VIS (0120) - (Tradeview 2016) Best Value Pick of The Year 2016 : Visdynamics Holdings Bhd. (Update)

Dear fellow readers,

Once

again, these writings are just my humble highlights (not

recommendation), feel free to have some intellectual discourse on this.

You can reach me at :

Telegram channel : https://telegram.me/tradeview101

Blog : http://tradeview101.blogspot.my/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

_____________________________________________________________________________

Best Value Pick of the Year 2016: Visdynamics Holdings Bhd (Updated TP of RM0.35 sens)

Telegram channel : https://telegram.me/tradeview101

Blog : http://tradeview101.blogspot.my/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

_____________________________________________________________________________

Best Value Pick of the Year 2016: Visdynamics Holdings Bhd (Updated TP of RM0.35 sens)

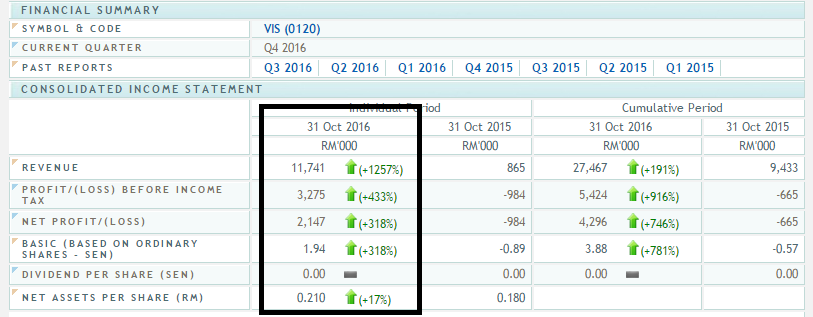

Vis

released their QR yesterday and registered an amazing 318% increase

YoY. Even QoQ, Vis registered a great 9% increase. The share price

immediately jumped 10% in morning trading session. The revenue grew from

RM865k to RM11.7 million (record high) YoY and net profit increased

from a loss of RM987k to RM2.1 million. For the immediate preceding quarter, the profit increased from the earlier record high 1.78 EPS to 1.94 EPS. NTA increased to 0.21 sens.

It

was a great turnaround from the start of the year and finally they

manage to end it with a bang with a record high performance. There is

increase in both topline and bottomline.

Most

importantly, I was factoring in the inconsistency of the semicon

industry yet it defied the odds and went ahead to outdo its earlier

record quarter. I am very pleased with the ability of the management to

translate growth into actual earnings unlike the earlier quarters.

From

the chart above, Vis earnings has been volatile and inconsistent.

However, this time, the company cap off the full 4Q with amazing

performance and record performance with a healthy profit margin. I think

the chart speaks for itself. This is a clear case of turnaround.

Considering the record performance, the management maintains their optimism for the the future prospect. This is another plus point.

Based

on the results of the latest QR and the management's comments, I

believe Visdynamics future prospect is bright. Altough many would argued

that Vis should be worth 38 sens based on the trailing 4Q EPS at 10x

multiple valuation, I think this view is simplistic. Having said that,

it is not farfetch.

Additionally, for a penny counter

10-12x PE is indeed quite a low, specifically a tech / semicon stock

where peers are usually 15x multiples. Nonetheless, my style of

investment is prudent. I would like to apply a discount at only attach

9x PE for the counter deriving a fair value of 35 sens. Those who are

bullish can maintain thier higher TP but the reason I am being

conservative is because of the overall economy.

To enjoy more picks like Visdynamics, feel free to join Tradeview group at:

My telegram channel : https://telegram.me/tradeview101

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

http://tradeview101.blogspot.my/2016/12/tradeview-2016-best-value-pick-of-year.html