近来经济风雨不测,很多保守性的投资者都把资金回流至定期存款 (Fixed Deposit)。无论如何,与通膨相比,银行定期的利率依然矮了一截,或许可以试试投资黄金?

定期存款最高的也只有 3% 出一点,因此我想要研究另一个领域,即黄金投资 Gold Investment 或者 Invest Gold。现在,大马主要有 4 家银行 (MAYBANK, PUBLIC BANK, CIMB, UOB ) 及科威特金融机构 (Kuwait Finance House) 进行买卖黄金。

我们无需用实际的“黄金”做买卖,只需在有关银行开个“黄金投资”的户口,拿一本像储蓄户口的存摺就可以了。买卖的记录都会记录在有关的存摺。现在让我们看看两家银行的买卖金价 (Buying and Selling Gold)

(a) Maybank

Maybank 买金 (Buying) 的价格是 RM 172.43

Maybank 卖金 (Selling) 的价格是 RM 179.97

相差是 RM 7.54

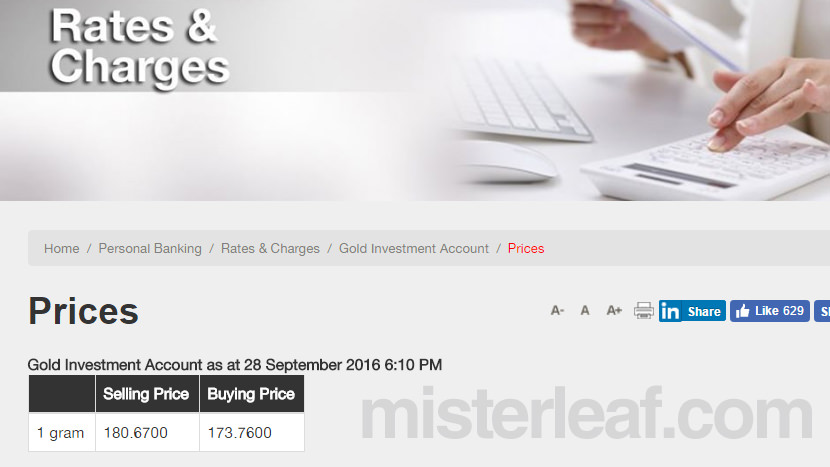

(b) Public Bank

Public Bank 买金 (Buying Price) 的价格是 RM 173.76

Public Bank 卖金 (Selling Price) 的价格是 RM 180.67

相差是 RM 6.91

疑问:什么是 Selling Price? 什么是Buying Price?

Selling 的意思是银行卖黄金给你的价钱,Buying就是银行跟你买黄金的价钱。比方说,你去Public Bank 买了 1 gram 的黄金,给了银行RM 180.67 。你转过身后,要卖掉黄金的时候,Public Bank 只会给回你 RM 173.76,当场你就损失了RM 6.91。所以,黄金算是中期性或长期性的投资,不像股票那样,一转身或一转眼就可以大赚一笔。

现在,我们来比较一下四家银行提供的黄金投资。

| Account | CIMB Bank | Maybank | Public Bank | UOB |

|---|---|---|---|---|

| Min Initial Deposit | 1 grams | 1 grams | 5 grams | 20 grams |

| Min Subsequent Transaction | 1 gram & multiple of 1 gram | in multiple of 1 gram | 1 grams & multiple of 1 gram | Multiple of 5 grams |

| Min Balance | 1 gram | 1 gram | 2 grams | 10 grams |

| Cash Withdrawal | Yes | Yes | Yes | Yes |

| Physical Gold withdrawal | Yes | No | Yes | Yes |

| Charge on Physical Withdrawal | based on the Bank’s prevailing gold BUYING price quoted in RM per gram | based on the Bank’s prevailing gold BUYING price quoted in RM per gram | based on the Bank’s prevailing gold BUYING price quoted in RM per gram | Differential between physical gold price and PGA/GSA price + processing fee |

| Annual Fees | RM5 if year end balance <10 grams="" td=""> | Unknown | RM10 if year end balance <10 grams="" td=""> | RM2 if month end balance <10 grams="" td=""> |

| Price Spread per gram* | ~ RM 5.60 (3.14%) | ~ RM7.57 (4.21%) | ~RM6.91 (3.82%) | ~ RM3 (1.69%) |

| Selling Buying Prices | CIMB | Maybank | Public Bank | UOB |

| Website | CIMB Bank Web | Maybank Website | Public Bank Web | UOB Website |