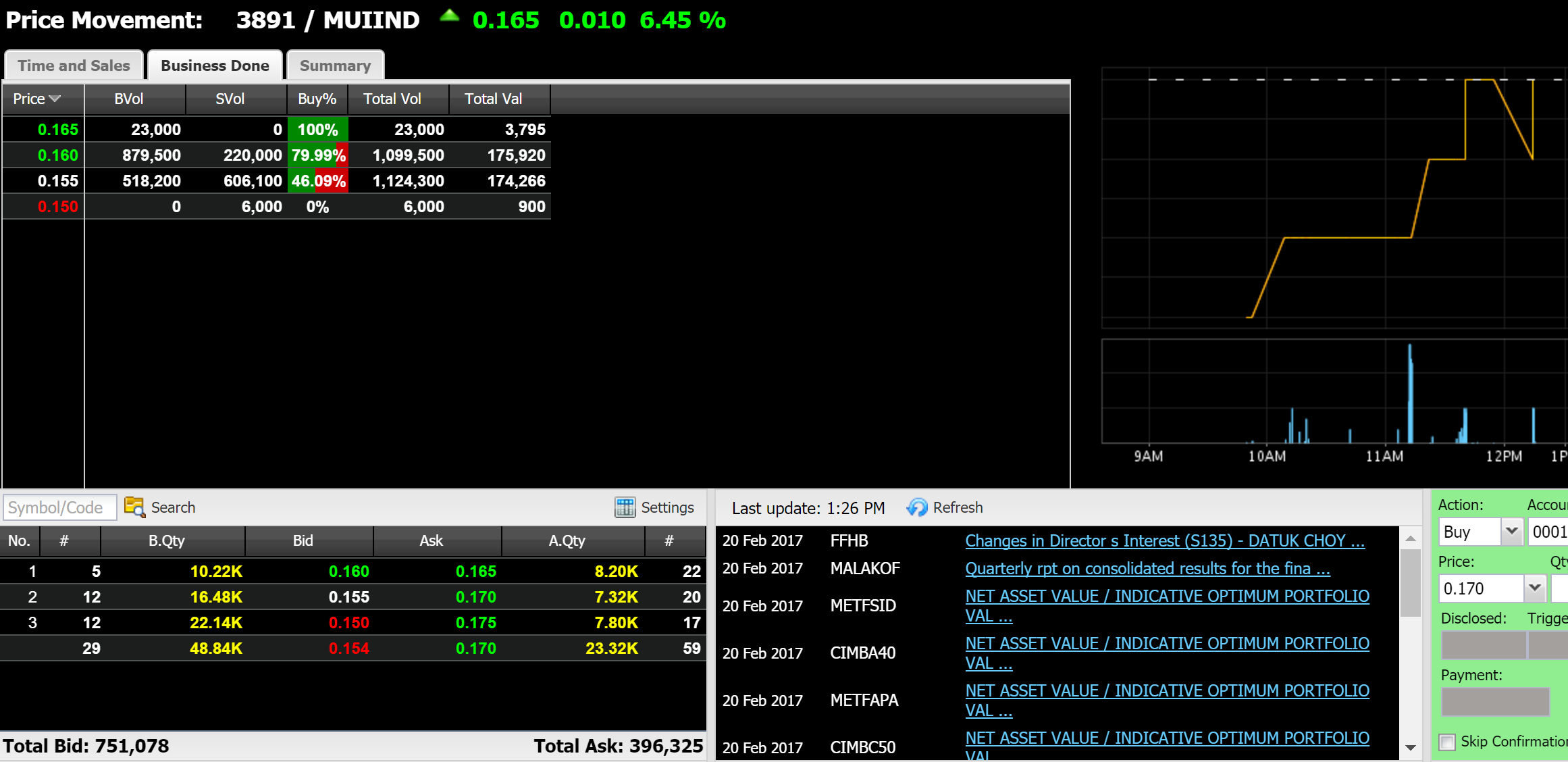

MUIIND (3891) - MUIIND (3891) Selling CORUS HOTELS at RM1.1 Billion.

MUIIND selling its London Corus Hotel at price RM1.1 Billion. MUIIND share price break 16sen resistance and moving toward 20sen.

MUIIND inherent value in the group.

MUI’s Corus Hotel in Jalan Ampang, sitting on 78,500 sq ft of prime

land opposite the Petronas Twin Towers, is carried at a net book value

(NBV) of only RM60.5 million, or RM770 per sq ft (psf), whereas land in

the KLCC vicinity had reached as high as RM3,000 psf.

Nevertheless, the main appeal of MUI lies in its chain of hotels in the

United Kingdom that have not been revalued for many years.

Notably, its crown jewel, the 390-room hotel known as Corus Hotel Hyde

Park at Lancaster Gate, London, which sits on 21,640 sq ft of freehold

land, is carried at a NBV of only RM257.5 million. MUI acquired the

property in 2001.

It would appear that Khoo is finally looking to sell Corus Hotel Hyde

Park. If the sale materialises, analysts said, the “surplus” of close to

RM800 million could serve to pare down MUI’s total borrowings of

RM893.5 million as at June 2014, and “finally let its profits shine

through”.

Such hefty borrowings, compared to the group’s total equity of RM762

million (excluding minority interests), resulted in a finance cost of

RM52.6 million in the financial year ended December 2013, which wiped

out a majority of MUI’s RM54.9 million operating profit.

Meanwhile, a surplus of close to RM800 million could also double MUI’s

shareholders equity to RM1.56 billion or 53.3 sen a share, from 26 sen

per share currently. MUI was traded at 25.5 sen last Friday, with a

market capitalisation of RM747.8 million.

“Khoo is now 75 years old. It is a matter of time [before] he wants to

unlock the value of assets in MUI, clean up its books, and leave a good

legacy,” said an analyst, who added that MUI is also looking to dispose

of some of the restaurants in the UK.

MUI owns and operates nine hotels and two restaurants in the UK and two

hotels in Malaysia, most of which operate under the “Corus” brand.

Apart from the hospitality business, MUI controls 94.52% of department

store operator Metrojaya Bhd, 35.17% of London-listed Laura Ashley

Holdings plc (market capitalisation of £195.8 million), and major stakes

in MUI Properties Bhd, Pan Malaysia Corp Bhd (foodstuff manufacturing),

Pan Malaysia Holdings Bhd (diversified), Pan Malaysia Capital Bhd

(stockbroking and financial services) and so on.

On its London assets, property market observers said it won’t be

difficult for MUI to fetch £200 million for Corus Hotel Hyde Park, given

upbeat investors’ sentiments on London hotels, especially with growing

interest from wealthy Chinese investors as well as sovereign wealth

funds in the Middle East.

更多既时股市资讯,请加入我们的TELEGRAM

WELCOME JOIN MY TELEGRAM

For more Real time information

PLEASE CLICK THIS LINK TO JOIN US

请按这个LINK 加入我们的TELEGRAM获取既时免费分享资讯

https://telegram.me/wecanstock

请按这个LINK 加入我们的TELEGRAM获取既时免费分享资讯

https://telegram.me/wecanstock

MUIIND (3891) - MUIIND (3891) Selling CORUS HOTELS at RM1.1 Billion.

http://klse.i3investor.com/blogs/Stockoftheday/116251.jsp