UNDERVALUED & FRONTRUNNER CSCSteel : Target Record High EPS On The Coming Quarter

Recently, shares on the steel counter have increase drastically and caught attention of many investors (Wealtwizard, moneysifu, smartrader2020, probabilty, KYY and OTB) The uptrend is just beginning due to reason as per below:

1)Global steel price rebound from the lowest

2)China’s decision to cut excess capacity by 45 million tones in Junes

http://themalaysianreserve.com/new/story/steel-prices-rise-over-10-china-cuts

3)Good outlook from Kenanga, MIDF, RHB and Thestar on end of 2016 and 2017 upward

http://www.theedgemarkets.com/my/article/misif-sees-recovery-year-better-outlook-2017-iron-and-steel-industy

http://www.thestar.com.my/business/business-news/2016/10/13/steel-sector-must-consolidate-says-ahmad-maslan/

http://klse.i3investor.com/blogs/kenangaresearch/105929.jsp

Although there are difference steel sector, what I would like to emphasize is CRC players. The major 4 CRC players CSCsteel, Mycron, YKGI and Eonmetal have risen to new high and the momentum uptrend will be continue as they going to announce the coming quarter result on November.

CSCsteel is the frontrunner which huge pile of cash flow, largest producer CRC and highest dividen yield. I have done a quick analysis on the coming quarter CcsSteel end 30/9/2015.

More upside potential for CSCSteel due to reason as per below:

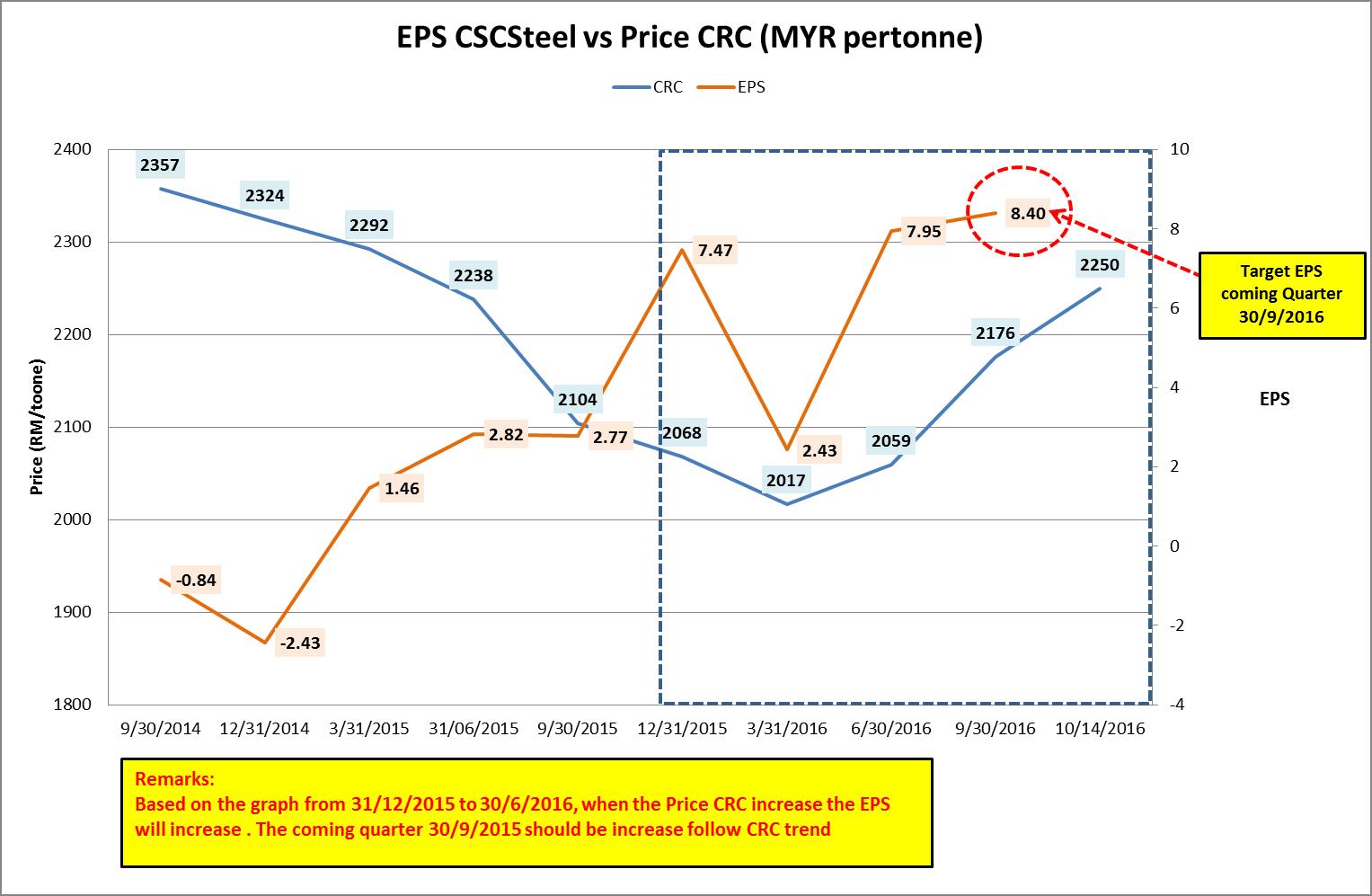

1)My target EPS for coming quarter (30/09/2016) is more than 8 (around 8.40) which increase 200% compare with previous quarter (30/09/2015) which is 2.77

When the price of CRC (31/12/2015) is 2068 and (30/06/2016) is 2059, the EPS is 7.47 and 7.95 respectively. The price CRC (30/9/2016) which higher at 2176 by logically will record EPS above than 8.

a)Table EPS versus CRC price (MYR/Tonne)

|

Quarter

|

CRC price (MYR/Tonne)

|

EPS

|

Remarks

|

|

30/09/2014

|

2357

|

-0.84

|

|

|

31/12/2014

|

2324

|

-2.43

|

|

|

31/03/2015

|

2292

|

1.46

|

|

|

31/06/2015

|

2238

|

2.82

|

|

|

30/09/2015

|

2104

|

2.77

|

|

|

31/12/2015

|

2068

|

7.47

|

|

|

31/03/2016

|

2017

|

2.43

|

EPS drop as CRC price drop to lowest

|

|

30/06/2016

|

2059

|

7.95

|

EPS rise due to CRC price rebound from 2017 to 2059 and Megasteel halted production and supply in Feb 2016

|

|

30/09/2016

|

2176

|

8.40 (ESTIMATION)

|

Estimation coming quarter > 8 due to increase 5.7%

of CRC price from 30/6 to 30/9, antidumping start on 24 May 2016 to 23

May 2021, closure of Megasteel and bigger spread of CRC and HRC price

|

|

31/12/2016

|

Need to monitor

|

Will update on 31/12/2016

|

|

2)By combine the estimation coming quarter EPS, the annualized EPS will be 26.25. Taking a very conservative PE 10 as a steel frontrunner, it will generate the FIRST TP RM2.60

3)Megasteel halted production and supply in February 2016 and The management's decision to fully shut down its RM3.2bil plant effective from Aug 30 until further notice. That mean, CRC player will save RM400 premium as they can source cheaper HRC raw material from China http://www.thestar.com.my/business/business-news/2016/09/10/megasteel-closes-banting-plant/

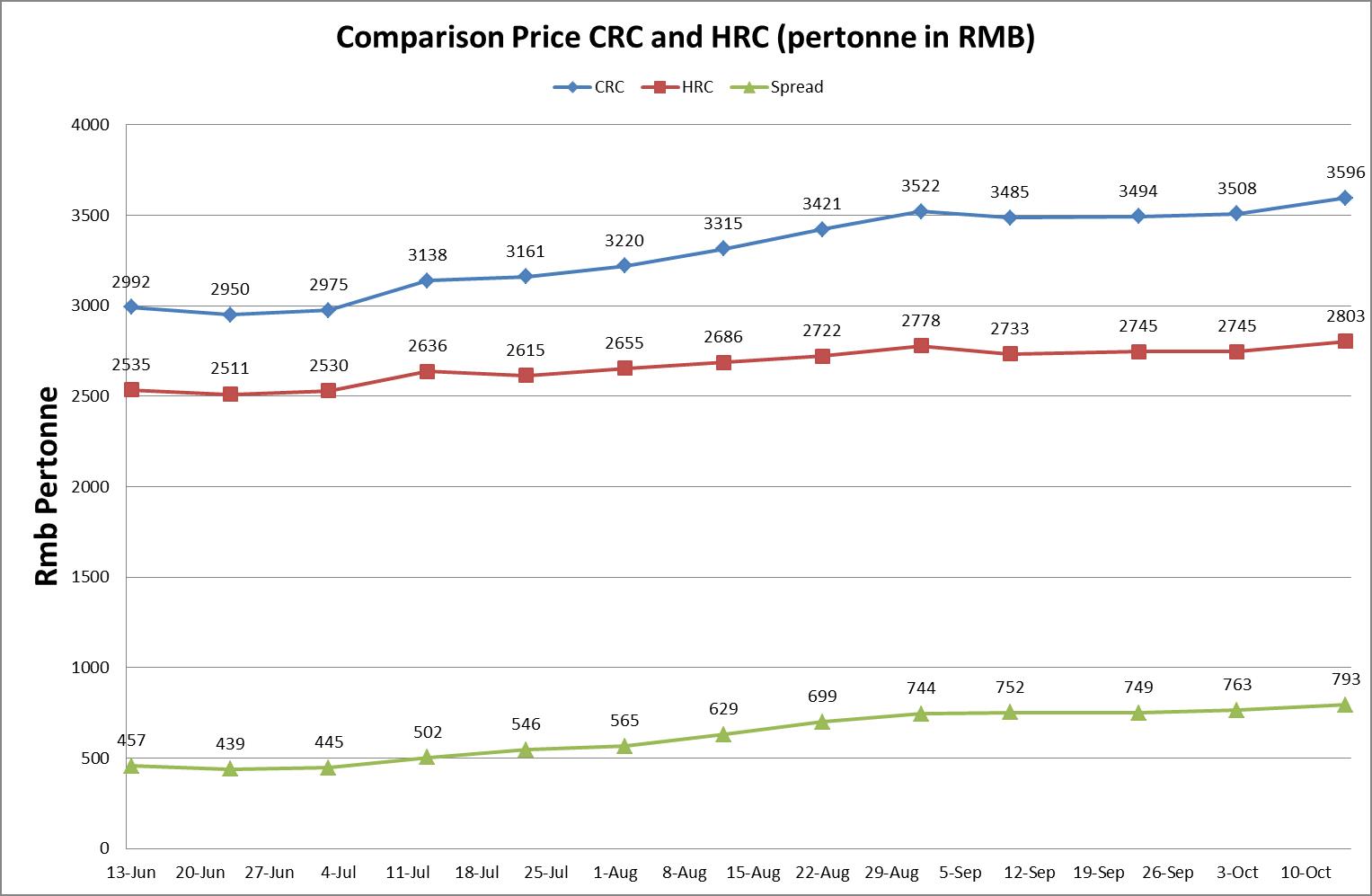

4)The spread CRC and HRC increase from 457rmb (13 Jun 2016) to 793rmb (14 Oct 2016) by 74%. The bigger spread the more profit as CRC player can use lower material price HRC to convert to higher price of CRC.

5)Believe now the cscsteel in wave 3 according to major 5 wave theory

Remarks : Technical Chart for Kenanga R1 (2.10) and R2 (2.25)

Thank you and happy invest

http://klse.i3investor.com/blogs/5094CSC/106446.jsp