HEVEA (5095) - (Icon) Hevea (2) - The Poster Boy of Export Play

1. Introduction

Hevea is a dynamic stock. When things are going its way, it can really shine. Between 2014 and 2015, boosted by strong USD, its share price went up by more than 300%.

Recently, several people have written about the stock. However, I will still like to do a proper analysis of its past few quarters' results. That will allow us to have a better feel of where we stand in terms of valuation.

2. Historical Profitability

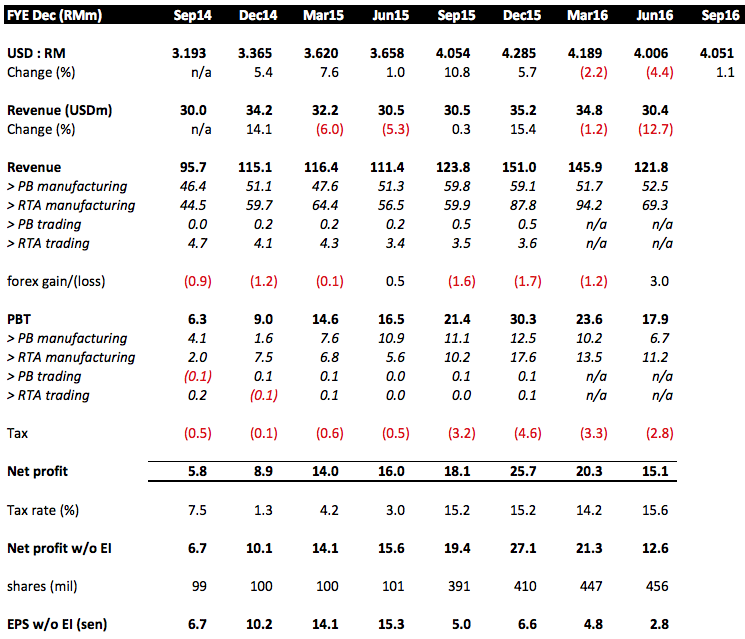

Note : PB = Particleboard, RTA = Ready to assemble furniture

The table is self explanatory. I don't really have much to comment.

As we all know, the group's June 2016 EPS was dragged down by line shutdown for maintenance. If you ask me to make a prediction for coming quarter result, I will nominate September 2015 quarter as the best proxy.

During that quarter, USD was 4.054, similar to September 2016 quarter's 4.051. Hevea reported core earning of RM19.4 mil in that quarter. Based on 456 mil shares, EPS works out to be 4.3 sen.

The company will be releasing its result in next one to two weeks. We will soon find out whether it meets our expectation.

Beyond the September quarter, all eyes are on the USD : RM exchange rate. If USD stays strong for extended period of time, Hevea will become a cash machine. With little debt, limited capex requirement and healthy operating cash flow, it will be in position to pay out strong dividend to reward its shareholders.

Interesting time ahead.

HEVEA (5095) - (Icon) Hevea (2) - The Poster Boy of Export Play

http://klse.i3investor.com/blogs/icon8888/109275.jsp