FLBHD (5197) - 富佳木材 RM 1.77 加码机会。

---个人估算FLBHD 2016财年EPS=16SEN,,PE=13,股价=RM2.08

而Q3和Q4可派共10 SEN股息,现RM1.77買入,DY(周息率)=5.6%,非常具吸引力

股市永远记得,当基本面小变下,就是机会了.

---于31-3-16年報中得知kyy于下列证行共有6931,000股:

ta(2334,200),kenanga(1750,800),ALLIANCE(1100,000),MAYBANK(781,000),

AFFIN(520,000),RHB(445,000),

KYY的 no of shares(7月)total of shares 是7,323,100.实际是增加392,100股,

仍然对公司看好,因此不用担心.

---30大股东共持有68325,717股(66.2%),总股数为103200,000股

---股票的買賣有時不能用基本面去计的,当事人有自己的因素,重要是公司健康就不怕了,

kyy 有很多,不用担心,当出售结束后,kyy 必定把股价拉回2元以上!

----正确机率多才能成功

所以,总括一句,我们只是平民散户,通过本身对投资的喜好和研究,

(努力)在股市中挣到不错 的回酬,

什么大师专家,受之有愧,不必对号入座。

不论我们做什么决定,都会诚实的面对结果。投资组合不是考试,不能每次要求一百分。

这三年多来,我们确然做了一些低级错误,不过也做了更多的正确决定,

什么大师专家,受之有愧,不必对号入座。

不论我们做什么决定,都会诚实的面对结果。投资组合不是考试,不能每次要求一百分。

这三年多来,我们确然做了一些低级错误,不过也做了更多的正确决定,

所以我们才能获得如此不差的成绩。

现实生活里,错和对总是交叉发生,每次都做对,不叫“成功”,那是“完美”,

现实生活里,错和对总是交叉发生,每次都做对,不叫“成功”,那是“完美”,

是每个人追求的境界(却不大可能达到)。

成功的投资者,只需要把正确的投资机率更多发生就是了。

取自于--http://klse.i3investor.com/blogs/golden_years/55570.jsp

---成功的投资者,只需要把正确的投资机率更多发生就是了。

取自于--http://klse.i3investor.com/blogs/golden_years/55570.jsp

有位朋友問馬雲:

我怎麼樣才能擺脫貧窮,

過上好的生活,

就像你一樣呢?

馬雲說:

你永遠不會像我一樣,

因為我所做的事你都不敢做,

要不然就是認為這件事有多難多難,

你窮的是你的思想!

只有打開思想,

用頭腦嘗試著去分析,

然後勇敢的去嘗試,

你才有可能成功!

如果區區只因為幾次的失敗跟挫折,

你就不去想了,不敢再嘗試了,

那麼這將註定了你的生活品質!

今天很残酷,明天更残酷,後天很美好,但是絕大部份人死在明天晚上!

馬雲

转贴:[Shaun Loong] - Value Emerge For FLBHD After 42% Rout YTD

Author: Shaun Loong | Publish date: Fri, 5 Aug 2016, 11:34 AM

Please do not construe this as an investment advice. Article presentation looks better in PDF. To view PDF, click FLBHD.

It’s only been 3 months since Datuk Muhammad Ibrahim was appointed as

the new BNM governor, and he has surprised the markets with a 25 bps cut

on key interest rates. His unprecedented move on 15th July sent the stock market rallying as investors seek opportunities in favour of high yield stocks.

One of the more attractive dividend stocks I came across is Focus Lumber (FLBHD); trailing 8.9% yield at its current valuations! FLBHD was a top performer in 2015 with a ROI of 182%, hitting an all-time high on 11th Jan 2016 at RM 3.09. However, since then the stock has consolidated 46% to close at RM 1.68 yesterday. YTD, the stock is down 42% and is at its 10-month low.

Yesterday, I have added FLBHD into my portfolio. In my opinion, I think that the market has significantly undervalued FLBHD, which should be fairly valued around RM 2.11 – RM 2.24 for the following reasons:

FLBHD is a timber company which focuses on the manufacturing and sale of plywood and veneer, using the waste from its manufacturing activities to generate and sell electricity. FLBHD has been around for more than 25 years. In FY2015, 99.9% of the company’s revenue the company’s revenue was derived from the manufacturing segment, with its main markets in United States (71.3%), Korea (12.4%) and Taiwan (11.5%).

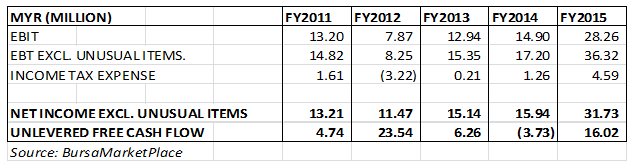

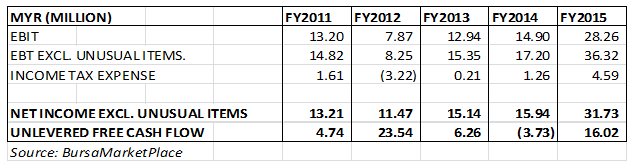

Over the last 5 years, the company has registered a 10.2% CAGR on its revenue and 23.3% CAGR on its earnings from continuing operations. Earnings growth outperformed revenue growth as the company continues to improve its operational efficiencies. As a result, net profit margin has also expanded from 11.2% in FY2011 to 17.6% in FY2015.

CATALYSTS

In the next 6 months, several catalysts that can help FLBHD realise its fair value include:

As a note, USD/MYR has strengthened 3.5% in the 2nd half of 2016. Given that FLBHD is extremely susceptible to lumpy forex gain/loss, the favourable forex fluctuations should help to provide forex gains for coming QR release. Additionally, FLBHD is stepping up production volume to improve cost efficiency. For these reasons, I reckon that FLBHD will report encouraging results for Q2FY2015. Historically, FLBHD reports Q2 around 21 – 22 August.

Over the past 5 years, FLBHD has tried to maintain a 50% dividend payout ratio. As a result, FLBHD’s dividends grew at a 25.7% CAGR within this period. With RM 89.1 million in cash and equivalents and zero debts, FLBHD is able to sustain repeat 15 cents payout for the next 6 years! Even if the 15 cents payout is a one-off reward, an 8 cents dividend still yields a decent 4.8% yield.

Finally, FLBHD should consider a bonus issue/share split to promote liquidity for its stock. Doing so could attract institutional investors in the market. As a note to FLBHD management, this might be the reason none of the top 30 shareholders are institutional investors! FactSet estimates that free float comprise 35.1% of total shares of 103.2 million. Hence, this implies 36,223,200 free float available for public trading; or RM 60.8 million worth of free float. FLBHD has a free float market capitalisation equivalent to a microcap stock, which does not appeal to institutional investors.

RISKS

Investing in FLBHD is not without its risks. They include:

As of 3rd August yesterday, Lu Kuan-Cheng has announced his

resignation from his position as an Executive Director. In his latest

filings, he continues to hold 5,920,415 shares or 5.7% stake in the

company. The risk of further downside in FLBHD lies in his hands

depending on how quickly he continues to dispose of his stake via the

open markets.

So far, the management has succeeded in their risk taking activities as they didn’t hedge their currency exposure during the periods of heightened volatility. As a reward, the company rejoices as USD/MYR rates remain favourable. Given the strong forex rates now, currency fluctuations are unlikely to continue being favourable, which may negatively impact its P&L. Investors of FLBHD should keep a close eye on the USD/MYR pair.

VALUATION

At present, FLBHD costs RM 1.68 per share and 103.2 million shares outstanding; hence a market cap of RM 173.4 million. Referring to BursaMarketPlace, in the last twelve months, the company reported RM 31.0 million EBIT and RM 31.7 million net profits. With RM 89.1 million net cash position, the company trades at a 5.5x trailing P/E and 2.7x EV/EBIT.

For valuation purposes, let’s ignore results in FY2015 and consider it as an outlier.

Over the past 5 years, FLBHD has received a total of RM 46.83 million in FCF; average RM 9.4 million p.a. Assuming 4% terminal growth at 10% discount, I obtain RM 156.7 million in NPV of FCF. Adding RM 89.1 million of net cash, fair value of FLBHD is RM 2.38.

On average, FLBHD is fairly valued at RM 2.13. At current price of RM 1.68, potential upside is 26.8%.

With steady FCF and consistent annual dividends over the past 5 years, FLBHD is an attractive investment; undervalued with a vast growth potential.

Disclosure: I own stocks of FLBHD.

One of the more attractive dividend stocks I came across is Focus Lumber (FLBHD); trailing 8.9% yield at its current valuations! FLBHD was a top performer in 2015 with a ROI of 182%, hitting an all-time high on 11th Jan 2016 at RM 3.09. However, since then the stock has consolidated 46% to close at RM 1.68 yesterday. YTD, the stock is down 42% and is at its 10-month low.

Yesterday, I have added FLBHD into my portfolio. In my opinion, I think that the market has significantly undervalued FLBHD, which should be fairly valued around RM 2.11 – RM 2.24 for the following reasons:

- Forex gain/loss distorts investment judgements by retailers, coupled with lack of professional guidance from investment banks.

- Low public float amplifies price deviation from fair value. It is easy for retailers to move market for FLBHD in the wrong direction.

- Top line growth remains solid. A strong USD/MYR rate should continue into the next few years as US aims to increase its interest rates while Malaysia reduces its interest rates.

FLBHD is a timber company which focuses on the manufacturing and sale of plywood and veneer, using the waste from its manufacturing activities to generate and sell electricity. FLBHD has been around for more than 25 years. In FY2015, 99.9% of the company’s revenue the company’s revenue was derived from the manufacturing segment, with its main markets in United States (71.3%), Korea (12.4%) and Taiwan (11.5%).

Over the last 5 years, the company has registered a 10.2% CAGR on its revenue and 23.3% CAGR on its earnings from continuing operations. Earnings growth outperformed revenue growth as the company continues to improve its operational efficiencies. As a result, net profit margin has also expanded from 11.2% in FY2011 to 17.6% in FY2015.

CATALYSTS

In the next 6 months, several catalysts that can help FLBHD realise its fair value include:

- QR with strong bottom line growths should help retailers discover and realise its fundamental values.

- Positive surprises in dividend payout.

- Increase in public float should help promote liquidity to encourage institutional investors.

As a note, USD/MYR has strengthened 3.5% in the 2nd half of 2016. Given that FLBHD is extremely susceptible to lumpy forex gain/loss, the favourable forex fluctuations should help to provide forex gains for coming QR release. Additionally, FLBHD is stepping up production volume to improve cost efficiency. For these reasons, I reckon that FLBHD will report encouraging results for Q2FY2015. Historically, FLBHD reports Q2 around 21 – 22 August.

Over the past 5 years, FLBHD has tried to maintain a 50% dividend payout ratio. As a result, FLBHD’s dividends grew at a 25.7% CAGR within this period. With RM 89.1 million in cash and equivalents and zero debts, FLBHD is able to sustain repeat 15 cents payout for the next 6 years! Even if the 15 cents payout is a one-off reward, an 8 cents dividend still yields a decent 4.8% yield.

Finally, FLBHD should consider a bonus issue/share split to promote liquidity for its stock. Doing so could attract institutional investors in the market. As a note to FLBHD management, this might be the reason none of the top 30 shareholders are institutional investors! FactSet estimates that free float comprise 35.1% of total shares of 103.2 million. Hence, this implies 36,223,200 free float available for public trading; or RM 60.8 million worth of free float. FLBHD has a free float market capitalisation equivalent to a microcap stock, which does not appeal to institutional investors.

RISKS

Investing in FLBHD is not without its risks. They include:

- Margin erosion from minimum wage policy and intense price war with competitors.

- Resignation and disposal of Lu Kuan-Cheng’s 7.3% stake as at 31 Mar 2016.

- High risk taking appetite of management; no/minimal hedging against wild currency fluctuations.

| Employees below new minimum wage | 10% | 20% | 30% | 40% | 50% |

| Impact on earnings (mil) | -2.20126 | -4.40253 | -6.60379 | -8.80505 | -11.0063 |

So far, the management has succeeded in their risk taking activities as they didn’t hedge their currency exposure during the periods of heightened volatility. As a reward, the company rejoices as USD/MYR rates remain favourable. Given the strong forex rates now, currency fluctuations are unlikely to continue being favourable, which may negatively impact its P&L. Investors of FLBHD should keep a close eye on the USD/MYR pair.

VALUATION

At present, FLBHD costs RM 1.68 per share and 103.2 million shares outstanding; hence a market cap of RM 173.4 million. Referring to BursaMarketPlace, in the last twelve months, the company reported RM 31.0 million EBIT and RM 31.7 million net profits. With RM 89.1 million net cash position, the company trades at a 5.5x trailing P/E and 2.7x EV/EBIT.

For valuation purposes, let’s ignore results in FY2015 and consider it as an outlier.

- From FY2011 – FY2014, EBIT averaged RM 12.2 million. Ascribing a 10x EV/EBIT, enterprise value for FLBHD is RM 122 million. Since FLBHD holds a net cash of RM 89.1 million, therefore the value of market cap is RM 211.1 million; implying a RM 2.05 fair value per share.

- From FY2011 – FY2014, net income averaged RM 13.9 million. Ascribing a 15x P/E, fair value obtained in RM 2.02.

Over the past 5 years, FLBHD has received a total of RM 46.83 million in FCF; average RM 9.4 million p.a. Assuming 4% terminal growth at 10% discount, I obtain RM 156.7 million in NPV of FCF. Adding RM 89.1 million of net cash, fair value of FLBHD is RM 2.38.

On average, FLBHD is fairly valued at RM 2.13. At current price of RM 1.68, potential upside is 26.8%.

With steady FCF and consistent annual dividends over the past 5 years, FLBHD is an attractive investment; undervalued with a vast growth potential.

Disclosure: I own stocks of FLBHD.

1271.【回归根本】- FLBHD(5197) Excluding 外汇盈利/亏损会变得怎么样? + Tax Rate = 24%.

公司出口至美国的plywood主要是用来制造旅游休闲车(RV), 现在RV的销售量已经是08金融风暴后的新高。因此FLBHD的产品在美国还是很有Demand的,所以我们可以看到FLBHD在淡季的Q1也可以有53.286 mil的营业额,位居历史第2高。

此外,他还说网络说应该有人好好计算FLBHD的Operating Profit成长,看看再排出外汇的因素之下,FLBHD到底赚了多少钱。因此笔者就做了一张图表供大家参考:

- 大家看看黄色的Total Forex Gain/Loss,2015年的外汇盈利是5.251 mil。扣除外汇盈利,公司的PBT是31.066 mil。

- 而公司在2015年的Corporate Tax rate是12.65%,由于排除外汇后的盈利减少。所以笔者使用了12%的Tax rate,PBT就是27.338 mil。比真正的31.722 mil减少了13.82%。但是也是非常出色盈利了,所以FLBHD【排除了外汇】后的EPS是26.49,还是处于非常出色的水平。

- 不过来到了2016年,公司享有较低的Tax rate,主要是因为因为他们出口plywood以及laminated veneer wood至国外,所以享有Double tax deduction Benefit。

- 去年整年FLBHD的Annual Corporate Tax rate是12.65%,可是最近季度却几乎上涨了1倍,Q1是24%的Tax。这也是为什么公司在赚了更多钱的情况下,Profit after tax却下跌。

- 假设仔细看,2016Q的Profit Before Tax Excluding Forex Gain/Loss (000)是7.792 mil,足足比2015Q1的4.227mil提升了84.34%。

总结:

- 假设诚如管理层所说,4月的产量已经比2015一起Q1来高的话,公司的operating profit正在处于正面的成长中。

- 不过公司在股东大会也表明,原木料的供应有限,这是公司正在面对的一个问题。

- 其次,公司的不再享有Double Tax Deduction Benefit,公司必须增加产能以抵消这个负面因素。

总体而言,FLBHD假设可以持续派发15仙或以上的股息,公司的Dividend Yield就有 7 - 8%。而RM2.00以下的价格是有严重被低估的迹象,因此今天股价再度站回RM2以上。

公司在股东大会说2016Q1使用了3.905的汇率,最近汇率都在4.10附近徘徊。只要6月30日的汇率可以维持在这个水平,公司应改会有1.5 - 2.0 mil之间的外汇盈利。

【回归根本】,只要公司的产量增加并持有有订单,2016年FLBHD是有能力克服种种困难,创造出更好的价值回馈股东。毕竟每年派息6 - 8%的公司,在大马没有可以做到的上市公司不到100家。

以上纯属分享,买卖自负。

Harryt30

15.30p.m.

2016.05.31

FLBHD (5197) - 富佳木材 RM 1.77 加码机会。

http://kongsenger.blogspot.my/2016/08/flbhd-5197-rm-177.html