By Asia Analytica / The Edge Financial Daily | August 4, 2016 : 10:22 AM MYT

This article first appeared in The Edge Financial Daily, on August 4, 2016.

AEM (7146) - Stock With Momentum: AE Multi Holdings

AE Multi Holdings Bhd (-ve)

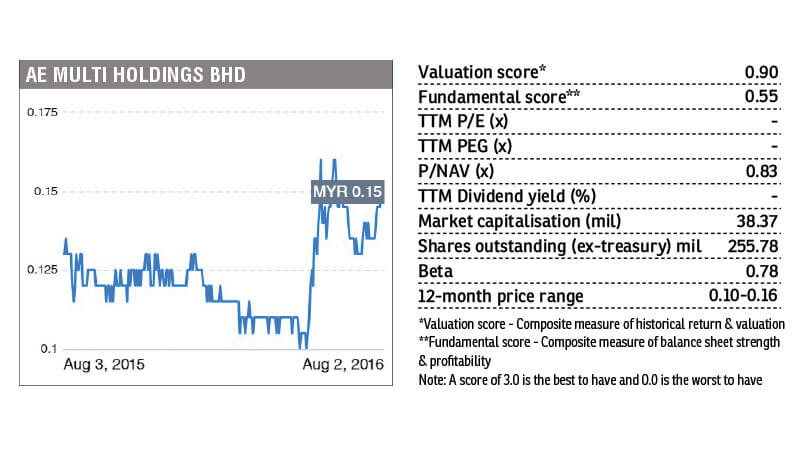

SHARES in AE Multi Holdings Bhd (AEM) (fundamental: 0.55/3; valuation: 0.9/3) triggered our momentum algorithm yesterday, after some 36.56 million shares changed hands. Its 200-day average volume is 2.44 million shares.

The counter closed 1.5 sen or 10% higher at 16.5 sen and was the ninth-most actively traded counter on the local bourse.

AEM, which manufactures and sells printed circuit boards and related products, announced on June 16 it had inked a heads of agreement with JMT Kelantan Baru Sdn Bhd that would pave the way for it to venture into renewable energy (RE).

JMT holds two feed-in tariff approvals for RE installations, and two power purchase agreements to sell electricity from the installations to Tenaga Nasional Bhd (TNB). It is planning two 10MW integrated flood mitigating mini-hydropower projects in Kelantan.

Under the proposed tie-up, JMT shall grant AEM the right to operate the Kelantan projects for which AEM shall be entitled to 80% of the profit from the power sale to TNB. But AEM has to pay JMT RM140 million as investment.

AEM (7146) - Stock With Momentum: AE Multi Holdings

http://www.theedgemarkets.com/my/article/stock-momentum-ae-multi-holdings-1