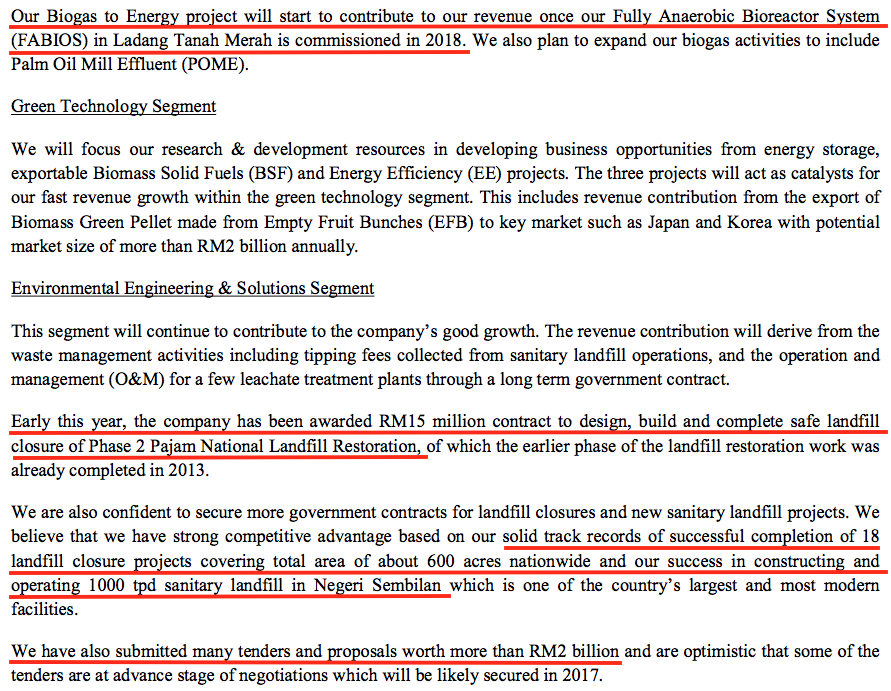

Cypark Resources Berhad's services include transforming neglected, degraded or contaminated land into sustainable and manageable fields. Its projects include the restoration of a disused mining land in Cyberpark, Cyberjaya, and the Taman Beringin Safe Landfill Restoration project in Kuala Lumpur. It is also involved in green technology.

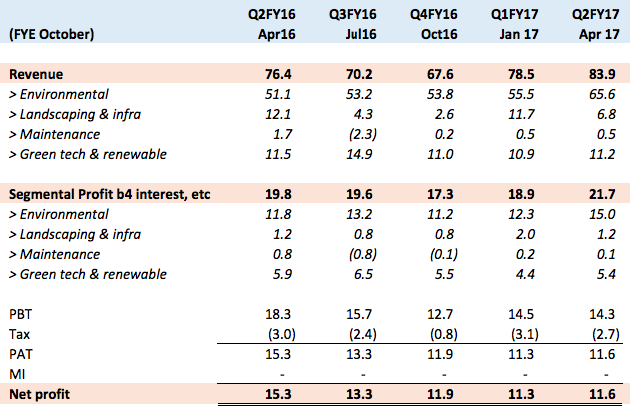

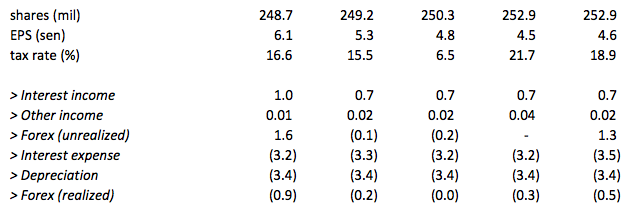

(Source : April 2017 quarterly report)

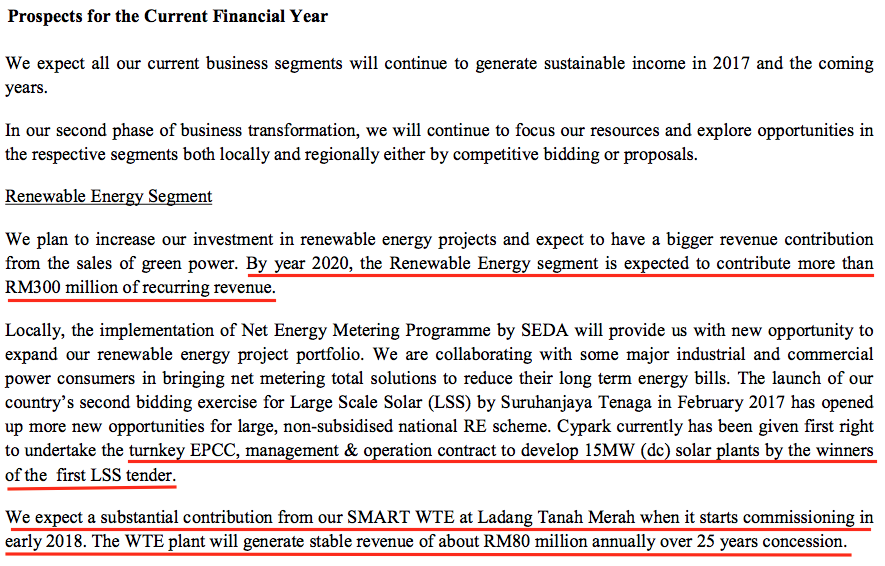

The group mentioned that revenue for renewable energy will increase to RM300 mil by 2020. This is very significant as in latest financial year, renewable related revenue was only RM50 mil. Unfortunately, the company has not provided more details.

Conclusions

Based on 12 months aggregate net profit of RM48.1 mil and maket cap of RM685 mil, the stock is trading at PER of 14 times. As mentioned above, the group expects revenue to grow by at least RM80 mil when the Waste to Energy project at Ladang Tanah Merah is commissioned in early 2018. Based on net margin of 16% and revenue of RM380 mil (being RM300 mil + RM80 mil), net profit might grow to RM61 mil, or EPS of 23.3 sen. Based on 14 times PER, target price of RM3.26 (23% upside). Stock price would of course go higher if the group secures additional contracts.

http://klse.i3investor.com/blogs/light/126661.jsp