AJIYA (7609) - (RICHE HO) Ajiya Berhad - Green IBS Provider, Benefited from PR1MA project

Ajiya Berhad (“AJIYA”)

Background

AJIYA’s history can be traced back to year 1990 when it started as a metal roofing manufacturer under the brand name “AJIYA”. It started a very small factory in Johor with only 3 employees. In year 1996, AJIYA ventured into the production of high value added safety glass products.Ajiya Berhad (“AJIYA”)

As to date, AJIYA’s products cater to a wide variety of users from industrial commercial buildings to the common residential houses. It had transformed from an unknown industry player to become a well-known national brand; from producing a simple metal roofing product to manufacturing a full comprehensive range of house building components.

AJIYA was listed on Ace Market of the Bursa Securities in year 1996 and subsequently transferred to Main Market in year 2003. From private company Sdn Bhd to a publicly-listed company on the Main Market of Bursa Securities, AJIYA had arrived at where it was today.

Financial Highlight

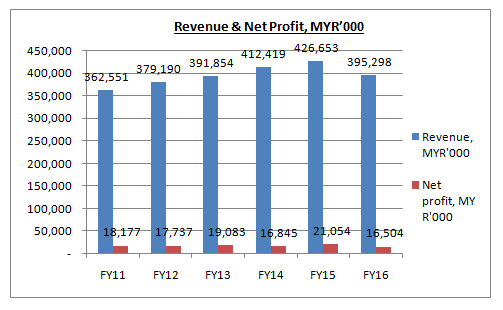

AJIYA was a profitable company with solid proven financial track record. It had been steadily growing over the past few years. Its revenue had improved 4 years consecutively, from MYR363m in FY11 to MYR427m in FY15, which equivalent to compound annual growth rate (“CAGR”) of 4%.

The overall growth in sales was driven by an increase in the demand for building materials driven by the Government’s on-going projects including the Economic Transformation Programme (“ETP”), the Economic Corridors and Green Building Tools.

Besides, the launch of high-end residential, commercial developments in Kuala Lumpur city as well as the development of MRT stations had contributed to the growth in demand in the property sector. The increased demand in architectural field had also contributed to the growth in AJIYA’s products orders.

Do note that, AJIYA’s financial performance was heavily relied on the market conditions especially construction sector, which might affect the demand of the Group’s products.

Even though AJIYA had registered an increase in turnover, its net profit was affected due to several challenges. An increase in overall production costs together with an increasingly competitive market had put a strain on the Group’s margin. Moreover, the importation of processed and energy saving glass from China had resulted in the fall of domestic prices.

Having said so, with the introduction of new product system, the AJIYA Green Integrated Building System (“AGIBS”), AJIYA’s result was led by better margins for certain products. As a result, AJIYA recorded a 5-year new high profit in FY16Q4. Its safety glass Thai subsidiary had returned to profitability during the year as well.

In segmental reporting, AJIYA only categorized its business into one segment – manufacture and supply of materials used in the construction and building based industries. Hence, the exact figure and contribution from metal roofing and safety glass were not provided.

Metal Roofing Division

AJIYA’s metal roofing division saw many changes in year 2014, including the development of new products and the expansion through new plants and operations buildings.

AJIYA’s new plant in Johor had successfully commissioned in Dec 2014. It was aimed to provide better services for its customers and to capture a bigger market share in the Southern region.

In FY15, AJIYA’s metal division had engaged in a number of mega projects, including:

- The Customs, Immigration and Quarantine Building in Langkawi

- The Royal Malaysian Airforce hangar in Subang

- Ipoh Padang Besar Electrified Double Track Project

- Country Garden Danga Bay and Eco Business Park in Johor Bahru.

The IBS sooner or later will be a revolution to the construction industry. It was designed for speedy construction and early completion of superstructures with lesser manpower. This system was gaining positive response from the market and the demand was expected to increase.

Going forward, the division will continue to innovate its offerings and develop a wider product range, including ceiling and roofing products. AJIYA aimed to work closely with government agencies in the provision of affordable housing projects, as well as with private developers.

Safety Glass Division

In FY15, AJIYA’s safety glass division continued to be impacted by new competitors from the domestic market as well as the expansion of production capacity by its competitors.

Besides, the imports of processed and energy-saving glass from China led to a further deterioration on the domestic selling price. Having said so, the demand for architectural glasses was sustained mainly by construction activities in the development of high-rise buildings and key infrastructure projects.

During FY15, AJIYA’s safety glass division had successfully participated in prestigious projects such as:

- Sunway Velocity integrated development

- Glomac’s Reflection residences

- The Public Mutual Building

- MITI building

- AraGreens residences - Phase 1, M City residential suites and Icon City residences

In the near-term, AJIYA planned to substitute part of its raw glass purchases with local raw glass supply to mitigate the risks of currency fluctuations as most of its raw glass supply was imported.

As for its oversea operation, AJIYA’s safety glass plant in Thailand had commenced operation in May 2013. After three years, AJIYA had begun to extract value from its Thai glass division which was now contributing positively to the Group.

Going forward, AJIYA will continue to build its brand awareness in Thailand as well as in neighboring Indochina countries.

Ajiya Green Integrated Building System (“AGIBS”)

Note:

1. Ground slab preparation -> Fabrication of frame

2. Erecting frames -> Fixing -> Pre-installed ducting, piping for M&E services and plumbing

3. Installation of door and window frames -> Installation of mesh -> Light weight steel trusses

4. Concreting -> Plastering work -> Roofing work

For video: https://youtu.be/QImLSG1MCvs

Project Reference

AJIYA only used 21 days in completing the whole construction in Clinic Desa in Shah Alam.

In Apr 2016, Prime Minister Najib announced that it was now mandatory for all government projects costing above MYR10m, and private sector ventures of above MYR50m, to hit an Industrialized Building System score of 70.

He believed that the IBS was the future of the construction industry. It was timely that the industry would make the quantum leap towards attaining developed nation status by 2020.

Future Growth

In year 2016, the number of affordable housing projects in Malaysia had surged. While construction and property development companies were the obvious beneficiaries of this theme, building materials companies supply the raw materials for these projects.

As at Oct 2016, more than 12,000 units of Perumahan Rakyat 1Malaysia (“PR1MA”) housing worth MYR3.3b had been booked, while 85,000 units were at various stages of approval.

With such market size, the lesser known companies that provide the IBS could benefit because of cost effective solution, shorter construction time and lesser manpower. The three listed companies which provide IBS or produce materials used in IBS were AJIYA, CHINHIN and ASTINO.

IBS provides builders with an innovative and advantageous solution as more affordable houses are churned out to meet the growing demand. IBS components are manufactured in a controlled environment, either on or off-site, to be later placed and assembled in construction works, much like building blocks, thus saving time.

As for AJIYA, with its own AGIBS, the conventional 24 months construction period was significantly reduced to only 8 months. In addition, the construction cost for one unit was only MYR80k and it can be reduced with economies of scale.

In Aug 2016, AJIYA had signed a memorandum of understanding (“MOU”) with IMAG Development & Construction (“IMAG”) to collaborate, secure and implement a project awarded by Prima Corp Malaysia.

Prima Corp Malaysia had previously awarded a letter of intent to Polybuilding Construction, to construct 746 units of PRIMA Homes on 24.88 acres of leasehold land in Sarawak.

Polybuilding intended to assign this project to IMAG, and IMAG was interested to use AJIYA’s Green Integrated Building Solutions for the project.

However, the MOU will only binding in the event of IMAG successfully securing the project. As to date, the MOU was still on-going and there was no material development pertaining to the MOU.

Partnership with YKGI

In Oct 2016, AJIYA had entered into a MOU with YKGI Holdings Berhad (“YKGI”) for a long-term strategic business partnership between both companies in Sabah and Sarawak.

The partnership will synergize and optimize both parties’ manufacturing resources. The MOU allows both companies to form the basis of consensus to examine the feasibility of the proposed partnership.

FYI, YKGI was mainly involved in the manufacturing and sale of galvanized and coated steel products, picked and oiled hot-rolled coils and cold-rolled coils.

The collaboration will open up business opportunities for AJIYA in Sabah and Sarawak by leveraging on the extensive network of YKGI.

Other than that, in mid of year 2016, AJIYA had also signed a MOU with Indonesian PT Baja Bahana Utama for a joint-venture company in Indonesia to manufacture and sell AJIYA’s metal-roll formed products, specifically Ajiya Green Integrated Building System (“AGIBS”).

Changes in Substantial Shareholder’s Interest

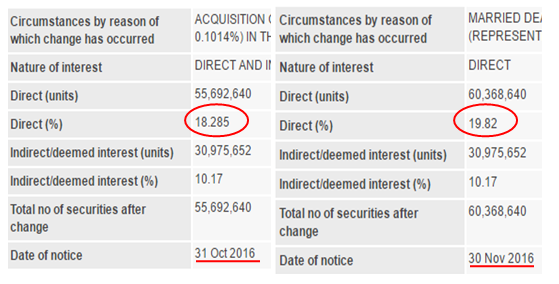

The above was the changes in Dato’ Chan Wah Kiang’s equity interest in AJIYA.

Dato’ Chan was the founder member of AJIYA. He was currently the managing director of the Group. Dato’ Chan had collected approximately 4.68m AJIYA shares in Nov 2016 and increased its stake from 28.46% to 29.99%.

Financial Strength

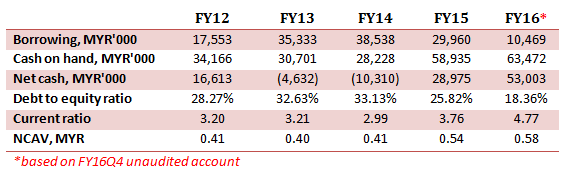

AJIYA had been improving its balance sheet since FY13. Currently, it had net cash of MYR53m on hand, reflecting its position as a mature business with strong and reliable cash flows.

It was partly due to proceeds from a Private Placement undertaken in FY15. The Private Placement saw the issuance of 6.92 million new ordinary shares which raise MYR29.07m from the exercise.

Besides, AJIYA’s debt to equity ratio had reduced from 26% to 18% in FY16. In addition with its current ratio of 5x and net current asset value of 58 cent per share, AJIYA was in a strong financial position. It will be able to focus on its planned expansion activities without distractions from debt obligations.

Technical Chart

As at 15th Feb 2017, AJIYA closed at MYR0.72.

AJIYA was in a downtrend since Aug 2016 due to its poor performance in FY16Q2. Its share price had dropped from 1.00 to 0.60 in 4 months time, which equivalent to a drop of 40%.

However, following the recovery of its result in FY16Q3 and FY16Q4, AJIYA was looking forward to go back to its previous level 1.00.

Currently, AJIYA had breakout from its resistance level 0.69, supported by huge buy volume. With the current momentum, AJIYA was expected to test its new resistance level 0.78 in short term.

Conclusion

In future, the construction method in Malaysia was expected to shift to intelligence building solution. The innovative idea of IBS will become more commonly in Malaysia.

According to Prime Minister Najib, it was now mandatory for all government projects costing MYR10m and more, and private sector ventures of MYR50m and above, to hit an Industrialized Building System score of 70. As such, AJIYA Green Integrated Building System (“AGIBS”) was expected to play a vital role in its growth trajectory.

Furthermore, AJIYA was also in the midst of expanding its production capacity as it seeks to capture more projects and increase the efficiency of its delivery. It was eyeing to participate in more public sector-led projects, such as the continuation of the MRT and LRT, infrastructure projects within KL city, affordable housing projects offered by PR1MA, etc.

Let’s assume AJIYA will be able to deliver MYR23m in FY17. Based on its outstanding shares of 304.58m, its earnings per share will be 7.55 cent. With an estimated PE of 12, AJIYA will have an intrinsic value of 90 cent. Do note that, AJIYA’s average PE over the past few years was around 14.

For those who interested in my research, I am providing stock analysis

report for a small fees. For more info, you may email me at

richeho_92@hotmail.com

If you guys like my writing, kindly give me a like on my FB page as well.

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

AJIYA (7609) - (RICHE HO) Ajiya Berhad - Green IBS Provider, Benefited from PR1MA project

http://klse.i3investor.com/blogs/rhinvest/116031.jsp