Market is directionless on lack of positive catalysts

As we all can see the FBMKLCI has been heading south since it tested its high of 1,796 points on 16/6/2017 even though DJIA notched a record high last week before ended lower towards the end of last week.

Accoding to MIDF Research Strategy team, Foreign investors sold RM205.5 million of local equity last week. Last week’s foreign withdrawal reduced the cumulative year-to-date net inflow to below the RM10 billion mark, at RM9.96 billion.

The heaviest foreign selling during the week was recorded on Tuesday, with net disposals reaching RM139.2 million.The markets in Indonesia, Thailand and the Philippines were also the casualties of foreign attrition on Tuesday.

Selling spree may continue further, yet may not be intense

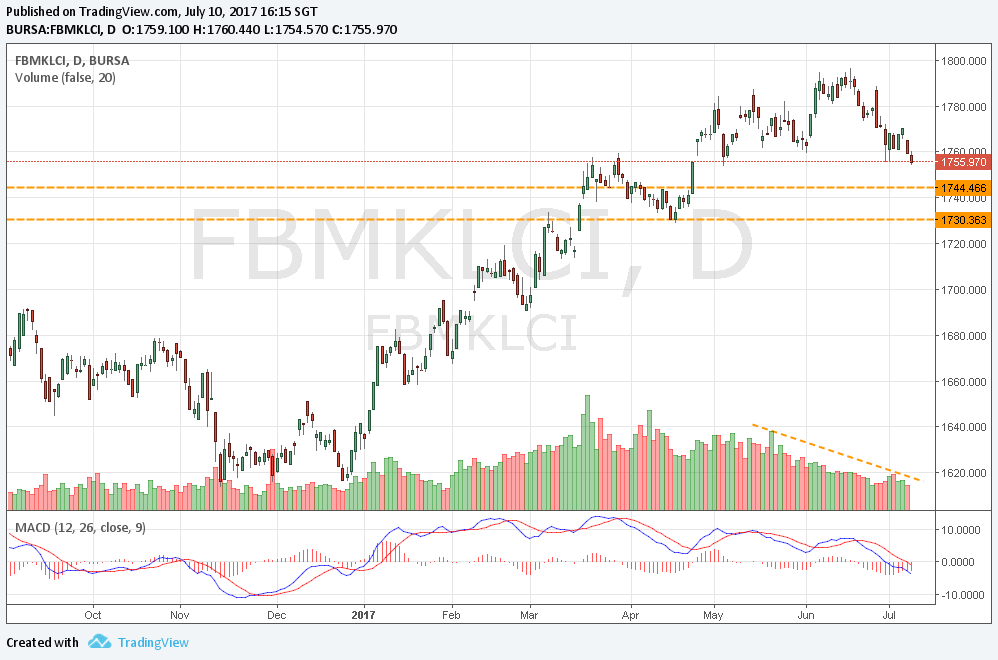

From following chart, the FBMKLCI has been on a downtrend with few support levels broken. Today will mark another lower close and on the verge to close below a significant support level.

Should the FBMKLCI close lower than 1,758 points today, the benchmarket will be heading lower to the next support level of 1,744 points and possibly may test 1,730 points level in the coming 7-14 days.

However, this selling spree could only be a knee-jerk reaction because the downtrend in the FBMKLCI has been in contrast to the declining volume. This indicates selling has not been so intense with the drop in value.

Dont catch falling knife, but prepare for accumulation

Investors might get spook with the downtrend of FBMKLCI, where nobody wants to be in the market while it gets lower and lower in the following days.

So, to catch the right moment to go in the market is to look at the support level of FBMKLCI and volume.

If the FBMKLCI continues to go lower to abovementioned support level with declining volume, that is the right moment to step in. Darling stocks will make a comeback that time.

http://klse.i3investor.com/blogs/tradingideas/127540.jsp

As we all can see the FBMKLCI has been heading south since it tested its high of 1,796 points on 16/6/2017 even though DJIA notched a record high last week before ended lower towards the end of last week.

Accoding to MIDF Research Strategy team, Foreign investors sold RM205.5 million of local equity last week. Last week’s foreign withdrawal reduced the cumulative year-to-date net inflow to below the RM10 billion mark, at RM9.96 billion.

The heaviest foreign selling during the week was recorded on Tuesday, with net disposals reaching RM139.2 million.The markets in Indonesia, Thailand and the Philippines were also the casualties of foreign attrition on Tuesday.

Selling spree may continue further, yet may not be intense

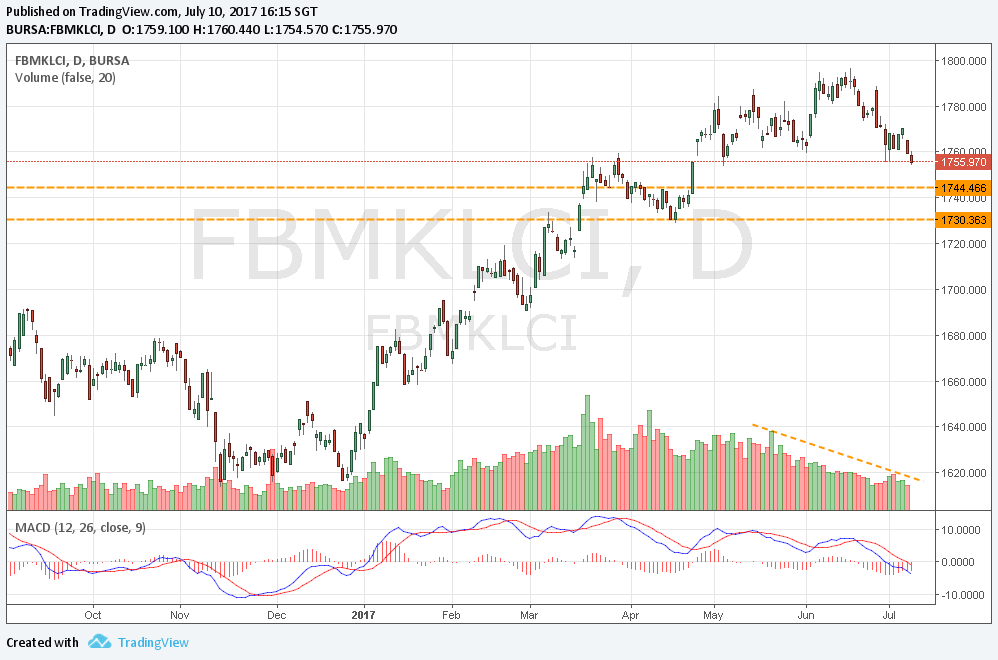

From following chart, the FBMKLCI has been on a downtrend with few support levels broken. Today will mark another lower close and on the verge to close below a significant support level.

Should the FBMKLCI close lower than 1,758 points today, the benchmarket will be heading lower to the next support level of 1,744 points and possibly may test 1,730 points level in the coming 7-14 days.

However, this selling spree could only be a knee-jerk reaction because the downtrend in the FBMKLCI has been in contrast to the declining volume. This indicates selling has not been so intense with the drop in value.

Dont catch falling knife, but prepare for accumulation

Investors might get spook with the downtrend of FBMKLCI, where nobody wants to be in the market while it gets lower and lower in the following days.

So, to catch the right moment to go in the market is to look at the support level of FBMKLCI and volume.

If the FBMKLCI continues to go lower to abovementioned support level with declining volume, that is the right moment to step in. Darling stocks will make a comeback that time.

http://klse.i3investor.com/blogs/tradingideas/127540.jsp