YSPSAH (7178) - (RICHE HO ) Y.S.P. Southeast Asia - Boring Counter with Strong Track Record

Y.S.P. Southeast Asia Holding Berhad (“YSPSAH”)

Background

YSPSAH’s history can be traced back to year 1987 when it established as a trading company under the name of YSP in Malaysia. It was mainly involved in manufacturing and trading of pharmaceutical and veterinary products.

In year 1992, the Group obtained manufacturing license from MIDA and began operation of manufacturing plant in Malaysia. In year 2004, YSPSAH was listed in Ace Market of Bursa Securities and subsequently transferred its listing status to Main Market in year 2006.

As to date, it was one of the innovative and leading pharmaceutical companies in Malaysia. It covered a wide array of pharmaceutical, veterinary and aquatic products, with regional offices as well as strategic alliances in most of the Southeast Asia countries. YSPSAH sells its products to clinics, drugstores, pharmacies, Chinese medical halls and private hospitals.

Besides, YSPSAH also diversified into traditional herbal products with 60% equity stake in Sun Ten Pharmaceutical, a renowned manufacturer of standardized and concentrated herbal extracts from Taiwan.

Financial Highlights

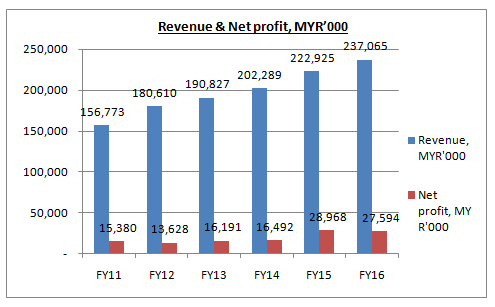

YSPSAH’s financial performance had been improving consecutively over the past 5 years. Its revenue had grown steadily from MYR157m in FY11 to MYR237m in FY16, which equivalent to compound annual growth rate (“CAGR”) of 8.6%.

Its excellent result was supported by better demand for the Group's products especially from local market. In other words, its domestic sales were still in a growing phase. It was partly due to the implementation of goods and services tax (“GST”) in year 2015 which led to consumers stocking up on pharmaceutical products in the first quarter.

In FY15, YSPSAH had successfully tendered to supply products to Government hospitals and the General Practitioners segment. The Group also registered higher sales from overseas markets and its subsidiary in Vietnam, namely Y.S.P. Industries Vietnam.

Despite a steady growth in revenue, YSPSAH’s net profit had remained flat in FY11 to FY15, before showing a significant improvement in FY15 and FY16. It was due to higher cost of goods sold from product mix which led to lower gross margin. In short, the cost of doing business had increased from year to year.

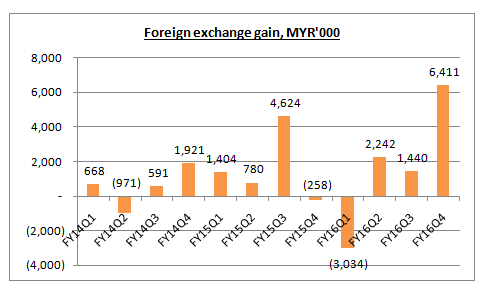

Having said so, in FY15 and FY16, USD/MYR had surged by approximately 25%, from 3.60 to 4.50. YSPSAH was a beneficiary of weakening of MYR. As a result, it recognized favorable foreign exchange gain in recent two years, which contributed significantly to the Group.

Foreign Exchange Risk

Annual Report 2016 had yet to be released. Hence, the latest FY16 data was not available.

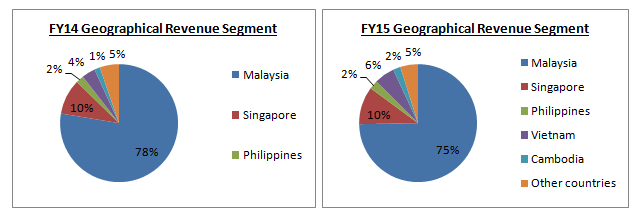

Domestic market contributed 75% of the Group’s revenue in FY15, whereas the remaining 25% was contributed by overseas market. YSPSAH was exposed to foreign currency risk on sales, purchases and borrowings.

Strengthening of USD against MYR was a double-edged sword for YSPSAH, as it allowed the Group to be more competitive in emerging markets in developing countries but also resulted in higher import costs for raw materials.

Even though the Group was predominantly operating in Malaysia, it still benefited from favorable foreign exchange gain due to its business exposure in Vietnam, Indonesia, Philippines and Singapore.

According to its quarter report, the foreign exchange gain recorded by the Group in recent two years was MYR6.55m and MYR7.06m respectively.

Excluding these non-cash item, YSPSAH’s net profit in FY15 and FY16 was supposed to be MYR22.4m and MYR20.5m respectively.

Seeking for Opportunities

In Sep 2016, the New Southbound Policy (新南向政策) was officially launched. It was the initiative of the Taiwan’s Government to enhance cooperation and exchanges between Taiwan and 18 countries in Southeast Asia.

The policy, which was aimed at improving trade and investment ties with Southeast Asia countries, presented opportunities for YSPSAH to work with its Taiwanese counterparts. As at Oct 2016, the Group was in talks with few local partners in Taiwan for possible partnerships, including dealerships, distributorships and joint ventures.

FYI, there were many good healthcare products made by Taiwanese manufacturers. The management believed the Group can play a major role to assist them in bringing their products to Southeast Asia, particularly Malaysia, by becoming their sales agent or distributor. YSPSAH can even jointly set up a manufacturing plant in the future.

In fact, the Group had already been approached by several Taiwanese firms keen to create partnership due to its long-established presence in this region and extensive network.

Commonly, China, Japan and US market was the primary options for Taiwanese business when they wanted to expand into new markets, due to strong domestic consumption in the countries.

However, the management believed Southeast Asia was an emerging market. Most countries were not facing an ageing population, so the earlier enter this market the better. Going forward, YSPSAH anticipated more Taiwanese investments in Malaysia, forming a perfect springboard to build their businesses in Southeast Asia.

Malaysia Operations – Bangi Plant

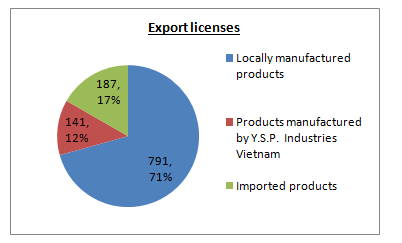

In FY15, YSPAH had successfully registered 13 pharmaceutical, veterinary and aquatic products in local. This had increased the Group’s total registered products in Malaysia to 378. Its total export licenses had increased to 1119 in FY15 as compared to 1013 in FY14.

Do note that, the date above was up to FY15 only. FY16 data was not available.

In FY16, YSPAH had upgraded its current Good Manufacturing Practice certified plant in Bangi, Selangor through automation. It had further improved the Group’s production efficiency.

For the venture into medical device manufacturing, YSPAH had granted Good Distribution Practice in Medical Device certification in Jul 2015. It was waiting conform of the requirement of manufacturing medical devices for its Bangi plant.

Other than that, YSPAH had successfully secured the approval in Oct 2015 of which added an ampoule production in its Bangi plant. Manufacturing of ampoule products can be expected to commence following the product registration.

In addition, its Bangi plant was granted GMP accreditation by the Gulf Cooperation Council. With this, YSPAH will be able to commence product registration, paving the way for further business opportunities in the Middle East.

YSPAH had also commenced renovation of its newly acquired building for Logistics and Research and Development in FY15Q4.

Overseas Operations – Vietnam & Indonesia plant

YSPSAH overseas operation was mainly focus on its pharmaceutical and veterinary factory in Vietnam. I had carved a niche in a significant market segment by supplying its veterinary products to feed mill factories. Besides, the plant was also gearing up to export veterinary products to Indonesia and Cambodia in FY16.

YSPSAH had improved its product registration from 59 in FY14 to 90 in FY15.

Other than that, YSPAH’s new pharmaceutical manufacturing plant in Indonesia had completed in FY15Q4. Approval of import permit was received in Nov 2015 and this facilitated the import of machineries and equipment for the plant. The commissioning of the machineries and equipment were expected to commence by now.

In Sep 2015, YSPAH had acquired an office building in Indonesia for Indonesian Rupiah 14.5 billion (equivalent to MYR4.38m)

HOVID – Manufacturing License Revoked

In Jan 2017, the pharmaceutical and herbal products maker HOVID had halted all its manufacturing activities following the revocation of its manufacturing licenses by the Health Ministry.

The manufacturing licenses for both HOVID’s facilities in Perak was repealed, as a result of audit conducted which found that the Group’s compliance were not acceptable and its pharmaceutical quality system did not comply with the latest requirements.

As a same industry player, YSPSAH potentially benefited from this event. It might be a golden opportunity to take over part of HOVID’s market shares in pharmaceutical industry.

Do note that, it may be difficult for a new company to attempt to produce the same products as a larger, established pharmaceutical firm. This was because the larger firm already had a large infrastructure and distribution network established and had achieved better marginal economies.

Besides, brand name recognition was critical when dealing with supplements or tablets that can have physiological effects. Most consumers were rightly wary of a product they had never heard of or a company they did not trust. This can be a difficult barrier to overcome.

Technical Chart

As at 14th Mar 2017, YSPSAH closed at MYR2.20.

YSPSAH was in a downtrend since Aug 2015 at where its share price had dropped from 3.30 to 1.80 in one and a half year, which equivalent to a drop of 45%.

However, in recent months, it had successfully breakout from the trend line, which indicated that its downtrend had temporarily came to an end.

Its immediate resistance level was located at 2.22. Once it breakout from this level, YSPSAH may trend higher to 2.70, followed by 3.30. Its current support level was located at 1.80.

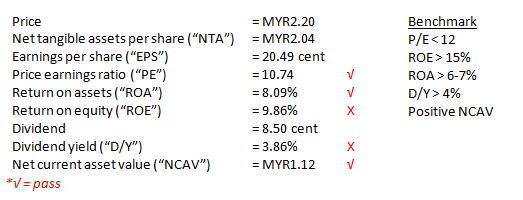

Ratio Analysis

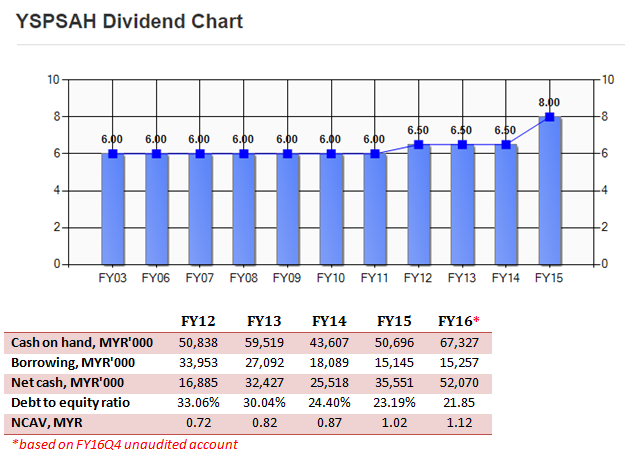

YSPSAH was very healthy in term of financial strength and balance sheet. Currently, it holds MYR52m net cash on hand, which equivalent to 39 cent cash per share.

Besides, the Group had been declaring dividends consistently since FY06. In FY16, it had proposed 8.5 cent dividends as a reward for shareholders, the highest in Group’s history.

Conclusion

YSPSAH was a good fundamental company with proven track record. It was one of the top four pharmaceutical companies in Malaysia, alongside Pharmaniaga, CCM Duopharma Biotech and Apex Healthcare.

Moving forward, the Group would remain focused in improving its operational efficiency, increasing product registration, and embarking on more aggressive marketing, promotional and sales strategies, to facilitate a sustainable performance in year 2017.

Besides, BMI Research holds a bullish outlook for Malaysia's pharmaceutical market over its forecast period. It believe the government's commitment to expanding healthcare access coupled with the country's growing population and disease burden will drive medicine demand in the coming years.

Fundamental wise, YSPSAH definitely will be a safe bet as its downside was limited. Technical wise, it had breakout from its major downtrend. It was expected to move further up once it breakout from its resistance level 2.22.

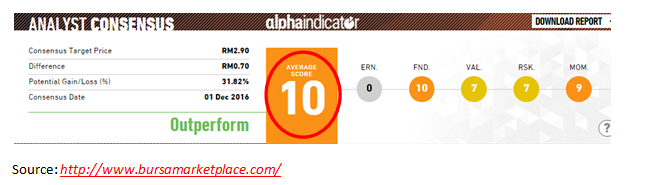

According to the analyst consensus in Bursamarketplace, they had given YSPSAH an average score of 10 and “OUTPERFORM” rating.

YSPSAH (7178) - (RICHE HO ) Y.S.P. Southeast Asia - Boring Counter with Strong Track Record

http://klse.i3investor.com/blogs/rhinvest/118588.jsp