BJCORP (3395) - (Icon) Berjaya Corp (5) - No Muscle, No Brain (Trying To Grow One)

1. Introduction

In

my previous article, I complained that BJ Land has a lot of assets, but

failed to generate meaningful profit (Plenty of Muscles, No Brain).

My

study of BJ Corp showed that the group is even worse. It is not only

unprofitable, but also does not have much surplus assets as well. Hence

the title for this article "No Muscle, No Brain".

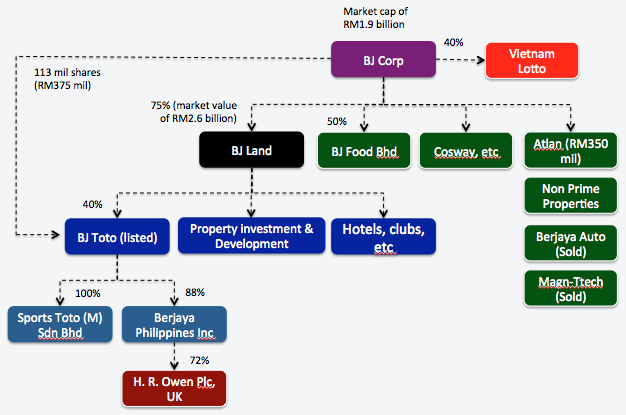

2. Group Structure

BJ Corp's core asset is its 75% equity interest in BJ Land. Please refer to diagram below for details.

The group also owns 40% equity interest in Vietnam lotto operation.

3. Historical Profitability

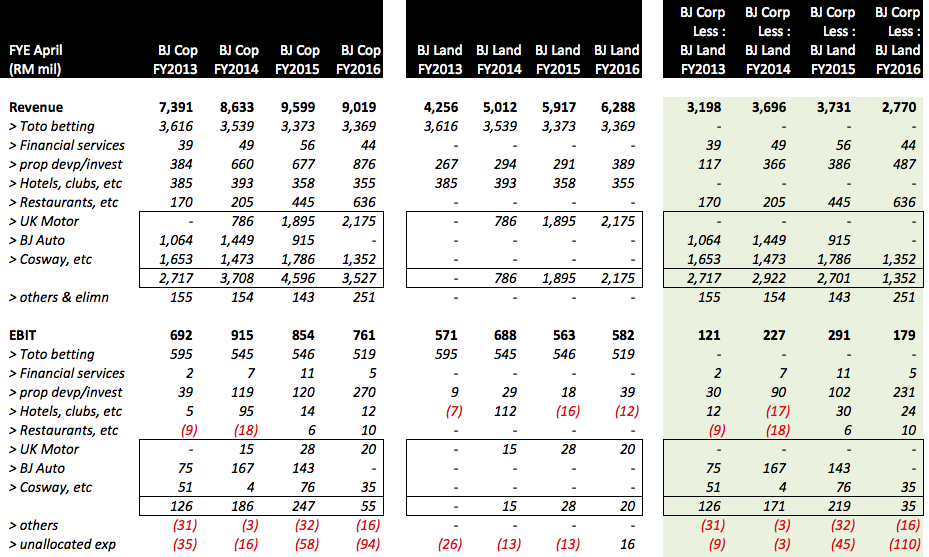

Key observations :-

(a)

In the quarterly reports, the Company group its consumer business under

one item, "Marketing of Consumer Products and Sevices".

To

provide better insight, I break it down to its respective three major

components of (i) UK Luxury Motor Dealing (H. R. Owen housed under

Berjaya Sports Toto), (ii) Mazda cars distribution under Berjaya Auto

and (iii) Cosway, which sells consumer household items.

(b)

After removing contribution by BJ Land Group, BJ Corp's own businesses

generated revenue of more than RM3 billion per annum. BJ Auto and Cosway

were the biggest contributors, accounted for approximately RM1.5

billion each. BJ Food and property development contributed another RM500

mil each.

(c)

Cosway had huge revenue. However, it is a low margin business and hence

not very profitable. In FY2015, Cosway generated PBT of RM21 mil only.

In FY2014, it incurred a loss before tax of RM60 mil.

(d)

Berjaya Auto was the star performer. Listed on Bursa Malaysia, the

group generated net profit of approximately RM200 mil per annum. BJ Corp

owns 50% of BJ Auto, so its share of the profit was approximately RM100

mil per annum.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) |

|---|---|---|

| 2016-04-30 | 2,112,243 | 198,012 |

| 2015-04-30 | 1,830,443 | 212,374 |

| 2014-04-30 | 1,450,790 | 130,622 |

| 2013-04-30 | 1,064,349 | 50,861 |

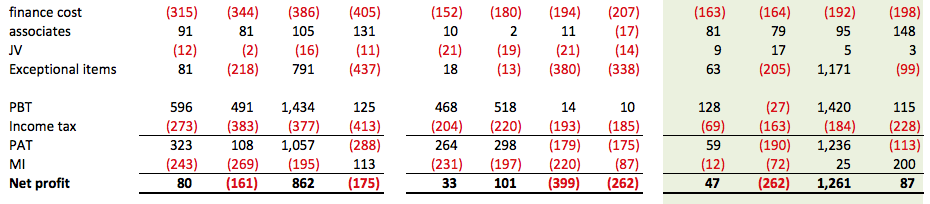

Unfortunately,

all these have become a thing of the past. During the period from May

2014 until July 2016, BJ Corp cashed out of its entire 50% stake in BJ

Auto through open market disposal (and partially through a Buyout by BJ

Auto's Management Team). The disposals brought in RM1.51 billion cash

(transaction PER of 15 times).

The details of the disposals are as set out below :-

(e)

Due to high gearing, the group needs to service high interest expenses

every year. In FY2016, total interest expenses was RM405 mil, out of

which RM207 mil belonged to BJ Land Group. This means that every year,

BJ Corp group's own operations is repsonsible for servicing interest

expenses amounting to approximately RM198 mil.

In

FY2016, the Group generated EBIT of approximately RM179 mil (please

refer to P&L table above). However, after hefty interest expenses

and unallocated corporate expenses, there is not much left for

shareholders.

(f)

Going foward, things are going to get even tougher (from P&L point

of view). The complete disposal of BJ Auto will result in disappearance

of NET PROFIT of RM100 mil per annum. Unless Vietnam's lotto operation

can start contributing in a meaningful way, the group will have a hard

time staying in the black.

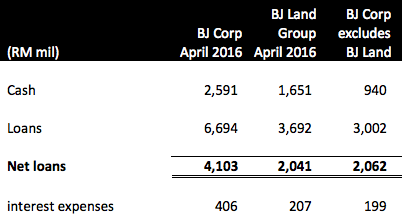

4. Gearing

As

at April 2016, the BJ Corp Group has loans of RM6.69 billion, out of

which RM3.69 billion is at BJ Land level. As such, its actual loans are

RM3 billion.

BJ Corp (excludes BJ Land Group) has cash of RM940 million. As such, net loans are approximately RM2.06 billion.

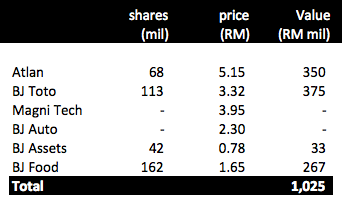

The

group holds closed to RM1 billion quoted securities. How much of them

will be disposed in the future to help pare down borrowings ?

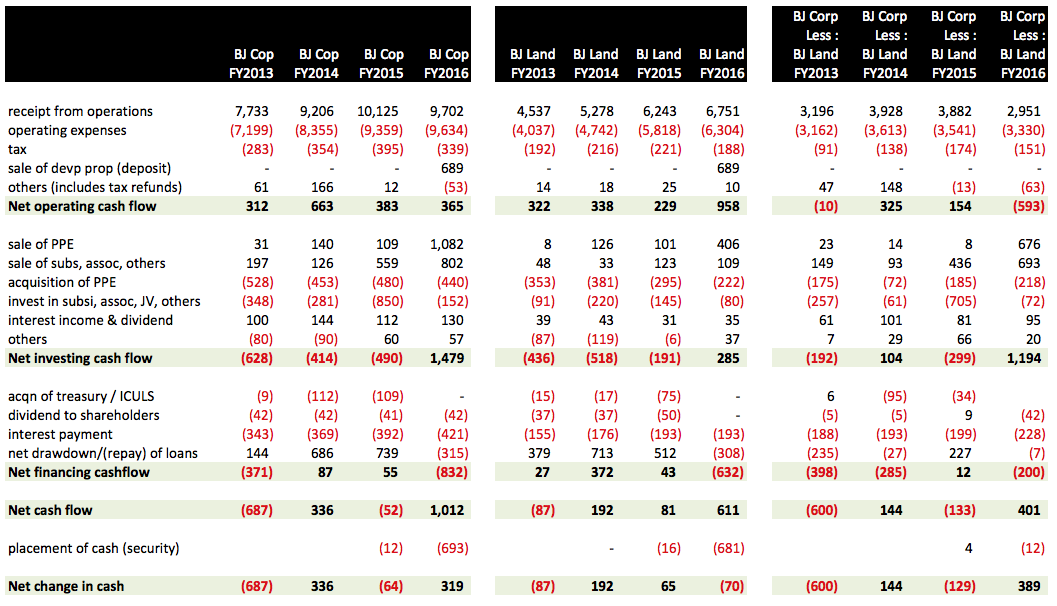

5. Cash Flow

Key observations :-

(a)

In FYE April 2014, BJ Corp (excludes BJ Land group)'s net operating

cash flow was quite robust at RM325 mil. That was mostly due to

contribution by BJ Auto. However, following the gradual disposal of BJ

Auto beginning November 2014 (Q3 of FY2015), net operating cashflow has

declined substantially (deconsolidated).

(b) In FY2016, they group disposed of a lot of assets, which brought in closed to RM1.4 billion cash.

(c) Every year, the group has to service interest payment of closed to RM200 mil.

(d) Overall, the group's cash flow is quite tight. Further assets disposal is required to pare down borrowings.

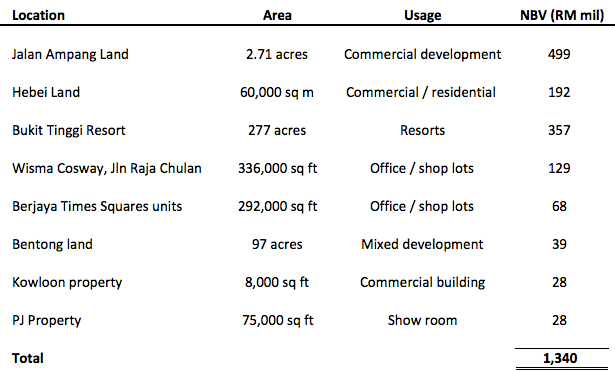

6. Property Assets

Unlike BJ Land, BJ Corp does not have many valuable property assets.

Key obersvations :-

(a) Jalan Ampang Land

This

development project comprises Menara Bangkok Bank and Ritz Carlton

Residence. Menara Bangkok Bank has already been completed while Ritz

Carlton is closed to completion.

(b) Bukit Tinggi Resorts

This

property has Net Book Value of RM357 mil. However, I believe the actual

realisable value is much lower. The Bukit TInggi Resorts is not

profitable. From yield point of view, I believe at most it is worth half

of its Net Book Value.

(c) Investment Properties

Wisma

Cosway, various floors at Berjaya Time Square and commercial property

in Hong Kong are collectively worthed RM225 mil. However, these few

properties are quite old already. Furthermore, they are mostly tenanted

by BJ Corp and subsidiaries. The Group can't really sell them to unlock

value.

7. Concluding Remarks

(a) I think not many people will disagree with me if I say that the BJ Corp group has weak fundamentals.

Its

auto distribution business (BJ Auto) generated more than RM200 mil net

profit per annum. However, over the years, the group chose to hive it

off gradually through IPO (at a very cheap price, on hindsight) and open

market disposals.

This

is not the first time they did something like that. In the early 2000s,

they also disposed of their Hyundai car distribution business, a

profitable entity, to Sime Darby.

Why

can't they be a little bit more commited ? Instead of spreading their

resources all over the place, why can't they stay focus and nurture

several core businesses into industry leaders ? I believe this lack of

focus is one of the major weaknesses of Berjaya Corp and is responsible

for their mediocre performance all these years.

(b) Will the Group ever change for the better ? I believe it is possible.

Tan Sri Vincent Tan ("VT") is not young anymore. The time has arrived for him to pass on the baton to his successors.

VT

is famous for his ability to manage borrowings. Despite high gearing,

BJ Corp has been able to survive one economic crisis after another. But

the same cannot be said of his successors.

To

ensure that the Group can continue to survive after his passing from

the scene, the most logical thing would be to clean up the group by

disposing of non core assets and pare down borrowings.

I

believe this is already happening. Over the past two years, the group

has disposed of more than RM2 billion worth of assets. The benefit has

already shown up clearly in BJ Land Group, which saw its net borrowings

dropped to only RM1.15 billion, a relatively small amount for a group

with more than RM10 billion assets.

(c) The BJ Corp Group (excludes BJ Land) still has a long way to go. Its net borrowings are quite high at RM2.1 billion. The only bright spot is its Vietnam lotto operation. Launched in July 2016, it seemed that the business has already begun "kicking asses", giving the existing operators a run for their money.

http://m.english.vietnamnet.vn/fms/business/161750/the-us-3-billion-game-in-the-lottery-market.html

Having said so, it is still early days. I believe it will easily take another two to three years before Vietnam's lotto operation can start making material contribution to Group bottomline (the group targets full roll out within a period of 5 years).

In the meantime, investors had to contend with lack of core earnings and high interest expenses of more than RM200 mil per annum.

Patience is required.

BJCORP (3395) - (Icon) Berjaya Corp (5) - No Muscle, No Brain (Trying To Grow One)

http://klse.i3investor.com/blogs/icon8888/99942.jsp