requirement, I am of the view that any topline growth will not be generating sufficient value for fellow shareholders.

Conclusion

Despite the specialty of the products and services of this business coupled with great growth prospects from its Indonesia subsidiary, the potential for dilution and the business net working capital requirement are points of caution for me. This can be a short-term punting but difficult to serve as a long-term investment proposition at this point in time. As I am no expert in the area of corporate exercises, I am hopeful to see more constructive feedbacks. Thank you.

http://klse.i3investor.com/blogs/asdas/128753.jsp

Company Overview

To a certain extent, I agree with Icon8888 that the business is beautiful because it incorporates the servicing aspects too that usually command better margin and the business structure requires quite high technical expertise. As a starter, Unimech Group Berhad is an investment holding company with four key subsidiaries involved in manufacturing and seven in engineering services and distributorship (they do import foreign products and distribute).

Product Analysis

-

Industrial oil and gas burners product (distributed and installed by UGB)

Applications Industries Rubber crumb dryer Rubber Rubber gloves and curing oven for rubber products Latex products Coating and curing baking oven type Epoxy coating in furniture Steam and hot water generator Steam boiler, hot water boiler Paint drying oven Automotive industries, food packaging -

Steam boiler plant (distributed and installed by UGB)

Applications Industries Power generation Power generation Oil refining and distillation Oil and gas, palm oil refinery Plating, cleaning and conditioning Electronics and semi-conductors -

Valves, fittings, piping works and accessories (manufactured and distributed by UGB)

Applications Industries Fuel oil transfer pipiline Boiler plant, oil firing plant, combustion equipment High pressure gas and oil pipelines Oil and gas industries Stainless steel chemical pipeline Chemical and corrossive fluid Water treatment pipe work Water treatment of plants and factory -

Bellow and pressure gauges (manufactured and distributed by UGB)

Applications Industries Rubber bellow for connecting water pipes to system Fire fighting, air-conditioning and chiller system Rubber mould Industrial machinery and equipment Measurement of air, oil, gas, water, liquid Petroleum and refinery Compressor services Cement and ceramic Pheumatic instruments Petrochemical and fertiliser

Financial Analysis

Despite frequent impairment costs being calculated into the company's expenses, there is almost a corresponding equal number of times for a follow-up reversal of impairment taken in the subsequent year so Other costs and Other income are included in the presentation to obtain the nett amount of impairment. Although impairment is not a cash expense, the nature of the company's impairments is difficult to determine accurately and hence should be factored inside.

NWC Requirement from 2009 to 2016

Although the business is beautiful in terms of its products and services, the company's net working capital requirement is too high and this is in my opinion the biggest value-destroyer in the busines operation. Unless the management can reduce their net working capital requirement, it will be difficult to discover value out of this business operation.

Free cash flow projection

Using the past eight year average of the company's capital expenditure requirement (including those paid to acquire incremental ownership in their subsidiaries and associates), upcoming capital expenditure is projected assuming 6% of sales revenue every year while depreciation expenses constitute an approximate 7% of Property, plant and equipment annually.

As for net working capital requirement, a benefit of doubt is given to the company that it can reduce its NWC requirement to 85% of sales revenue for the next 4 years from its current 91.8% and on the fifth year to 80% (which is still high) to show confidence towards the management.

Given a discount rate of 9% (cost of equity at 12%), terminal growth of 3%, annual sales growth for the next five years at 10% (the company wants to keep expanding although sales growth in my opinion is not generating significant incremental cash flow due to high net working capital requirement) and EBIT margin of 15%, the net present value after debt and minority interest comes to be around RM1.28. However, the complication lies in the potential dilution from its outstanding warrants and ICULS.

Dilution Potential

| Scenario | Number of outstanding shares | Intrinsic value | Margin-of-safety |

| Current number of shares | 131000000 | RM1.28 | 18.75% |

| Dilution from ICULS only | 159703276 | RM1.18 | 11.9% |

| Dilution from ICULS and warrants | 220117628 | RM1.05 | 1% |

PT Arita Prima

On 29th October 2013, Unimech Group Berhad completed its proposed listing of its 85% indirect owned subsidiary, P.T. Arita Prima Indonesia. This business subsidiary targets to get contracts in oil and gas secotrs, customers from power plant, oil palm and oleochemical companies. Infact, it is the first valve company listed in Indonesia. There is no doubt that Indonesia has huge growth potential in the future but with current net working capital requirement, I am of the view that any topline growth will not be generating sufficient value for fellow shareholders.

Conclusion

Despite the specialty of the products and services of this business coupled with great growth prospects from its Indonesia subsidiary, the potential for dilution and the business net working capital requirement are points of caution for me. This can be a short-term punting but difficult to serve as a long-term investment proposition at this point in time. As I am no expert in the area of corporate exercises, I am hopeful to see more constructive feedbacks. Thank you.

http://klse.i3investor.com/blogs/asdas/128753.jsp