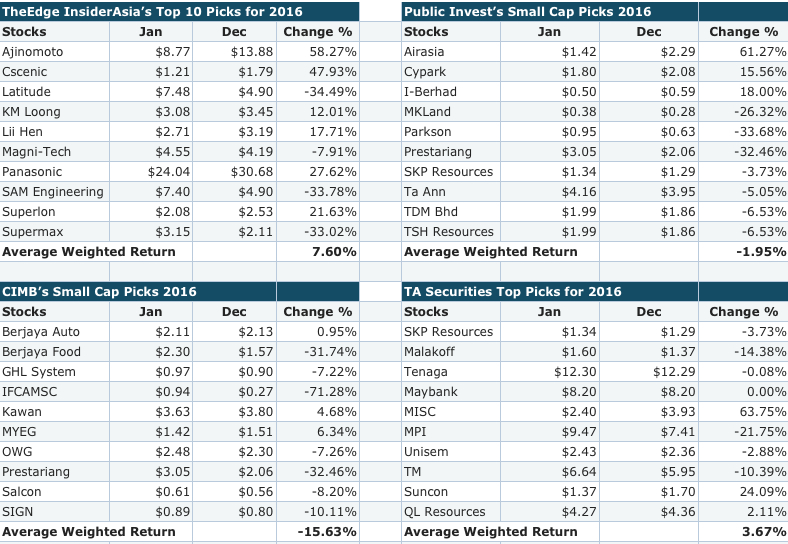

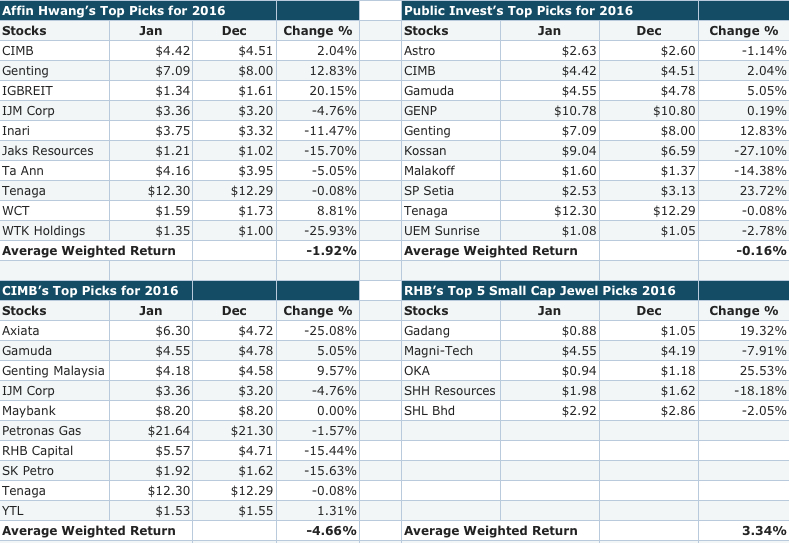

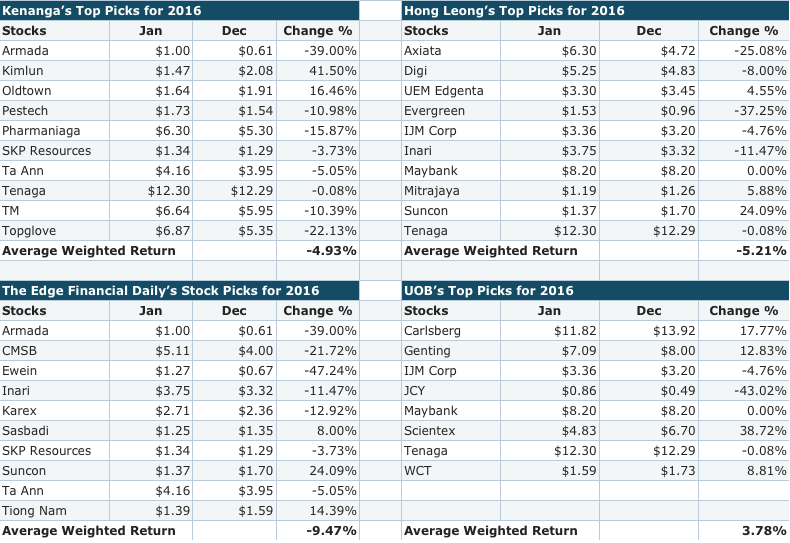

Heading into 2017, we are all eager to find out what are the potential winnings stocks and generally, fund managers’ top picks is a starting point for most investors. But before we look forward, let’s look backward. There’s much more things to learn looking backwards. Below are some of the top picks from research house, newspaper publications and their stock performance.

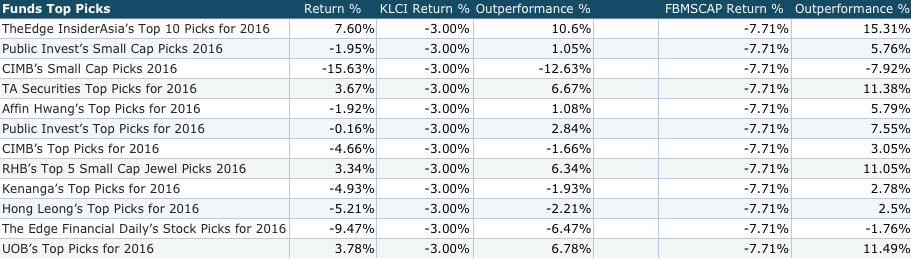

Out of the 12 lists of top picks, 4 managed to have a positive return this year. Make no mistake, it is a tough year, KLCI is down 3% this year and FBMSCAP is even worse, capping -7.71%. Out of the 80 top picks stocks, 34 had positive returns compare to 46 that register negative return. Overall return sits at -2.20%. Below is how they had performed against the benchmark. Against KLCI performance, only 1 list managed to outperform the index by 10%, and 4 out of 12 when compared against FBMSCAP or Small Cap Index.

Now this is not a question if they had done a good job this year but more of a question if these research houses are finding it hard to pick the right stocks that are considered defensive, growth or strong potential, what is the validity of having a list of top picks every year? And this rightly goes into the mentality of most investors that cycle through stocks every year. How did the construction theme perform this year? Pretty decent with average of 5.24%, but probably below what most investors would expected, considering it is the theme of the year.

The lesson here is Picks of the year doesn’t guarantee winners. It is better to sticks to your own strategy and stocks you understand well. And the fund managers’ failure to dramatically outperform the index isn’t because they are incompetent, it just means anything can happen in a year. But the most important thing is you don’t need to have an informational (insider information) or analytical edge to pick winners. There are another edge that is free to you - investment horizon.

I have no doubt given all the top picks in these lists, the odds that their return will improve increases once you expand your horizon from a year into 3, 5, 10 years. And if you do that to the stocks you are familiar with, you will do even better! Thinking long term, beyond 5, 10 years is a rarity in investing, which also makes it an extremely powerful edge if you can will it. Expanding your investment horizon starts from restricting rubbish stocks into your portfolio and using tools like decision tree or checklist is a good place to start. When you expand your horizon, you will unlock another edge - psychological. You can read more here.

If you find this helpful please share it and subscribe to our list http://eepurl.com/b93qbH

All the best for 2017. May the force be with you.

http://tradingandpsychology.blogspot.my/2017/01/on-validity-of-top-picks-of-year-2016.html