16. Review of performance

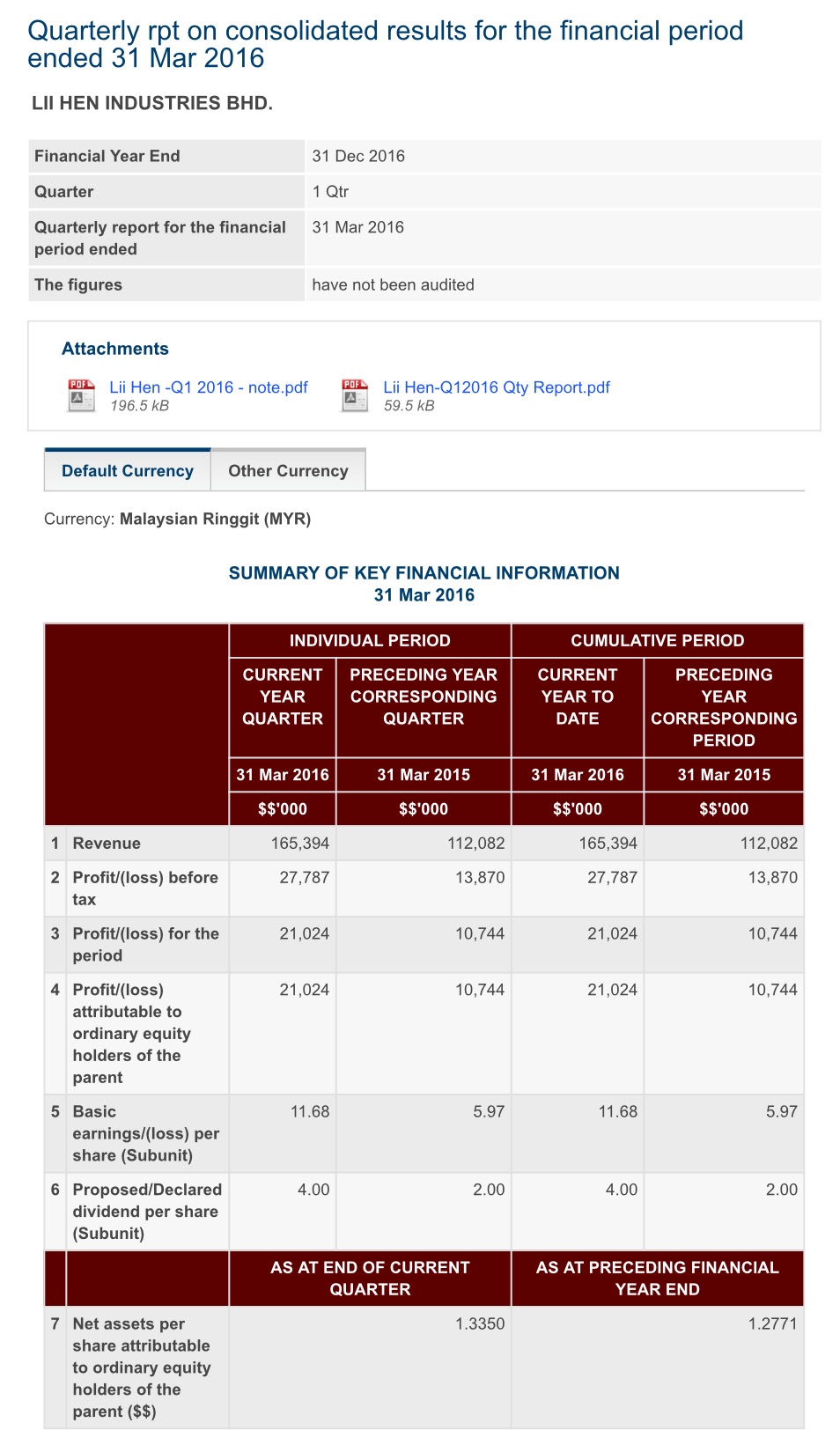

The first quarter of Group’s revenue

for 2016 registered at RM165 million, rose 48% as compared to the

corresponding quarter of last year. The increases were mainly

contributed from the increased in orders of the Group’s products by 27% and the strengthening of the US Dollar against RM.

In spite of forex loss, net profit more than doubled! Dividend doubled to 4 Sen per share!

In spite of forex loss, net profit more than doubled! Dividend doubled to 4 Sen per share!

Annualised EPS 47 Sen. At 2.51, PER is only 5 times!!

_____________________

^Doing better than board makers? We peg the furniture players’ valuation at an average of 10.6x Fwd PER, based on applying 0%-20% premium to Malaysian board maker companies’ average Fwd. PER of 9.6x. We think the benchmark is fair as board makers have enjoyed similar margin expansion driven by USD appreciation, and furniture makers’ raw materials are partially derived from board makers as well.

http://klse.i3investor.com/blogs/kenangaresearch/89699.jsp