By Billy Toh / The Edge Financial Daily | September 27, 2016 : 8:37 AM MYT

This article first appeared in The Edge Financial Daily, on September 27, 2016.

However, some analysts feel that the momentum could be short-lived as they are not convinced that the recovery in steel prices is sustainable.

The head of research at a local fund house said the steel price hike is likely to be temporary and has more to do with sentimental play than a change in its fundamentals.

“The steel prices have been going up, but is that sustainable amid the lack of economic growth globally and low oil prices,” he asked. “These protection measures proposed by the government do not guarantee the survival of the steel players. While some of these measures could help, it’s going to be temporary.”

The research head added that the mass rapid transit (MRT) projects will not be enough to spur the steel market, pointing out that MRT Line 1 has not been able to boost the sector.

“A lot of these recent hikes are due to sentiment play. Steel is a very cyclical sector and I don’t think any of that has changed,” he said.

Mercury Securities head of research Edmund Tham also thinks that the protection measures proposed by the government will not be beneficial to all parties.

“The fact that so many of the steel counters move, I think they don’t know what they are doing,” said Tham. “It’s not so straightforward that all these steel players will benefit from the safeguard measures proposed. I don’t see any sustainable movement at the moment.”

Inter-Pacific Securities Sdn Bhd head of research Pong Teng Siew said the increase in steel prices is mainly due to China’s move to cut its steel production capacity, but there is no certainty that this will last.

Pong noted that the construction projects in the country have not been able to help the steel players until China cuts its production. “We realise that steel prices have rebounded, but we are not very certain how long it will last,” he said.

Benny Lee, chief market strategist at Jupiter Securities, however, feels that steel players might benefit from the good growth in the construction sector as well as the weaker ringgit. He said steel prices could be sustainable in the next few quarters.

Lum Joe Shen of Kenanga Research has issued a report on Ann Joo Resources Bhd, switching the valuation to “outperform” with a higher target price of RM2.24. He said the research house is positive on the steel sector as steel prices are expected to remain stable despite the prolonged overcapacity issue in China.

Lum said China’s depleting steel inventory indicates rising domestic demand, closure of loss-making steel mills in the country, and Beijing’s strong commitment in reducing steel production capacity through consolidation of steel groups coupled with financial support of 100 billion yuan (RM61.9 billion) for worker retrenchment schemes.

Lum is also positive of the provisional safeguard measures issued by Putrajaya, saying it would boost Ann Joo’s steel rebars.

Looking at the technical indicators, the rise in the share prices of steel players has also been overdone. Malacca Securities Sdn Bhd technical analyst Loui Low shared that profit-taking activity is likely to be coming in the next couple of days, citing that the chart is a bit “overheated”, indicating an overbought signal.

“For me, I’ll look at the nine-day EMA (exponential moving average) line as the first defence. Once it drops below that line, you should take profit,” he said.

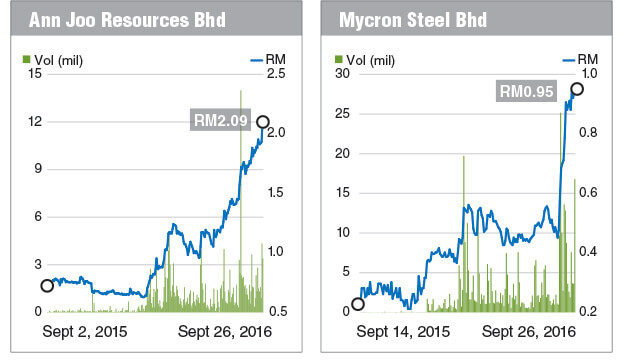

Most steel counters have risen sharply in the last three months, with Mycron Steel Bhd up by 123.53%, Ann Joo by 95.33%, YKGI Holdings Bhd by 95%, Malaysia Steel Works (KL) Bhd by 94.17%, Melewar Industrial Group Bhd by 86.15% and CSC Steel Holdings Bhd by 50.74%.

http://www.theedgemarkets.com/en/article/steel-players%E2%80%99-momentum-could-be-short-lived