DUFU (7233) - Dufu: Technology leader of micro precision components

Company Background

- An advanced one-stop manufacturing facility offering superior quality manufacturing, engineering capabilities and services. With talented and skilled resources, they are able to deliver from conceptual to physical realities of various product ranges that require basic machining to close tolerance products. Their services also include finished components, modular or sub-modular fabrications and assemblies.

-

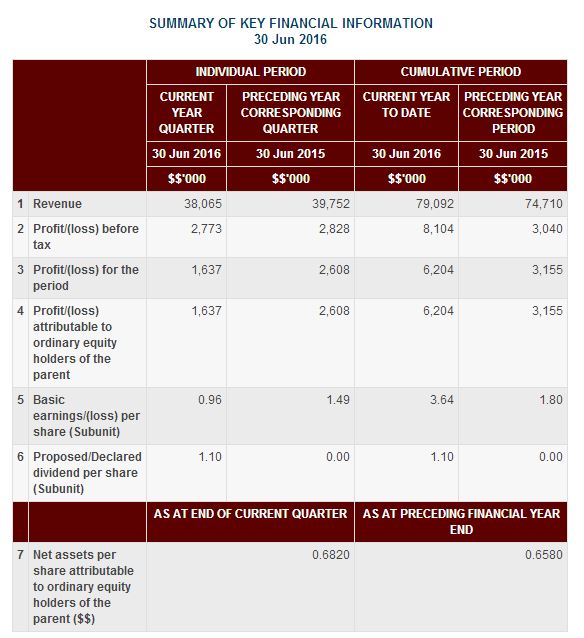

The company has shown a strong earnings credibility despite

its smaller size compared with JCY. Dufu still managed to record decent

core earnings growth of 9.5% after excluding one-off item in 1H16.

-

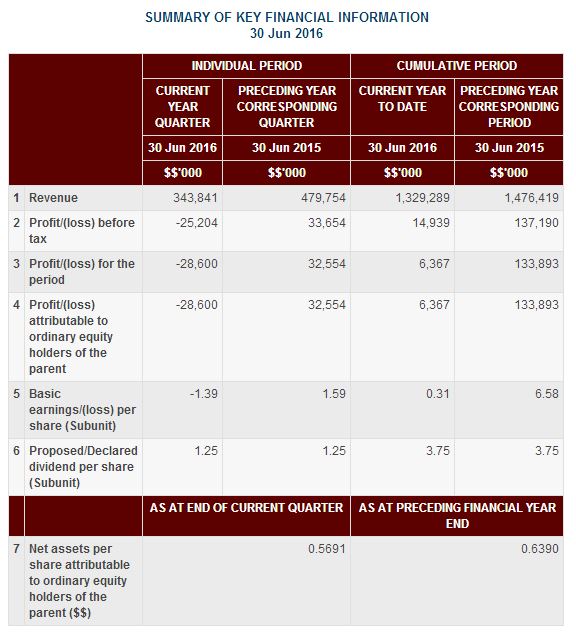

Meanwhile

JCY's 9M16 core earnings of RM19.6m (after add back write-off item)

shrank 85%, and in fact it has posted losses in 3Q16 alone.

-

Yet,

Dufu has been underappreciatedly trading below its book value of 68sen.

As at market price of 63.5sen, its price-to-book is only at 0.93x. On the other hand, JCY has been trading slightly higher at 0.96x to its price-to-book value of 57sen.

-

FY16

PE wise, Dufu has been trading at 15x based on its annualised FY16 core

earnings of RM6.91m or EPS of 4sen while JCY has been wildly trading at

42x based on its annualised FY16 core earnings.

-

As a conclusion, Dufu deserves more credit to trade higher. By pegging to conservative PE of 20x, Dufu's fundamental value is arrived at 80sen.

-

20x? It is a normal to technoloy sector. It can go even higher to 30x.

Source: Bursa Malaysia

JCY's financial statement

Source: Bursa Malaysia

All The Way Bullish

-

Longer-term

view, Dufu's share price has been on uptrend since last year. The

positive momentum in the stock is in line with its stronger earnings

path

-

It is now heading to recent high of 70sen.

-

Volume has been built up well and not yet reach peak level.

-

Should the stock close trading above 70 sen, there is higher chances that stock may meet fundamental value of 80sen.

-

Critical support remains at 60sen, immediate resistance stands at 67sen.

-

If it were to trade above 70sen, traders may want to target shor-term profit at 77sen instead.

Source: Bloomberg

DUFU (7233) - Dufu: Technology leader of micro precision components

http://klse.i3investor.com/blogs/discoverychannel/105127.jsp