From the annual report of Sapura Energy:

Those numbers seem very high, especially given the rather poor recent results of the company:

While the company lost a combined amount of RM 585,000,000 over the last two years, the directors earned a combined fee of more than RM 187,000,000 over the same period.

The share price over the last five years:

After reaching almost RM 5, the share price has declined by about 64%, nothing to shout about for the minority shareholders. And dividends have not been much better:

In other words: 37,000 shareholders received less in dividends than the Directors in remuneration. It seems the company is more interested in rewarding the Board of Directors than the shareholders.

If we look in more detail we notice the following:

Most of the remuneration for the directors is earned by a single person (I assume Sharil, the president and group CEO, although unfortunately the director is not named), and mostly based on performance.

But with the company losing more than half a billion over the last two years, the share price down a lot and the dividend cut, one wonders what the KPIs for that performance are.

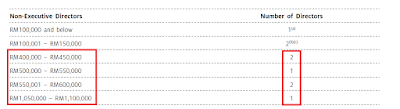

The fees for the non-executive directors are also on the high side:

The major shareholders of the company:

We notice three government linked funds in the list of substantial shareholders. Will they make noise about the above remuneration? At the last AGM that did not happen, all resolutions were approved by a large majority of the shareholders.

Let's wait and see if the next AGM to be held in July will be any different.

http://cgmalaysia.blogspot.my/2017/05/sapura-energy-excessive-remuneration.html