PSIPTEK (7145) - The RETURN OF LEGEND STOCKS - PSIPTEK PART2

The RETURN OF LEGEND STOCKS - PSIPTEK PART2

We actually covered PSIPTEK earlier in 9 January 2017. The quarter result announced in 24 February show favourable of 77% in YOY which is within our expectation.

Enclosed link: https://klse.i3investor.com/blogs/stockalliance/113406.jsp

Hence we feel PSIPTEK still have further upside. Why?? We will update further below.

PSIPTEK (7145) - The RETURN OF LEGEND STOCKS - PSIPTEK PART2

We actually covered PSIPTEK earlier in 9 January 2017. The quarter result announced in 24 February show favourable of 77% in YOY which is within our expectation.

Enclosed link: https://klse.i3investor.com/blogs/stockalliance/113406.jsp

Hence we feel PSIPTEK still have further upside. Why?? We will update further below.

Company Background

PSIPTEK

is engaged in construction works in Malaysia and Thailand. The company

also develops residential and commercial properties; and provides

project management and secretarial services. In addition, it is engaged

in the trade of building materials; and manufacture and trade of ready

mixed concrete.

The main business segments of the Group comprise the following:

1. Construction: Construction works.

2. Property Development: Development of residential and commercial properties.

3. Trading: Trading in building materials, provision of project management and secretarial services and investment holding.

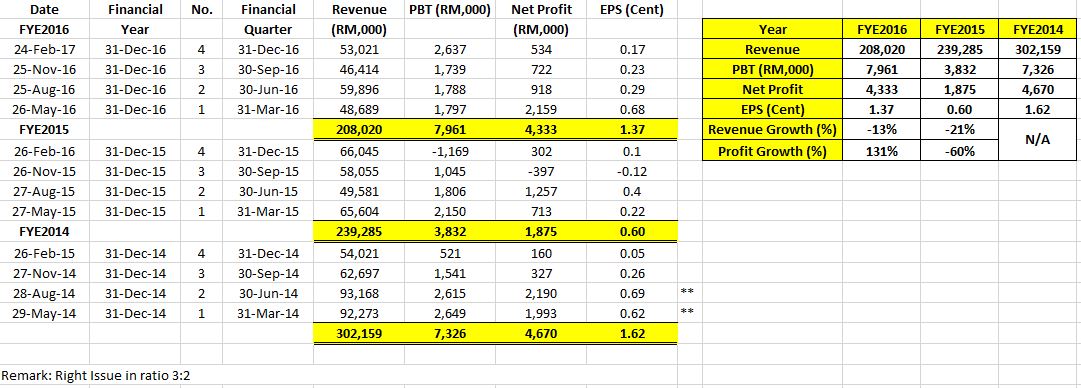

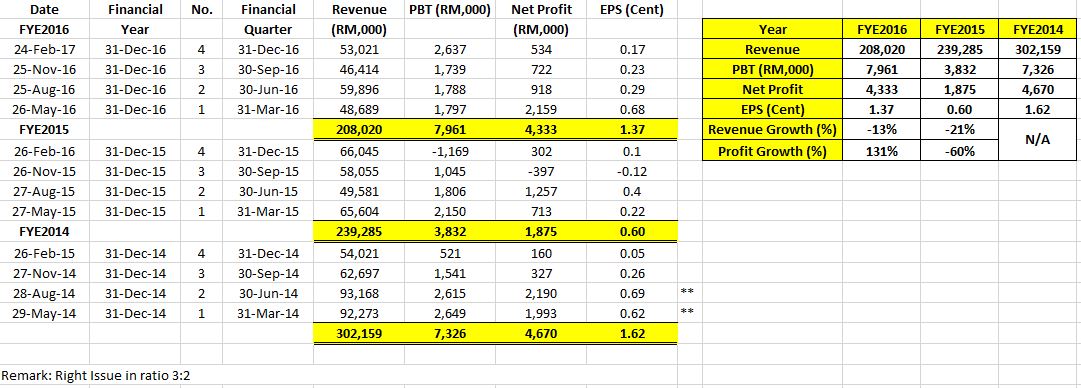

Financial Analysis

As

you can see, although there is a drop of revenue due to lesser

recognition of progress billing however there is a significant increase

of profit percentage of 131%, this was mainly due to the recognition of

higher profit margin projects and also the drop in operating expenses

and finance costs during the current year to date.

PSIPTEK

foresees the economy is challenging, they have foresight and implement

kinds of initiatives to lower the operating expenses and finance costs

to maintain good profit margin. We strongly believe with the management

capabilities, PSIPTEK is going to head north despite economic downturn

in worldwide.

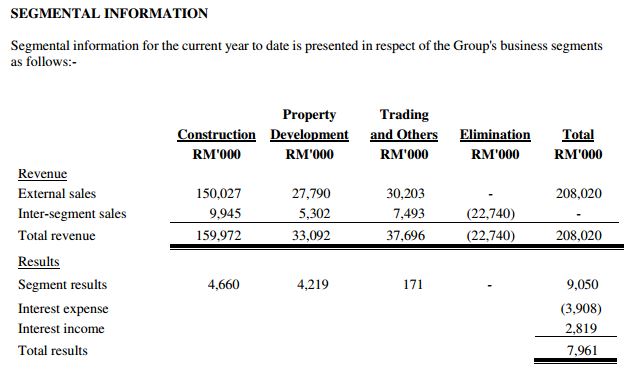

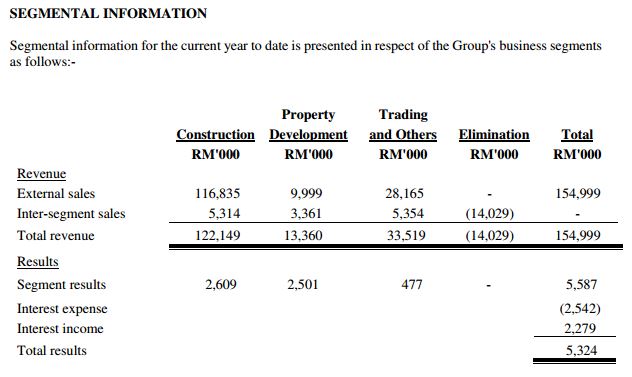

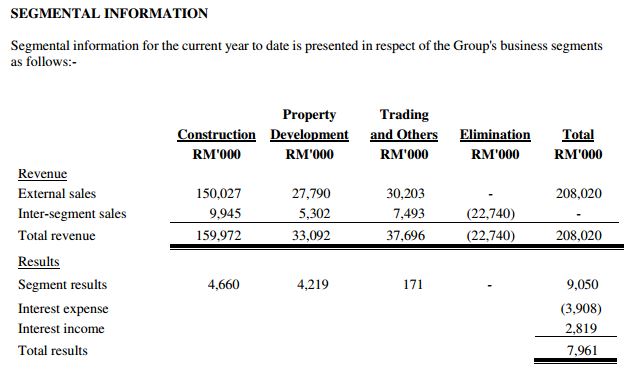

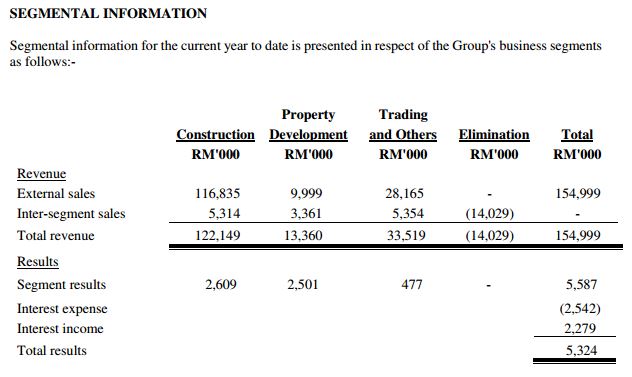

Segmental Analysis

(Source: Q4 FYE2016 Quarter Report)

(Source: Q3 FYE2016 Quarter Report)

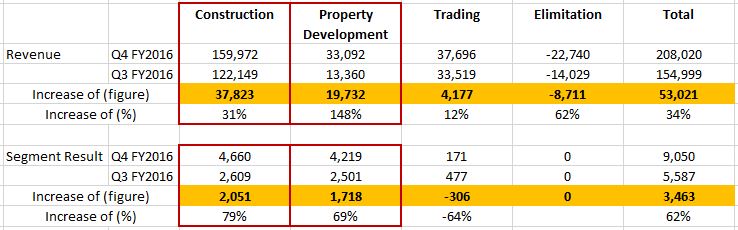

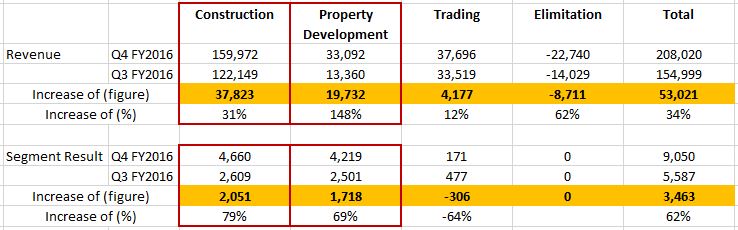

We hereby compare the growth of business segment between Q4 2016 and Q3 2016 in term of revenue and gross profit.

Kindly

refer to the four red redbox we highlighted. Clearly Construction and

Property Development Segment are the major source generator for PSIPTEK.

Construction: Revenue has increased 31% and Profit has increased a WHOPPING of 79%.

Property Development: Revenue has increased a WHOPPING OF 148% and Profit has increased a WHOPPING of 69%.

Why a huge increase?! To be frank, we have actually highlighted the reason in our FIRST article. With more future development,

(Source: https://klse.i3investor.com/blogs/stockalliance/113406.jsp)

Property Development: The project in Thailand and Shah Alam Puncak 7 will continue to bring high progress billing to the company revenue and profit.

Construction: We will see higher construction progress billing being recognised in coming quarter.

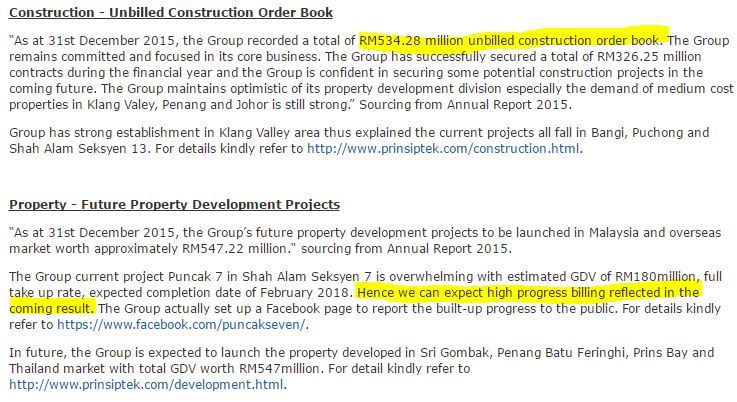

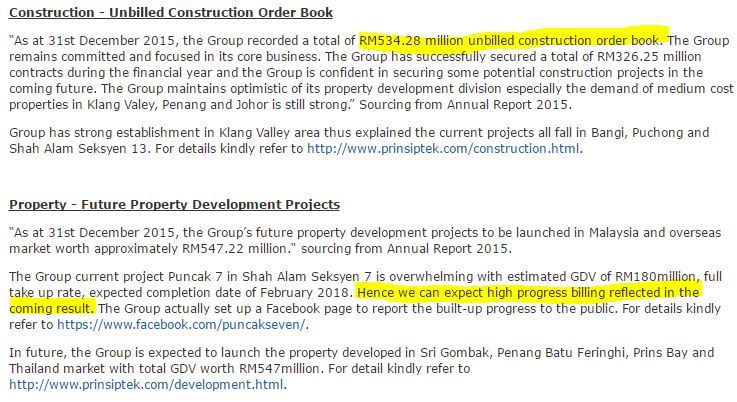

Update on Outstanding Order Book as at December 2016 (FORECAST)

Construction: RM534million – RM159mil (figures from Q4 FYE2016) + **RM326mil = RM700mil.

**Assumption

construction order book won in FYE2016 is similar with FYE2015

equivalent to RM326mil. For detailed and more accurate figure, awaiting

annual report 2016.

With

a huge outstanding order book, it is sufficient to hold the company for

the upcoming years. This kind of company will survive the turbulent

with fashion calm.

Balance Sheet

The

Group has over 100 acres of undeveloped landbank, mainly in the Klang

Valley. This form partial of the NTA of RM0.59. The NTA is at 195%

discounted as per current closing price.

The gearing ratio is at 0.50 which is comparatively low as per the competitors (ZELAN: 3.62, JOHAN: 0.80).

Technical Analysis

PSIPTEK

has broken its long term resistance @0.19 and closed @0.20 highest with

huge volume. Despite weak market sentiment in the last 2 days, PSIPTEK

managed to go green in red ocean and close STRONG. We shall see further

upside to our TP 0.35 in coming days.

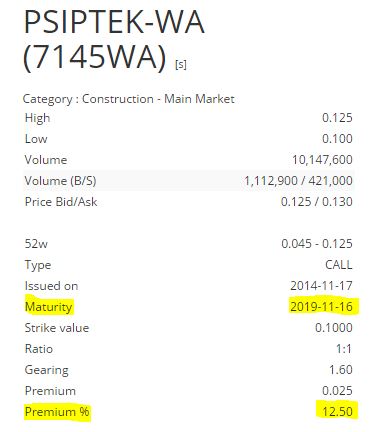

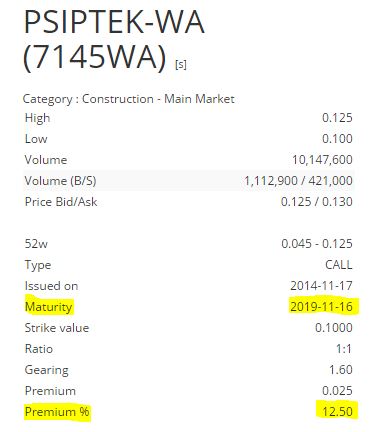

PSIPTEK WARRANT

What drawing our attention is the PSIPTEK-WA. The warrant will be only

expired at November 2019 (more than 2 years) and the premium is only at

12.5%. Clearly the warrant is lagging behind with benchmark 30% with

similar length of maturity period. We don't usually recommend warrant

unless it is discounted at very high level.

Conclusion

With

the trilling events we have mentioned/updated above, we strongly

believe PSIPTEK still have higher upside. With the industry PE of Zelan

(Negative PE), Johan (Negative PE) approximately 25, the share price

should be valued at RM0.35 (havent taken account of future earning

growth), 75% upside from current price.

Disclaimer:

The information contained in this channel is for general information purposes only and NOT a recommendation for buying or selling stock. Any reliance you place on such information which incur profits/losses is therefore strictly at your own risk. We are merely sharing our trades and hold no enforcement on issuing buy calls. If you share the same view with us on stocks, let time prevail.

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

PSIPTEK (7145) - The RETURN OF LEGEND STOCKS - PSIPTEK PART2

http://klse.i3investor.com/blogs/stockalliance/120744.jsp