Disclaimer for Duit's publication

This publication is for general discussion only. It does not form part of any offer or recommendation, or have any regard to the investment objectives, financial situation or needs of any specific person. Before committing to an investment, please seek advice from a financial or other professional adviser regarding the suitability of the sharing for you. If you do not wish to seek financial advice, please consider carefully whether the finding is suitable for you.

Dear Esteemed Reader,

Every year I will try to discover at least one silent stock and invest it as long term portfolio. Last year I eyed on AYS ventures (5021) when it was still silent, non active trading and price flat at RM0.275 during my article (https://klse.i3investor.com/blogs/duitKWSPkita_AYS_Ventures/88891.jsp). Thereafter it delivered steady revenue and consistent net profit in last few quarters. I like this company because of the management proven to us that eventhoughduring volatile period of ringgit currency and fluacture global steel price the company managed to mitigate it and deliver QoQ/YoY fantastic profit and dividend (humble starting) to share holders. Many investors missanalyze this counter when they scrutinize the past results because it was belong to Nirvana Group but not the newly listed steel and construction material trading business. Salute the management for impressive P&L so far.

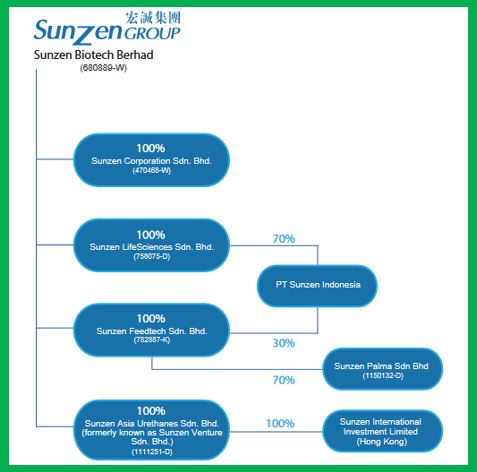

In 2017, I discovered a company named Sunzen Biotechnology which complied my selection criteria such as long term plan, business acumen, position in the indutry by SWOT score, competency of key management but not limited to price action vs risk reward.

This article covers

1) Introduction of company

2) Fundamental Analysis

3) Catalyst

4) References

5) Conclusion

1) Introduction of company

We are not strange to the name of Pfizer as Sunzen was part of Pfizer back in 1997. Today the company is specialized in the niche market of premix, acidifier, pet food, medicine, vaccine, fat powder and latest palm oil mill and trading business. After numerous quarter loss making results the company welcomed new line up of major shareholders, technical based key management as well as resterling company strategy to encompass the mission of management specialization, technical specialization and market diversification. On the necessity of the focus of food safety & security the company play an important role in the segment of antibiotic-free "green" products and the latest plant your own healthier living through "My City My Farm 2016" campaign. The company working closly with AUstralian High Commision, AUstralian Chamber of Commerce for the OzMade Liquidplant product which believe to be the key to My City MY Farm business.

Give my fullest support to Mr.

Hong Choon Hau and Mr. Lim Eng Chai and we shall see biggest and most

sustainable turnaround in future.

2) Fundamental Analysis

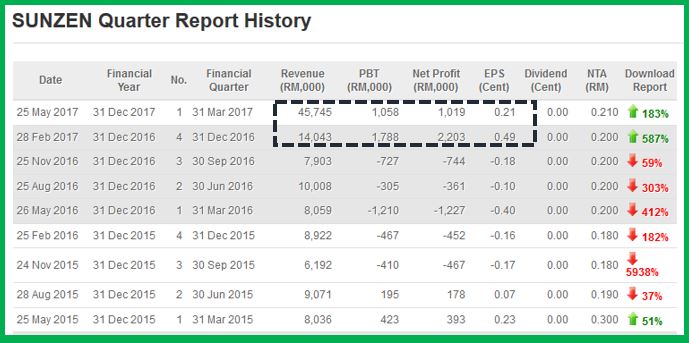

Profit & Loss: It's second consecutive quarters gain after seven (7) consecutive losses. EPS roars 183% compare to last year Q1.

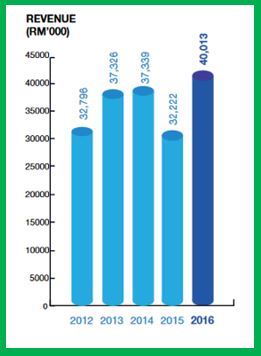

Revenue:

Revenue grew 24.18% to RM40.01 mil from RM32.22 mil in previous FY. The higher revenue was due to the higher sales of powder fats and also Australia improted products such as Ozmade and liquid Plantfood which contributed significant figure of RM3.24 million.

Q1 reported the single quarterly result of RM45.7 million and believe the following quarters remain robust.

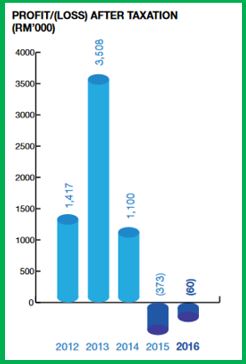

Profit After Tax:

PAT shown an impressive turnaround result from last FY loss of RM373k to a small loss of RM60k. This is not the commercial loss but was due to tax credit from the reduction of deferred tax liabilities provision, which was mainly attribute to timing differences on PPE acquired during the FY.

YTD PAT is amounting of RM1.1 million for the latest Q1 31st Mar' result.

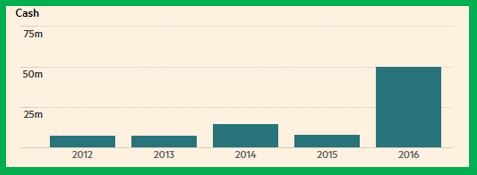

Cash and Balance

The cash and bank balances has increased to RM50.55 million as at 31st Dec 2016 after the Rights issue of shares of RM44.85 million. As at 31st Mar' 2017 the balance sheet stood at a net-cash position of RM55.5 million with a Current Ratio of 3.5X.

Remarks: With the conservative estimation of 5% growth in Revenue (Q2, Q3 and Q4) and also 4.3% Profit Margin I estimate Financial Year 2017 will register total Revenue of RM80 million and PBIT of RM3.40 million. This PBIT estimation is exclusive of trading contribution from palm based like CPO and kernel products.

3) Catalyst

In every investment we either purchase the company share to take benefit of the company value (stable & dividend payout) or invest in future growth. I would say catalyst is very crucial and decisive for my long term holding. I am not in the best position to hard sell or whatsoever to give imaginative justification to make any blind followers to fall in love with that. My absolute foreseen catalysts are:

-

Higher demand from "My City My Farm" initiative from high income households.

"It is now importing and distributing OzMade Liquidplant, an earthworm extract fertiliser from New South Wales, Australia.

“We are targeting to sell the product to more than 1,000 farmers in Malaysia, as well as to supermarkets, Baba Products and Jasmine Food Corp. We believe this product will generate more sales for Sunzen,” he told Business Times at the “My City My Farm 2016” campaign, here, recently."

-

Strong brownfield investment income from palm oil investment

I realize that Sunzen Biotech has aggresively acquired two(2) oil mills in Northern Penisular but they are still in very low profile in the market. The CEO Mr. Jim has remarked that current strong Revenue was contributed by trading of crude palm oil, palm kernel oil and kernel cake & shell products. How can oil mill make windfall gain? Despite CPO price at RM2,500 or climb up to RM3,000 miller will still pay B grade and C grade prices of FFB to estate owners and we hardly see small holder could receive A grade (big palm fruit) price.

-

Strong cash reserve for greater acquisition opportunity

It is logic and most welcomed should the company look into more acquisition such as Brand new licensed animal health products, highly efficient oil mill or palm oil refinery to leverage the resources in the company. When Sunzen acquire a palm oil refinery it has the supply chain advantage to convert commodities reliant CPO into value added end product or specialities fats which can be exported oversea for greater margin. Any breakthrough of new vaccine product will not only claim back tax rebate but to penetrate new market in emerging countries since developing countries have larger demand in farm livestocks.

-

Share price in charging phase

Technically, the share price hit RM0.450 and retracted back to RM0.380. The price is trading above Ichimouku cloud and also we can see MACD cross over volume bar. It has widen cushion to derive for its uptrend.

This is a buy on dip strategy before further accumulation on Q2 result. Execute stager buying strategy.

Phase 1 - acquire 40% at RM0.380

Phase 2 - acquire 30% at RM0.370

Phase 3 - acquire 30% at RM0.350 or RM0.380 (if fail to dip to that point)

- http://www.bursamalaysia.com/market/listed-companies/company-announcements#/?category=all&sub_category=all&alphabetical=All&company=0148

- http://m.klse.i3investor.com/servlets/forum/903571743.jsp

- http://www.malaysiastock.biz/GetReport.aspx?file=AR/2017/4/28/0148%20-%201059583231550.pdf&name=SUNZEN%20AR%202016.pdf

- https://www.nst.com.my/news/2016/06/154902/sunzen-biotech-bullish-new-market-prospects

5) Conclusion

Everything look nice but I'd hope management will update us more info and more structured plans how the turnaround strategy will create better yield for mid term and long term investors.

This article is for LEARNING AND DISCUSSION PURPOSES only. OBVIOUSLY IT IS NOT A PROMOTION OR BUY CALL. Please dont let OTHER cloud your judgement.

http://klse.i3investor.com/blogs/duitkwspkitaSUNZEN2017/124096.jsp