CRESBLD (8591) - (Icon) Crest Builder (2) - 2017 Will Be An Interesting Year

1. Introduction

I first wrote about Crest Builder in May 2014.

http://klse.i3investor.com/blogs/icon8888/50292.jsp

The stock recently caught my attention again because it secured RM438 mil new contracts from Sime Darby. I did a quick study of the Group and found a few interesting points. There is a possibility that the stock could be re-rated in 2016 and take off in a big way in 2017. Please read on.

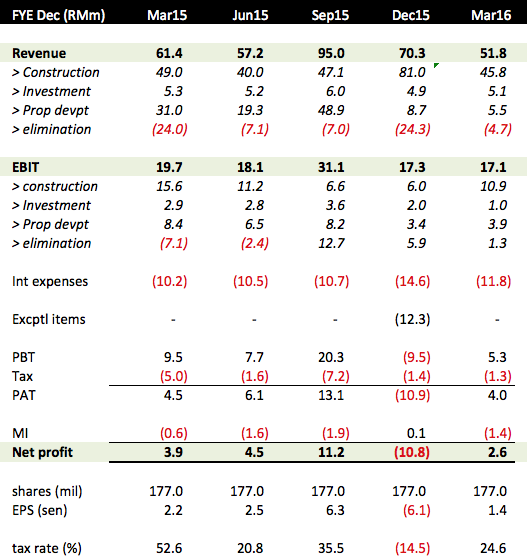

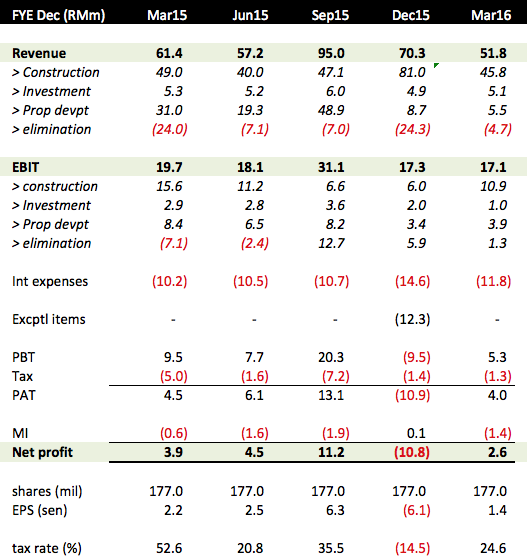

2. Background Financials

Crest Builder is principally involved in construction and property development. It also holds 51% equity interest in a 23 year government concession (ending 2033) to construct and maintain Universiti Teknologi Mara in Tapah, Perak.

Based on 177 mil shares and latest closing price of 92 sen, Crest Builder has market cap of RM163 mil.

In my opinion, the group is quite well run, as evidenced by its consistent profitabaility since at least 2003.

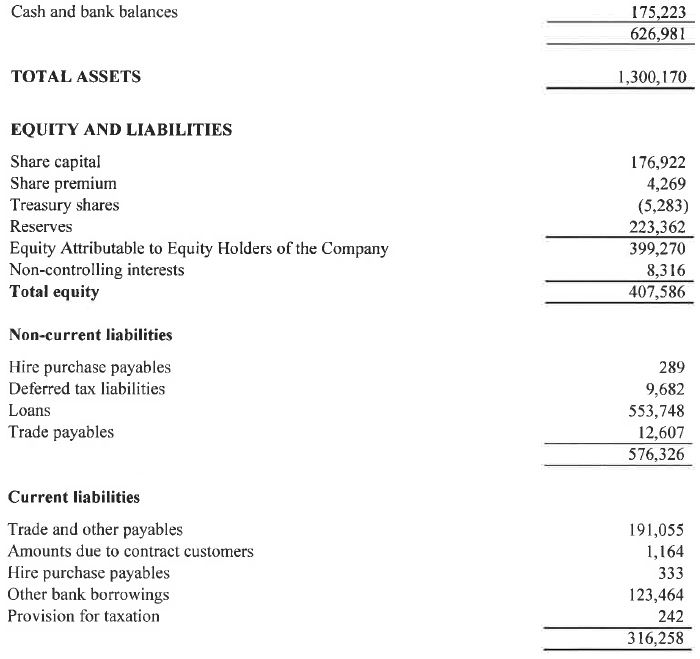

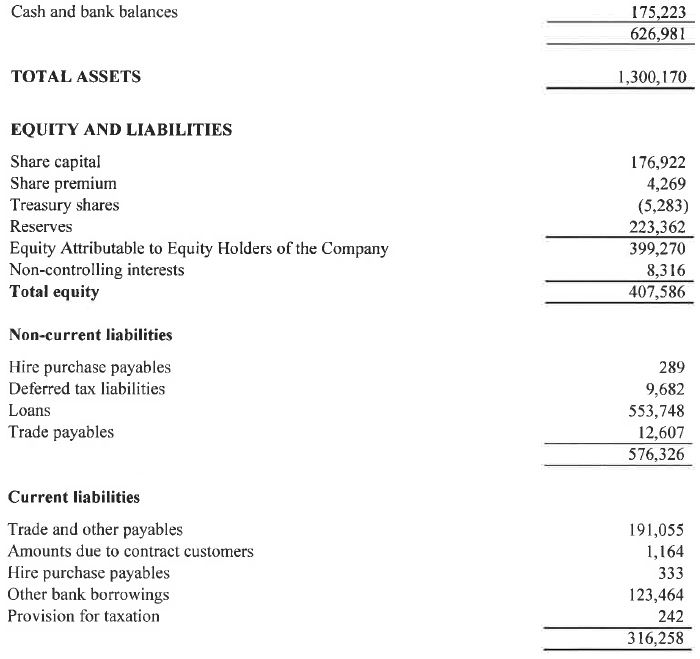

As at 31 March 2016, the group has net assets of RM399 mil and loans of RM677 mil. The actual gearing is not as alarming as it looked. Closed to RM500 mil of the borrowings are related to the Universiti Teknologi Mara concession. Actual borrowings is approximately RM177 mil, which translates into gearing of 0.44 times (I have been conservative by ignoring its cash holding of RM175 mil).

3. King Of TODs

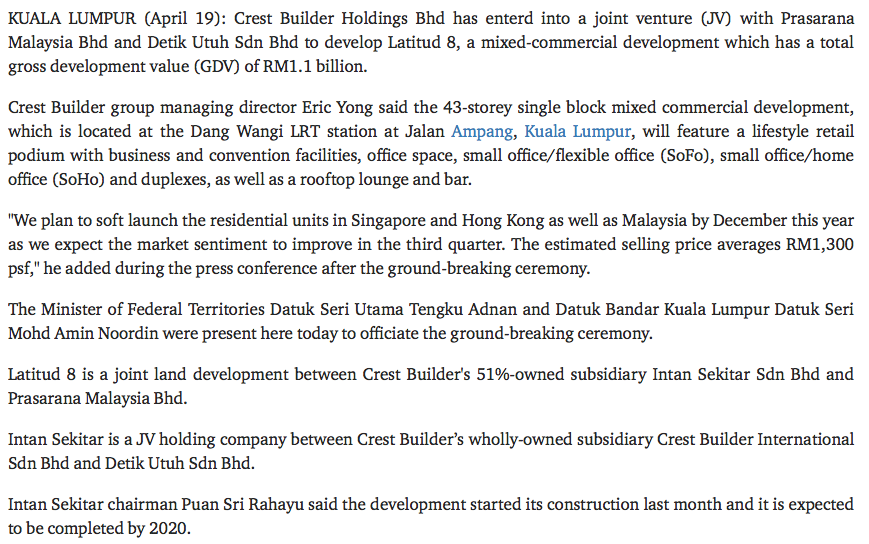

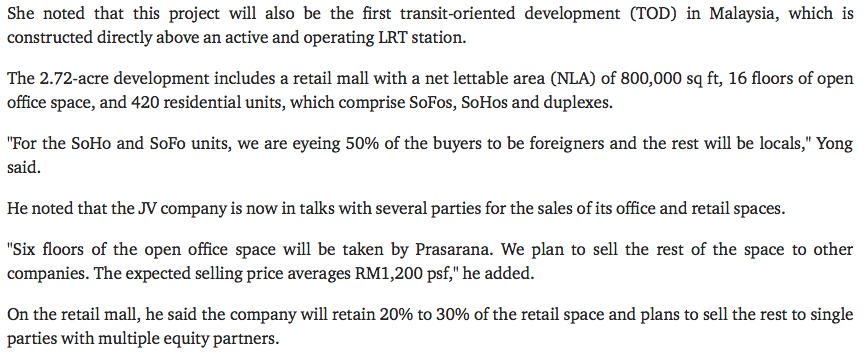

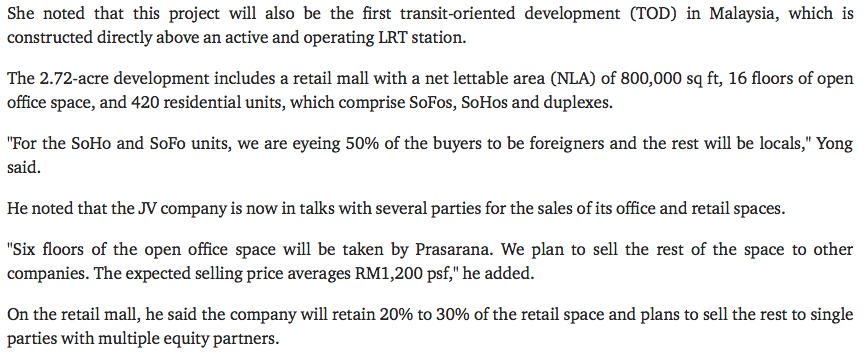

TOD stands for "Transit Oriented Development". In Malaysia, it is a term used to describe property projects located within the compound of LRT stations. Prasarana, being the owner of the LRT station land, enters into joint venture with developers to construct commercial and/or residential properties on the site. In return, Prasarana will get back certain percentage of the Gross Development Value by cash or payment in kind (property units).

Around 2012, Prasarana awarded several TODs to developers. Crest Builder managed to secure two. One at Dang Wangi LRT Station and the other one at Kelana Jaya LRT Station.

(Dang Wangi LRT Station, Jalan Ampang, KL)

(Kelana Jaya LRT Station, PJ)

However, the projects had been very slow to get off the ground. Prasarana needs to go through various government departments to secure the requisite approvals.

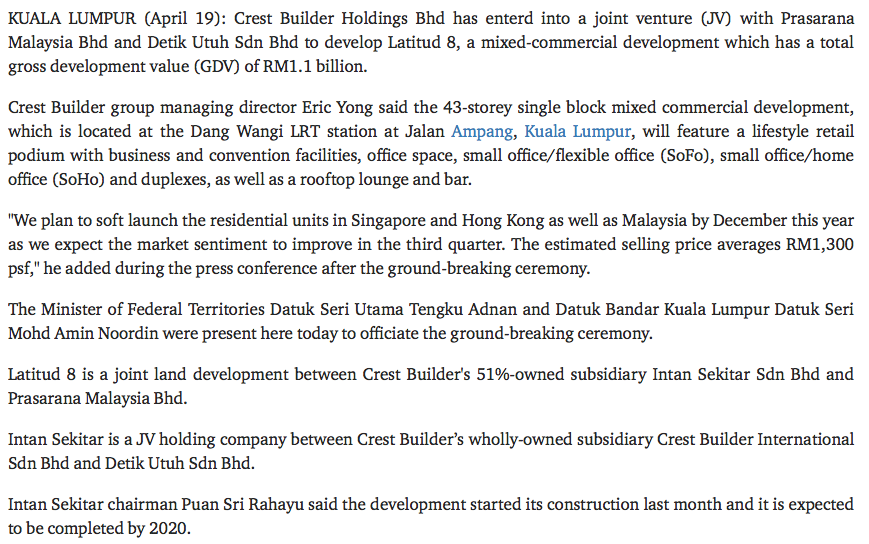

Finally, on 19 April 2016, Crest Builder and its partner Detik Utuh Sdn Bhd entered into formal agreement with Parasarana to finalise the Dang Wangi deal (Kelana Jaya project yet to be finalised).

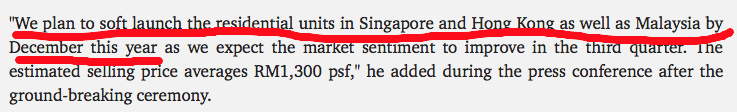

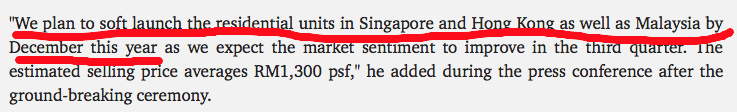

As mentioned in article above, they target to launch the residential units in Malaysia, Singapore and Hong Kong by December 2016.

THAT, actually is not sufficient to get me excited. If they launch the units by end 2016, it will easily take another one to two years before they can start booking in profit (progress billing). It is too early to buy this stock if you are aiming for development profit.

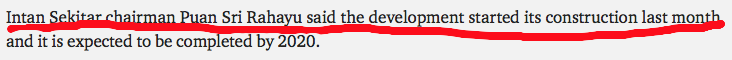

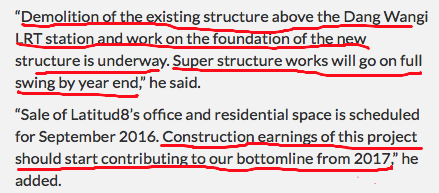

However, the article above also mentioned that they "have started construction last month". The story has now become much more interesting.

Crest Builder has a property development division. All this while, the construction works are all done in house (as disclosed in their financial statements). It turns out that it will also be the contractor for the Dang Wangi project.

(Source : New Straits Time 30 May 2016)

According to the Company, construction profit will start contributing to bottomline in 2017.

THIS IS POSITIVE POINT #1.

(Please note that the Dang Wangi project is not wholly-owned by Crest Builder. As such, the construction profit is real, not something to be eliminated upon consolidfation).

4. Potential Disposal of Investment Property

After finalising the JV agreement in April 2016, the next step is to sort out financing for the construction works.

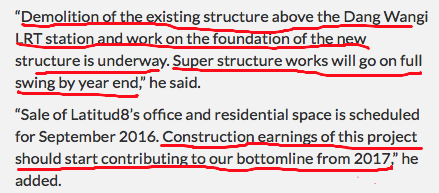

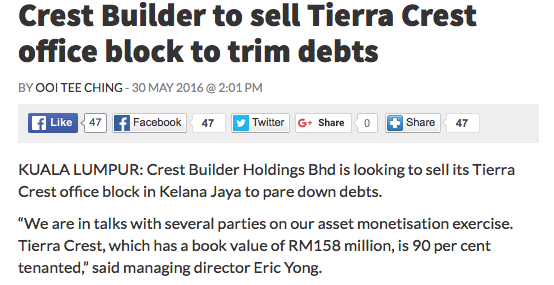

Crest Builder is currently in talks with investors to come in as equity partner for the Dang Wangi project. On top of that, it is also in discussions with potential buyers to dispose of its investment property Tierra Crest.

(Tierra Crest is located in Kelana Jaya. In 2012, Crest Builder secured a nine year tenancy agreement with Unitar International University)

(Source : New Straits Time)

I strongly believe that Crest Builder will dispose of the property as mentioned above. The group is currently in growth mode. Apart from the Dang Wangi project, the group will kick start its Galleria @ Jalan Ampang in 2017. It is a JV project with (again) Detih Utuh Sdn Bhd and Lembaga Getah Malaysia (more details below).

The disposal, if materialised (very likely over next few months), will trigger a re-rating.

THIS IS POSITIVE POINT #2.

5. Healthy Order Book

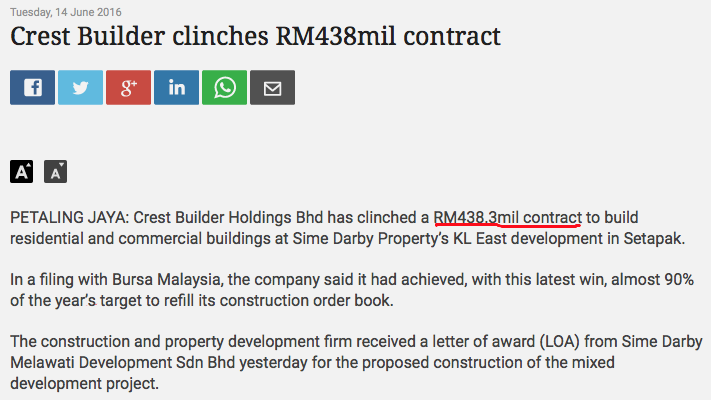

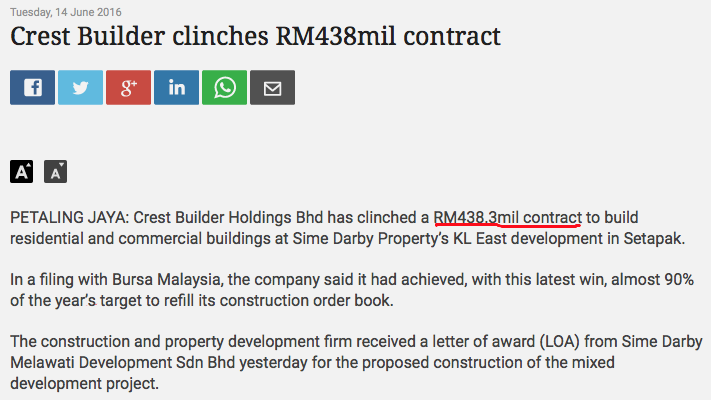

On 14 June 2016, Crest Builder announced that it has secured RM438 mil construction contracts from Sime Darby. This boosted its order book to RM750 mil.

The size of the order book might not be big if compared to other major players. However, in FY2015, Crest Builder's construction revenue was only RM106 mil. As such, RM750 mil should be sufficient to last them at least two to three years (the group is currently tendering for RM4.5 billion contracts).

THIS IS POSITIVE POINT #3.

6. JV With Lembaga Getah Malaysia

(Galleria @ Jalan Ampang, to be launched in 2017 and has GDV of RM1.3 billion. The land is owned by Lembaga Getah Malaysia and is located opposite Great Esatern Mall at Jalan Ampang, near LRT station)

7. Other Development Projects

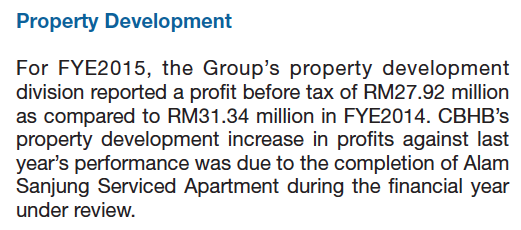

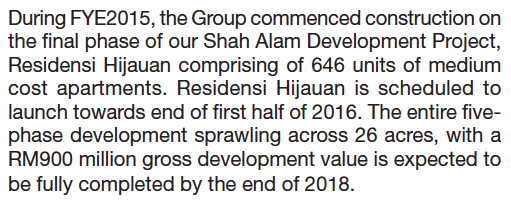

(Source : FY2015 annual report)

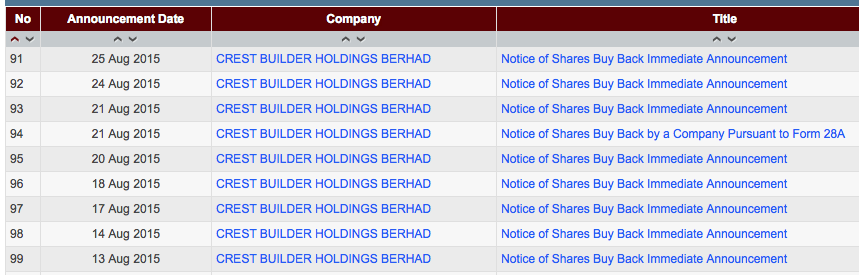

8. Shares Buy Back

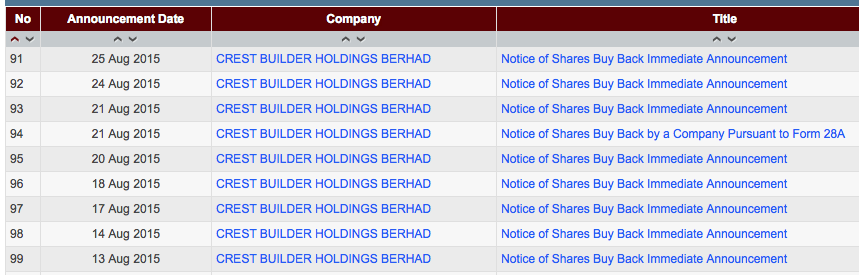

Since August 2015, the company has been consistently buying back shares (6 mil shares so far).

This active support by the company gives me a lot of comfort, and is one of the main reasons I bought into the stock. I believe downside is limited, while there is potential upside as early as 2016 / 2017.

I first wrote about Crest Builder in May 2014.

http://klse.i3investor.com/blogs/icon8888/50292.jsp

The stock recently caught my attention again because it secured RM438 mil new contracts from Sime Darby. I did a quick study of the Group and found a few interesting points. There is a possibility that the stock could be re-rated in 2016 and take off in a big way in 2017. Please read on.

2. Background Financials

Crest Builder is principally involved in construction and property development. It also holds 51% equity interest in a 23 year government concession (ending 2033) to construct and maintain Universiti Teknologi Mara in Tapah, Perak.

Based on 177 mil shares and latest closing price of 92 sen, Crest Builder has market cap of RM163 mil.

In my opinion, the group is quite well run, as evidenced by its consistent profitabaility since at least 2003.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-12-31 | 283,944 | 10,411 | 6.20 | 16.46 | 4.00 | 3.92 | 2.3000 |

| 2014-12-31 | 207,392 | 20,756 | 12.80 | 10.55 | 3.75 | 2.78 | 2.3500 |

| 2013-12-31 | 223,404 | 48,767 | 32.60 | 4.79 | 3.75 | 2.40 | 2.2900 |

| 2012-12-31 | 485,067 | 21,585 | 16.60 | 5.25 | 5.00 | 5.75 | 2.1800 |

| 2011-12-31 | 499,849 | 30,423 | 24.60 | 2.04 | 5.00 | 10.00 | 2.1600 |

| 2010-12-31 | 460,079 | 13,939 | 11.30 | 4.70 | 4.00 | 7.55 | 1.9400 |

| 2009-12-31 | 329,564 | 10,987 | 8.90 | 6.75 | 3.00 | 5.00 | 1.8600 |

| 2008-12-31 | 270,275 | 12,343 | 10.00 | 3.30 | 3.00 | 9.09 | 1.7900 |

| 2007-12-31 | 365,766 | 40,193 | 32.50 | 3.02 | 7.00 | 7.14 | 1.7500 |

| 2006-12-31 | 318,266 | 20,034 | 16.40 | 4.76 | 5.00 | 6.41 | 1.4600 |

| 2005-12-31 | 253,006 | 11,740 | 10.30 | 6.02 | 4.00 | 6.45 | 1.3400 |

| 2004-12-31 | 266,291 | 16,264 | 14.30 | 4.62 | 4.00 | 6.06 | 1.2800 |

| 2003-12-31 | 205,316 | 17,472 | 18.60 | 5.76 | 4.00 | 3.74 | 0.5141 |

As at 31 March 2016, the group has net assets of RM399 mil and loans of RM677 mil. The actual gearing is not as alarming as it looked. Closed to RM500 mil of the borrowings are related to the Universiti Teknologi Mara concession. Actual borrowings is approximately RM177 mil, which translates into gearing of 0.44 times (I have been conservative by ignoring its cash holding of RM175 mil).

3. King Of TODs

TOD stands for "Transit Oriented Development". In Malaysia, it is a term used to describe property projects located within the compound of LRT stations. Prasarana, being the owner of the LRT station land, enters into joint venture with developers to construct commercial and/or residential properties on the site. In return, Prasarana will get back certain percentage of the Gross Development Value by cash or payment in kind (property units).

Around 2012, Prasarana awarded several TODs to developers. Crest Builder managed to secure two. One at Dang Wangi LRT Station and the other one at Kelana Jaya LRT Station.

(Dang Wangi LRT Station, Jalan Ampang, KL)

(Kelana Jaya LRT Station, PJ)

However, the projects had been very slow to get off the ground. Prasarana needs to go through various government departments to secure the requisite approvals.

Finally, on 19 April 2016, Crest Builder and its partner Detik Utuh Sdn Bhd entered into formal agreement with Parasarana to finalise the Dang Wangi deal (Kelana Jaya project yet to be finalised).

As mentioned in article above, they target to launch the residential units in Malaysia, Singapore and Hong Kong by December 2016.

THAT, actually is not sufficient to get me excited. If they launch the units by end 2016, it will easily take another one to two years before they can start booking in profit (progress billing). It is too early to buy this stock if you are aiming for development profit.

However, the article above also mentioned that they "have started construction last month". The story has now become much more interesting.

Crest Builder has a property development division. All this while, the construction works are all done in house (as disclosed in their financial statements). It turns out that it will also be the contractor for the Dang Wangi project.

(Source : New Straits Time 30 May 2016)

According to the Company, construction profit will start contributing to bottomline in 2017.

THIS IS POSITIVE POINT #1.

(Please note that the Dang Wangi project is not wholly-owned by Crest Builder. As such, the construction profit is real, not something to be eliminated upon consolidfation).

4. Potential Disposal of Investment Property

After finalising the JV agreement in April 2016, the next step is to sort out financing for the construction works.

Crest Builder is currently in talks with investors to come in as equity partner for the Dang Wangi project. On top of that, it is also in discussions with potential buyers to dispose of its investment property Tierra Crest.

(Tierra Crest is located in Kelana Jaya. In 2012, Crest Builder secured a nine year tenancy agreement with Unitar International University)

(Source : New Straits Time)

I strongly believe that Crest Builder will dispose of the property as mentioned above. The group is currently in growth mode. Apart from the Dang Wangi project, the group will kick start its Galleria @ Jalan Ampang in 2017. It is a JV project with (again) Detih Utuh Sdn Bhd and Lembaga Getah Malaysia (more details below).

The disposal, if materialised (very likely over next few months), will trigger a re-rating.

THIS IS POSITIVE POINT #2.

5. Healthy Order Book

On 14 June 2016, Crest Builder announced that it has secured RM438 mil construction contracts from Sime Darby. This boosted its order book to RM750 mil.

The size of the order book might not be big if compared to other major players. However, in FY2015, Crest Builder's construction revenue was only RM106 mil. As such, RM750 mil should be sufficient to last them at least two to three years (the group is currently tendering for RM4.5 billion contracts).

THIS IS POSITIVE POINT #3.

6. JV With Lembaga Getah Malaysia

(Galleria @ Jalan Ampang, to be launched in 2017 and has GDV of RM1.3 billion. The land is owned by Lembaga Getah Malaysia and is located opposite Great Esatern Mall at Jalan Ampang, near LRT station)

On

28 June 2012, Crest announced that its 51% subsidiary has entered into

JV agreement with Lembaga Getah Malaysia to develop 5 acres of land at

Jalan Ampang, opposite Great Eastern Mall and next to Gleneagles

hospital.

The

proposed development will comprise three 28 storey Apartments and SOHO

Towers, a 33 storey Corporate Tower and a 6 storey retail mall.

GDV is estimated to be RM1.3 billion. LGM will be entitled to RM300 mil (22.5%), in cash and completed property.

Based on latest update, the Galleria is scheduled for a launch sometime in 2017.

7. Other Development Projects

(Source : FY2015 annual report)

8. Shares Buy Back

Since August 2015, the company has been consistently buying back shares (6 mil shares so far).

This active support by the company gives me a lot of comfort, and is one of the main reasons I bought into the stock. I believe downside is limited, while there is potential upside as early as 2016 / 2017.

CRESBLD (8591) - (Icon) Crest Builder (2) - 2017 Will Be An Interesting Year

http://klse.i3investor.com/blogs/icon8888/101827.jsp