● The country's economic backdrop provides a conducive environment for

the banking sector. However, the main concern that is overshadowing the

promising economic growth prospects

for Malaysia is the recent currency weakness.

● The RM has weakened 5% against the USD since the US presidential election, and restrictions imposed by the central bank on offshore trading of the RM has fuelled concerns over the risk of further weakness. Should the currency sell-off continue, the key direct risk to the banking system would be (1) tighter liquidity, and (2) risk of bond market collapse.

● Key threats to earnings outlook includes: (1) Net Interest Margins (NIMs) could face increasing funding cost pressure, (2) deterioration in asset quality, (3) pressure on non-interest income (NOII) from bond market sell-off and curbs on currency transactions.

● We have UNDERPERFORM ratings on Maybank and Public, which appear overvalued. Our top idea is CIMB as the turnaround of its Indonesia operations could be an earnings growth driver, and

it trades at >30% discount to its local peers.

for Malaysia is the recent currency weakness.

● The RM has weakened 5% against the USD since the US presidential election, and restrictions imposed by the central bank on offshore trading of the RM has fuelled concerns over the risk of further weakness. Should the currency sell-off continue, the key direct risk to the banking system would be (1) tighter liquidity, and (2) risk of bond market collapse.

● Key threats to earnings outlook includes: (1) Net Interest Margins (NIMs) could face increasing funding cost pressure, (2) deterioration in asset quality, (3) pressure on non-interest income (NOII) from bond market sell-off and curbs on currency transactions.

● We have UNDERPERFORM ratings on Maybank and Public, which appear overvalued. Our top idea is CIMB as the turnaround of its Indonesia operations could be an earnings growth driver, and

it trades at >30% discount to its local peers.

Malaysia bank Valuation:

Resilient economic growth overshadowed by currency concerns

The country's economic backdrop provides a conducive environment for

the banking sector. Malaysia's GDP growth has been resilient and even

exceeded expectations in the latest 3Q16 release where growth was 4.3%

YoY versus consensus expectations of 4%. Private consumption, net

exports and current account (RM6 bn vs consensus estimate of RM2 bn)

exceeded expectations. CS is still forecasting a pick-up in GDP growth

to 4.5% in 2017 (vs the consensus estimate of 4.2%) from a forecast of

4.1% in 2016. GDP growth is expected to be supported by: (1) boost to

private consumption and investments arising from the lagged effect of

stabilising commodity prices, in particular palm oil; (2) increased

consumer spending power arising from the 25 bp interest rate cut; (3)

pick-up in infrastructure spending that is fuelled by a combination of

an increase in spending by the government and government-linked entities

as well as the implementation of Chinese-sponsored mega projects.

However, the main concern that is overshadowing the promising economic growth prospects for Malaysia is the recent currency weakness. The RM has weakened 5% against the USD since the US presidential election, and restrictions imposed by the central bank on offshore trading of the RM has fuelled concerns over the risk of further weakness. The USD/RM exchange rate of 4.4862 is now close to the weakest post-AFC level of 4.457 in September 2015 but still stronger than the AFC low of 4.71

However, the main concern that is overshadowing the promising economic growth prospects for Malaysia is the recent currency weakness. The RM has weakened 5% against the USD since the US presidential election, and restrictions imposed by the central bank on offshore trading of the RM has fuelled concerns over the risk of further weakness. The USD/RM exchange rate of 4.4862 is now close to the weakest post-AFC level of 4.457 in September 2015 but still stronger than the AFC low of 4.71

Key threats to earnings outlook

NIMs could face increasing funding cost pressure. On the monetary policy front, we see limited scope for local authorities to further lower interest rates. Meanwhile, we also believe it is unlikely

that authorities will hike rates as well, given the high household debt and economic vulnerability should the US change its foreign policy. As such, we believe there is limited scope for upside to loan yields.

NIMs could face increasing funding cost pressure. On the monetary policy front, we see limited scope for local authorities to further lower interest rates. Meanwhile, we also believe it is unlikely

that authorities will hike rates as well, given the high household debt and economic vulnerability should the US change its foreign policy. As such, we believe there is limited scope for upside to loan yields.

Meanwhile, the currency weakness could fuel competition for deposits and

translate into higher funding cost. As such, we believe there could be

some NIM pressure for the banks in 2017.

Asset quality—expect modest rise in default rates.

Banks still expect weakness in oil and gas exposures in coming quarters.

While less of a concern, other areas of risk that are being closely

monitored are unsecured personal loans, credit cards and loans to

investment holding companies. Asset quality for the bulk of household

debt (namely car loans and housing loans) has been resilient and is

expected to remain intact. In anticipation of higher default rates and

given the more challenging prospects for bad debt recoveries, we expect

credit cost to trend upwards in 2017. Only CIMB, which has already

suffered from huge spikes in credit cost in Indonesia and Thailand in

recent years, could experience an improvement in credit cost as asset

quality stabilises in its offshore ASEAN operations.

However, should banks surprise the market by showing improvement in asset quality (like Maybank and Alliance in 3Q16), then concerns over asset quality could gradually subside and credit cost assumptions would need to be reviewed.

NOII—pressure from bond market sell-off and curbs on currency transactions. Non-interest income (“NOII”) of the banks could face pressure from downside risk to investment and trading income arising from bond market sell-down. Foreign ownership of MGS remains high at 48%. In the past month, the ten-year MGS yield spiked from 3.62% to 4.22% (vs the post GFC high of 4.45% in August 2015 at the height of concerns over 1MDB). Should foreign investors decide to exit their positions, there could be further downside risk to MGS that would put pressure on borrowing cost in the debt capital markets and lead to some losses on the bond portfolio of banks. However, the regulatory pressure on exporters to convert a substantial portion of inflows in RM could help to generate more forex-related fees for the banks.

Investment strategy

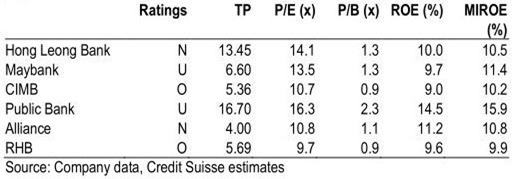

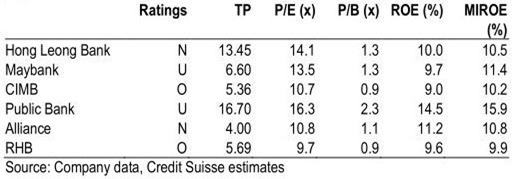

We maintain our UNDERPERFORM ratings on Maybank and Public, which we believe are overvalued. Our top long idea is CIMB. We believe the turnaround of its Indonesia operations could be an earnings growth driver, while its domestic asset quality seems comparatively more robust than other GLC peers. Our TP offers 12% upside. Trades on 0.9x P/B (vs the local peer average of 1.4x) and 2016 P/E of 10x (vs the peer average of 13.3x). Foreign ownership in CIMB is also well below historic levels and at a ten-year low.

We maintain our UNDERPERFORM ratings on Maybank and Public, which we believe are overvalued. Our top long idea is CIMB. We believe the turnaround of its Indonesia operations could be an earnings growth driver, while its domestic asset quality seems comparatively more robust than other GLC peers. Our TP offers 12% upside. Trades on 0.9x P/B (vs the local peer average of 1.4x) and 2016 P/E of 10x (vs the peer average of 13.3x). Foreign ownership in CIMB is also well below historic levels and at a ten-year low.

source: Credit Suisse 9/1/2107