TGUAN (7034) - (Icon) Thong Guan (8) - Yes, It Is a Buy

1. Horrible June Results

It has been a long time since I last kept track of Thong Guan. I sold the stock before June 2016 results, below RM4.00. Yesterday I took a look at the quarterly report and have a big shock - the result was horrible.

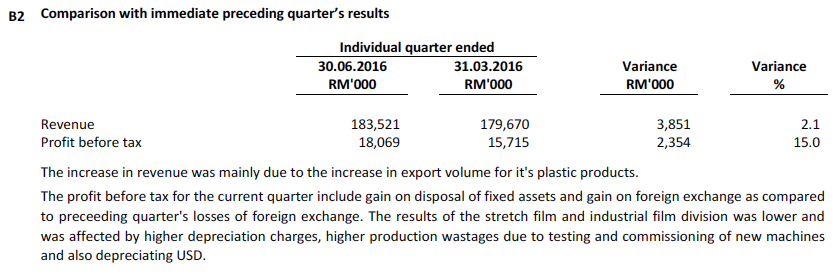

On the surface, the group reported a fantastic set of result with net profit of RM14.6 mil. However, there were exceptional items amounted to RM4.1 mil. Excluding those items, core earning was only RM11.2 mil. This level of profitability is disconcerting. Thong Guan shareholders are used to core earning of approximately RM15 mil per quarter. Anything lower than that will not be well received.

Fortunately, management provided explanation in the quarterly report - the lower than expected profitability was mainly due to two major factors :-

(i) wastage due to testing and commissioning of new machines; and

(ii) depreciating USD.

I don't really have much to say about the first factor. Let's just hope that they have fully resolved the issue and none of that will show up again in the coming quarter result.

As for the forex effect, I agree that the Group should have taken a hit.

If you refer to the table above, in June 2016 quarter, average USD was only 4.006, 4.6% lower than previous quarter's 4.189. Apply this to revenue of USD45.8 mil would have resulted in differential of RM2.1 mil.

Another potential factor that management didn't mention but I picked up from quarterly report is that tax rate was higher at 17%, compared to 12% in previous quarter. Based on PBT of RM18.1 mil, 5% will translate into differential of RM0.9 mil.

If you want me to guess, I will say that the earning differential of RM4.4 mil (being the difference between RM15.6 mil and RM11.2 mil) could be due to a combination of the following :-

(a) RM1.74 mil net curreny effect (being RM2.1 mil x 0.83 pursuant to effective tax rate of 17%);

(b) RM0.9 mil additional tax; and

(c) the remaining RM1.76 mil due to wastage related to commissioning of new production line.

2. Coming Quarter Result

Thong Guan will release its September quarter result in the next one to two weeks. Our forum member YiStock has an interesting prediction of RM20 mil net profit.

http://klse.i3investor.com/blogs/thongguan/106177.jsp

The mathematical model he used was very complicated and I couldn't really understand it. So I can't really say whether his prediction makes sense of not. However, I like the article very much as it is very innovative and amusing. Great job, YiStock !!!

As for me, I guess that the coming quarter earning will be somewhere between March and June 2016 quarter. By taking the simple average of RM15.6 mil and RM11.2 mil, I arrive at core earning of RM13.4 mil (EPS of 8.5 sen).

This is not simply plucked from the air. It is based on assumption that the wastage is no more there (saving them RM1.76 mil) and takes into consideration that September quarter's average USD of 4.051 is more or less the same as June quarter's 4.006 (hence the currency drag effect of approximately RM1.7 mil is probably still in place).

Let's just wait and see how close my guesstimate is to the actual figure.

3. Why Still A Buy ?

So far, I have nailed down two points. Firstly, June 2016 quarter's earning was lousy at RM11.2 mil. Secondly, even though coming quarter's predicted earning of RM13.4 mil is an improvement, it is still uninspiring. If that is the case, why am I still calling for a Buy ?

That is because those information (including the coming quarter result) represents the past, and we should be acting based on the future.

Let's not forget in the first place the reason why I write this article and the reason you are reading it - it is the prospect of strong USD that motivated us to do so.

As mentioned in my 16 November 2016 article, USD is expected to be strong in the foreseeable future. To benefit from that, we need to look beyond this coming quarter and position ourselves accordingly.

As mentioned earlier, average USD for September 2016 quarter was 4.051. However, it has now gone up to 4.415. One CIMB analyst predicts 4.80 by 2017. Nobody knows whether 4.80, if it ever materliase, will be long lasting. However, the likelihood is that USD will be trading at elevated level in 2017.

This provides fertile ground for earning upgrade and re-rating. Buying Thong Guan now is to prepare yourself for that opporunity. Nobody can assure you that it will work out as planned, but the reward vs. risk is favorable.

4. Growth Story Intact

Currency is not the only reason I am comfortable with Thong Guan. Before I write this article, I went through various articles written by our own forum members (YiStock, Harryt30, etc) and various newspaper articles. Those articles provide me with a wealth of information. The picture that emerges for Thong Guan is not stagnation, it is a group still growing, with a stated objective of reaching RM1 billion market cap ultimately (based on 158 m shares, share price of RM6.33).

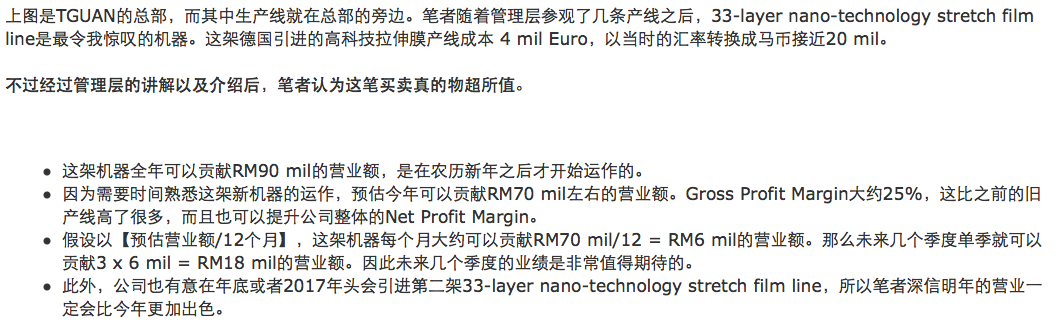

(a) 33 Layer Nano Tech Stretch Firm Lines

The following is extracted from Harryt30's 10 August 2016 article :-

(Source : http://klse.i3investor.com/blogs/kianweiaritcles/101826.jsp)

Key points :-

(a) The new Nano Tech line could potentially generate RM90 mil revenue per annum. It started production in Q2 2016 (Icon8888 note : this could be the line that caused the wastage).

(b) The company plans to install second production line in 2017.

(c) Higher profit margin than existing products.

I did a quick analysis to try to make sense of the above information. In the past 12 months, Thong Guan generated revenue of RM741 mil. The 2 Nano Tech lines will increase revenue by RM180 mil, representing increase of 24%. Harryt30 has mentioned that the profit margin will be higher. As such, net profit will be growing at faster pace than 24%.

Well done, young man Harryt30.

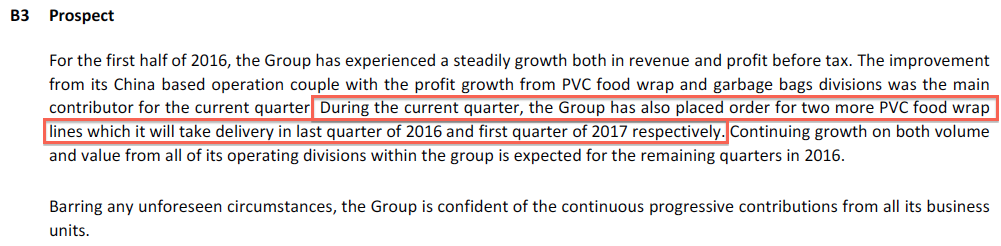

(b) PVC Food Wrap Lines

According to June 2016 quarterly report, the company has placed order for 2 more PVC food wrap lines to be delivered by end 2016 and early 2017 respectively.

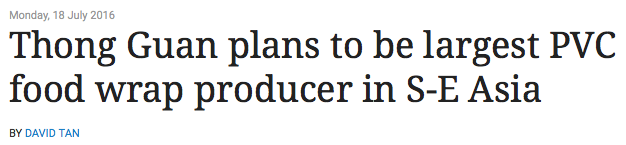

In my opinion, what was mentioned above only covered new production lines that "had been ordered". There should be more to come. In an earlier interview with The Star on 18 July 2016, Thong Guan's Group MD mentioned that between 2016 and 2017, they will add 4 new production lines for PVC food wrap.

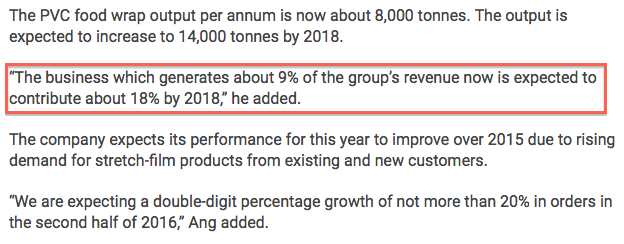

In the same article, the Group MD mentioned that with the additional four lines, PVC food wrap's contribution to revenue will increase from the current 9% to 18% by 2018.

What is the impact on bottomline ? Let's run some numbers. Thong Guan registered net profit of RM54.5 mil in past 12 months. PVC food wrap is a high margin product. However, let's be conservative and assume that its profit contribution is same as its revenue share. 9% of RM54.5 mil will be RM4.9 mil. Doubling it (accounting for 18% revenue) will add RM4.9 mil to bottom line.

(c) Others

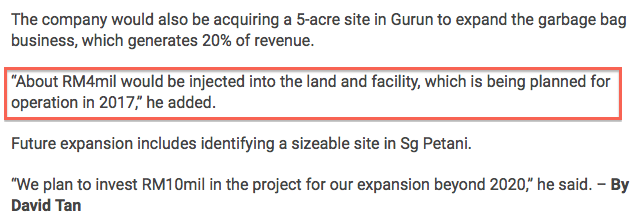

According to the same article (The Star), Thong Guan is also investing RM4 mil to expand its rubbish bag business.

On top of that, its food division is in discussion with China's COFCO to produce organic noodles. I am happy to see that happens. However, I am not really that bullish about its profit potential. Orginaic or not organic, noodle is still noodle, nobody makes big money out of it. But as a shareholder, I hope I am wrong. : )

Thong Guan is also in talks with Japanese companies to manufacture Barrier Film and other advanced products. However, it seemed that it will only materlialise in two to three years time.

Before I move on to the next section, let me just sum up what I have discussed so far. The two Nano Tech lines should add at least RM13 mil to net profit (being 24% x RM54.5 mil). The 4 PVC food wrap lines should add at least RM4.9 mil to net profit.

PROFIT ENHANCEMENT OF AT LEAST RM18 mil BY FY2018 ?

This is before factoring in any surplus earning from strengthening of USD.

5. Concluding Remarks

In the absence of a crisis, all stocks will be priced to almost perfection, there will be no arbitrage opportunity. If you want to make money, you need to be a little bit patient, willing to hold for at least 12 to 18 months.

In my opinion, Thong Guan has good prospect in the next one to two years.

First of all, the macro environment is favorable. USD is expected to be strong vs. the Ringgit and that will make Thong Guan's products very competitive.

Secondly, Thong Guan is still half way through its growth plan. The adding of new production lines will drive earning growth all the way to 2018.

Thirdly, Thong Guan has the resources to grow further. What we are witnessing now is still the Growth Plan kicked start in 2014 funded by rights issue.

In the past 12 months, following the devaluation of the Ringgit, the Group has enjoyed a bonanza. In March 2015, the Group has net cash of RM1 mil. Today, its net cash stands at RM100 mil. With the resources in hand, it is in a position to start planning for the next phase of growth.

This is aided by the fact that it has got the right strategy in place - invests in new machineries and technology to migrate to higher margin products. The group has learned a lot in the past two years on how to do it. Now is the time to go even further. We have already seen the early signs of this happening - the Group is in talks with Japanese companies to explore Barrier Film production. This is something new and not in the original 2014 growth plan.

It seemed that Thong Guan is now swimming in blue ocean. There are plenty of opportunities.

TGUAN (7034) - (Icon) Thong Guan (8) - Yes, It Is a Buy

http://klse.i3investor.com/blogs/icon8888/109289.jsp