Cost worries on the home front

If you recall, last week I talked a little about my expectations for the New Year on the global front. This week, I will share some thoughts on issues closer to home.

To recap, I believe we will see a stronger US economy and US dollar.

Trump and his fellow Republicans want – and need – to show tangible results, to cement their win in November. To start, they will push through the least contentious policies, likely tax cuts and some shovel-ready infrastructure projects, as quickly as possible.

We will see a continued flow of funds into the US, attracted by improving prospects and importantly, revival of the “animal spirit” among businesses, big and small.

That translates into corresponding outflows from, and weaker currencies for, the rest of the world.

While countries in Europe and Japan will welcome weaker currencies – to give stagnant consumer prices the lift that years of extreme monetary policies have failed to do – it’s less positive for emerging markets.

Last week, Indonesia – sensitive of capital outflows – cut ties with JP Morgan after the US bank downgraded the country’s equities to “underweight”.

I doubt cracking down on independence of analyst reports will alleviate investor concerns or stop money from leaving the country. “Buy” and “Sell” reports are two sides of the same coin. You can’t have one without the other. If, however, there were ill intention, false data or factual error, they would be better off disputing them in the court of law, as Singapore is prone to do.

Malaysia too has seen more than its fair share of capital outflows, resulting in the sharp drop for the ringgit and prompting Bank Negara to step in with new measures. That has stabilised the currency, at least for now. But the downtrend, evident over years (not just recent months), has to be driven by more than speculative activities.

The strengthening US dollar is beyond our control and affects all other currencies, not just the ringgit. But we can’t deny that confidence in the country has been shaken, by the long-running 1MDB saga, divisive political rhetoric and structural weakness in the underlying economy.

China’s heady growth and demand for commodities and our own debt-fuelled consumption boom drove Malaysia’s economy in the past two decades. Neither growth will reach such levels again, at least not for a long time.

I expect China’s economy will continue to moderate – barring a full-blown trade war with the US. And that will affect regional supply chain and trade, which is a big part of our exports. Further weakness for the yuan will also mean downward pressure on the ringgit.

We can’t simply hope to talk up the value of the ringgit. We have to convince investors – local and foreign – of our prospects. That means addressing the underlying issues with real policies. Action speaks louder than words.

This year, cost inflation is our biggest worry – due to the ringgit weakness as well as the broader commodities uptrend. That includes prices for petrol, gas, cooking oil, sugar, food and other necessities, clothing, education, healthcare, etc. Basically, cost of living and cost of doing business are rising.

These, I believe, will result in subdued corporate earnings for the broader market. I am also leery of companies with high gearing. Market liquidity will tighten and cost of borrowing is on the rise.

There is speculation that an early general election may be called sometime this year. If so, the market could see a limited rally.

In any case, I definitely wouldn’t shun investing in stocks altogether. There will always be those that will outperform – even in a broader market that is lacklustre – and better than any interest income you can earn from bank deposits.

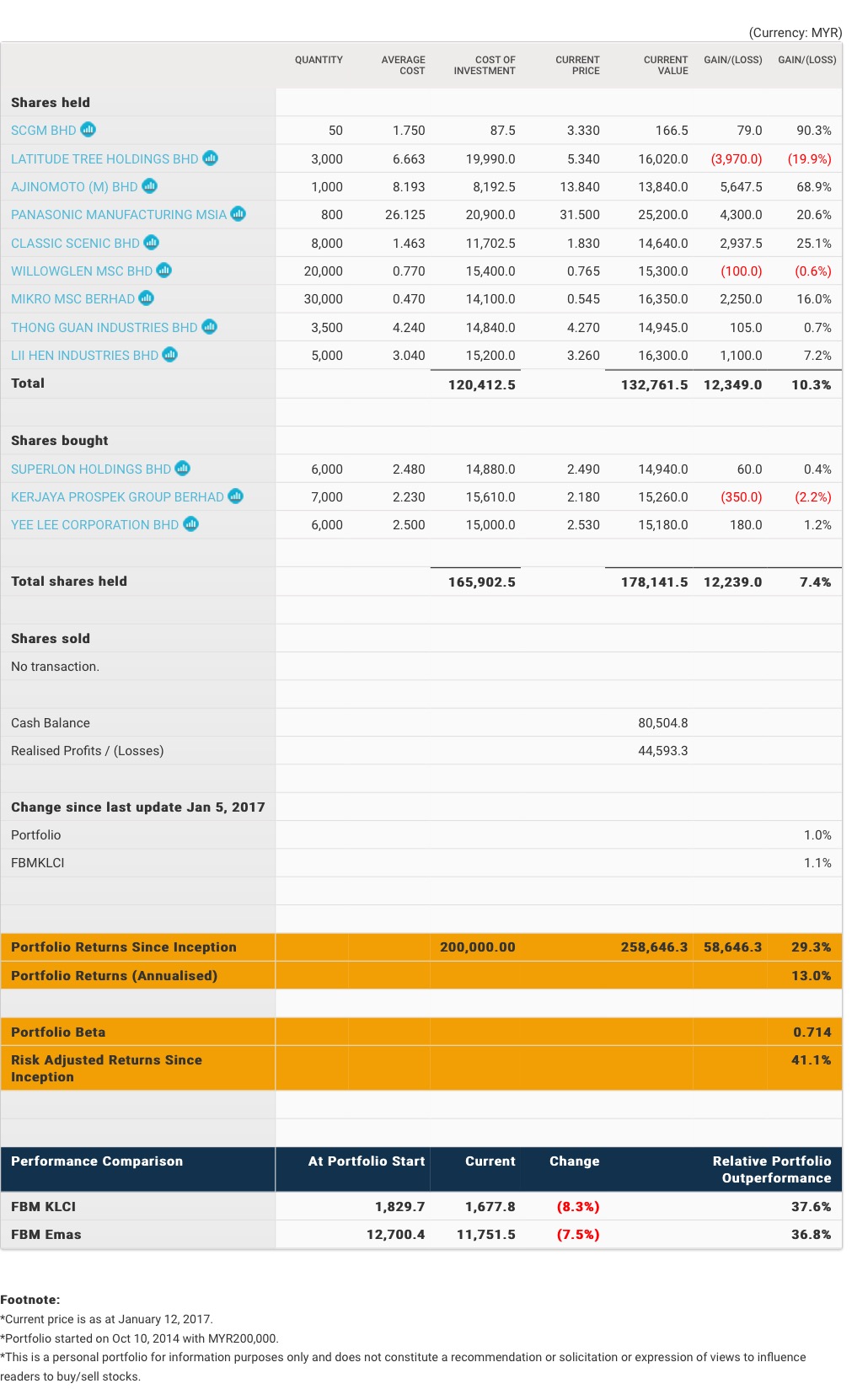

This week, I acquired shares in Superlon (Fundamental: 3/3; Valuation: 2.1/3), Kerjaya (Fundamental: 2.6/3; Valuation: 1.8/3) and Yee Lee (Fundamental: 1.4/3; Valuation: 2/3) for a combined RM45,490.

All three stocks are part of the InsiderAsia Portfolios, which are published on www.absolutelystocks.com.

With these purchases, my portfolio is now 69% invested.

My total portfolio returns stand at 29.3% since inception. I continue to outperform the FBM KLCI, which is down 8.3% over the same period, by some distance.

Source: The Edge